Mastering AI in Fraud Detection: How to Stay Ahead in 2025

AI Automation Tools | Cybersecurity Risk Assessment | Blockchain and IoT

How to use AI in fraud detection in 2025? It is not just a question that is jumping into everyone’s mind; it is a survival roadmap for every organization that deals in digital transactions, customer data, and online payments. Moreover, with the emergence of AI in fraud detection, as a result, organizations have the ultimate power to identify and predict threats. Organizations can easily take action to stop threats and minimize the chances of damage with the help of AI fraud detection.

Cybercriminals are taking advantage of security gaps and playing very smartly with high-tech tricks from account hacking and credit card fraud to deepfake detection technology, while also engaging in advanced online scams. To encounter these digital threats, consequently, organizations and businesses are acquiring AI for fraud detection, fraud detection machine learning, and generative artificial intelligence tools to secure their customers, systems, and revenue from cyber crimes.

In this blog, we will explore AI fraud detection techniques, the advanced AI technologies, and strategies that organizations must adopt in 2025 to ensure unshakable cybersecurity and stay one step ahead of threats.

What is AI Fraud Detection?

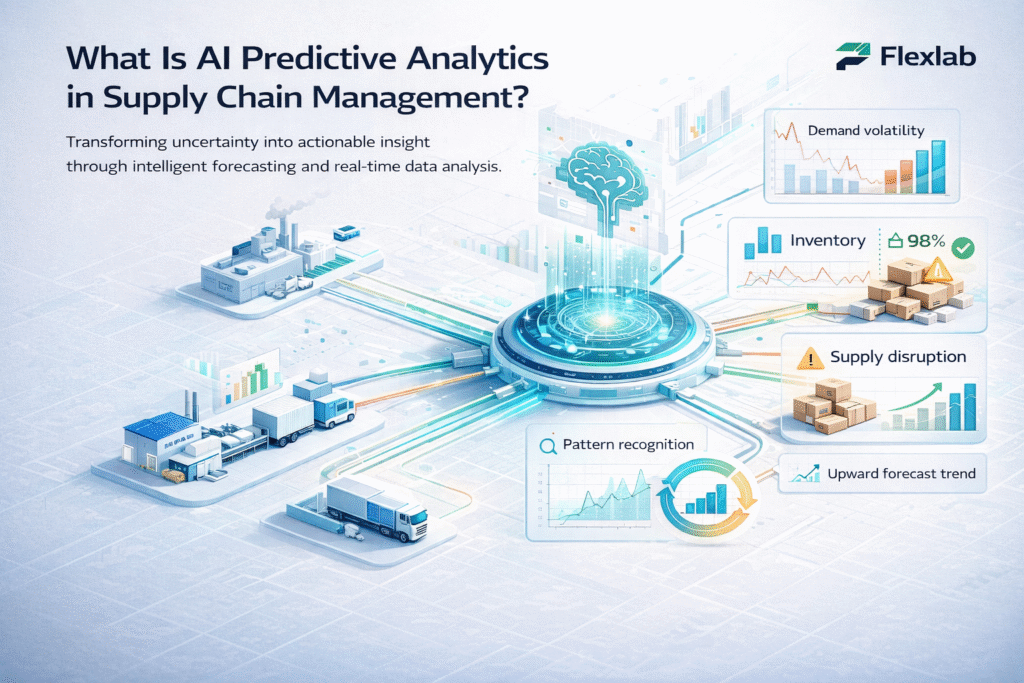

AI fraud detection uses machine learning (ML) models to analyze large amounts of data and identify irregular patterns that help prevent fraud. Traditional fraud detection relies on static rules. In contrast, AI-powered systems continuously learn from new threats and adapt to evolving cyber risks.

AI software development is a powerful approach that can build smart, fast, and accurate fraud detection tools. For instance, while analyzing transactions in an e-commerce payment system, AI systems can easily and efficiently detect irregular spending patterns, false accounts, or uncover misleading credentials instantly.

Why AI Fraud Detection is Crucial in 2025?

As digital transactions rise globally, businesses are facing more security risks, including identifying fraud protection gaps, chargeback scams, and account takeover fraud. According to industry experts, by 2025, cybercrime is expected to cost the world a massive $10 trillion annually, and this burden falls on the shoulders of individuals, businesses, and economies worldwide. Therefore implementation of AI-powered fraud detection systems has become mandatory for survival.

Consequently, organizations are in search of artificial intelligence solutions for cybersecurity protection. By adopting AI in e-commerce and in financial services, businesses can unlock real-time insights that protect and retain customer trust, minimize risk, and keep operations running smoothly.

AI in E-Commerce Fraud Prevention

With the continued growth and usage of online transactions and payments, the chances of threats are also increasing as fraudsters try to exploit identity fraud protection gaps, fake accounts, and account hacking techniques.

Businesses are now taking advantage of AI in financial services to identify scammers, detect fake customer profiles, block suspicious activities, and prevent chargeback fraud. Moreover, most of the leading businesses are already taking advantage of AI solutions successfully. For instance, Amazon utilizes AI for fraud detection and detects unusual patterns in milliseconds, which significantly reduces its losses.

Types of Emerging Frauds in the AI Era

Over the past decade, fraud detection has significantly improved. Meanwhile, AI technologies have become the game-changer driving this evolution. As noticeable and rapid advancement occurs in AI technologies, fraud is also having multiple varieties.

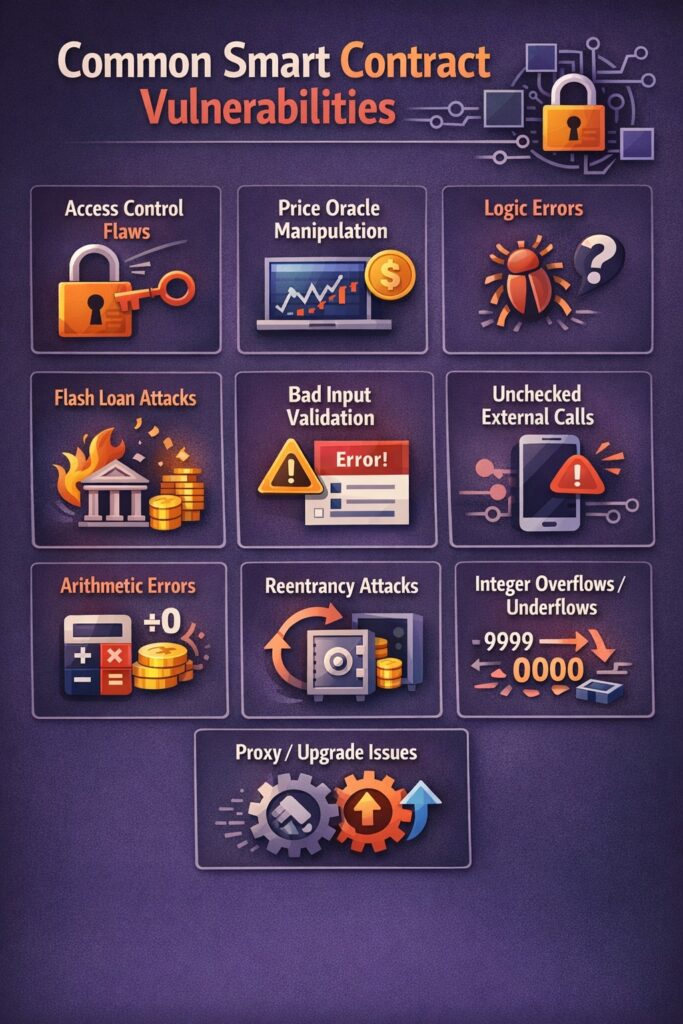

- Chargeback Fraud: Falsely creating a dispute on a legitimate payment to cheat the merchant and get the payment back is known as chargeback fraud.

- Identity Fraud Protection Gaps: scammers try to exploit the loopholes in the identity verification and misuse personal data.

- AI-Powered Phishing Attacks: Fraudsters use generative AI tools to create convincing messages and emails to get access to sensitive information.

- Deepfake Scams & Voice Cloning: Businesses face a challenging situation due to the deepfake detection technologies in video verification and KYC (Know Your Customer) processes.

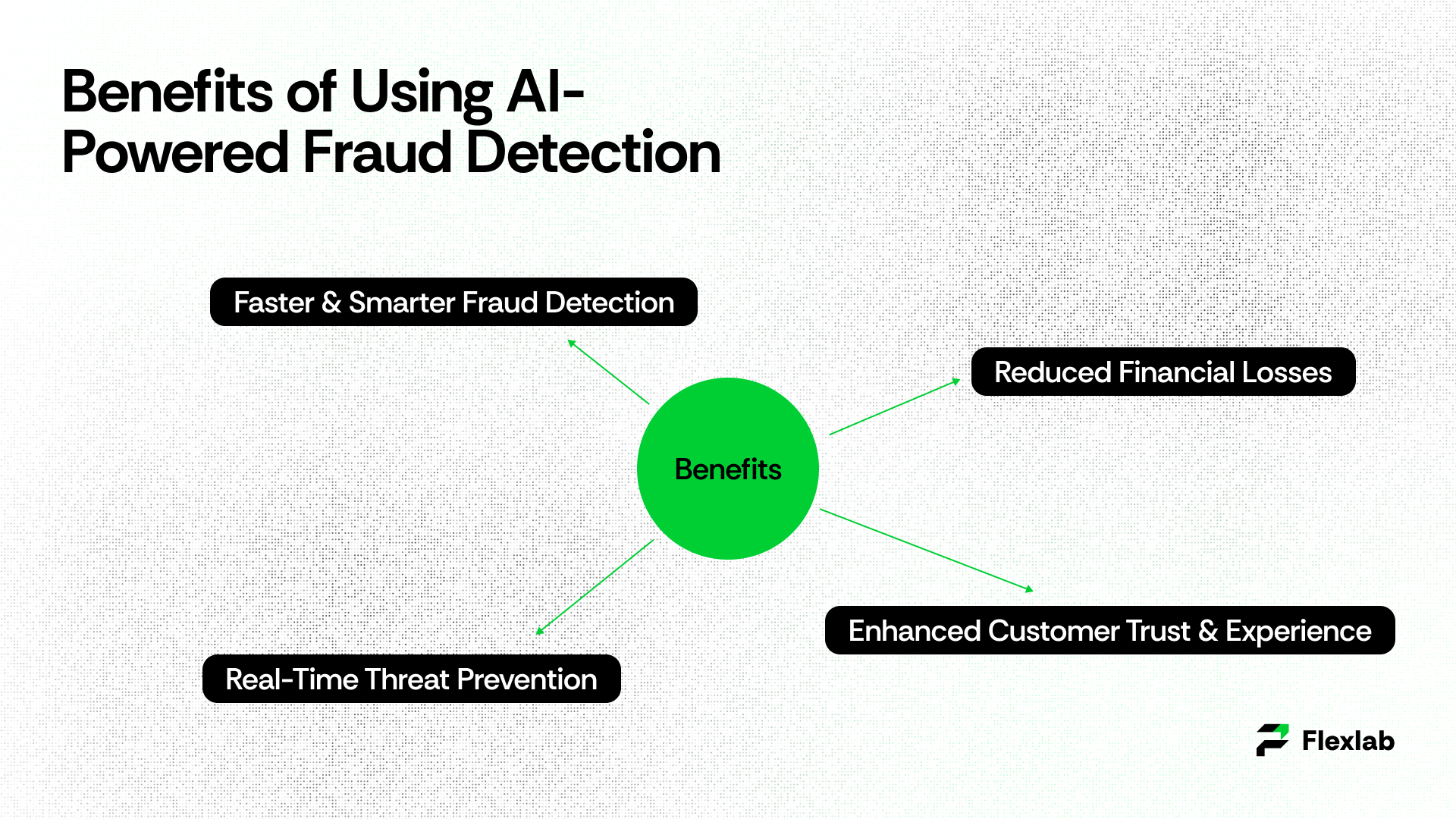

Benefits of Using AI in Fraud Detection

There are multiple benefits of utilizing AI in fraud detection, such as:

- Faster & Smarter Fraud Detection

Firstly, AI fraud detection tools can analyze a large number of transactions per second with high speed and accuracy.

- Real-Time Threat Prevention

Secondly, Predictive AI algorithms enable businesses to prevent attacks before they cause any harm.

- Reduced Financial Losses

Moreover, AI-powered systems can reduce business risk from hacking and credit card fraud.

- Enhanced Customer Trust & Experience

Finally, AI-powered fraud detection builds customer trust and provides secure transactions.

Businesses can leverage fraud detection techniques to ensure security and facilitate seamless transactions.

How Businesses Can Implement AI Fraud Detection in 2025?

Implementation of AI fraud detection in 2025 requires a clear and moderate strategy and the right tools. Businesses should begin by assessing their fraud risks, no matter if it is chargeback scams in e-commerce, account hacking in banking, or individuals’ or businesses’ identity fraud in digital platforms.

After assessing the fraud risks, the next step is selecting reliable AI-powered tools to take out the solutions such as SEON, Riskified, or Feedzai that specialize in real-time risk analysis. Integration of these tools with customer verification processes and existing payment systems ensures seamless fraud monitoring without disturbing the user experience. Training staff to collaborate with AI systems is equally important, as human judgment and oversight ensure that decisions are made with context and ethics in mind. Ultimately, organizations must continuously monitor and update AI models to stay ahead of evolving threats to ensure protection and customer trust in the long run.

Effective AI-Powered Fraud Prevention Strategies for 2025

The integration of AI in fraud detection and prevention is becoming crucial. Let’s explore key strategies that help AI to fight newly generated frauds effectively and efficiently.

-

Multi-Factor Authentication

In this method, users have to provide two or more verifications to access online activities. This technique is quite helpful to reduce the chances of unauthorized access and strengthen user login and transaction security.

-

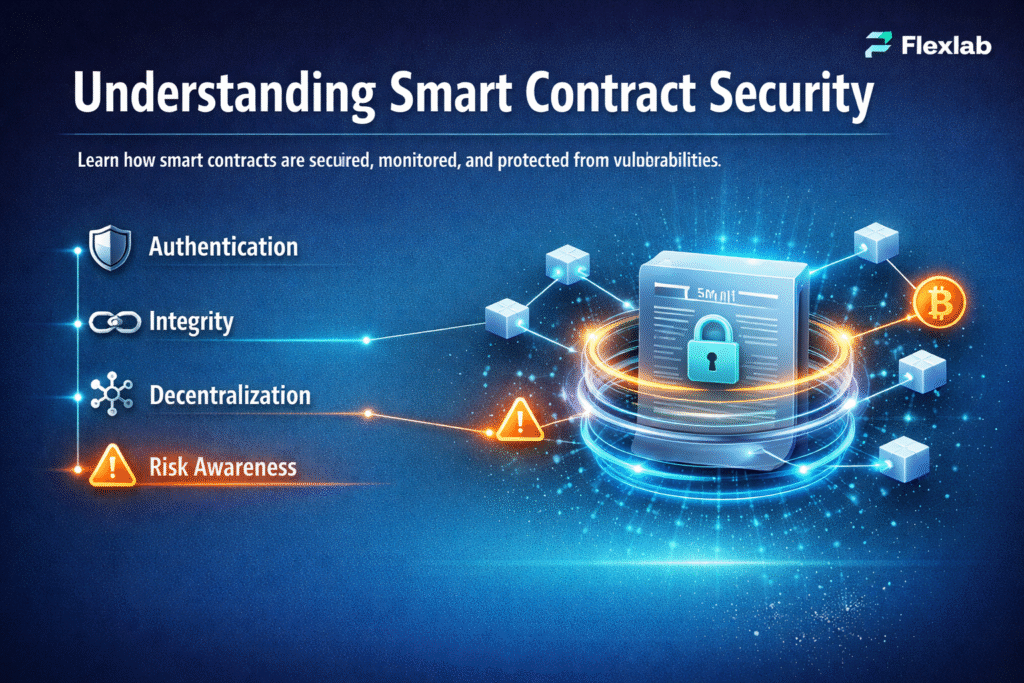

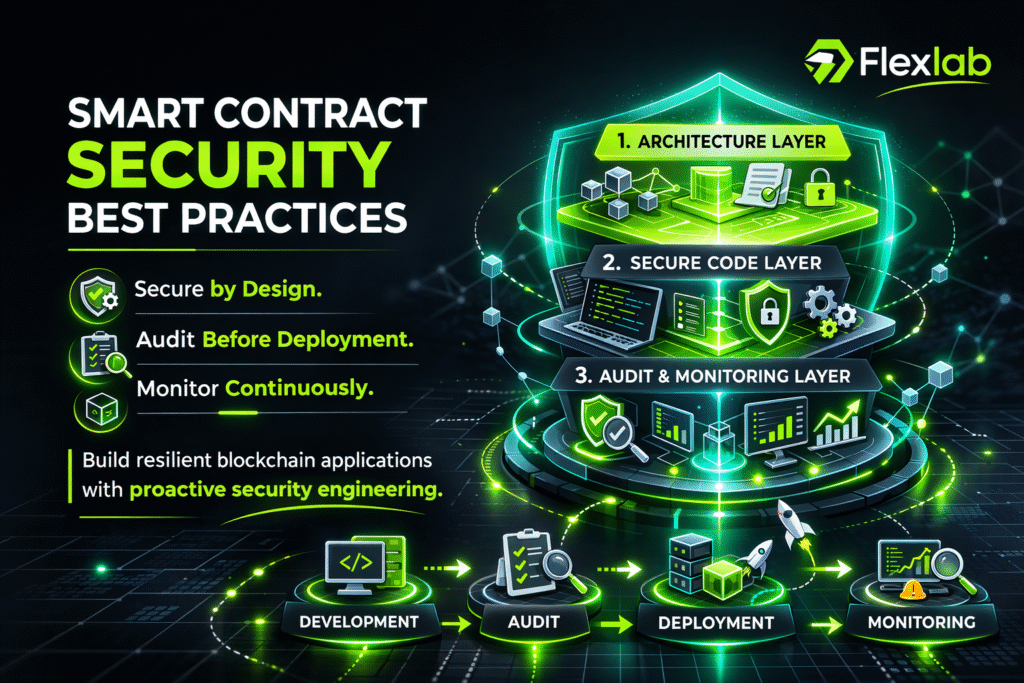

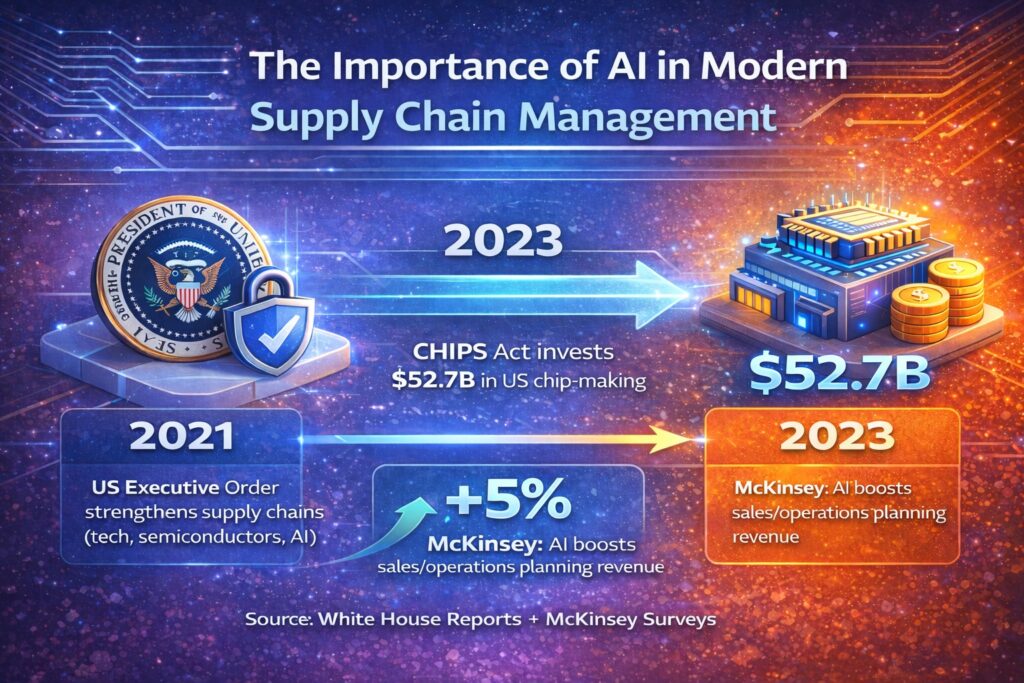

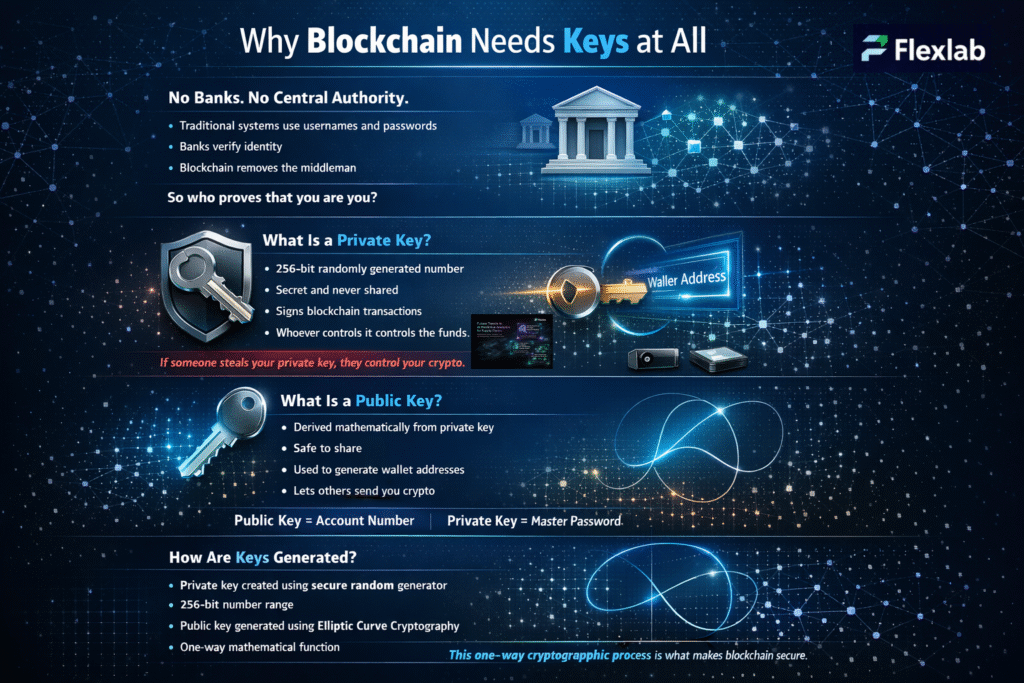

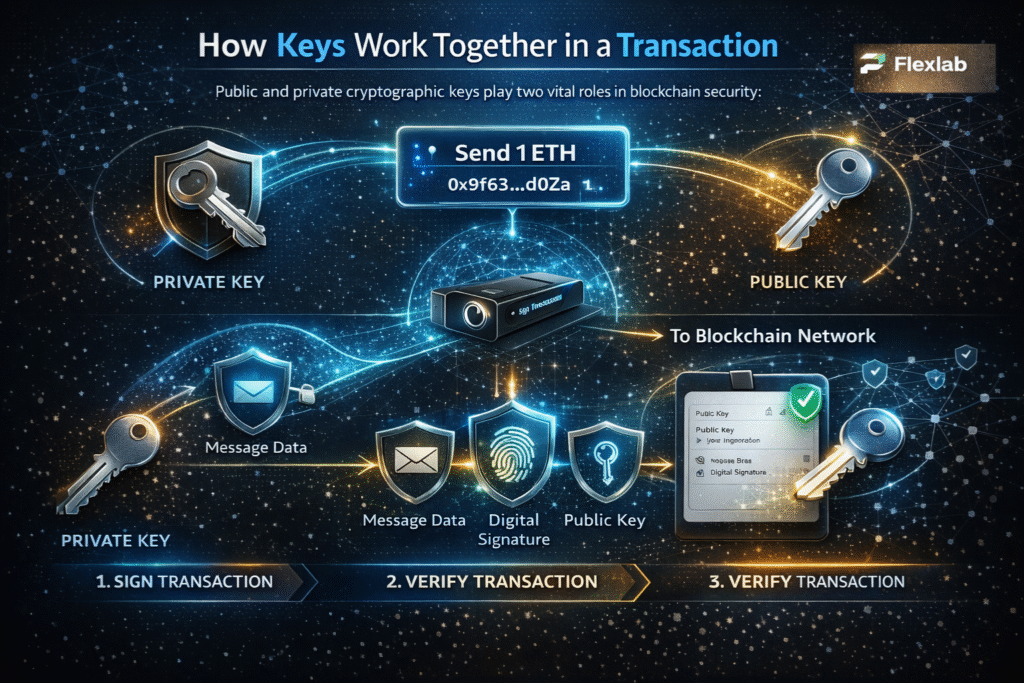

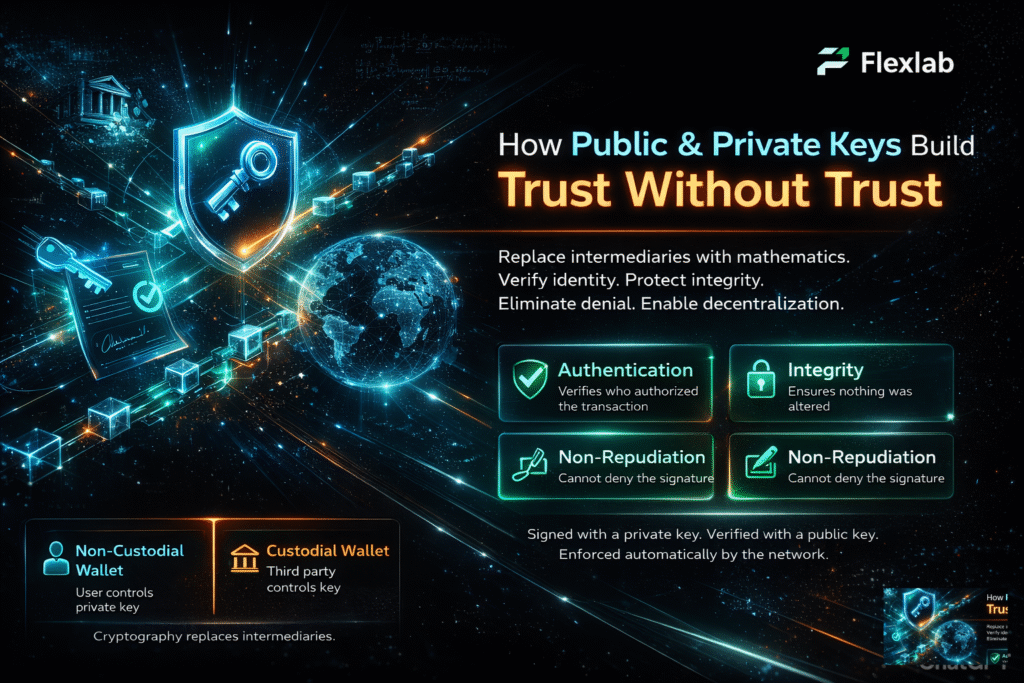

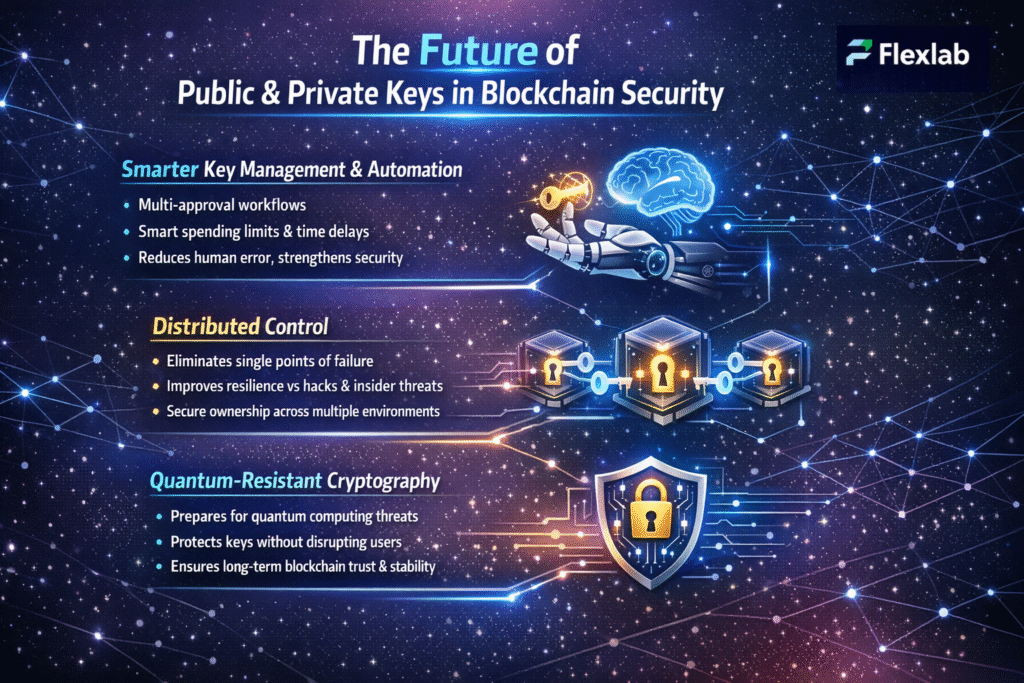

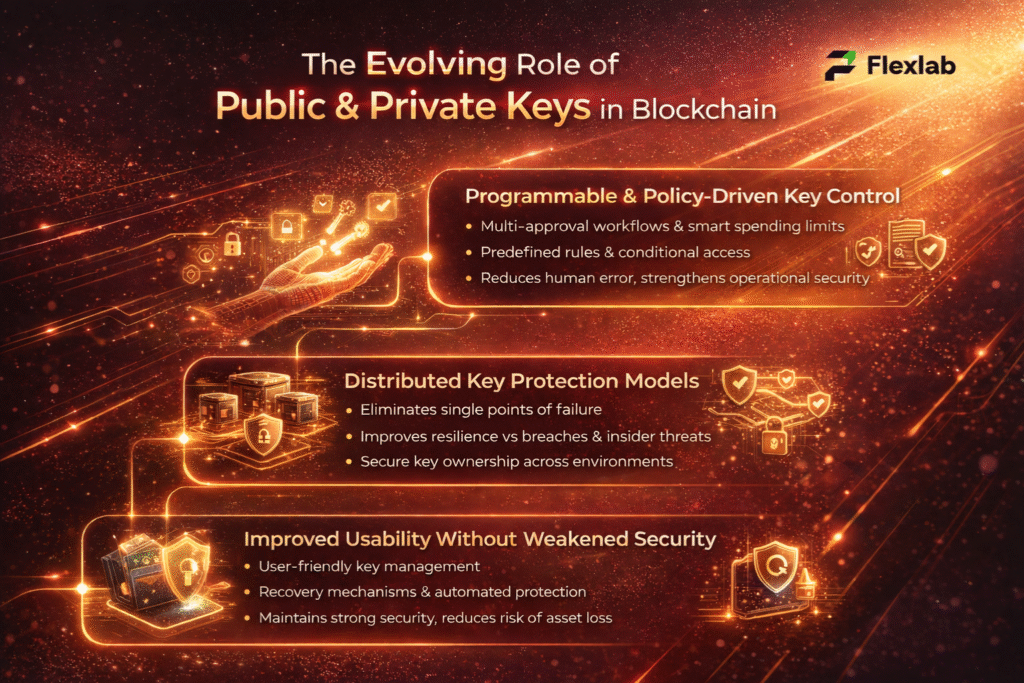

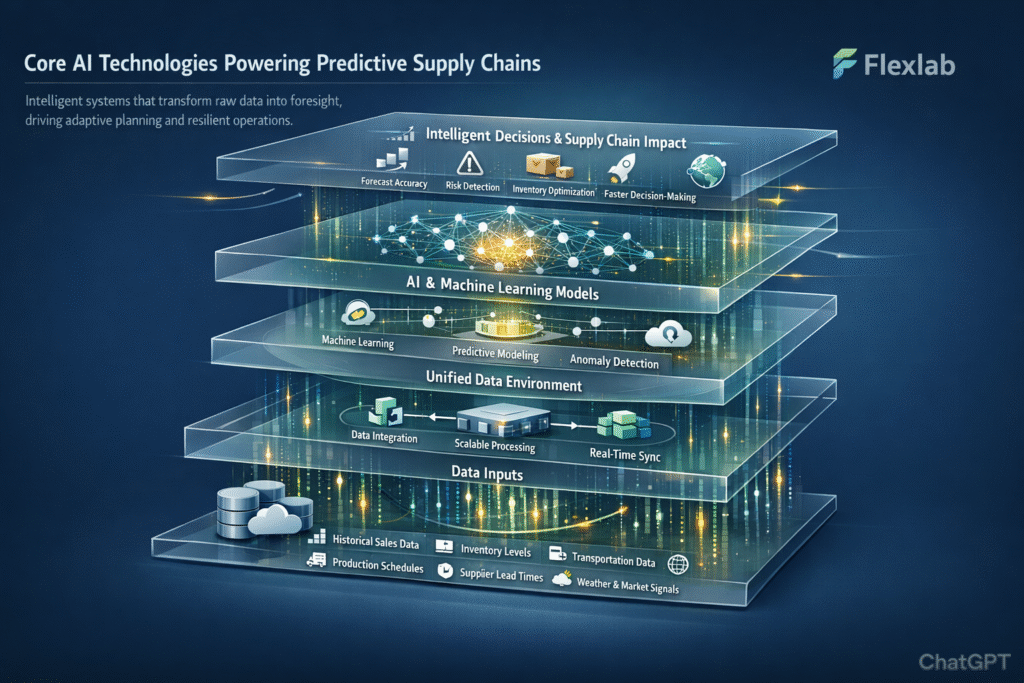

Enhance Security with AI & Blockchain

Blockchain is a digital ledger used to record all transactions. Its transparency and security create difficulty for hackers to manipulate or detect digital data. In contrast, AI is a smart detective that analyzes digital activities and detects irregular and suspicious patterns, can easily alarming about potential threats and alert us before major issues occur. Together, they create powerful protective shields that secure users’ identities and prevent fraud. It’s a dynamic combination of digital bodyguards that is unstoppable.

-

Customer Awareness

Run awareness campaigns to empower the customers to recognize and be ready to avoid fraudulent activities. Educating users about types of fraud and prevention techniques is essential.

In addition, businesses can enhance their fraud prevention potential and protect themselves and their customers from cybercrime by implementing these strategies.

Human and AI Collaboration in Fraud Detection

AI fraud detection tools are powerful in 2025; however, this does not mean that AI completely replaces humans. Instead, the most successful fraud prevention strategies come from a human + AI collaboration.

Furthermore, AI systems can handle and analyze millions of transactions per second, detect irregular spending patterns, and instantly report suspicious activities that would be difficult for humans to identify. AI can process large amounts of data in real time. In contrast, humans ensure empathy, context, and ethical decision-making.

Al and humans create a fraud detection system that is faster, smarter, and more reliable than working alone. To sum up, AI is working as an assistant, and as a human, you can take advantage of its capabilities to enhance productivity.

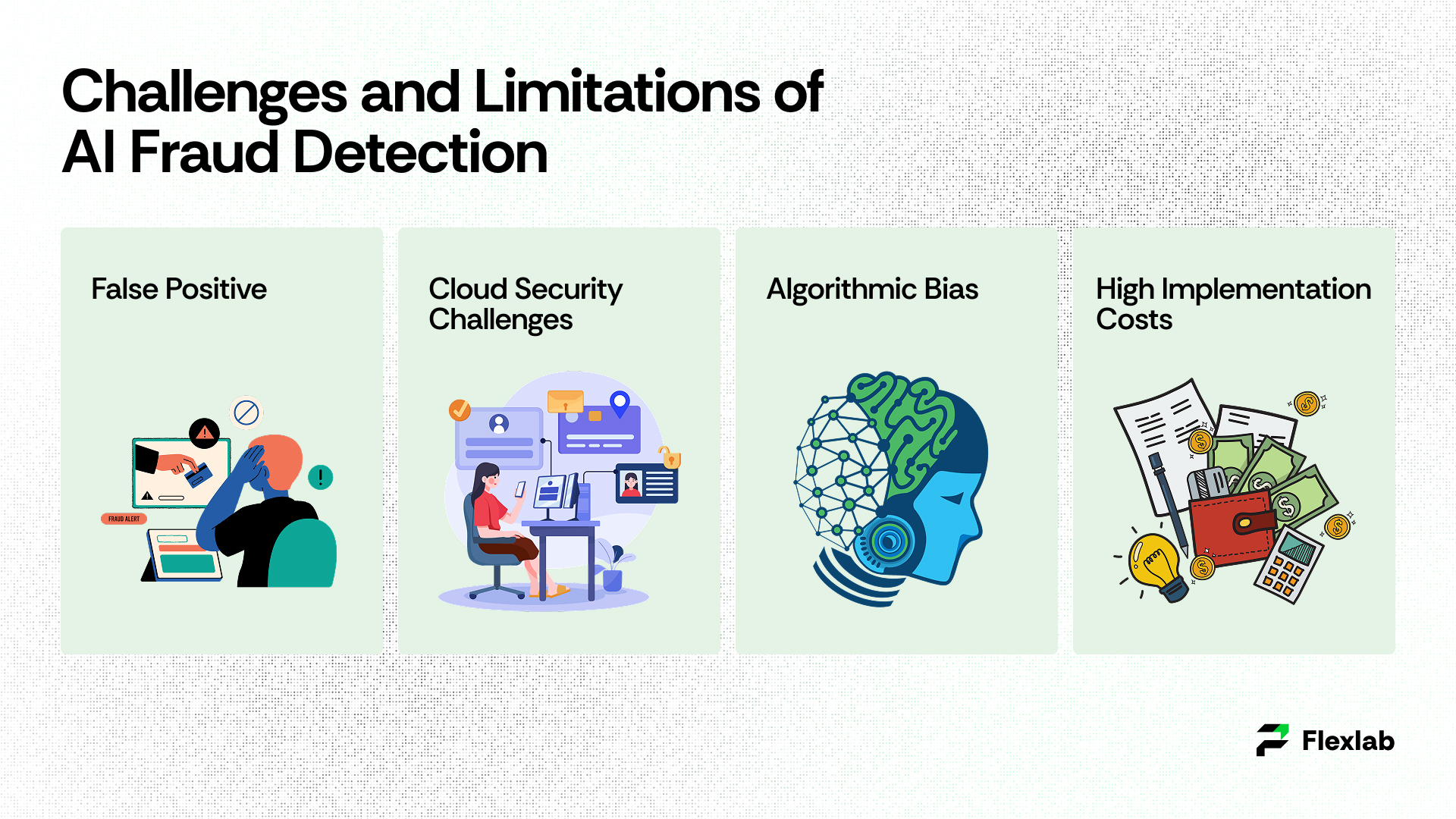

Challenges and Limitations of AI Fraud Detection

However, AI in fraud detection has great potential; it also faces several challenges, which include:

- False Positive: A false positive occurs when a legitimate activity or transaction is incorrectly flagged as suspicious or blocked due to a fraudulent detection error.

- Cloud Security Challenges: One of the key cloud security challenges is to manage sensitive data on a large scale.

- Algorithmic Bias: If an AI system is not designed perfectly, it may generate inaccurate results or information.

- High Implementation Costs: High-quality AI development services involve significant implementation costs that deliver results in the long run.

Ethical AI & Responsible Fraud Detection

In 2025, businesses are adopting AI for fraud detection. A top priority is ethics. However, AI can give protection to the customer and minimize financial losses; we must use it responsibly to build trust and to get its benefits.

Responsible AI means combining fairness, privacy, and accuracy. If businesses follow ethical guidelines and compliance standards properly, get help to prevent fraud and also strengthen customer trust. In today’s era of globalization, where trust is everything, ethical AI is no longer optional; it is a game-changer for organizations aiming for long-term success and growth.

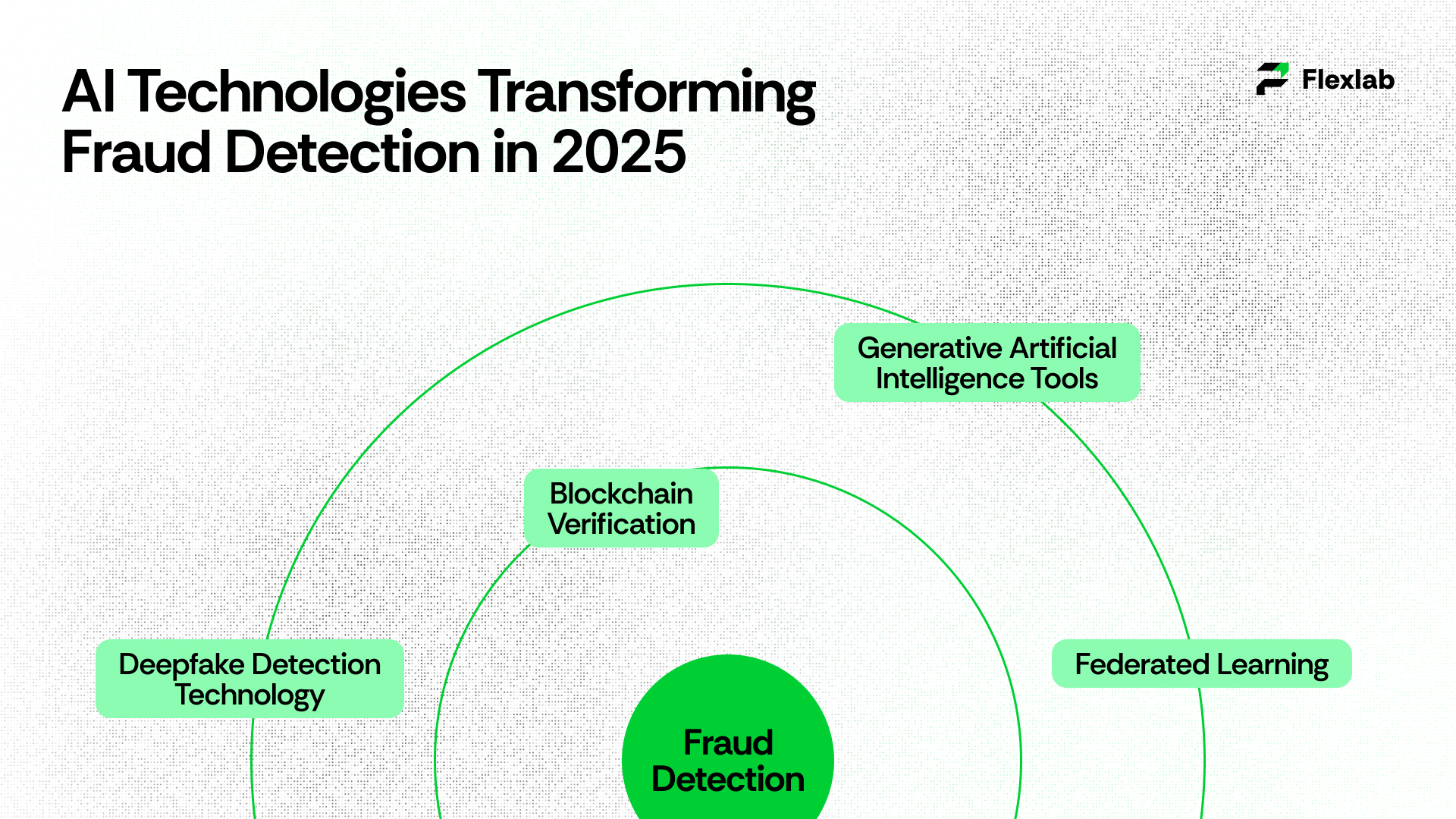

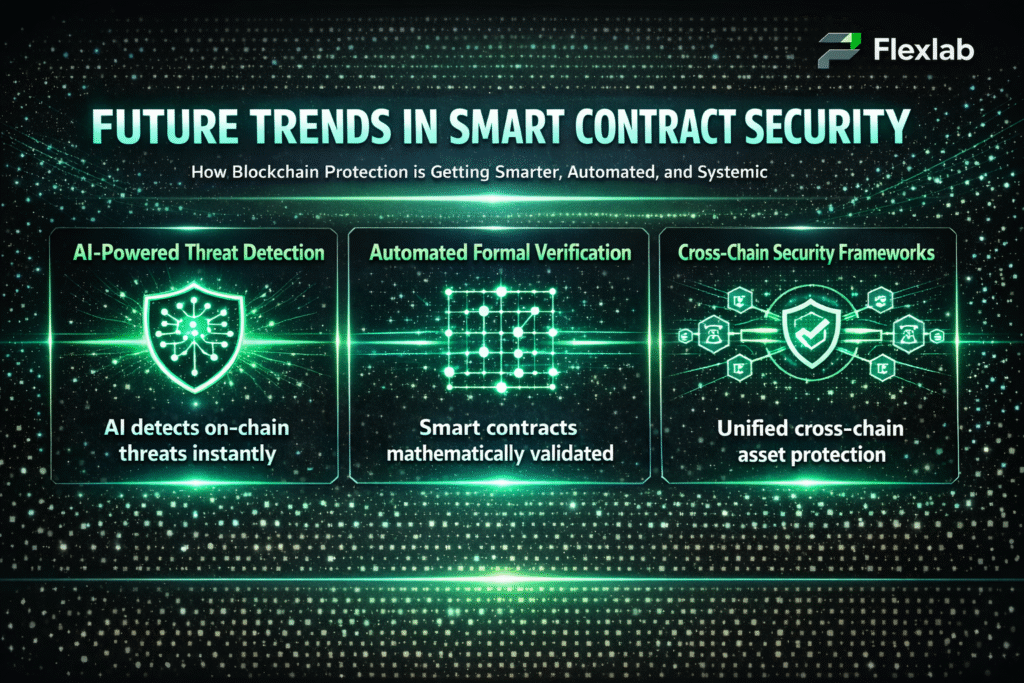

Emerging Tools and Trends in AI Fraud Detection (2025)

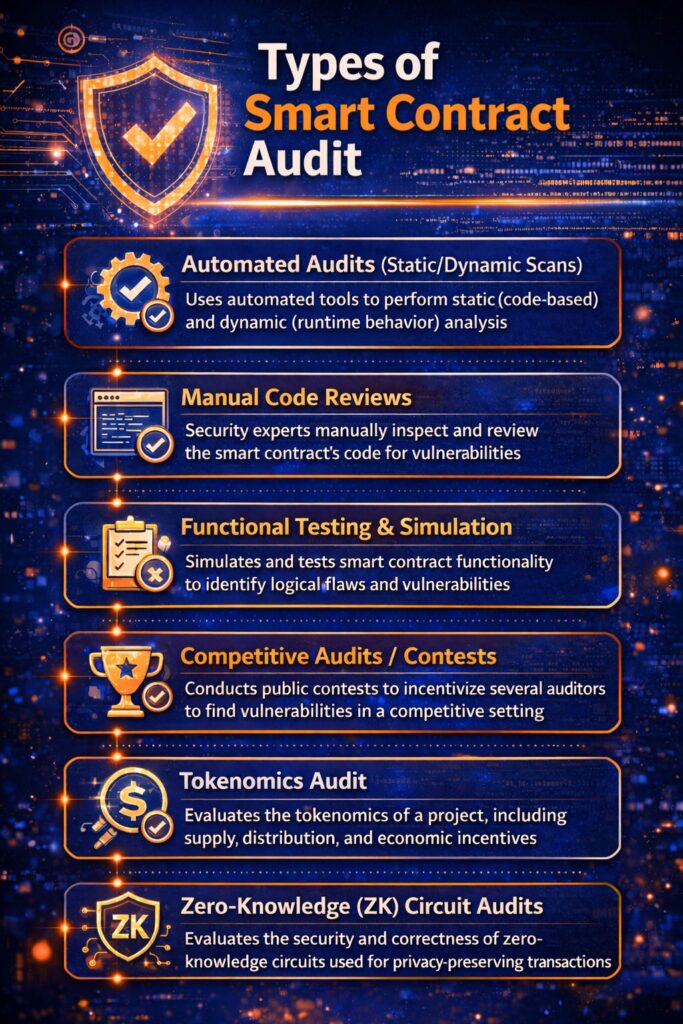

Emerging tools and trends in AI fraud detection. It helps to identify and prevent white collar financial crimes with the help of transaction monitoring software and protects organizations’ assets and sensitive data from fraudsters.

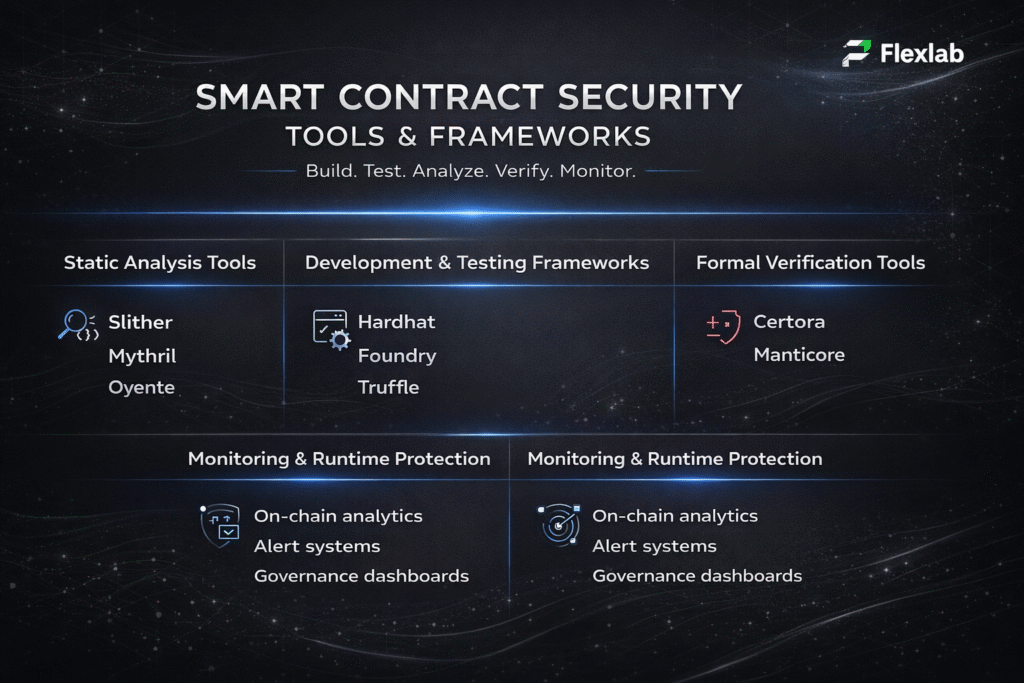

- Generative Artificial Intelligence Tools: One key tool is fraud detection and prevention, achieved by identifying irregular and suspicious activities, analyzing data to spot active and potential threats, and blocking them before they occur.

- Blockchain Verification: It gives secure identities in the digital ecosystem to ensure trust in interactions and payments.

- Deepfake Detection Technology: It protects individuals and businesses from artificial video and video fraud.

- Federated Learning: A methodology to create modern AI systems with enhanced privacy and security.

Why Partner with Flexlab for AI Fraud Detection Solutions?

Flexlab specializes in AI-driven fraud detection, blockchain-powered security, and custom web development solutions designed to future-proof your business. Our expert team helps you to carefully analyze and provide outstanding AI solutions for innovation that drive results. Our expert team seamlessly integrates AI-powered fraud detection tools into your current system while keeping your business running smoothly.

We design an end-to-end security setup to stay one step ahead of scammers. From transaction transparency to identity assurance, we provide a shield of solutions against fraud. Protecting your business is just a start. We aim to help you grow with secure, performance-driven websites and applications. Our team of experts is dedicated to future-proofing your business. Explore our portfolio to discover how we empower businesses like yours to thrive.

Real-World Success Stories

- Fintech Startup Saved $1.2M: By integrating AI-driven fraud detection and custom payment monitoring tools, a FlexLab client cut fraudulent transactions by 68% within just three months.

- E-commerce Store Boosted Customer Trust: A top online retailer partnered with FlexLab to revolutionize risk management through real-time risk scoring solutions, strengthening customer confidence. They achieved a remarkable 54% reduction in chargeback fraud and improved customer satisfaction.

These results aren’t just statistics – they’re a testament to the power of AI in revolutionizing your fraud prevention strategy. When experts put AI to work for you, the impact is real: safer transactions, reduced losses, and peace of mind. AI can transform your fraud prevention strategy when implemented by the right experts. Interested in learning more about our services? Contact us today.

Ready to Grow Your Business?

📞 Book a FREE Consultation Call: +1 (416) 477-9616

📧 Email us: info@flexlab.io

Let’s Flexlab empower your business with artificial intelligence solutions designed for the future.

Conclusion: Use of AI in Fraud Detection in 2025

Fraud detection in 2025 is about being one step ahead of cybercriminals. It requires intelligent, adaptable, smart, and ethical AI systems that can highlight suspicious activities and help in the prevention of financial crimes.

In conclusion, AI-powered fraud detection tools are a game-changer. They transform the organizations’ methodologies to protect their revenue, safeguard customer trust, and continuity of business operations. By integrating strategies like multi-factor authentication, blockchain security, real-time monitoring, and deepfake detection, businesses can build an unshakable defense system. However, it is important to note that, yet, the real power comes when humans and AI collaborate. By combining the speed and scale of AI with human judgment, ethics, and oversight, they can make a huge difference. Simply, together, humans and AI can achieve amazing results.

Nevertheless, some challenges, such as false positives, algorithmic bias, and high implementation costs, remain constant. The benefits of AI in fraud prevention, faster detection, reduced financial losses, and enhanced customer trust. In short, it clearly outweighs the risks. The future is ready to welcome the organizations that smartly adopt responsible AI, balancing security with fairness, privacy, and transparency.

Consequently, when AI-driven fraud detection is implemented by the right experts, the results are transformative. It ensures safer transactions, reduced losses, and long-term customer loyalty. The message is crystal clear in 2025 and beyond. Adopting AI in fraud detection is not just an idea or a luxury. It is mandatory for survival and growth in the digital economy.

What are the best AI fraud detection tools in 2025?

In 2025, top AI fraud detection tools include SEON, Riskified, and Sift, known for real-time risk analysis and behavior monitoring. Feedzai and Forter enterprise enterprise-grade protection for financial institutions. Data Dome specializes in bot prevention, while Trulioo provides global identity verification. These tools combine machine learning and analytics to detect fraud.

What is the future of AI in fraud detection?

The future of AI in fraud detection is predictive and proactive. Preventing scams and threats before they happen. Advanced tools like blockchain verification, federated learning, and deepfake detection will enhance security in 2025 and beyond. AI will act as an assistant or partner to humans, combining speed and accuracy with ethical decision-making. Businesses that adopt AI-driven fraud prevention will reduce losses, strengthen customer trust, and stay ahead of cybercriminals.

How can small businesses use AI for fraud detection in 2025?

Small businesses can adopt affordable AI-powered tools that analyze transactions, detect unusual patterns, and flag suspicious activities in real time. Cloud-based fraud detection platforms offer scalable, pay-as-you-grow solutions, making advanced security accessible without huge upfront costs. By leveraging these tools, even small businesses can protect revenue, build customer trust, and compete securely in the digital economy.

6 Responses

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?