How to Invest in Cryptocurrency Safely and Smartly

Post-Quantum Cryptography | Crypto Wallets | Cybersecurity Risk Assessment

Buying your first cryptocurrency can feel exciting and overwhelming. If you are searching for how to invest in cryptocurrency for beginners, you are not alone. A recent survey shows that 64 percent of new investors fear losing money due to a lack of understanding of how cryptocurrency works. Additionally, over 46 percent admitted that early investment decisions were influenced more by hype than by careful research.

Social media moves fast, prices move even quicker, and bold promises can push beginners into impulsive mistakes. Fortunately, cryptocurrency becomes much easier to navigate when you slow down, learn the basics, and follow a structured approach. The goal is not to get rich overnight, but to protect your money while gaining a solid understanding of digital assets.

Globally, more than 300 million people hold cryptocurrency, but many beginners still lose money early due to a lack of knowledge. Understanding the basics early helps you make more confident decisions.

This guide will provide a clear, structured plan for beginners to invest safely. You will learn:

- What cryptocurrency is and how it works

- The main risks involved and how to reduce them

- How to create a smart investing plan

- How to choose secure tools such as exchanges and wallets

- How to store your assets safely using different types of crypto wallets

- How to build long-term crypto investing strategies

- Whether cryptocurrency is a good investment for beginners

- How to understand the crypto ecosystem using a simple Crypto Periodic Table

Understand Crypto Basics and Security Overview

Before spending a single dollar, understand what you are actually investing in. Most beginners skip this step, then panic the moment the price drops or a headline goes viral. Learning about the basics can save you from stress and regret. Start with three basic questions:

- What is cryptocurrency?

- What types exist? And

- What can go wrong?

Once you can answer those in your own words, then you are ready to think about your first small investment.

What Cryptocurrency is and How it Works

Cryptocurrency is digital money powered by blockchain networks. It records transactions on a transparent, decentralized system.

You can think of a blockchain as a public ledger. Whenever someone sends or receives crypto, a new entry is added to the ledger. Moreover, its copies are stored on numerous computers worldwide. Because of this, everyone can easily see it, making it hard to cheat. Additionally, there isn’t any central bank that controls the ledger. Consequently, if you send crypto to the wrong address, it is usually gone, and no customer service helpline can undo the mistake.

Furthermore, prices also fluctuate significantly. A coin that is worth $100 today can be worth $60 or $150 tomorrow. Most cryptocurrencies lack government-backed insurance.

Core Building Blocks

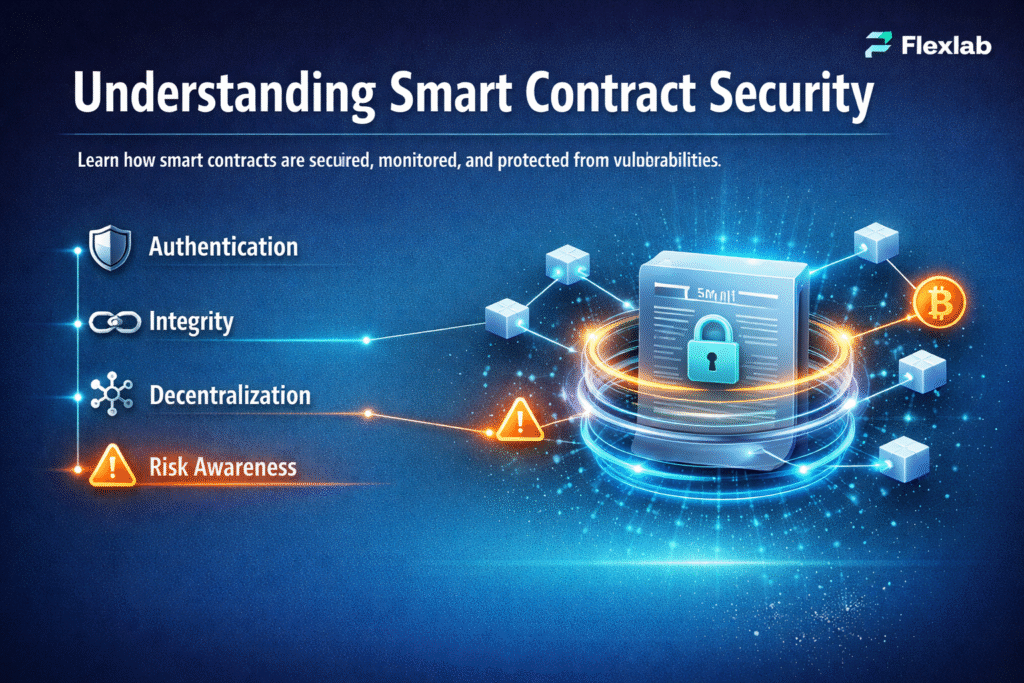

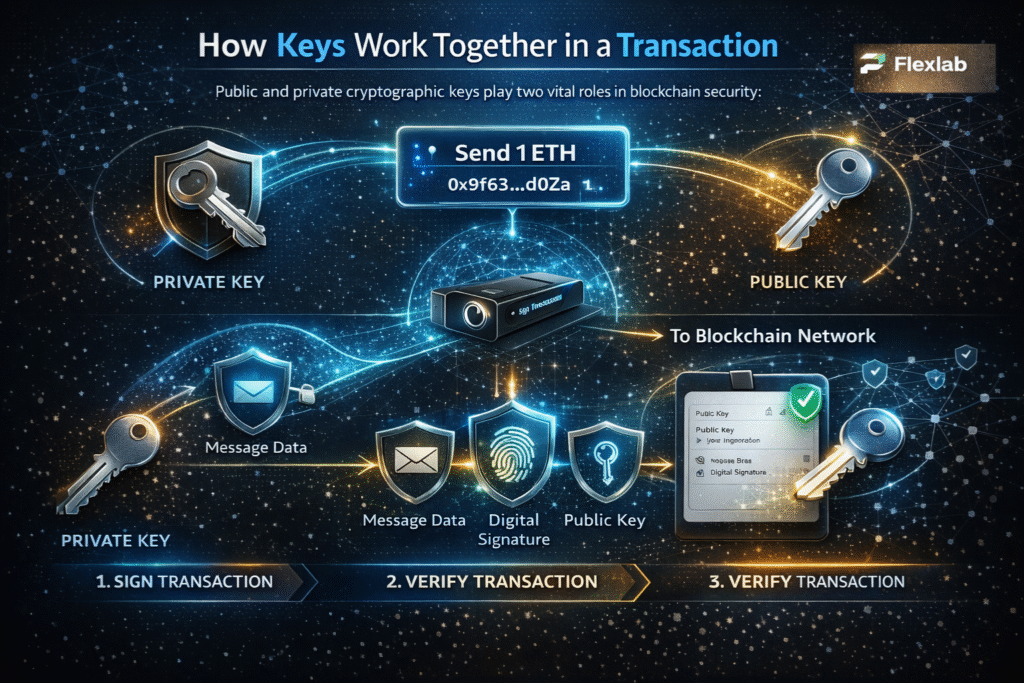

- Blockchain and Security

A blockchain is a digital ledger where transactions cannot be easily altered or tampered with. This level of security comes from cryptography techniques, which not only protect data but also verify ownership.

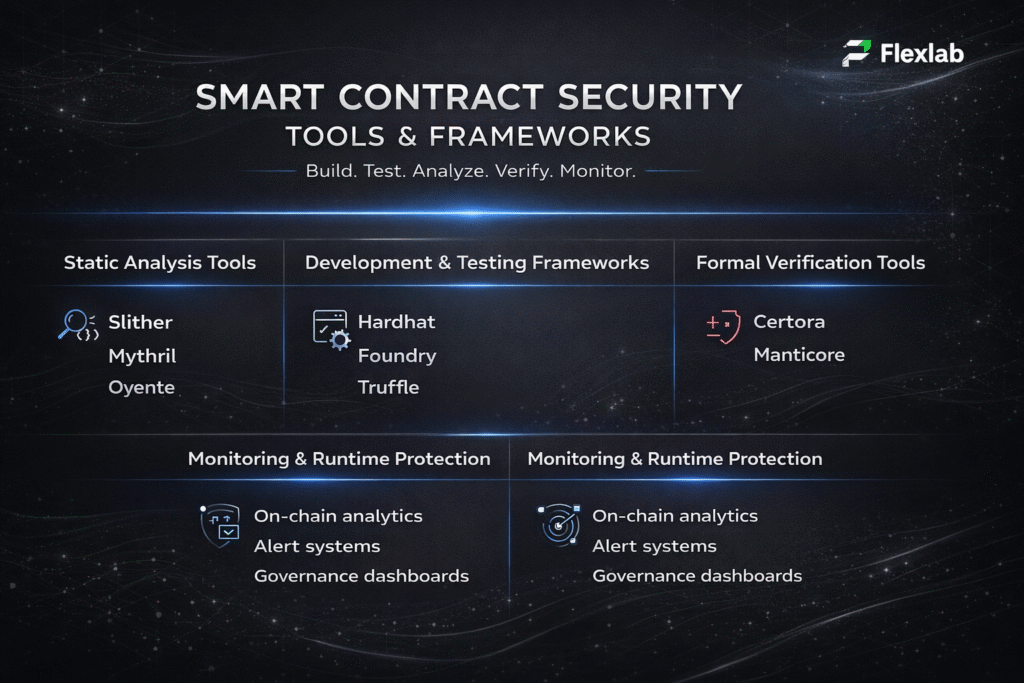

- Smart Contracts

Many cryptocurrencies use smart contracts, which are self-executing digital agreements. Consequently, they operate automatically, thereby eliminating the need for banks or middlemen.

- Peer-to-Peer Payments

Crypto enables peer-to-peer payments, which means money is transferred directly between individuals without the need for a bank or intermediaries. Consequently, transactions can be faster and more efficient.

- Digital Payment and Global Access

Cryptocurrency can serve as a digital payment method, thereby providing access to global financial systems for individuals who might otherwise face traditional restrictions. Furthermore, understanding these basics helps beginners start with clarity instead of confusion.

Types of Crypto Beginners Should Know

Although thousands of digital assets exist, most fall into a few main categories. Understanding these categories helps clarify how different crypto assets function and where their risks may lie.

Coins: Coins are cryptocurrencies that operate on their own independent blockchains.

Examples include Bitcoin and Ethereum. They are commonly used as:

- Digital money

- A store of value

- The foundational layer for building other blockchain-based applications

Because coins rely on their own networks, they often have stronger infrastructure, broader adoption, and more proven security compared to smaller assets.

Tokens: Tokens are digital assets built on existing blockchains rather than having their own networks.

For example, many tokens exist on the Ethereum blockchain. Tokens can serve various purposes, such as:

- Providing access to a decentralized application

- Representing governance rights in a protocol

- Acting as utility points for gaming, finance, or digital services

Tokens tend to be more experimental and carry a higher risk, because they depend on the strength and legitimacy of their own project.

Stablecoins: Designed to maintain a relatively stable value, generally connected in value to a standard currency, such as the US dollar.

Examples include USDT and USDC. Stablecoins are useful for:

- Storing value without high volatility

- Moving funds quickly across crypto platforms

- Providing liquidity in trading and decentralized finance

Although they are mainly less volatile, stablecoins still carry risks related to regulation, transparency of reserves, and the stability of the issuing entity. These coins usually provide stronger infrastructure and wider adoption. In contrast, new or small tokens can be far more volatile, may have limited oversight, and are more vulnerable to fraud or sudden collapse.

Safe Tools & Security Steps for Beginners

Ensuring digital safety is essential for beginners. This includes using strong passwords, enabling two-factor authentication, keeping recovery phrases offline, and carefully choosing trusted wallets and exchanges. Additionally, prioritizing digital safety not only helps protect your assets but also reduces the risk of scams, hacks, and other online threats.

1. Pick a Trusted Crypto Exchange & Create a Secure Account

A crypto exchange is a platform where you can buy and sell digital assets using regular money.

Choose exchanges that have:

• A long track record

• Strong security features

• Clear company information

• High trading volume

• Two-factor authentication

Additionally, use a strong, unique password and enable two-factor authentication through an app. Avoid logging in on public devices. Regulated exchanges also offer investments such as exchange-traded products and exchange-traded funds, providing beginners with alternative exposure without requiring them to manage private keys directly.

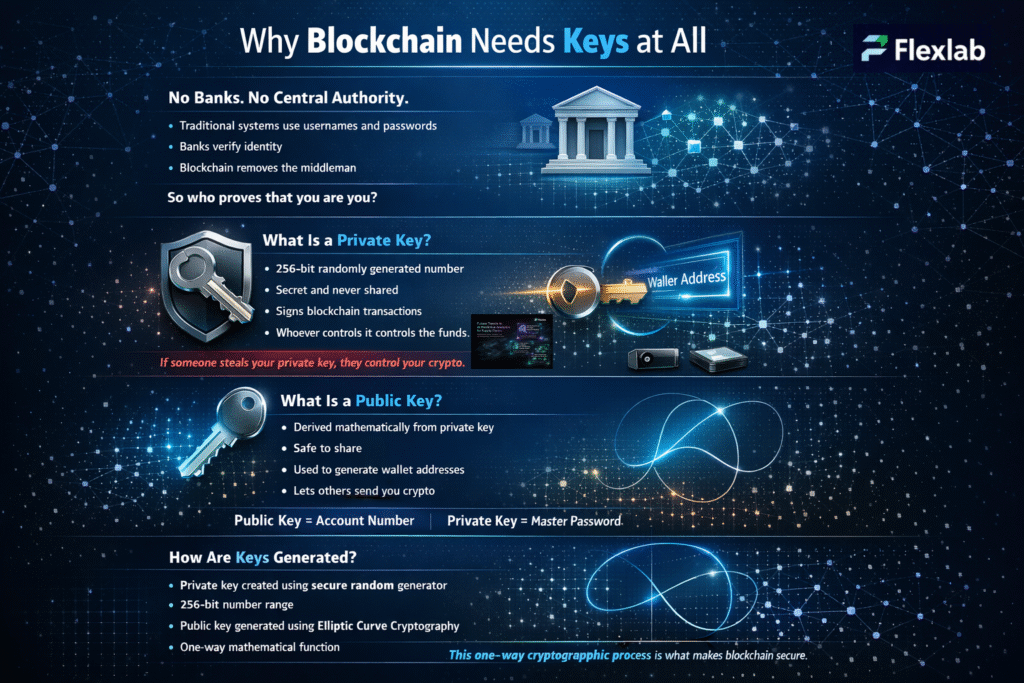

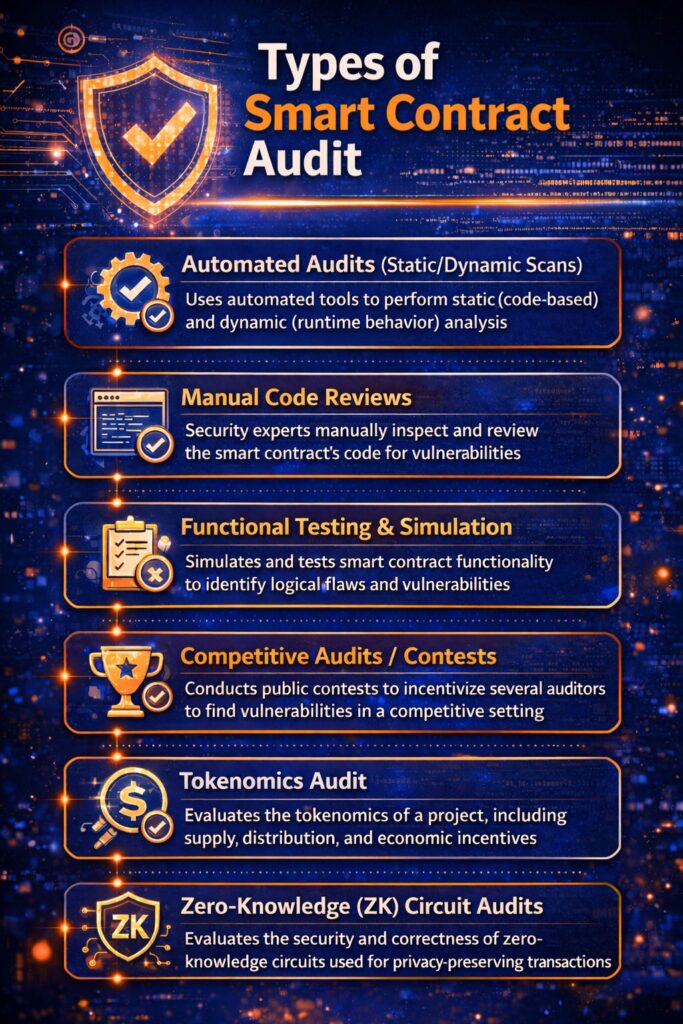

2. Understand Wallets & Storage Options

A wallet does not store coins. It stores your private keys, which control access to your funds. Here are the main types of crypto wallets:

- Hot Wallets: App-based or online wallets. Good for small amounts and daily use.

- Hardware Wallets: Offline physical devices. Best for large, long-term storage.

- Paper Wallets: Printed keys stored offline. Less common but highly secure when managed properly.

Most beginners start with a trusted app or exchange wallet, then move to hardware wallets as their holdings increase.

3. Protect Your Keys, Passwords, & Recovery Phrases

Your recovery phrase is the master key to your wallet. If you lose it, you may lose access to your crypto forever. Follow these golden rules to protect against any kind of scam.

- Never share your private keys

- Write your recovery phrase on paper

- Keep copies in two secure locations

- Avoid storing it digitally

- Double-check URLs before logging in

4. Avoid Early Mining Attempts

Mining requires specialized technical skills and hardware; therefore, it is less ideal for beginners.

5. Advanced Features for Beginners

Platforms may offer tools such as smart contracts, contracts for differences, peer-to-peer payments, and digital payment capabilities. Beginners should master basic investment principles before engaging with these advanced features.

Crypto Investing Strategies for Beginners

When starting, beginners should focus on proven crypto investing strategies to grow their holdings safely and manage risk effectively.

1. Long-Term Holding (HODL)

This is the “buy it and forget about it” strategy. Essentially, you pick strong, well-established cryptocurrencies and hold them for years, while ignoring short-term ups and downs. Therefore, it’s ideal for individuals who prefer not to trade daily and who believe the market will grow over time.

2. Dollar-Cost Averaging (DCA)

Invest a fixed amount on a schedule, such as weekly or monthly. It reduces timing risk and promotes discipline. This strategy supports dollar cost averaging, one of the safest techniques for beginners.

3. Diversify Your Crypto Portfolio

Practicing good portfolio management helps beginners strike a balance between risk and reward. By consistently keeping track of the coins, tokens, and stablecoins you hold, and by regularly reviewing your allocations, you can make more informed decisions while adjusting your strategy as the market evolves. Ultimately, this approach improves your chances of long-term success. A healthy crypto portfolio may include:

- Major coins

- A few reliable tokens

- Stablecoins

- Optional crypto index funds if available

4. Use Simpler Investment Products

Beginners can also explore contract for differences (CFDs), which allow them to speculate on cryptocurrency price movements without owning the underlying assets. However, this approach can provide flexibility and leverage, and at the same time, it carries a higher risk and should be used cautiously by new investors.

5. Avoid Emotional Decisions

Stick to your plan, and stay disciplined, while avoiding hype-driven choices. In conclusion, clear and consistent strategies not only reduce risk but also support long-term success.

Is Cryptocurrency a Good Investment for Beginners?

Cryptocurrency can be an exciting addition to your investment portfolio when you approach it responsibly. With that in mind, the right mindset and strategy allow beginners to confidently and safely enter this digital world.

-

Start Small & Learn

Think of crypto like an experiment at first. Begin with only what you can afford to lose without affecting your daily life. Start with amounts that feel comfortable while you learn how the market behaves.

-

Focus on Strong Coins

For beginners, it’s best to stick with well-known cryptocurrencies.

- Bitcoin (BTC): The original and most widely accepted crypto

- Ethereum (ETH): It is known for smart contracts and decentralized apps

- Stablecoins: These are tied to traditional currencies and are much less volatile

These options give beginners a reliable starting point. Additionally, some beginners prefer exposure through exchange-traded products, which allow you to invest in cryptocurrencies without directly holding the assets yourself. For example, these products track the price of coins like Bitcoin or Ethereum, making them easier to manage for those who want a simplified and regulated way to participate in the market.

-

Understand Cryptocurrency Mining

Cryptocurrency mining can sound exciting, but it’s not usually the best starting point for beginners. Here’s why:

- Mining requires expensive hardware that can cost thousands of dollars.

- Electricity costs can easily outweigh the coins you earn.

- It isn’t very easy, requiring setup, maintenance, and constant monitoring.

For most beginners, buying small amounts on a regular schedule (like weekly or monthly) is a much simpler and safer way to get started.

-

Follow KYC Requirements

Most reputable exchanges require Know Your Customer (KYC) verification, which means providing identification to confirm your identity. As a result, this process helps enhance security and prevent fraud.

This step might feel like a struggle, but it:

- Improves the reliability of the platform

- Helps reduce fraud

- Ensures regulatory protection for users

Think of it as a small safety measure that keeps your money and crypto secure.

-

Use Safe Storage

For beginners, the safest approach is usually a simple, trusted wallet:

- A mobile wallet app is easy to use and convenient for daily access.

- Many beginners also keep small amounts in a reputable exchange wallet.

At this stage, the key is security and simplicity, not complex storage setups.

Benefits of Investing in Cryptocurrency

- Accessibility: Open to anyone with internet access

- Potential Growth: Historical appreciation of major coins

- Transparency: Blockchain ensures verifiable transactions

- Diversification: Adds a layer to traditional portfolios

- Innovation Exposure: DeFi and smart contracts introduce new opportunities

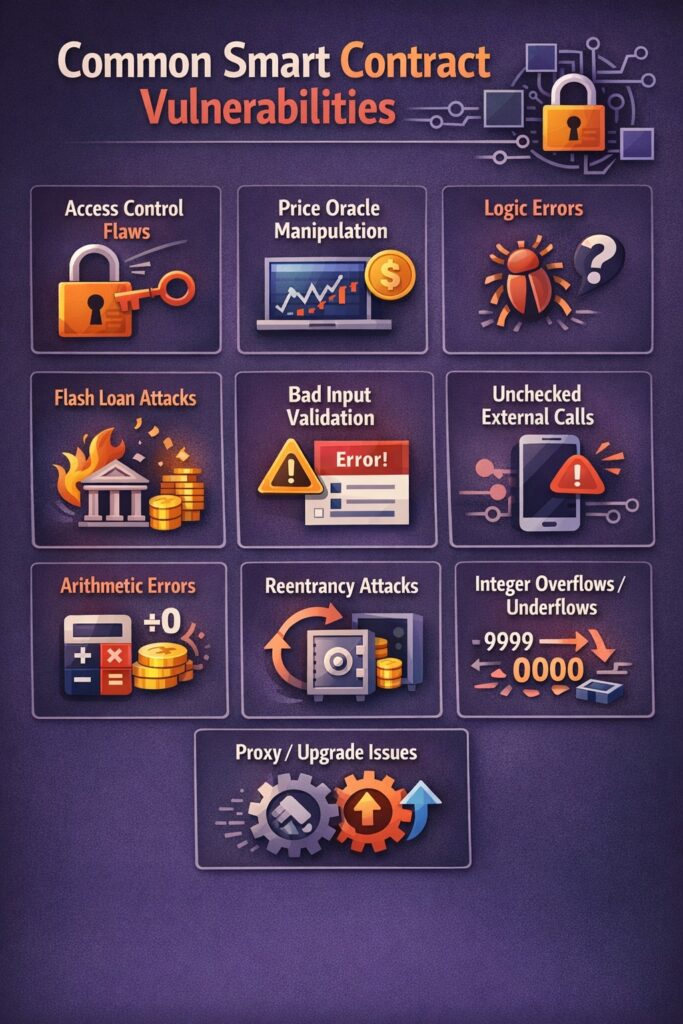

Risks of Investing in Cryptocurrency

- High Volatility: Prices can fluctuate dramatically

- Security Threats: Scams, phishing, and hacks are common

- Regulatory Changes: Cryptocurrency regulations can impact access and legality

- Lack of Insurance: Wallets are not covered by the government

- Emotional Decisions: Fear of missing out (FOMO) can lead to impulsive mistakes

Overall, a careful approach, patience, and knowledge effectively balance these benefits and risks.

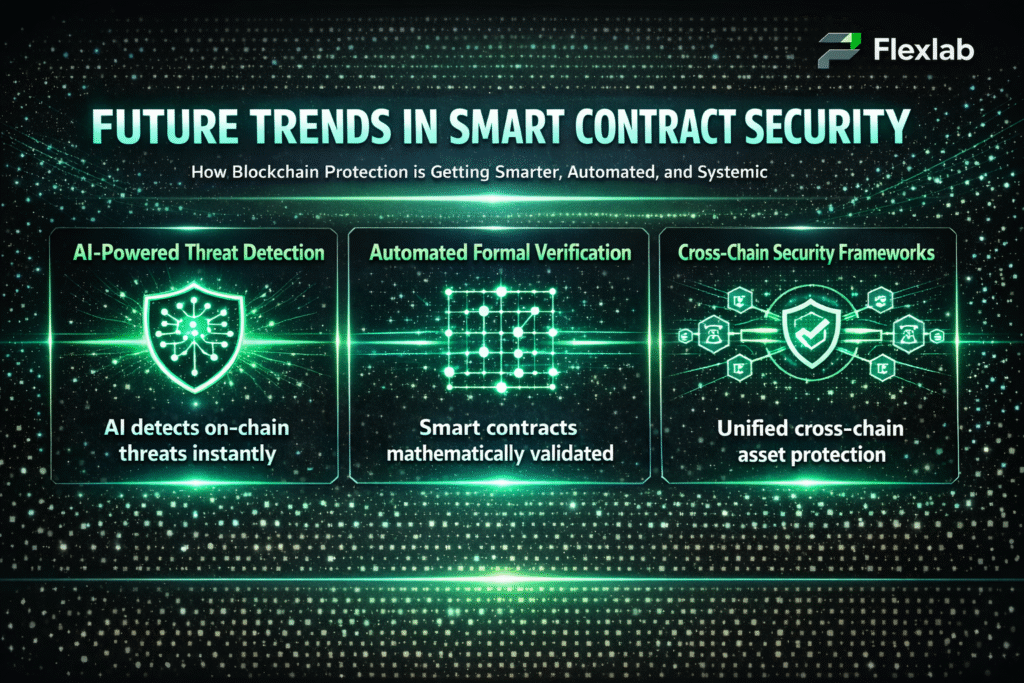

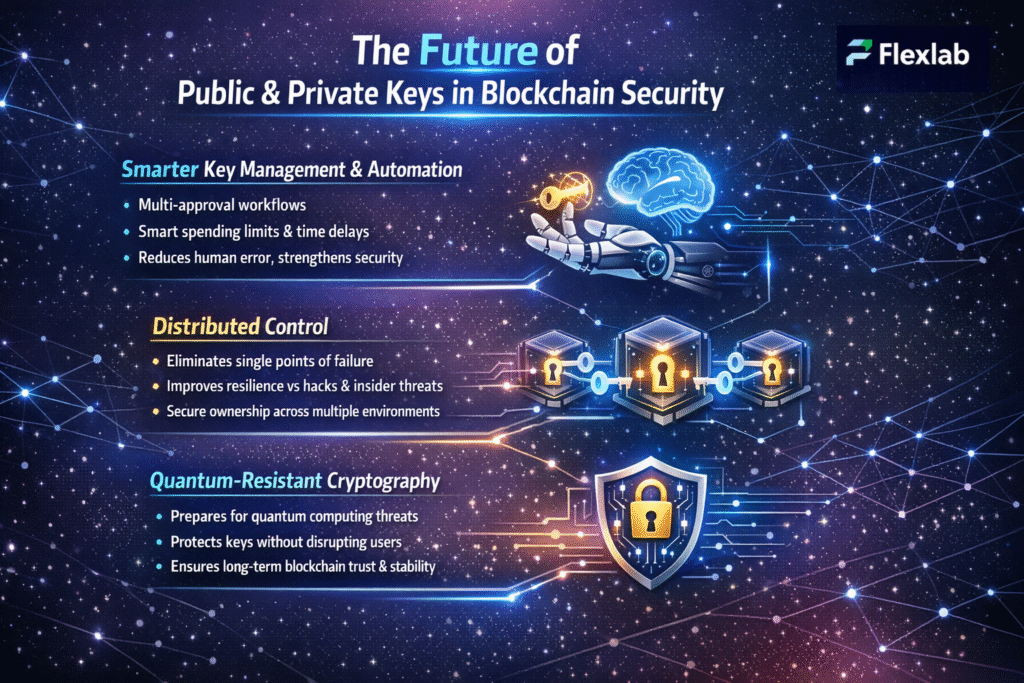

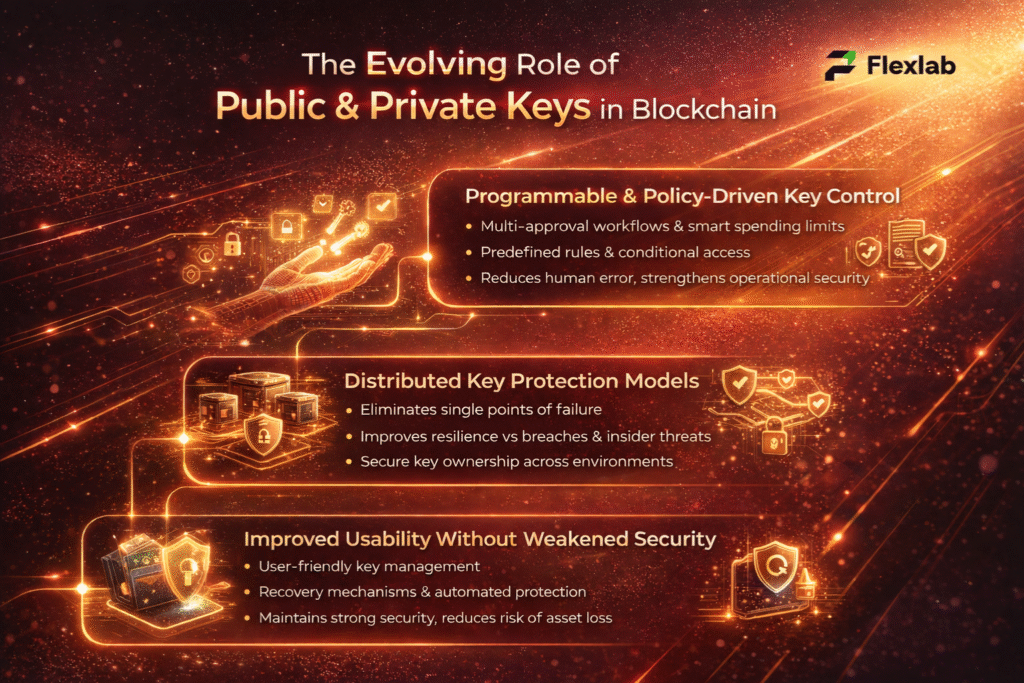

The Future of Cryptocurrency

The cryptocurrency landscape is evolving rapidly. Looking ahead, beginners should be aware of trends and potential developments to make informed decisions.

Increasing Adoption

More companies, payment platforms, and even governments are starting to accept or regulate cryptocurrencies. For instance, Bitcoin is gaining a mainstream payment option in several regions.

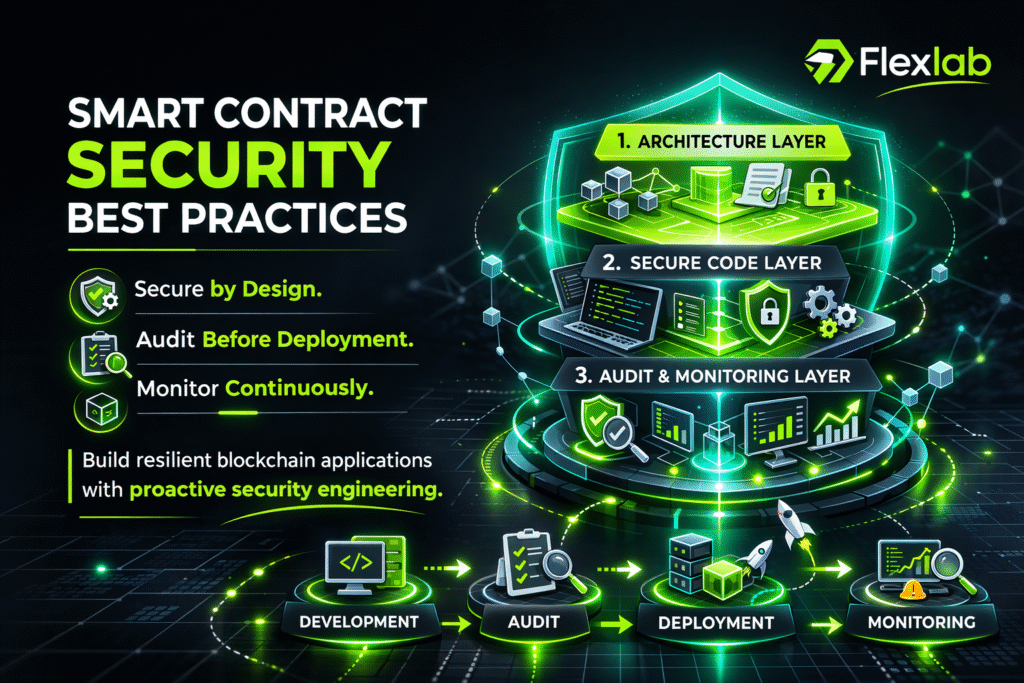

Technological Innovation

Additionally, advancements in smart contracts, Layer-2 scaling solutions, and decentralized applications (dApps) will continue to expand cryptocurrency’s capabilities and usability.

Regulation and Security Improvements

Governments and institutions are implementing clearer rules and improved security measures. Consequently, this will make crypto markets safer for beginners over time.

Long-Term Investment Outlook

Ultimately, patient and informed investors who diversify their portfolios and follow disciplined strategies are more likely to benefit from the long-term growth of cryptocurrency. Moreover, staying consistent and avoiding impulsive decisions can further improve their outcomes.

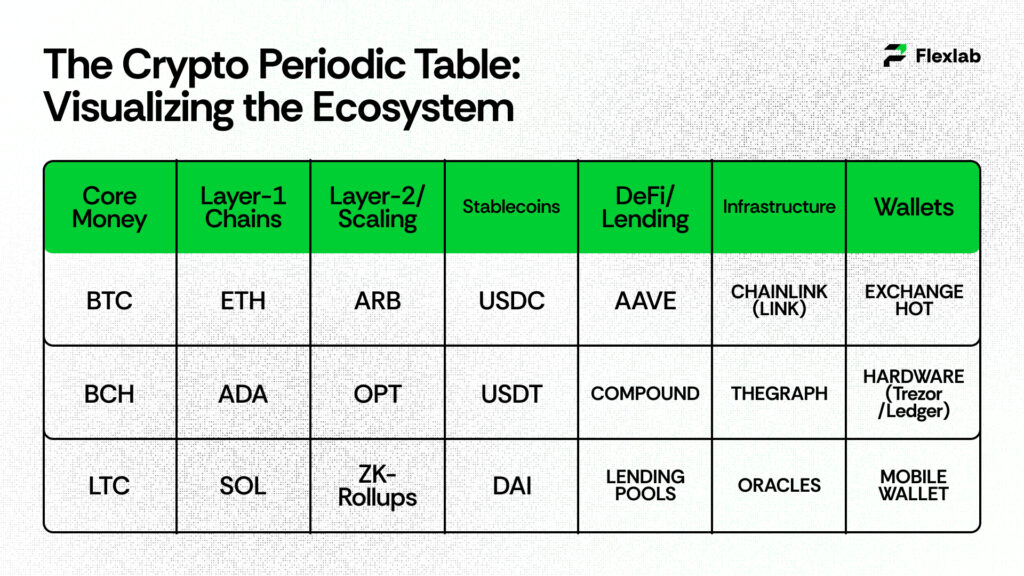

The Crypto Periodic Table: Visualizing the Ecosystem

Understanding the crypto world can feel overwhelming because there are thousands of coins and tokens. Fortunately, the Crypto Periodic Table serves as a handy reference, enabling beginners to see how different assets fit together at a glance. It’s an excellent tool for organizing your learning and simplifying decision-making.

Core Money

BTC, BCH, LTC: These are the foundational coins of the crypto world, serving as digital money and a store of value.

Layer-1 Chains

ETH, ADA, SOL: These blockchains host applications, smart contracts, and tokens, forming the infrastructure of the crypto ecosystem.

Layer-2 and Scaling Solutions

ARB, OPT, ZK-Rollups: These solutions enable transactions to move faster and more cost-effectively, thereby improving the user experience on busy networks.

Stablecoins

USDC, USDT, DAI: Stablecoins are typically indexed to traditional currencies like the US dollar, therefore providing a more stable option for beginners who want to navigate a volatile market.

DeFi and Lending Platforms

Platforms like AAVE, COMPOUND, and various lending pools enable decentralized finance users to lend, borrow, and earn interest without relying on traditional banks. As a result, they allow for more dynamic interaction with crypto assets.

Crypto Index Funds

Beginners can also explore crypto index funds to gain diversified exposure. Specifically, these funds track a selection of cryptocurrencies, which makes it easier to manage a balanced portfolio without having to handle multiple individual assets.

Infrastructure and Oracles

CHAINLINK, THEGRAPH, ORACLES: These provide essential data and connectivity, powering smart contracts and other blockchain applications.

Wallets

For instance, exchanging hot wallets, hardware wallets (Ledger/Trezor), and mobile wallets allows beginners to store crypto securely, while also matching different security and accessibility needs.

By using this visual framework, beginners can quickly grasp the crypto ecosystem. Moreover, they can understand how different asset types fit together, which in turn makes investment decisions easier and more informed.

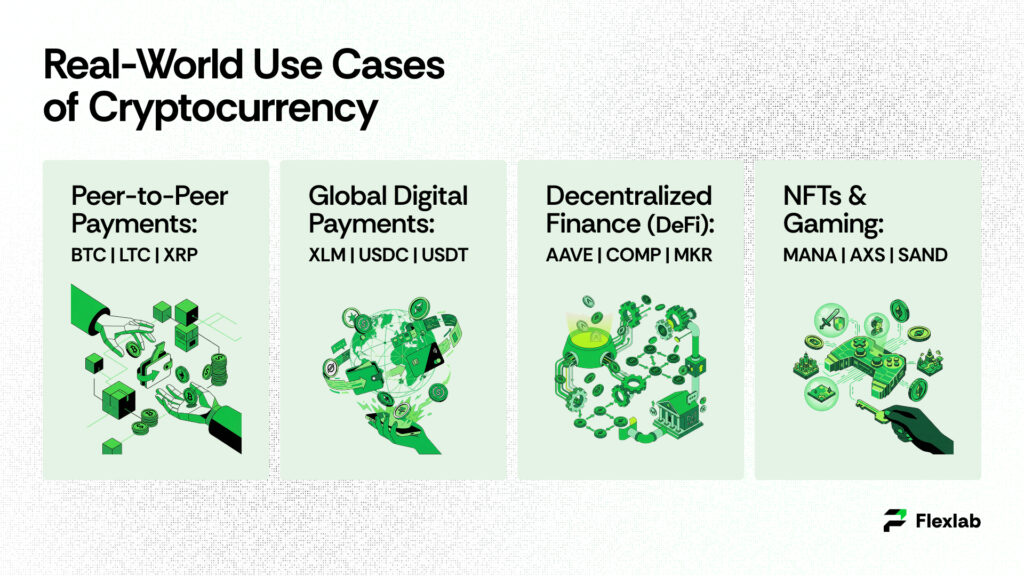

Real-World Use Cases of Cryptocurrency

To fully understand crypto, it’s helpful to see how it’s applied in the real world. For beginners, these use cases highlight the practical value of digital assets beyond investing.

-

Peer-to-Peer Payments

Cryptocurrencies enable direct transactions between individuals without the need for intermediaries. For instance, sending money across countries can be faster and cheaper than traditional methods.

-

Global Digital Payments

Digital currencies not only allow global payments but also reduce reliance on banks, thereby making international transactions seamless.

-

Decentralized Finance (DeFi)

Additionally, DeFi platforms let users lend, borrow, and earn interest without traditional banks, opening new financial opportunities.

-

NFTs and Gaming

Cryptocurrencies not only power digital collectibles (NFTs) but also support blockchain-based games, thereby providing new ways for creators and players to interact and monetize content.

Finally, these use cases give beginners practical examples of how crypto functions in everyday life, helping to connect theory with reality.

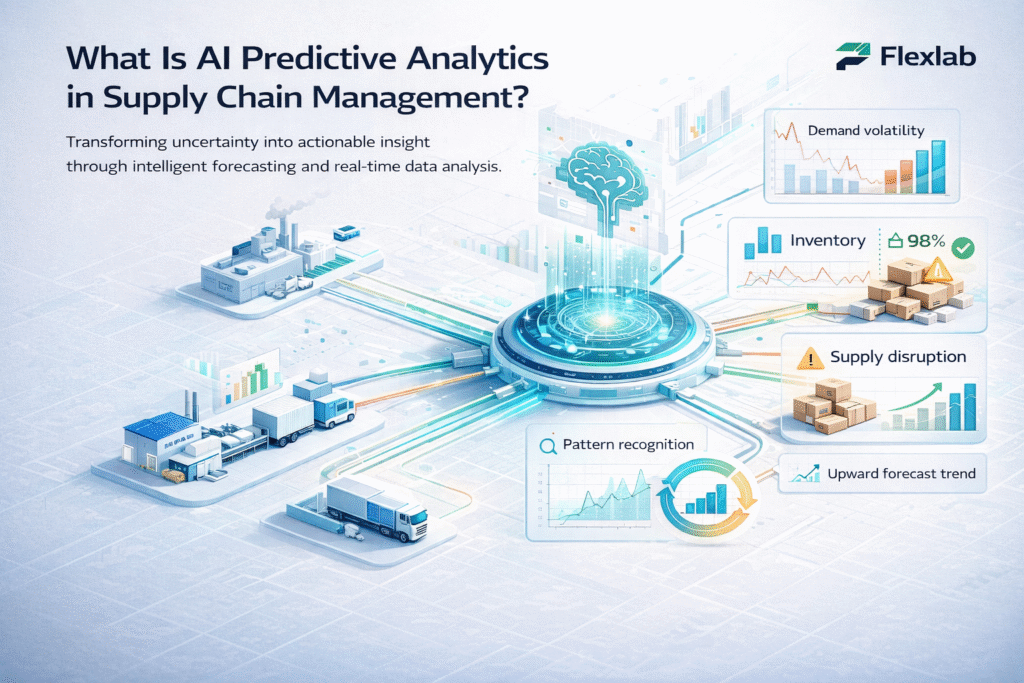

Track and Manage Your Crypto Securely with Flexlab

Flexlab’s all-in-one portfolio solutions enable both beginners and experienced investors alike to organize their crypto portfolios, monitor performance, and implement crypto investing strategies safely and efficiently. Are you excited to grow your crypto portfolio? Start today with Flexlab.

Ready to Grow Your Business?

📞 Book a FREE Consultation Call: +1 (416) 477-9616

📧 Email us: info@flexlab.io

Let’s discuss how our solutions can help you track, manage, and grow your investments securely. Additionally, explore our services, see our portfolio, or contact us directly. Moreover, stay connected and follow us on LinkedIn for the latest updates. With FlexLab, beginners can confidently manage their crypto, stay informed, and grow their investments safely. Finally, read our latest blog posts for expert insights and thoughtful perspectives on the future of care.

- Hot Wallet vs Cold Wallet: Which Crypto Wallet Should You Use

- Top 10 Mistakes to Avoid When Performing Crypto Transactions

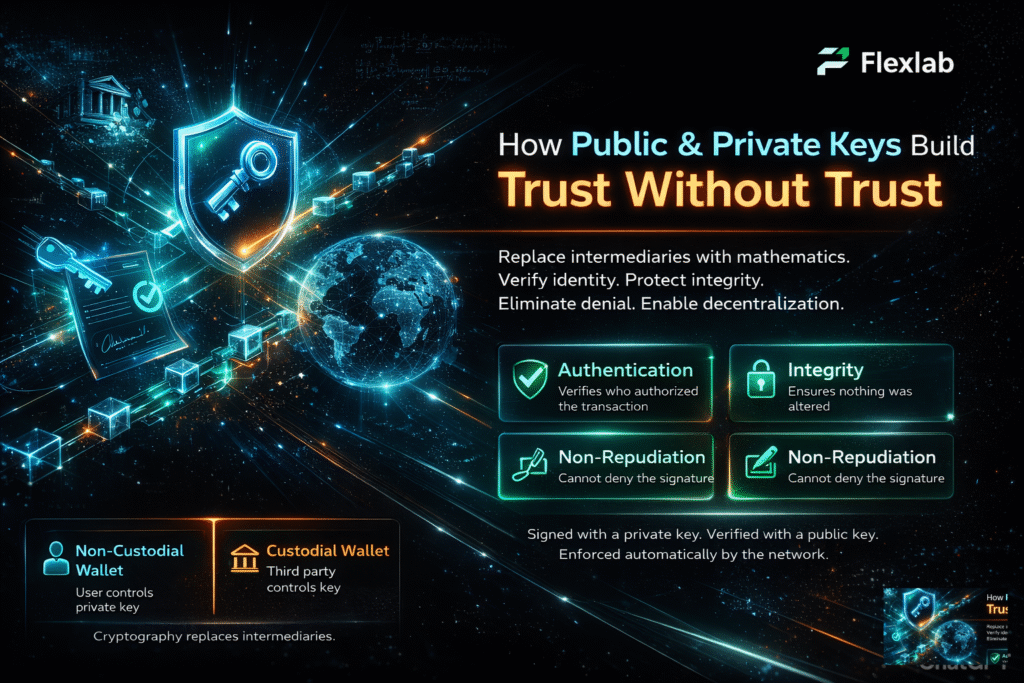

- What are Public and Private Keys? A Detailed Insight

Final Thoughts on How to Safely Invest in Cryptocurrency for Beginners

Investing in cryptocurrency for beginners can be exciting, but knowledge, patience, and a clear plan are essential. Approach crypto with a clear plan and a steady learning mindset. By understanding the basics, following strategies such as HODL or DCA, and staying informed about regulations and trends, you can safely navigate this digital financial world. Ultimately, cryptocurrency is not just an investment; it’s a learning journey. Start safely, stay informed, and explore the opportunities gradually.

What are the best cryptocurrencies for beginners?

Beginners usually start with well-known, established cryptocurrencies because they have stronger reputations and clearer use cases. Bitcoin and Ethereum are often considered the easiest entry points due to their history and widespread support. Stablecoins can also help beginners understand how value stability works in crypto. Starting with trusted options gives newcomers a safer foundation as they learn the basics.

How much money should a beginner invest in cryptocurrency?

Most beginners start small to keep their risk low while they learn how crypto markets behave. Investing only what you can afford to lose helps you stay comfortable and avoid emotional decisions. As your confidence grows, you can slowly increase your investment based on your goals and risk tolerance. Taking a gradual approach makes learning smoother and much less stressful overall.

How do beginners avoid scams in cryptocurrency?

Beginners can avoid scams by sticking with reputable platforms and by never trusting offers that promise guaranteed profits. Typically, scammers use urgency, pressure, or fake endorsements to trick new investors into rushing decisions. Therefore, taking a moment to research a project or exchange can prevent costly mistakes and protect your money. In addition, learning to slow down and verify information is one of the strongest defenses a beginner can have.