How White Label Crypto Exchange Empowers Startup Growth?

Custom AI Agents | Smart Contracts | AI in Digital Marketing

The cryptocurrency has experienced significant growth over the last few years, evolving from a niche market into a global digital financial ecosystem. Currently, thousands of digital currencies are traded regularly, with millions and billions of dollars flowing through crypto exchanges. For startups and entrepreneurs looking to enter this rapidly evolving market, launching a cryptocurrency exchange can be a highly impactful idea.

However, building a cryptocurrency exchange from scratch can cost you a lot. It can also be very time-consuming and comes with a lot of technical complexity. This is where white label crypto exchanges make an entry. It has proven to be one of the best crypto exchanges for beginners and startups. They tend to provide startups with a ready-made, customizable platform that encourages them to enter the market fast and at a fraction of the cost of developing their own exchange.

In this blog, you’ll explore the potential benefits of using white label crypto exchanges for startups. This article will break down the concept into simpler terms and highlight why it becomes one of the most common choices for entrepreneurs in the crypto sector.

Introduction to White Label Crypto Exchange

A white label crypto exchange is a pre-made and customizable cryptocurrency trading platform developed by a third-party provider. Entrepreneurs and startups can buy the software, customize it with their own branding, and launch it as their own exchange.

Instead of spending years on maintaining the infrastructure, security features, and user interface, startups tend to get a plug-and-play solution that is already tried and tested.

Basically, these crypto solutions are devised to be easily branded and customized by the purchasing party. Some promising key components of white label solutions are integrated crypto payment gateways for fiat, a user-friendly interface, advanced trading features, and robust security measures to protect funds and data.

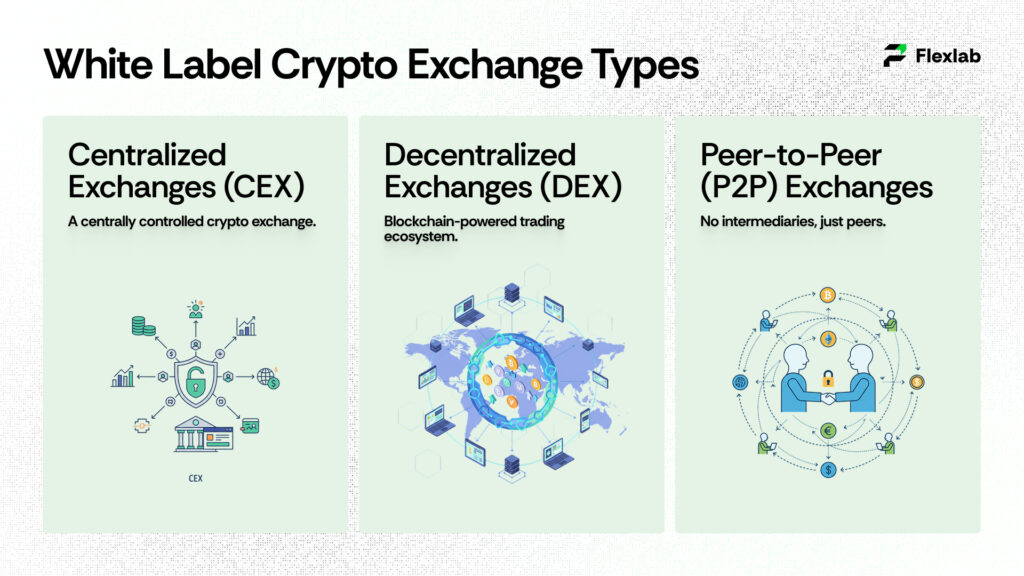

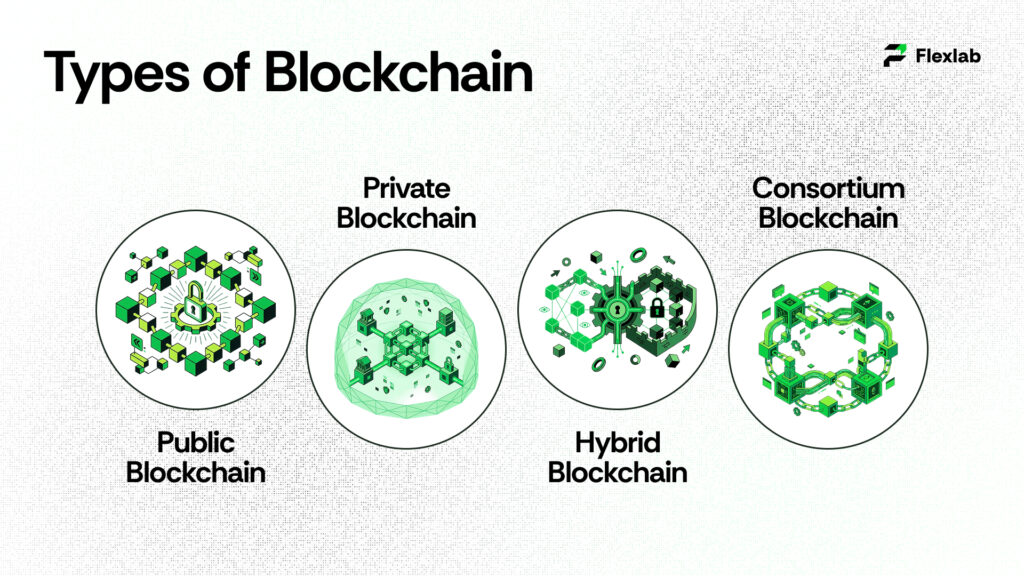

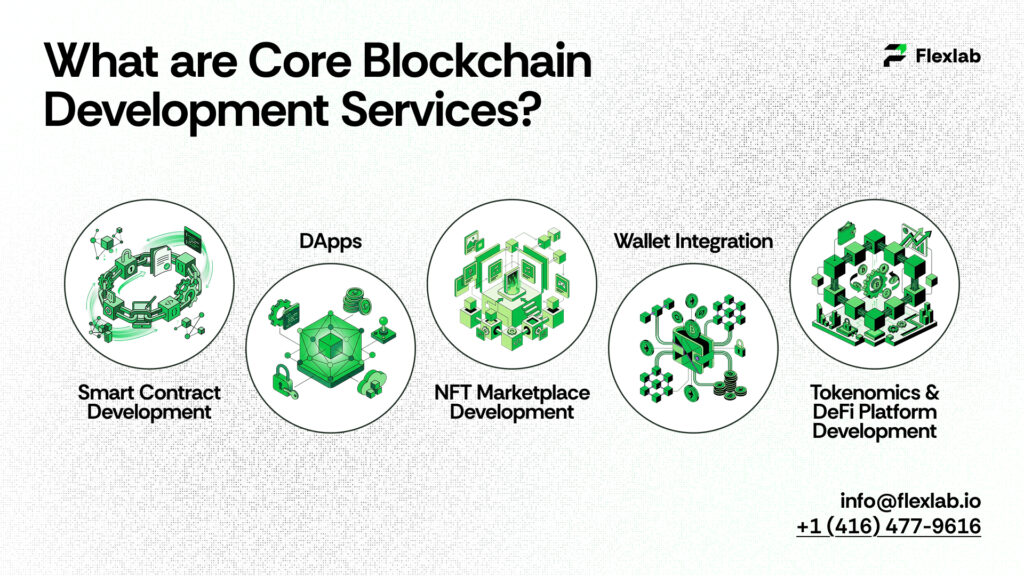

There are three major types of white label solutions;

- Centralized Exchanges (CEX)

- Decentralized Exchanges (DEX)

- Peer-to-Peer (P2P) Exchanges

Why Startups Should Consider White Label Crypto

Introducing or launching a new business in the cryptocurrency industry requires technical innovations with a practical approach. When it comes to startups, they come across various challenges like limited budget, strict deadlines, and a lack of technical expertise. White label solutions are likely to address these issues by delivering scalable, economical, and customizable options.

Key Benefits of White Label Crypto Exchange for Startups

White label crypto exchanges offer a significant number of benefits that address many of the challenges faced by startups stepping into the crypto space. Here are some of the potential benefits;

- Quick Development

- Cost-Effective Solutions

- Robust Security Features

- Customization and Branding

- Regulatory Compliance Support

- Access to Advanced Features

- Liquidity Options

- Scalability

- Minimized Risk of Failure

- Constant Technical Support and Upgrades

1. Faster Time to Market

In this constantly evolving and fast-paced crypto industry, timing is everything. Trends shift quickly, and being lazy can mean significantly losing out to competitors. Building a crypto exchange from scratch is a time-consuming task that can take over a year because it may involve lengthy processes of design, coding, and complex regulatory compliance matters.

White label crypto solutions significantly accelerate this launch process, allowing startups to enter the market faster. Crypto Startups can launch their platforms within weeks or even days, depending on the level of customization they need. This allows businesses to seize market opportunities quickly and start building their user base without any delay.

2. Cost-Effective Solutions

One of the most critical hurdles startups can face is funding. Developing a crypto exchange from scratch can cost you millions of dollars because of complex infrastructure and security systems. For startups starting with a limited budget, this is not really possible. A white label exchange software helps significantly cut costs. The core technology is already developed, reducing the development costs. Therefore, startups only have to pay for licensing, customization, and ongoing maintenance. Consequently, this reduces financial risks and enables funds to be allocated to other potential departments, like marketing, customer acquisition, and growth strategies. This, in turn, helps enhance the return on investment (ROI).

3. Robust Security Features

Security is one of the most important aspects of running a crypto exchange. Hackers and cybercriminals often tend to attack crypto exchanges due high value of digital assets stored in them. Established providers implement robust security protocols through advanced, encrypted storage, protecting sensitive user data. Most of the white label solutions come with updates, built-in security features like anti-DDOS protection, Multi-signature wallets, two-factor authentication, and cold and hot wallet integration. By leveraging the expertise of a crypto exchange development company, startups can offer their customers a secure environment without needing to build these systems from scratch.

4. Customization and Branding

There is a common misconception that white label solutions are ‘generic’. However, in reality, they are highly customizable. White label crypto exchanges empower businesses with customization and branding, enabling them to design platforms aligned with their values. With the integration of secure digital wallets for seamless transactions, while incorporating blockchain technology to ensure trust, transparency, and improved user experience.

The customization includes branding with the company’s logo and colors, designing a user-friendly interface, and adding unique trading pairs and tokens. White label solutions also allow startups to integrate additional tools, like market analytics, portfolio management, or fiat-to-crypto gateways.

Ultimately, this customization allows startups to distinguish themselves in a crowded market while still depending on a solid technical foundation.

5. Regulatory Compliance Support

The cryptocurrency industry is subject to complex and constantly evolving regulations across different nations. Going through complex regulatory challenges can be overwhelming for startups. Cryptocurrency regulations get very challenging, especially when it comes to policies associated with anti-money laundering AML processes and know-your-customer KYC tools.

The majority of white label exchange providers also take into account the integration of compliance tools. In particular, these tools include automated KYC verification, transaction monitoring, and reporting systems. As a result, they help reduce the risk of legal issues while simultaneously enhancing the overall credibility and trustworthiness of the platform.

6. Access to Advanced Features

Many white label crypto exchange solutions come equipped with a wide range of advanced built-in features. For instance, these include spot and margin trading, liquidity management, automated market-making (AMM), staking and lending modules, as well as mobile app integration. As a result, businesses can offer a competitive and feature-rich trading platform without having to develop these complex functionalities in-house. Therefore, in this way, startups can provide their customers with a professional, feature-rich experience right from day one, saving both time and money.

7. Scalability

White label crypto solutions are designed in a way to grow with the business. The majority of startups actually begin with a small user base, but the goal is to grow. Sclability is extremely important in the crypto exchange business, because trading volumes increase rapidly. White label solutions are devised in a way to handle growth, enabling exchanges to expand their operations without bigger overhauls.

For instance, as a startup gains traction, the platform is able to support additional training pairs, high transaction volumes, and new services like derivatives of NFT marketplaces. Therefore, white label solutions offer flexibility, which ensures long-term business sustainability.

8. Liquidity Options

Liquidity, or the availability of digital assets, is crucial for any exchange. Users are often discouraged by platforms with low liquidity because they lead to delays and poor training experiences. In addition to this, white label crypto exchange liquidity providers mostly connect startups with global liquidity pools. This helps ensure that even startups with new exchanges can offer smooth trading with competitive prices and minimal slippage. In fact, in some cases, liquidity providers also offer built-in market-making services.

9. Constant Technical Support and Upgrades

Running a crypto exchange demands constant evaluation, monitoring, and bug fixes. For a startup without a complex and large technical team, this can be a major concern.

Most of the white label providers offer dedicated support, ensuring the platform remains stable and updated with the advanced technological standards. This enables startups to focus more on business development and customer acquisition rather than worrying about technical issues.

10. Reduced Risk of Failure

Stepping into a new business always involves risk, but entering the crypto sector involves additional challenges as well, like volatility, regulatory concerns, and technological uncertainties. By using a white label solution, startups can reduce the risk of many of these failures.

The platform is already tested, secure, and compliant, which minimizes the chance of errors that cost businesses a lot. Additionally, startups can experiment with different business models, tokens, or customer engagement strategies without worrying about the reliability of the underlying technology.

Considerations Before Choosing a White Label Provider

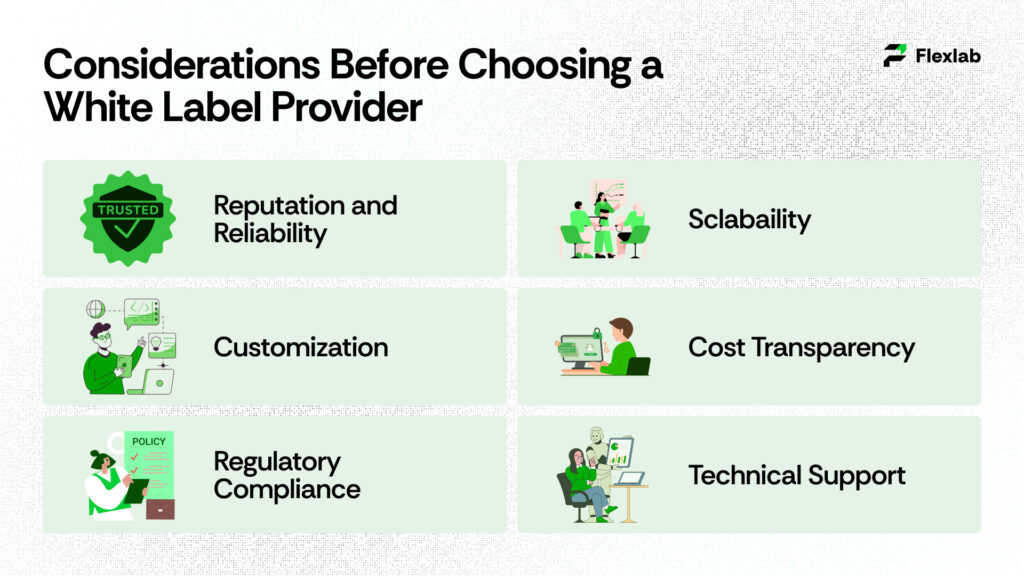

While benefits are significant, startups should carefully evaluate and choose their white label exchange provider. Here are some of the key considerations that startups can take into account;

- Reputation and Reliability: Before committing to a white label exchange provider, check the provider’s track record and client reviews.

- Customization: Ensure that the provider gives you customization options, ensuring that the platform can be tailored to your brand and market.

- Regulatory Compliance: Startups must confirm that the platform meets the regional regulatory requirements.

- Scalability: Make sure the platform can handle long-term business growth.

- Cost Transparency: Startups should understand the complete pricing structure, including licensing, maintenance, and transaction fees.

- Technical Support: Startups must look for providers that offer 24/7 technical assistance.

Making the right choice guarantees that startups get the most value from their investment.

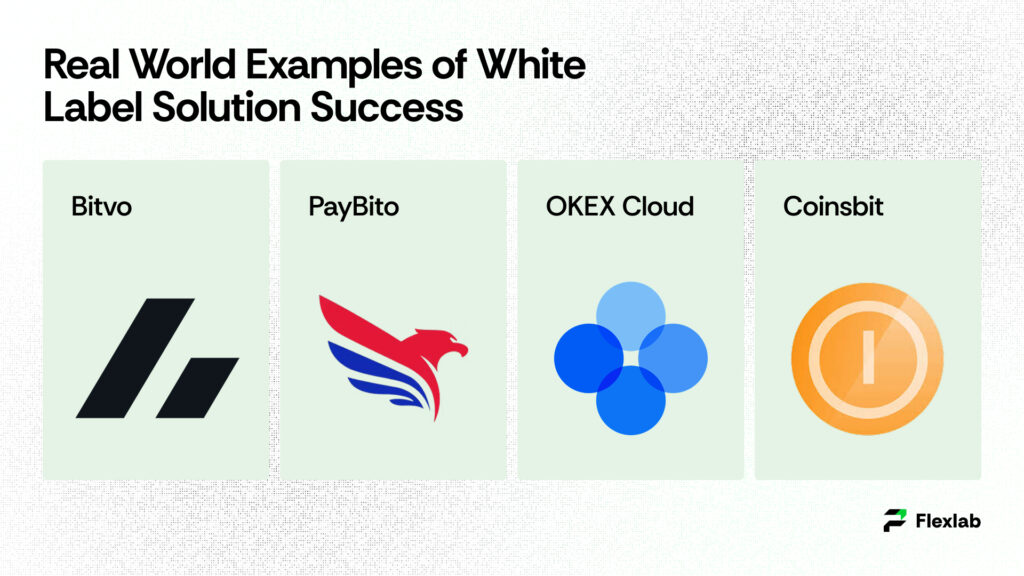

Real World Examples of White Label Solution Success

A large number of crypto exchanges around the world began as white label platforms, clearly demonstrating how effective this model can be for startups. For example, Bitvo, a Canadian exchange, partnered with a white label provider to launch a secure and compliant trading platform tailored to local users. Similarly, PayBito, a US-based exchange, also started with a white label solution, which enabled it to scale rapidly and offer services such as crypto custody and institutional trading. In addition, in Asia, OKEX Cloud operates as a white label exchange provider that allows multiple regional exchanges to function under its infrastructure. Meanwhile, in Europe, Coinsbit leveraged white label software to attract a large and complex user base within just a few months of its launch. Overall, these examples highlight how white label crypto exchanges have become a popular and effective choice for various platforms across the globe.

Looking for a Reliable White Label Exchange Provider?

If you are a startup, you can launch your own crypto exchange with Flexlab’s white label crypto exchange solutions. Our ready-to-deploy and completely customizable solutions empower startups and entrepreneurs to enter the crypto market faster, with advanced security, regulatory compliance, and an effortless use experience. From customization to liquidity integration, our team of skilled developers handles the technology so you can concentrate on growth. With Flexlab, your startup gets enterprise-grade reliability, 24/7 technical support, and scalability for long-term benefits. Why spend years building from scratch? With our services, go live in weeks and start generating revenue with a trusted, future-ready exchange solution.

To have more knowledge about us, have a look at our projects to go through Flexlab’s success stories. To have more insights into different topics, like cybersecurity risk assessment, what are NFTs?, and Blockchain and IoT, visit our blog page.

Ready to Launch Your Blockchain Project?

📞 Book a FREE Consultation Call: +1 (416) 477-9616

📧 Email us: info@flexlab.io

Concluding White Label Crypto Exchange Benefits

As the cryptocurrency industry continues to expand, the demand for trading platforms is constantly growing alongside it. For new businesses or startups, launching a crypto exchange is a promising opportunity, but it also comes with its own challenges. White label crypto exchanges provide a practical, impactful, and cost-effective solution by combining speed, security, and scalability.

Instead of spending millions of dollars and years building an exchange from scratch, startups can focus on branding, marketing, and community building, while depending on the solid foundation offered by white label crypto solutions. In a competitive industry of cryptocurrency, where time, security, and legal compliance are crucial, white label crypto exchanges level the playing field for startups. These smart solutions not only lower the barriers to entering the market but also provide the tools needed to compete with established businesses in the market.

For entrepreneurs looking to enter the world of digital assets, a white label crypto exchange is not just an option; it is one of the smartest strategies to launch and grow a successful business in the continuously changing crypto landscape.

FAQs

How much does the white label crypto exchange cost?

The cost of white label crypto exchanges depends on the provider and the features of the exchange. On average, a white label crypto exchange costs businesses ranging from $8000 to $14000. It may add to the price if a startup wants to add highly advanced features.

Is a crypto exchange profitable?

Yes, crypto exchanges can make significant profits, with revenue mainly coming from trading fees, listing charges, and withdrawal commissions. Top exchanges like Binance and Coinbase generate billions of dollars annually due to high transaction volumes. However, profitability depends on user acquisition, liquidity, and compliance management.

How to start a white label crypto exchange?

To start a white label crypto exchange, pick a reputable white label provider that offers secure, compliant, and scalable software. Customize the platform with your branding, trading pairs, and payment integrations. Ultimately, obtain necessary licenses, integrate liquidity sources, and launch with a strong marketing and compliance strategy.

3 Responses

I have been surfing oline more than three hours today, yet I never

found any interesting article lke yours. It is pretty worth enough for me.

In myy opinion, if all site owners and bloggers mazde good content as

you did, tthe net will be a llot more useful than ever before.