How Do Smart Contract Audit Services Work?

Blockchain Audit | White Label Crypto Exchange | Crypto Wallets

Do you want to know what a smart contract audit is? Smart contract audits are comprehensive, independent code reviews that expose security vulnerabilities, bugs, and inefficiencies in blockchain applications before immutable deployment. Expert auditors use manual analysis, automated tools, and formal verification to harden smart contracts against exploits, ensuring reliability when a single flaw can trigger million-dollar disasters in DeFi or dApps.

In this complete guide, discover audit types, the step-by-step process, real-world costs and timelines, essential tools, common vulnerabilities like flash loans and oracle manipulation, and why Flexlab’s audit-first expertise powers secure launches for Toronto’s enterprise blockchain projects.

What Is a Smart Contract Audit?

A smart contract audit is a detailed analysis of a protocol’s smart contract code to detect security vulnerabilities, poor coding practices, and inefficiencies. It suggests fixes to solve these issues. Audits make sure decentralized applications in Web3 are secure, reliable, and fast.

During the audit, a team of security experts reviews the code, logic, architecture, and security measures. They use automated tools and hands-on checks to spot issues. Specifically, they hunt for spots where hackers could attack and ways to improve the code.

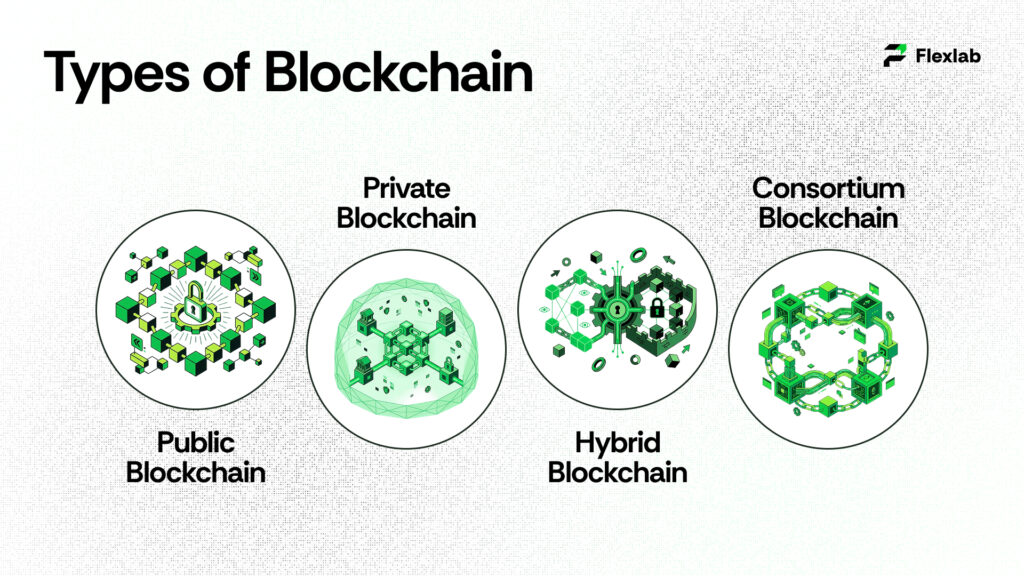

Smart contract code is deployed to a blockchain such as Avalanche, BNB Chain, or Ethereum. Once the contracts are live, they can be used by anyone, from end-users to malicious actors. This is why all flaws and vulnerabilities must be fixed before launching or updating the decentralized app in the blockchain ecosystem.

After the audit wraps up, auditors share a summary report that contains details about their findings, how issues were fixed, other problems, and a plan for leftovers. As a result, projects can launch confidently, knowing the app is solid and user funds are safe from catastrophic risk.

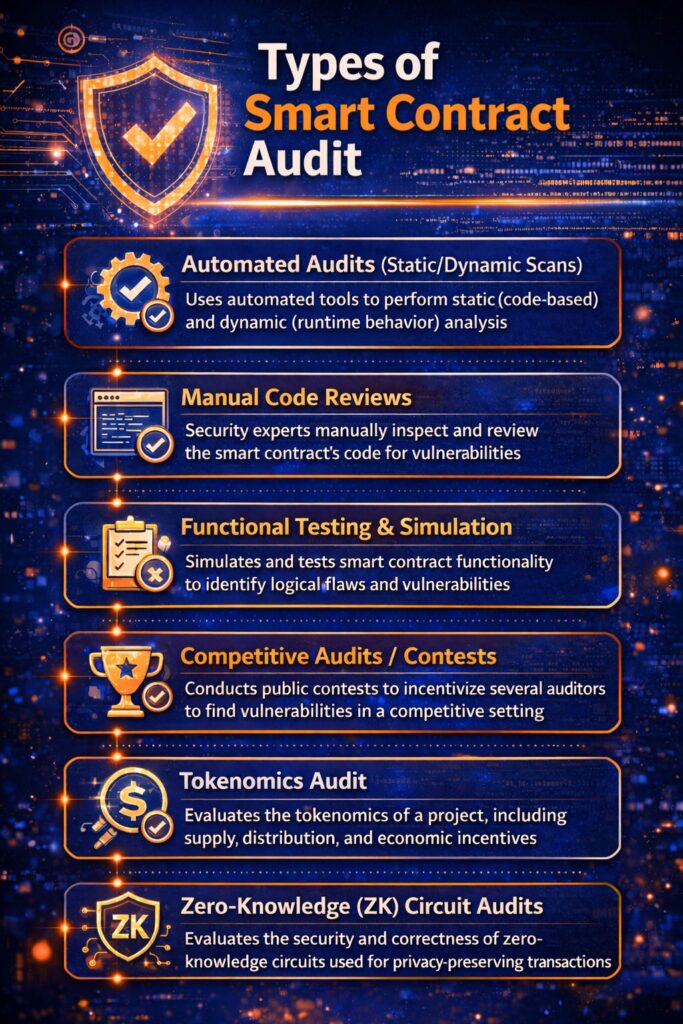

Types of Smart Contract Audit

Smart contract audits ensure that blockchain code is safe in many ways: automated scans for rapid vulnerability detection, manual expert reviews for logic flaws, and specialized audits such as Tokenomics and zero-knowledge proofs. These security audits target high-risk vulnerabilities, including reentrancy attacks (where hackers drain funds by looping calls), weak access controls, and wasteful gas use that could crash the app. Most end with a report listing fixes to avoid hacks and protect users.

Let’s read some of the key types of smart contract audits:

1. Automated Audits (Static/Dynamic Scans)

Teams often use automated tools like Slither, Mythril, or Securify to quickly check code. Specifically, static scans read the code without running it, thereby spotting syntax errors or common bugs. Meanwhile, dynamic scans execute the code to detect runtime issues, such as overflows, which makes them great for catching basic problems in just a few hours. In addition, combining both methods ensures a more thorough audit.

2. Manual Code Reviews

Experts read every line by hand to get the full picture. They spot tricky logic flaws, like reward miscalculations, that tools miss. Plus, they confirm the code matches your project goals, using the docs as a guide. Thus, it’s essential since machines can’t grasp intent.

3. Functional Testing & Simulation

Smart contract auditors test in a fake setup, such as Hardhat and Ganache networks. They run functions under stress-high loads, weird inputs to check behavior, and gas efficiency. For instance, they simulate user flows to ensure deposits and withdrawals work without breaking.

4. Competitive Audits / Contests

Platforms like Code4rena or Sherlock run contests where many auditors examine the same code. This provides more comprehensive coverage than a single firm, often uncovering rare issues. It’s competitive, so top spotters win prizes, boosting thoroughness.

5. Tokenomics Audit

These focus on your token’s economics. Specifically, experts review incentives, supply rules, inflation risks, and how they integrate into smart contracts, such as whether staking rewards dilute value unfairly. This helps prevent pump-and-dump schemes or unfair distributions.

6. Zero-Knowledge (ZK) Circuit Audits

Specialized smart contract auditing uses ZK-proof protocols that hunt bugs in arithmetic circuits and ensure the integrity of privacy-focused apps. This is especially critical for rollups or shielded transactions where correctness is everything.

Why is a Smart Contract Audit Needed?

A smart contract audit is important for rectifying security vulnerabilities, bugs, and inefficiencies in code before deployment. It also prevents irrevocable financial losses. Blockchain code is immutable and acts as law. Therefore, audits are essential for ensuring security, reliability, and functionality in DeFi and dApps. Moreover, it protects against hacks that cost billions of dollars.

Have a glance at the key reasons for smart contract audits:

- Security & Vulnerability Mitigation: Audits identify critical flaws like reentrancy attacks, integer overflows, and unchecked external calls that lead to theft.

- Irreversibility of Transactions: Once deployed, smart contract code cannot change. Hence, flawed code can lead to irreversible loss of funds.

- Financial Protection: Audits prevent and minimize massive financial losses, as over $5B has been lost to DeFi hacks.

- Trust and Credibility: A clean audit report proves you’re serious about smart contract security. It wins over investors, users, and partners.

- Compliance and Logic Verification: Experts verify that your code matches business rules and meets regulations, such as token standards. No surprises in how it runs.

- Efficiency and Optimization: Audits trim wasteful code too, cutting gas fees for users and improving speed.

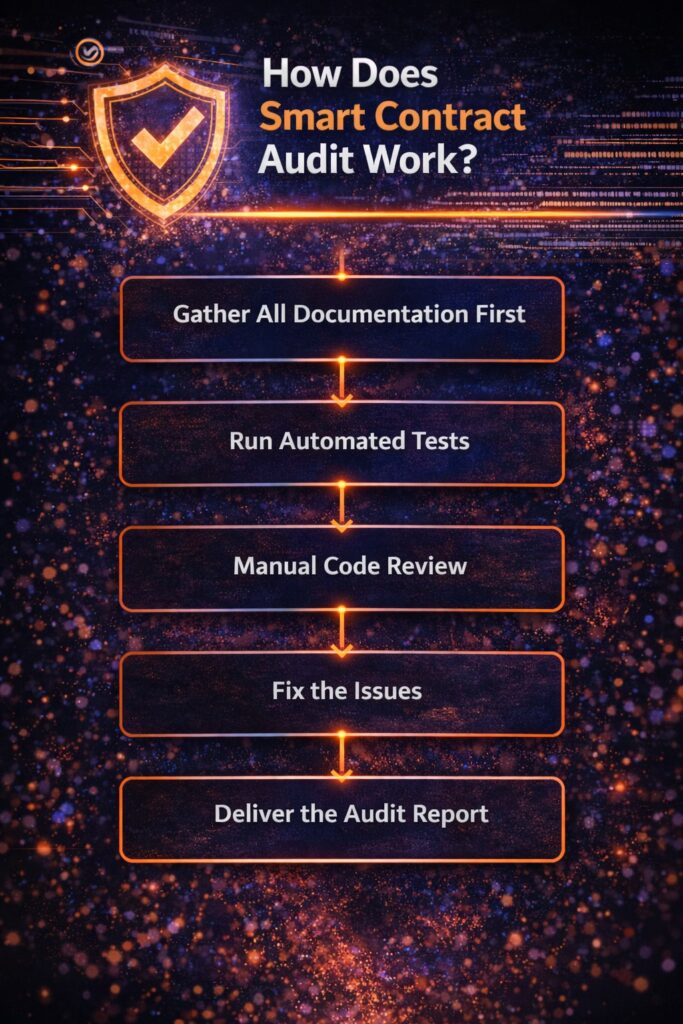

How Does Smart Contract Audit Work?

A smart contract audit is a detailed and comprehensive process. It consists of thousands or even tens of thousands of lines of code that uncover bugs, security gaps, sloppy coding, and anything that is missed. Tools and expert reviewers team up to check both what’s there and what’s not. Here’s the full process, broken down in detail.

Gather All Documentation First

Firstly, the auditor needs to gather all the relevant documents related to the project. This includes the white paper outlining the big idea, the complete codebase, architecture diagrams, tokenomics details, and a full spec sheet explaining exactly what the smart contract should do. Auditors read the documentation to grasp a high-level understanding of blockchain application goals, such as how users interact, where funds move, and the core business logic.

Without having access to the documentation, a smart contract developer can’t determine whether the code delivers on your vision or not. For instance, if your DeFi protocol promises locked staking rewards, the docs spell that out clearly. At this stage, developers and auditors lock in a “code freeze”; no more edits after this point, or anything new gets ignored in the review. This prevents mid-audit changes from messing up the analysis. Expect this prep phase to take a day or two, depending on project complexity.

Run Automated Tests

Once auditors understand the code and app, they run automated tests with specialized tools. This is the fastest way to spot potential problems. For instance, they run integration tests across big code chunks, unit tests on single functions, and penetration tests to poke for security holes. They also track line coverage; a high percentage means tests hit most code lines. After this wraps up, they shift to manual checks.

Manual Code Review

Automated tests flag some issues, but they miss the big picture, like what developers intended or subtle logic flaws. Plus, they sometimes give false alarms. That’s why a hands-on review is crucial. Auditors read every line, map how parts connect, and cross-check against project specs to catch what tools overlook. Combining both methods ensures nothing sneaky slips by during Ethereum Virtual Machine execution.

Fix the Issues

When problems surface, auditors team up with blockchain developers to patch them. This back-and-forth can drag on, but it’s key to success. Fixing everything upfront ensures contracts are deployment-ready. In blockchain technology, security is everything; user funds depend on it, so budget time for pros to hunt and squash risks during this quality assurance phase.

Deliver the Audit Report

Finally, auditors hand over a detailed report on findings. It lists issues, fixes applied, and a plan for leftovers. This becomes your roadmap for polishing the project and sharing proof of security with users and investors.

How Long Does a Smart Contract Security Audit Take?

Smart contract security audit takes 1 to 6 weeks. However, timelines vary depending on project size and complexity. For instance, simple ones wrap faster, while DeFi protocols stretch longer due to thorough checks.

Factors Affecting Duration

Code size and complexity matter when considering time. A basic ERC-20 token might take 3-5 days, while advanced apps with custom logic require 3-4 weeks or even more. Moreover, poor documentation or messy code adds time, as auditors must reverse-engineer intent. Team responsiveness during fixes also matters; unresponsive devOps services extend remediation.

Typical Timelines by Project

Here’s a breakdown from industry standards:

|

Project Type |

Estimated Time |

Examples |

| Simple tokens (ERC-20/BEP-20) | 3-5 days | Basic mint/burn/transfer logic |

| Medium dApps | 1-2 weeks | Lending platforms or governance DAOs |

| Complex DeFi/DAOs | 3-4 weeks | Multi-contract ecosystems with integrations |

| Enterprise-grade | 1-2 months+ | Large codebases with heavy custom features |

How Much Does a Smart Contract Audit Cost?

Smart contract audit cost anywhere from $5,000 to $500,000+ in 2026, depending on project complexity and scope. Most standard DeFi projects fall in the $50,000-$100,000 range.

Key 2026 Audit Cost Benchmarks

- Simple/Basic Projects: $1,500 – $15,000 (e.g., standard ERC-20 tokens, simple NFTs).

- Medium Complexity: $15,000 – $50,000 (e.g., standard staking, basic DAO).

- DeFi/Complex Protocols: $50,000 – $150,000+ (e.g., DEXs, lending protocols, cross-chain bridges).

- Top-Tier Firm Audits: $20,000 – $50,000+ for standard, and much higher for complex work by a smart contract development company.

Cost Factors

There are some factors that affect smart contract audit cost. For instance, prices hinge on codebase size, like lines of code, logic complexity (e.g., custom math or cross-chain features on blockchain infrastructure), blockchain (Solana/Rust audits cost 20-30% more than Ethereum/Solidity), urgency (rush fees add 30-50%), and firm reputation. Moreover, poor docs or extra services like formal verification also increase the cost price. Retainers for ongoing fixes charge $5k-$30k/month.

The Top 6 Smart Contract Audit Tools in 2026

Here are the main tools for smart contract development. Let’s read each tool below:

- Slither

- Mythril

- Echidna

- Securify

- Madmax

- Certora Prover

1. Slither

Slither is a free static analyzer for Vyper contracts and Solidity code. For example, it has over 90 detectors for issues like reentrancy and overflows. Additionally, it runs seamlessly in CI/CD pipelines like Hardhat and has low false positives.

2. Mythril

Mythril performs symbolic execution on EVM bytecode to detect bugs such as unchecked calls or timestamp tricks. It works via CLI or SaaS and requires only contract addresses.

3. Echidna

Echidna fuzzes contracts with random inputs to crash invariants. Specifically, it is perfect for property-based testing on key functions like token balances.

4. Securify

Securify automates pattern matching for compliance and basic logic errors using 37+ templates. In addition, it provides quick scans with code snippets in reports.

5. MadMax

MadMax specializes in gas griefing detection, for example, spotting unbounded loops that enable denial-of-service attacks through high fees.

6. Certora Prover

Certora uses formal verification to mathematically prove that specs hold, making it particularly ideal for complex DeFi invariants on blockchain protocols like Aave.

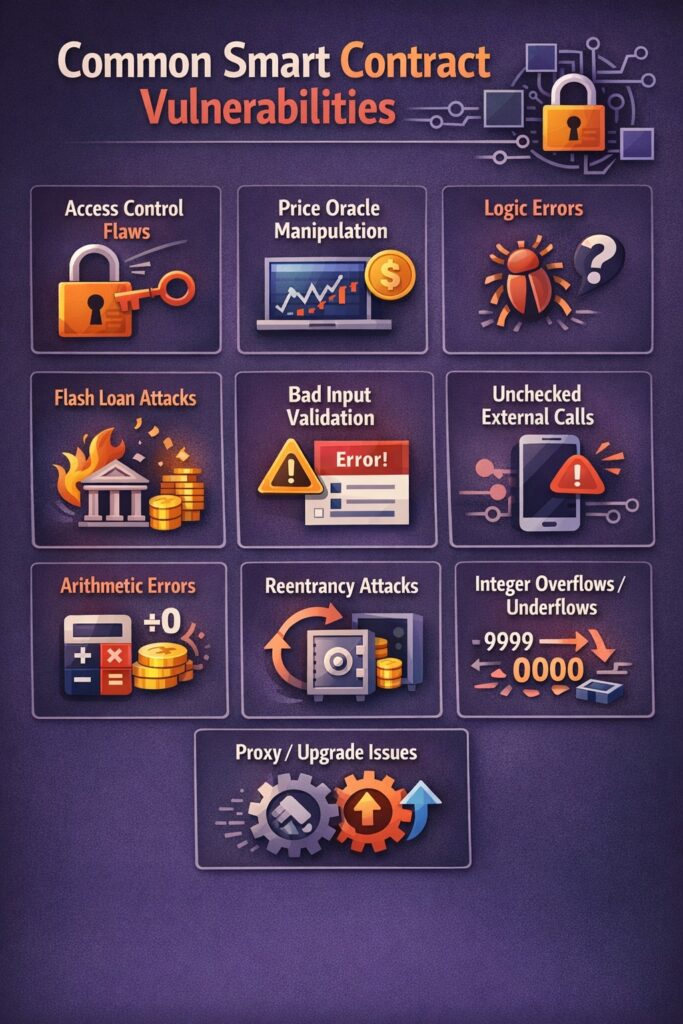

Common Smart Contract Vulnerabilities

Common smart contract bugs can wipe out millions in hacks, but audits catch them early. Here’s a rundown of the top ones from OWASP’s 2026 list, explained simply.

Access Control Flaws

Hackers sneak into admin functions they shouldn’t touch. For example, anyone can call a “mint” button and create unlimited tokens. Always lock down roles with checks like “if msg.sender is owner.”

Price Oracle Manipulation

Bad price feeds let attackers fake asset values. Then, they borrow huge loans cheaply or liquidate unfairly. Fix it by using trusted oracles like Chainlink with multiple sources.

Logic Errors

Code does the wrong thing, like wrong reward math or bad voting. Users get overpaid, or votes flip. Test every business rule step-by-step.

Flash Loan Attacks

Borrow tons instantly, exploit a tiny bug, and repay in one go. As a result, it drains pools fast. To prevent this, implement rate limits or checks, and ensure effects and interactions occur in the correct order.

Bad Input Validation

No checks on user data, crashes, or tricks the code. Like huge numbers breaking math. Always sanitize inputs first.

Unchecked External Calls

Call another contract, assume it worked, but it fails silently. Leads to stuck funds. Add “require(success)” after calls.

Arithmetic Errors

Math glitches beyond simple overflows, like division by zero. Wrap numbers with SafeMath libraries.

Reentrancy Attacks

Contract calls out before updating balances. Hacker loops back and drains funds, like the 2016 DAO $60M hack. Update the state first, then call out.

Integer Overflows/Underflows

Numbers wrap around (255 + 1 = 0), minting fake tokens. To prevent this, use Solidity 0.8+ safe math or libraries.

Proxy/Upgrade Issues

Upgradable contracts letthe attackers hijack versions or reset states. Therefore, double-check init logic and admin controls.

The Role of Flexlab in Smart Contract Security

Flexlab plays a key role in smart contract security as a blockchain development and AI automation agency. They offer smart contract audit services to keep blockchain applications safe.

Flexlab’s Audit Expertise

Flexlab provides detailed smart contract audits following 10 critical steps, from docs review to ongoing monitoring. First, they check documentation for mismatches. Then, static tools like Slither spot basic bugs like reentrancy. Manual reviews catch tricky logic errors next.

Hands-On Testing and Fixes

They run unit, integration, and fuzz tests to simulate attacks. Plus, they review external dependencies and optimize gas use. After the findings, Flexlab helps fix issues and retests everything. For example, their 2025 guide stresses secure access controls and no timestamp tricks.

Why Flexlab Stands Out

As your go-to for AI-blockchain workflows, Flexlab uses an “audit-first” approach for DeFi platforms. As a result, this builds trust, cuts hacking risks, and ensures compliance. Additionally, their full reports give clear fixes, making deployment confident—perfect for enterprise automation and private chains.

Moreover, explore our blockchain and AI blog page and discover how Flexlab helps Toronto businesses, NFT Marketplace Development Company, Custodial vs Non-Custodial Wallet, Crypto Trading Bot, and Public vs Private Blockchain.

Conclusion: Smart Contract Audit

Smart contract audit services aren’t a luxury; they’re the armored vault protecting your blockchain empire from exploits that drained $385 million in January 2026 alone. By blending automated precision, manual mastery, and rigorous testing, audits mitigate reentrancy risks, access control gaps, and logic errors, delivering 135:1 ROI against average $13.5 million incidents while building unbreakable user trust.

Choose Flexlab for your next audit: our AI-enhanced workflows, 10-step process from docs review to post-deployment monitoring, and proven expertise in DeFi, NFTs, and private chains ensure compliant, gas-optimized code ready for Toronto’s booming Web3 scene. Contact us now and visit our LinkedIn page for more insights.

Ready to Take Your Smart Contract Project?

📞 Book a FREE Consultation Call: +1 (416) 477-9616

📧 Email Us: info@flexlab.io

FAQs

Q1: Can ChatGPT audit smart contracts?

No, ChatGPT cannot reliably perform full smart contract audits on its own. While tools like AuditGPT (built on GPT models) show promise in spotting ERC rule violations with high precision (96.6%) but low recall (37.8% F1-score), it misses many vulnerabilities and serve best as an auxiliary for code parsing or PoC generation.

Q2: Who audits smart contracts?

Leading smart contract auditors include Sherlock (top-ranked for lifecycle security with contests and AI monitoring), Halborn, Trail of Bits (research-grade for rollups), BlockSec, ConsenSys Diligence, Nethermind Security (formal methods), Quantstamp, and QuillAudits. Firms like INORU and Hashlock handle multi-chain audits, while platforms like Code4rena crowdsource via contests. For enterprise needs, Flexlab offers AI-blockchain audits.

Q3: How to become a smart contract auditor?

Master Solidity/Rust programming, blockchain fundamentals (EVM, consensus), Web3 security (OWASP top 10 like reentrancy), and auditing tools (Slither, Mythril). Then, build hands-on experience via CTFs (Capture The Flag), bug bounties on Immunefi/Code4rena, open-source contributions, and personal audits, while also developing critical thinking, communication for reports, and continuous learning on new exploits.