10 Essential Day Trading Strategies for Beginners

Crypto Wallets | Crypto Trading Bot | White Label Crypto Exchange

Day trading strategies are available for anyone interested in making a profit from short-term market moves while taking control of their financial future. However, success requires structure, discipline, and a clearly defined plan. With the right approach, traders can work from anywhere while managing trades efficiently and strategically.

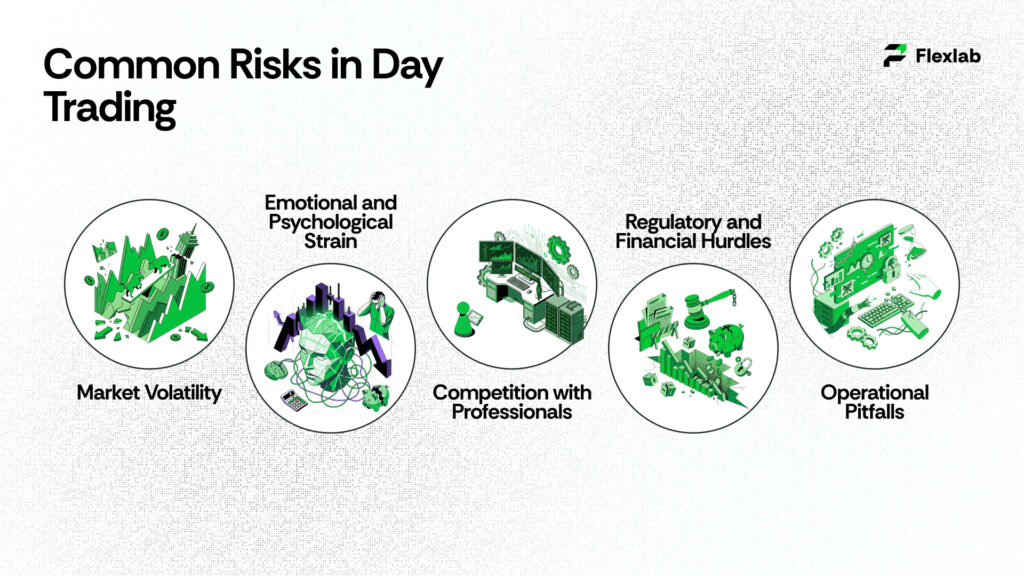

As markets evolved, and 2026 began, the market environment had noticeably changed. As a result, fast-moving AI-driven algorithms, high trading volume, and real-time global news mean beginners need structure more than ever. Without a clear plan, day trading often becomes inconsistent and emotional. Understanding proven trading techniques substantially builds confidence and removes guesswork.

With that foundation in place, this guide presents 10 practical, beginner-friendly strategies for modern markets. Each one focuses on clarity, disciplined risk management, and real-world application so you can easily learn before putting real money at risk.

Choosing the Battle: Which Strategy Fits Your Style?

In the 2026 market, one-size-fits-all is a myth. The rapid rise of AI-driven liquidity and predictive analytics has made the markets more efficient. Furthermore, it has also created distinct areas of opportunity for retail traders who know where to look. Day trading is just one of several types of trading, alongside swing trading, position trading, and long-term investing, each requiring a different mindset and time commitment.

In practical terms, before we explore the technical mechanics of each setup, it’s vital to understand that your success depends on matching a strategy to your daily schedule and personal risk tolerance. This alignment also depends on the financial instruments you trade, such as stocks, futures, forex, or cryptocurrencies.

Whether you’re a morning person looking to capitalize on the 9:30 AM opening bell or a systematic thinker who prefers the set-it-and-forget-it nature of moving averages, the following breakdown will help you identify your best entry point into the world of day trading.

Strategy Comparison at a Glance

| Strategy | Complexity | Time Commitment | Market Condition | Best For |

| Trend Trading | Low | Moderate | Strong Trends | Beginners |

| Breakout Trading | Moderate | Moderate | High Volatility | Momentum Seekers |

| Mean Reversion | Moderate | High | Overextended | Patient Traders |

| Scalping | High | Extreme | High Liquidity | Fast Thinkers |

| Gap and Go | Moderate | Low (9:30 AM) | Morning Moves | Morning Traders |

| Pullback Trading | Low | Moderate | Healthy Trends | Disciplined Entry |

| Range Trading | Low | High | Sideways Markets | Quiet Markets |

| News Trading | High | Low (Burst) | Major Events | Reactive Traders |

| MA Crossover | Low | Moderate | Trending Markets | Systematic Fans |

| Reversal Trading | High | Moderate | Exhausted Trends | Contrarians |

How to Navigate These Strategies

At a high level, the above table presents a bird’s-eye view; the secret sauce is in the execution. Below, we break down each of these 10 strategies into three critical components:

- The Setup (what to look for),

- The Tools (what indicators to use), and

- The Reality Check (a common beginner pitfall to avoid).

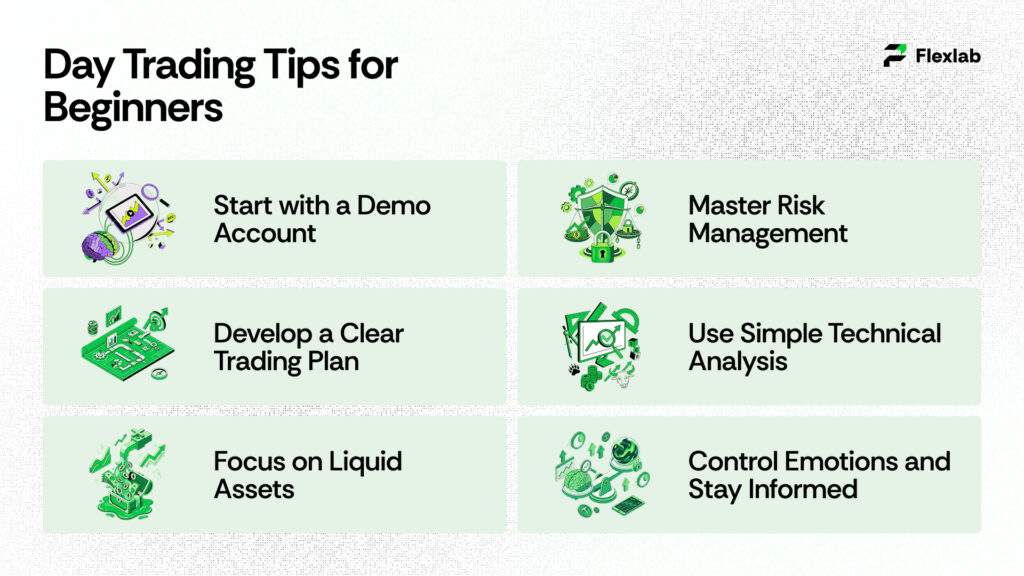

More importantly, don’t try to master all ten at once. Pick one that fits your current schedule, such as Gap and Go if you only have an hour in the morning, and master it in a simulator first. One of the most practical day trading tips for beginners is to build consistency with a single setup before expanding further.

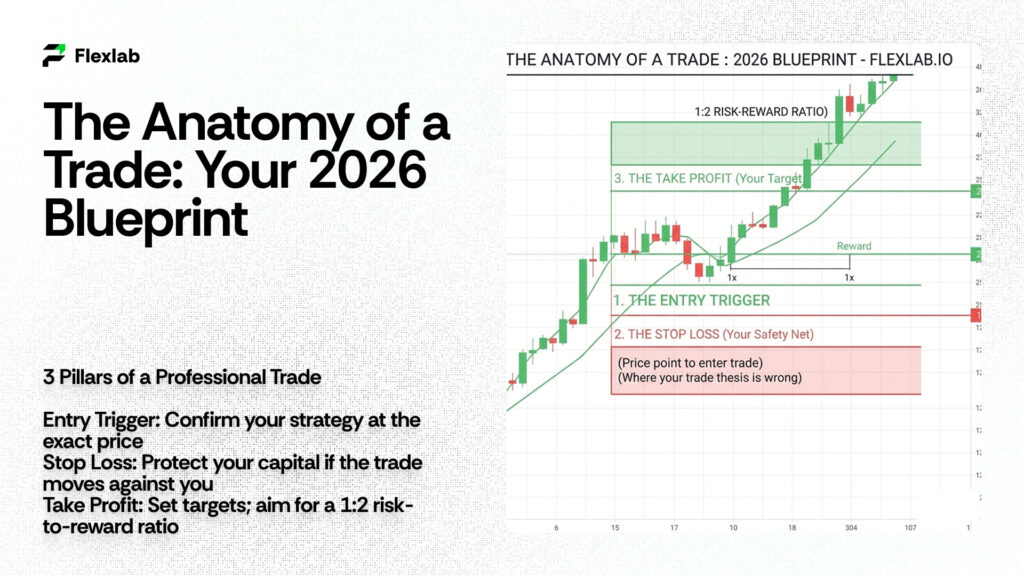

The Anatomy of a Trade: Your 2026 Blueprint

Before executing any trade, you must visualize the three pillars of a professional setup. From a risk perspective, in a market dominated by algorithms, entering and hoping is a guaranteed way to blow an account. Using fractional shares allows beginners to apply these day trading strategies/principles precisely, even when trading higher-priced stocks with limited capital.

- The Entry Trigger: The exact price point where your strategy is confirmed. Clearly defining your entry points prevents impulsive trades and improves execution discipline.

- The Stop Loss: Your safety net, the price at which your market thesis is proven wrong.

- The Take Profit: Your target. We recommend a 1:2 risk-to-reward ratio as the baseline for beginners.

The 1% Rule: A Survival Guide for Beginners

In reality, in the volatile 2026 landscape, the difference between a professional and a gambler is position sizing. This principle is one of the foundational day trading rules that professionals follow to protect capital. This rule ensures that no single market move can end your trading career. When trading on margin, ignoring risk limits can rapidly magnify losses, making strict discipline essential.

How it works in practice:

- Account Balance: $10,000

- Max Risk per Trade (1%): $100

- The Calculation: If your stop loss is $2 away from your entry, you buy exactly 50 shares ($100 risk ÷ $2 distance).

By following this evaluation, you would need to lose 100 trades in a row to blow your account. This discipline allows your strategy’s edge to play out over time.

1. Trend Trading (The Trend Is Your Friend)

Trend trading is one of the most reliable day trading strategies for beginners because it aligns with the market’s natural direction. As a result, traders avoid emotional reversals and focus on momentum. Instead of guessing reversals, you trade with momentum, which simplifies decision-making and reduces impulsive trades.

-

Spotting the Trend

A healthy trend forms higher highs and higher lows in an uptrend or lower highs and lower lows in a downtrend. Think of price action as a staircase; consistent steps give a surety of direction.

-

Tools and Timing

The 200-period EMA is the primary trend filter. When the price stays high, it focuses on long trades. On the contrary, it focuses on shorts. Advanced traders sometimes combine moving averages with Ichimoku trading to confirm trend strength and momentum. The 20-period moving average helps identify pullback entries within the trend.

-

Real-World Case

During tech sector rallies, traders who entered on pullbacks to the 20 MA captured steadier gains than those chasing breakouts near the highs.

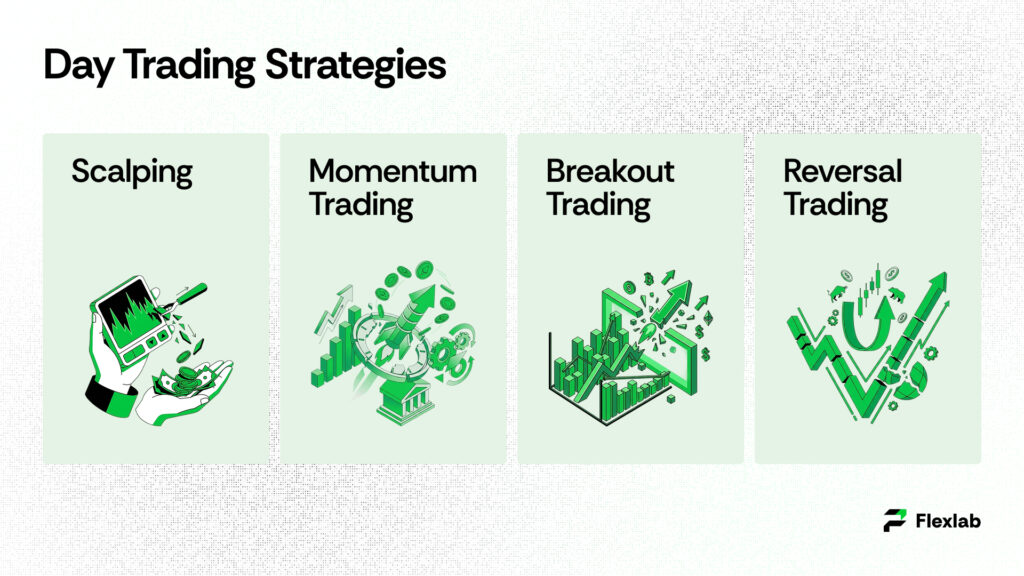

2. Breakout Trading (Catching the Big Move)

By contrast, breakout trading targets assets that are about to make strong directional moves. It’s popular because it captures momentum rather than slow price action.

-

Identifying Breakouts

Search for stocks consolidating between clear support and resistance. A valid breakout occurs when the price closes above resistance with strong trading volume. This approach is a classic form of momentum trading, designed to capture rapid price expansion. Low volume often signals a fake move.

-

Tools and Confirmation

Volume is the key confirmation tool. Many traders wait for a breakout retest before entering, which helps reduce the number of false entries.

-

Real-World Example

A biotech stock, which had been trading between $42 and $44, broke above $44 with heavy volume. Traders who waited for confirmation captured a clean daily fluctuation, while early entries were stopped out.

3. Mean Reversion Trading (The Rubber Band Strategy)

Mean reversion is one of the most misunderstood trading techniques, yet it remains effective when used correctly. When a price swings too far, too fast, it often snaps back toward its average.

-

When Price Moves Too Far

In numerous instances, markets rarely move in straight lines. Sharp moves typically attract late buyers or sellers, pushing prices beyond reasonable levels. Mean reversion traders look for exhaustion, not prediction.

-

The Core Tool: RSI

The Relative Strength Index (RSI) helps spot extremes. Readings above 70 suggest overbought conditions, while readings below 30 indicate oversold levels.

-

Managing Risk

This strategy requires great patience. Waiting for the price to slow down before entering improves consistency and protects capital.

4. Scalping (Fast Trades, Small Profits)

Scalping focuses on capturing small price movements within seconds or minutes. However, this day trading strategy demands speed, discipline, and precise execution. The goal is consistency, not large wins.

-

Speed and Discipline

Under fast-moving conditions, scalping works best during peak market hours when liquidity is high. These peak trading hours provide tighter spreads and faster order execution. Fast execution and clean charts matter more than complex technical analysis.

-

Tools That Matter

Short-term moving averages and volume spikes are common tools because profits are lower; commissions and platform speed both play a significant role.

-

A Common Beginner Mistake

Overtrading and ignoring stop losses. One bad trade can wipe out several small wins, making discipline essential.

5. Gap and Go (Trading the Opening Bell)

Typically, a gap occurs when a stock opens significantly higher or lower than its previous closing, usually due to news or earnings.

-

Finding the Right Gap

The best setups show strong pre-market volume and clear catalysts. Many gap opportunities appear in penny stocks, though they carry higher volatility and execution risk. Liquid stocks tend to perform more accurately than thinly traded names.

-

Executing the Trade

Most traders focus on the first 5–15 minutes after the opening. A break above the initial range with momentum often leads to continuation.

6. Pullback Trading (Entering at a Better Price)

Pullback trading rewards patience. Instead of chasing price, you wait for a retracement within an existing trend.

-

Why Pullbacks Matter

Strong trends pause before continuing. These pauses offer lower-risk entry points and reduce instinctive decision-making.

-

Tools for Entry

Common tools include Fibonacci retracements (50% and 61.8%) and short-term moving averages.

-

Mistake to Avoid

Entering too early. Waiting for confirmation improves results.

7. Range Trading (Sideways Markets)

During consolidation phases, range trading works best when markets lack direction. Price tends to bounce between support and resistance.

-

Identifying a Range

A valid range forms when price repeatedly respects the same upper and lower levels.

-

Helpful Tools

Bollinger Bands help visualize range extremes. Some traders also apply pivot point trading to identify short-term support and resistance levels. Low volume supports range behavior, while rising volume warns of breakouts.

8. News Trading (React, Don’t Predict)

That said, news trading can be risky for beginners. In contrast, structured day trading strategies such as trend trading or pullbacks offer more predictable outcomes. Prices often move violently right after the major announcements.

-

How News Affects Price

Algorithms react first, causing sharp slashes. Waiting for the initial reaction to settle provides clearer opportunities.

-

Risk Control

News can ignore technical levels. This risk is amplified in over-the-counter markets, where liquidity can disappear instantly. Tight stop losses and strong trading psychology are mandatory.

9. Moving Average Crossover (Rule-Based Trading)

This strategy uses predefined rules to reduce sentiment-driven trading.

-

How It Works

A fast-moving average rising above a slower one indicates a possible buy; in contrast, dropping below suggests a sell.

-

Why Beginners Like It

Clear rules help to maintain discipline, especially during strong trends.

10. Reversal Trading (The Contrarian Approach)

By definition, reversal trading goes against the trend and carries higher risk.

-

Why It’s Challenging

Trends usually last longer than expected. Trying to call tops or bottoms too early leads to losses.

-

When It Makes Sense

Extreme price moves combined with candlestick patterns like hammers or shooting stars can signal exhaustion. Tight stops are essential.

The 2026 Infrastructure: Powering Your Strategy

At the same time, in today’s market, having a great strategy is only half the battle. Professional day trading software is essential for executing trades with speed and reliability.

To execute these 10 techniques or day trading strategies effectively, your technical setup must be as sharp as your analysis. High-frequency AI algorithms now account for over 70% of daily volume, meaning speed and reliability are non-negotiable.

Execution Platforms: Utilize institutional-grade platforms such as TradingView or Interactive Brokers that support real-time API hooks. These tools are widely regarded as some of the best online trading platforms for active traders.

Edge Computing: Many pro traders now use Virtual Private Servers (VPS) to ensure their trades execute in milliseconds. Working with the best brokers for day trading further reduces slippage and execution delays. Even if their home internet sparks.

AI-Assisted Scanning: Don’t waste hours hunting for setups. Modern tools like Flexlab’s proprietary scanners can monitor 500+ tickers simultaneously, alerting you only when a strategy like the Gap and Go or Mean Reversion meets your exact criteria.

Beyond the Bot: Why Human Intuition Is Still the Greatest Asset

While automation excels at rocket speed. Within a millisecond, high-frequency algorithms can process a million data points; they only lack the one thing that defines the world’s most successful traders: context. In 2026, the most profitable strategies are augmented. They combine the raw speed of AI with the nuanced judgment of a human brain.

While a bot can identify a staircase trend, it cannot sense the subtle shift in market sentiment during a geopolitical event when a breakout is driven by social media hype rather than institutional volume. Success doesn’t come from fighting the machines; it comes from utilizing Flexlab’s engineering to automate the complaint work, freeing you to focus on high-level decision-making where the real value is created.

2026 Market Outlook: Why Traditional Methods Are Evolving

Looking ahead, the trading landscape of 2026 is defined by predictive liquidity and volatility compression. Unlike the markets of five years ago, today’s price action is heavily influenced by large-scale AI models that can front-run traditional retail indicators.

To survive, beginners must shift from static analysis to dynamic execution. This means not just looking for an RSI crossover but understanding the volume profile behind it. We expect 2026 to favor those who utilize hybrid systems and strategies that are technically sound but flexible enough to adapt when institutional algorithms shift their bias.

From Manual to Algorithmic: Scaling Your Success

Over time, most beginners start with manual execution, staring at charts and clicking buttons. However, the true path to consistent profitability in 2026 is automation. Manual trading is likely to lead to fat-finger errors and emotional exhaustion.

By converting these 10-day trading strategies into automated agentic workflows, you remove human bias entirely. Imagine a system that never sleeps, calculates your risk-to-reward ratio instantly, and executes a Moving Average Crossover at 3:00 AM while you rest. This isn’t just a convenience; it’s how you scale a small account into a professional operation.

Dominate the Markets: Secure Your 2026 AI Strategy with Flexlab

Average traders rely on luck, but elite performers rely on architecture. In a market dominated by lightning-fast algorithms, you need more than just a plan; you need a technical advantage. Flexlab engineers the high-performance frameworks and AI-driven workflows required to outpace the competition. Stop reacting to the market and start commanding it with systems built for precision, scale, and relentless reliability.

Whether you are looking to automate complex trading logic or deploy sophisticated agentic workflows, we possess the expertise to turn your vision into a live, high-speed reality.

Ready to Automate Your Day Trading Strategies?

📞 Book a FREE Consultation Call: +1 (201) 347-8591

📧 Email us: info@flexlab.io

Elevate Your Technical Infrastructure

Success in the digital age demands a partner who understands the intersection of finance and cutting-edge automation. You can explore the full spectrum of our high-tier services to understand how we architect elite solutions or navigate through our portfolio to examine the high-speed automation projects we’ve already successfully deployed. If you are ready to stop theorizing and start building, contact us immediately to initiate your transformation. We also invite you to sharpen your edge by absorbing the technical insights found on our blog or by syncing with our latest breakthroughs on LinkedIn.

Expand Your Knowledge:

- What Is Automated Machine Learning and How Does It Work?

- How AI Strategy Consulting Boosts Business Growth?

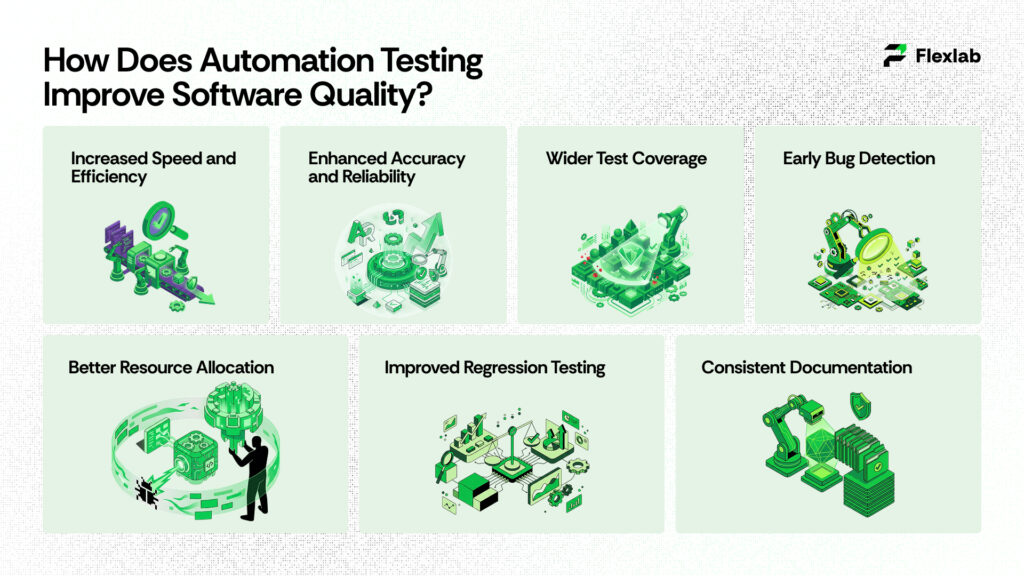

- How Does Automation Testing Improve Software Quality?

Conclusion: Master Day Trading Strategies for Consistent Success

Day trading doesn’t have to feel overwhelming. The right day trading strategies for beginners, combined with strong trading psychology, make consistency possible. Focus on clear setups, manage risk carefully, and utilize tools such as the 200 EMA, RSI, Fibonacci levels, and volume to guide decisions. Practice first using a real-time trading simulator, start with small amounts, and treat trading as a skill that is built over time. Remember that it’s not a shortcut to generate quick money.

FAQs

-

How much money do I need to start day trading?

It really depends on what you’re trading. Some crypto or offshore accounts let you start with as little as $100, but realistically, you’ll want a bigger cushion to handle early losses. In the U.S., if you’re trading stocks frequently, there’s a $25,000 minimum for pattern day trading. On the other hand, micro-futures, forex, or fractional shares allow beginners to start smaller while still practicing solid risk management.

-

What technical tools and software are essential for day trading in 2026?

Modern-day trading requires a high-speed internet connection and a dedicated trading platform that offers Level 2 market data and real-time execution. In 2026, the use of AI-powered screening tools and advanced charting software with built-in back testing capabilities has become the industry standard for gaining a competitive edge. Beginners should prioritize platforms that offer a paper trading simulator to test strategies against live market data safely.

-

What are the primary factors that determine day trading profitability?

Profitability comes from a solid strategy, strict risk management, and emotional control. Data reveals that the majority of retail traders fail due to over-leveraging and a lack of ability to follow a trade plan during periods of high volatility. Long-term success requires treating trading as a business, where consistent execution of a backtested system outweighs the pursuit of occasional large wins.