Key Advantages of AI in FinTech for Companies and Users

Blockchain and IoT | Multi-Agent Systems | AI vs Automation

Over the last few years, the world has seen a remarkable transformation in the financial sector, driven by the fusion of technology and finance. What is FinTech? Finch is short for Financial Technology, which refers to innovative digital technologies that improve financial services, such as banking, payments, lending, investments, and insurance. From mobile banking apps to digital wallets to robo-advisors, Fintech is redefining how we interact with money. Fintech allows faster, more efficient, and more accessible financial services than ever before.

At the heart of this revolution lies Artificial Intelligence (AI)—the technology that mimics human intelligence, learns from data, and makes informed decisions. For both businesses and consumers, AI provides a range of benefits that enhance financial services, making them better, smarter, and more accessible.

In this blog, we will explore the benefits and potential uses of AI in Fintech, discovering how it empowers financial institutions, startups, and customers.

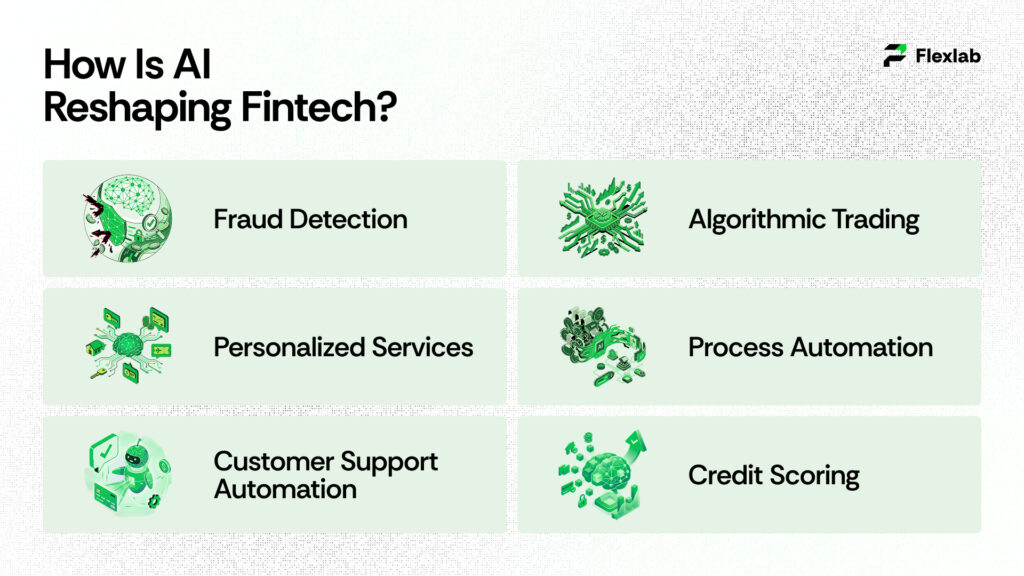

How AI is Reshaping Fintech?

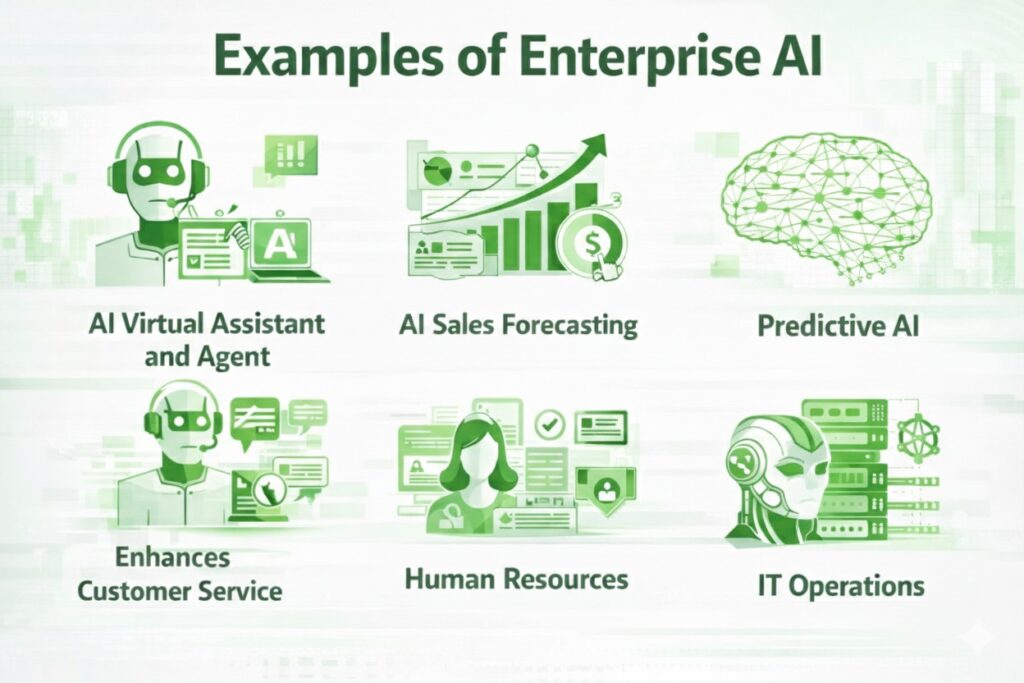

The integration of AI in the financial sector represents a dynamic aspect at the forefront of disruptive innovation in the financial services industry. By leveraging AI assistants and intelligent automation, Fintech companies are redefining customer experience and entering a new era of personalization. AI in finance is characterized by the implementation of machine learning, natural language processing, and cognitive computing to empower fintech businesses. It helps companies process large volumes of financial data records in real-time, identify patterns, and prevent fraudulent activities.

Here are a few major areas where AI is actively transforming the Fintech Sector.

- Fraud Detection

- Personalized Services

- Customer Support Automation

- Algorithmic Trading

- Process Automation

- Credit Scoring

Let’s discover how these smart innovations bring solid benefits to both businesses and customers.

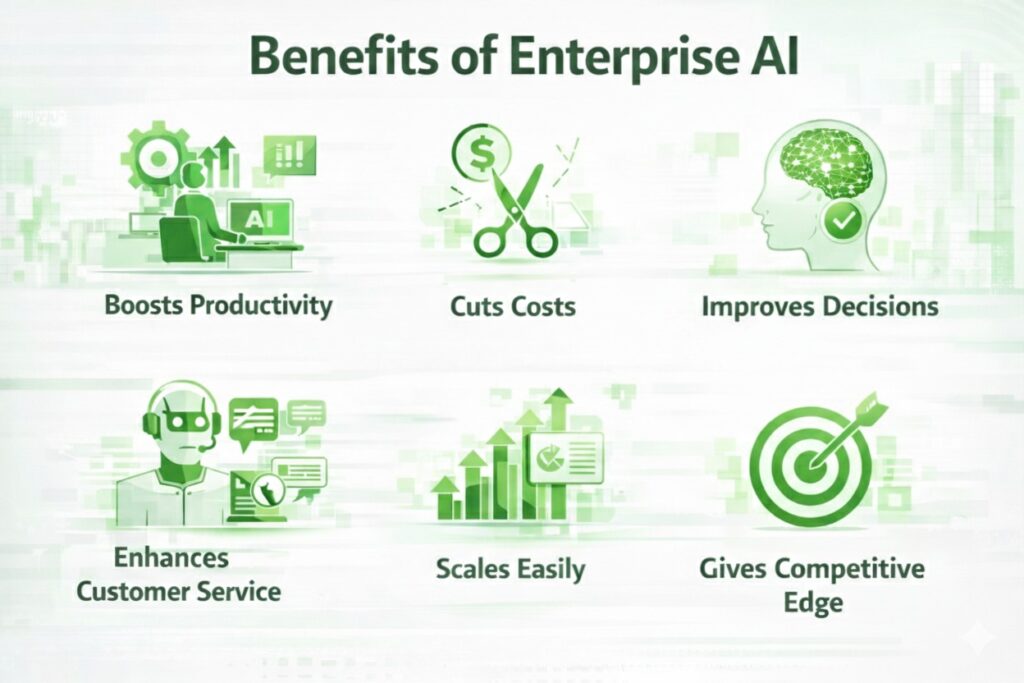

Key Benefits of AI in Fintech

Artificial intelligence is becoming the backbone of next-generation Fintech businesses rapidly. From enterprise chatbots that deal with client inquiries to AI algorithms that provide creditworthiness, AI is reshaping almost every aspect of the financial sector. Here are some of the key benefits of AI in Fintech.

1. Smarter Fraud Detection and Prevention

Financial fraud is one of the greatest challenges for banks and financial institutions in 2025. According to a 2024 report by Statista, fraud losses for global online payments are expected to exceed USD 48 billion by 2030. Blockchain and AI have become a critical line of defense against such cyber threats. As financial transactions have moved online, cybercriminals have become more active and sophisticated. Old and traditional fraud detection systems rely on predefined conditions, which cannot adapt quickly to increasingly evolving threats.

However, to combat this, AI uses machine learning algorithms that continuously analyze patterns through transaction data. If any unusual behavior or activity takes place, AI systems flag or block it instantly, resulting in improved fraud prevention. Unusual or suspicious activities include unexpected location, an odd spending pattern, or suspicious login attempts, etc.

For instance, Mastercard uses AI-powered intelligence tools that can analyze more than 75 billion transactions annually. AI technology also helps identify suspicious activities with high accuracy.

Similarly, PayPal deploys deep learning to detect fraudulent transactions in real time, saving the company millions of dollars annually.

For businesses, AI integration helps reduce financial losses and protect brand reputation. For customers, it improves trust and security, ensuring their funds, treasures, and personal data remain safe.

2. Enhanced Customer Experience

Consumers in today’s age expect financial services to be fast, secure, and tailored to their unique needs. AI makes it happen seamlessly by analyzing customer data to understand consumer goals, spending habits, and preferences.

For example, digital banks like Revolut and Monzo use AI-driven business intelligence to offer insights, such as budgeting advice, automatic savings, and spending highlights. Leveraging AI in customer service helps recommend personalized investment portfolios or credit products based on user profiles.

According to Deloitte’s report on Fintech Insights in 2023, 70% of consumers say they prefer that are capable of “understanding” their habits and offer personalized solutions. For businesses, customization of services increases engagement and loyalty. On the other hand, for consumers, when services are built around their needs, they are more likely to stick to the brand. Therefore, AI helps Fintech businesses create human-like experiences, but faster, more precise, and 24/7 available.

3. AI-Powered Chatbots and Assistants

Gone are the days when customers had to wait on hold for a bank representative to respond. AI agents now provide instant support, answering queries, offering advice, and guiding users through transactions. AI-powered assistants can use natural language processing (NLP) and natural language understanding to connect and interact with customers through a chatbot interface.

In addition to this, these AI-powered chatbots and assistants can guide customers through new features and services. This way, they offer personalized recommendations for products or services that would help customers with their business or financial situation.

For example, Bank of America’s virtual assistant, Erica, tends to serve more than 35 million users. Erica helps them check balances, pay bills, and get insights into their spending with the help of natural language conversations.

For businesses, these AI-driven chatbots can help banks and fintech companies improve their operational efficiency. AI enables process automation for time-consuming clerical tasks, including data entry, invoicing, online payment processing, and financial data analysis. Also, chatbots help reduce operational costs by freeing up human force for complex tasks. For consumers, they provide 24/7 assistance. They ensure availability, anytime, anywhere. Additionally, owing to their natural language processing, these chatbots also provide multilingual support.

4. Credit Risk Assessment and Management

Financial business comes with several risks, and credit risk is one of the greatest ones. In the past, financial businesses or banks used to rely on credit risk modeling to predict how likely customers were to repay loans.

Risk management is one area where AI has made substantial improvements. AI-driven credit assessment evaluates alternative data such as mobile usage, utility bill payments, transaction history, and even online activity to assess creditworthiness. This helps make the process more accurate and inclusive. For example, AI can help detect customers who are more likely to default on loans, allowing fintech businesses to make informed decisions. Upstart, a US-based AI lending platform, uses more than 1000 variables in its machine learning models to evaluate consumers.

For consumers, AI-driven risk assessment and management means faster approvals and fairer access to financial services. For businesses, this means minimized risk of fraud, and it allows them to reach more potential customers responsibly.

5. Algorithmic Trading and Portfolio Management

Use of artificial intelligence technologies in fintech helps provide valuable insights and predict changes in market trends, exchange rates, and investments. AI applications make use of data analytics that account for news, the current state of financial markets, economic indicators, and sentiments across social media platforms. They can help with automated trading and portfolio management by offering risk vs. return calculations and appropriate financial advice.

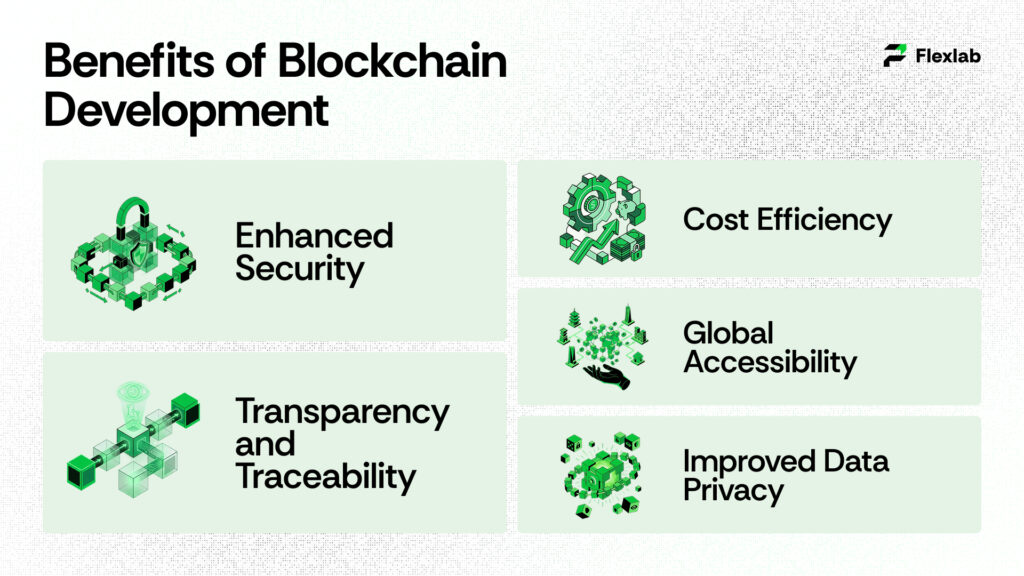

Additionally, integrated with blockchain technology, AI helps ensure transparent and tamper-proof records, improving trust and transparency. In advanced investment management systems, AI helps automate asset allocation, risk management, and rebalancing strategies based on investor goals and market trends.

These applications and technologies can be personalized to individual risk profiles, depending on past investment history and financial goals. For instance, HSBC is using AI to boost its predictive analytics to recognize potential high-growth stocks. This intelligent automation not only maximizes returns but also helps minimize risks. Together, AI and blockchain create a more efficient, data-driven, and transparent financial ecosystem for both businesses and consumers.

5. Streamlined Operations and Cost Efficiency

AI-powered intelligent automation has significantly reduced the need for repetitive manual tasks in Fintech operations. Activities, such as data entry, compliance regulations, and transaction processing, can now be performed without manual assistance. For example, Robotic Process Automation (RPA) driven by AI helps Fintech companies handle high volumes of regulatory paperwork and consumer onboarding efficiently.

According to a report by McKinsey in 2023, AI automation can help reduce operational costs by 30% in financial institutions, while improving employee productivity by 20%.

For businesses, that means higher profit margins and better resource allocation. For consumers, it means lower fees, faster service, and more accessible financial products.

Real World Examples of AI in Fintech

To better understand how AI is making a difference in the Fintech sector. Here are some of the real-world examples where AI is bringing revolution.

- PayPal: PayPal is using AI to analyze transactions and detect fraudulent activities and behavior in milliseconds, ensuring safe online transactions.

- Square: Square uses AI to evaluate small business loan applications quickly, allowing entrepreneurs to access funding faster.

- Revolut: Revolut integrates AI for customer support automation and spending pattern analysis.

- Klarna: Klarna uses machine learning for individualized shopping experiences and risk-based credit scoring

- American Express: leverages AI to predict cardholder churn and tailor loyalty programs and offers accordingly.

These examples prove that AI is not just a futuristic idea; it’s a present-day powerhouse revolutionizing the FinTech ecosystem.

Challenges and Ethical Considerations of AI in Fintech

While AI offers significant benefits when it comes to the Fintech sector. However, it also comes with challenges that Fintech firms must address responsibly. Here are some of the challenges Fintech businesses come across.

- Data Privacy: Since AI collects and relies on a large number of datasets, ensuring user data is protected is crucial.

- Algorithmic Bias: AI systems can unintentionally reflect social or economic biases based on customer usage, or if they are not monitored properly.

- Transparency: Sometimes consumers demand a clear understanding of how AI-driven decisions, such as loan approvals and creditworthiness, are made.

- Centralized Use of Generative AI: Generative AI models hold immense potential, but centralized implementation faces concerns like data management, outdated banking applications, and retrieval-augmented generation.

Regulators and Fintech companies are constantly working on ethical AI frameworks to ensure fairness, accountability, and transparency. Responsible use of AI is the key to maintaining discipline and sustainability in the sector.

Conclusion: Benefits of AI in Fintech In a Nutshell

AI has become the backbone of modern financial businesses. From fraud detection and risk management to personalized banking and automated operations, AI is revolutionizing financial services into safer, faster, and more inclusive systems.

For businesses, AI in fintech means higher operational efficiency, reduced costs, and smarter and informed decision-making. On the other hand, for consumers, it translates into personalized banking, automated investments, robust security, and easier access to financial services.

As AI continues to evolve and thrive, the line between finance and technology will blur even further. This revolution is on its way to creating a world where managing money becomes intelligent, effortless, and intuitive.

Therefore, the future of fintech is not just digital, it’s AI-powered. Also, it promises to make finance more human, accessible, and helpful for everyone.

Want a Reliable AI Development Company for Your Fintech Business?

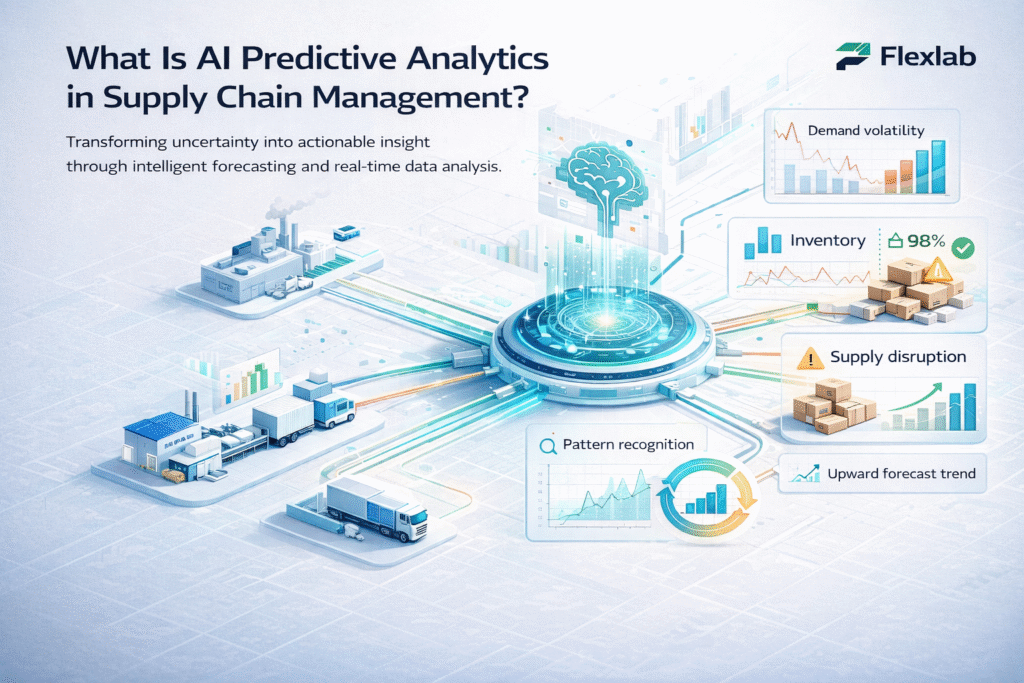

Unlock the full potential of your financial business with Flexlab’s AI-powered services designed for the finance sector. We specialize in developing scalable AI and blockchain solutions that speed up innovation, optimize operations, and cut development costs by up to 80% while delivering new features within 30 days, or we work for free until we do.

Whether you’re looking to streamline customer onboarding, detect fraud in real-time, automate risk analytics, or personalize financial product offers, Flexlab provides pre-vetted AI engineers and tailored development teams that match your tech stack and business culture. Start with a free technical audit and strategy session, and let us build a future-ready, data-driven platform that gives consumers smarter services and your business a competitive edge. Give us a call if you want to hire one of the best AI software development companies for your Finance business to thrive and grow.

Ready to Grow Your Business?

📞 Book a FREE Consultation Call: +1 (416) 477-9616

📧 Email us: info@flexlab.io

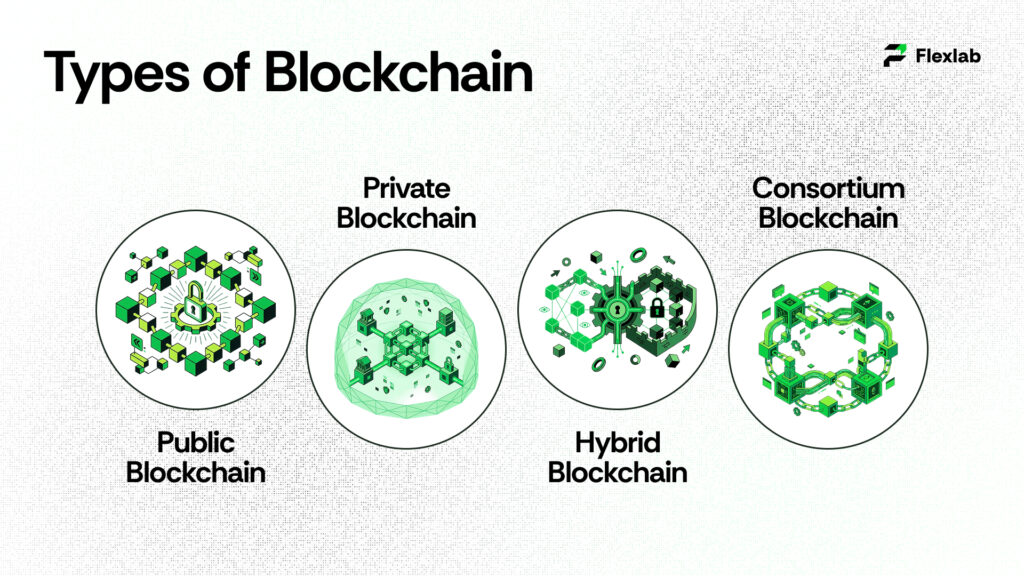

Visit our website and get to know about us and the services we provide. Contact us today for innovative blockchain-based solutions for your business.

Want to dive deeper into blockchain app development, What are NFTs?, and AI in digital marketing. Have a look at our blog page for detailed insights and expert perspectives.

FAQs

1. What is the 30% rule in AI?

The “30% rule” in AI refers to the idea that around 30% of tasks in most jobs can be automated using artificial intelligence, while the remaining 70% still require human judgment, creativity, or emotional intelligence. It highlights how artificial intelligence helps enhance human work, rather than replacing it.

2. What are the 3 Cs of AI?

The 3 Cs of AI are Comprehension, Cognition, and Computation, representing how AI systems understand data (comprehension), think and make informed decisions (cognition), and execute tasks efficiently through processing power (computation). Together, they define AI’s ability to simulate intelligent human behavior and its ability in natural language processing.

3. Is ChatGPT LLM or Generative AI?

ChatGPT is both an LLM (Large Language Model) and a Generative AI system. As an LLM, it’s trained on massive datasets to understand and generate human-like text, while as generative AI, it creates original responses, ideas, and content based on user input. In essence, all versions of ChatGPT are powered by large language modeling, the core technology behind generative AI.