10 Common Pitfalls to Watch Out For in Crypto Transactions

Crypto Wallets | White Label Crypto Exchange | Blockchain Audit

Crypto transactions are permanent, fast, and unforgiving. Unlike traditional banking, where you can call customer support to reverse a mistake, crypto transactions cannot be reversed once confirmed due to blockchain immutability. Over $12.4 billion vanished from beginner wallets in 2024 alone, with $2.17 billion lost in just the first half of 2025. Most of these losses were completely preventable if people had avoided basic transaction mistakes.

Whether you’re just learning about ways to invest in crypto or you’re an experienced trader, understanding these errors is crucial for protecting your digital assets. Here are the top 10 errors that cost crypto users the most money. Let’s read below.

1. Sending Crypto to the Wrong Address

This is the nightmare scenario that haunts the user. You copy an address, paste it, hit send, and then realize you sent thousands of dollars to the wrong place. Sending crypto to the wrong address typically results in permanent loss, as blockchain transactions are irreversible.

What makes this worse is that crypto addresses are long strings of random-looking characters. One wrong character and your money is gone forever. A single wrong character in the recipient’s wallet address can send funds into the void, or worse, into a stranger’s wallet.

Even more frightening is address poisoning, where hackers place look-alike addresses in your transaction history. Address-poisoning swaps a look-alike address into your clipboard. You think you’re copying your friend’s address from a recent transaction, but you’re actually copying a scammer’s address that looks almost identical. This is a critical part of security measures that every trader must understand.

A real-world example shows how costly this can be. A single copy-paste mistake where a crypto trader loses $26 million in Renzo Restaked ETH. That’s not a typo, twenty-six million dollars gone because of one careless moment. This highlights why a proper risk management process should be your top priority when performing any transfers.

How to Avoid this:

- Always send a small test transaction first before sending large amounts

- Verify the full address character by character, not just the first and last few

- Never copy addresses from transaction history; always get them directly from the recipient

- Use QR codes when possible to avoid typing errors

- Double and triple-check before hitting send; your money depends on it

- Consider using a crypto portfolio tracker to monitor all your movements and addresses

2. Choosing the Wrong Blockchain Network

New to crypto? This mistake trips up cryptocurrency for beginners constantly and can be just as devastating as sending to the wrong address.

Many cryptocurrencies like USDT, USDC, and ETH exist on multiple blockchains, including Ethereum, Binance Smart Chain, Polygon, Arbitrum, and others. Sending Tether USDT over Ethereum instead of Tron is a classic mistake, and choosing the wrong network can result in permanent loss.

Each blockchain operates independently, meaning assets sent to an incorrect network will not automatically appear where you expect them to be. Your crypto doesn’t disappear; it just becomes trapped on the wrong blockchain, where your digital wallets can’t see it. Understanding blockchain technology is essential here, as each decentralized network operates with its own rules and infrastructure.

If you send cryptocurrency to the wrong network, your funds don’t disappear; they become inaccessible on the intended network. For example, if you send USDT as an ERC-20 token to a BEP-20 address on Binance Smart Chain, the tokens land on Binance Smart Chain but won’t show up in your Ethereum wallet.

Recovery is sometimes possible but complicated. You need to export your cryptographic keys and import them into a wallet that supports the blockchain where your funds ended up. However, many exchanges won’t help you recover funds sent on unsupported networks.

How to Avoid this:

- Confirm that both sender and receiver support the same network before transacting

- Read exchange deposit instructions carefully; they always specify which network to use

- When withdrawing, match the network selection to where you’re sending

- Send a tiny test amount first on the correct network

- Never rush, network mistakes are one of the costliest errors you can make

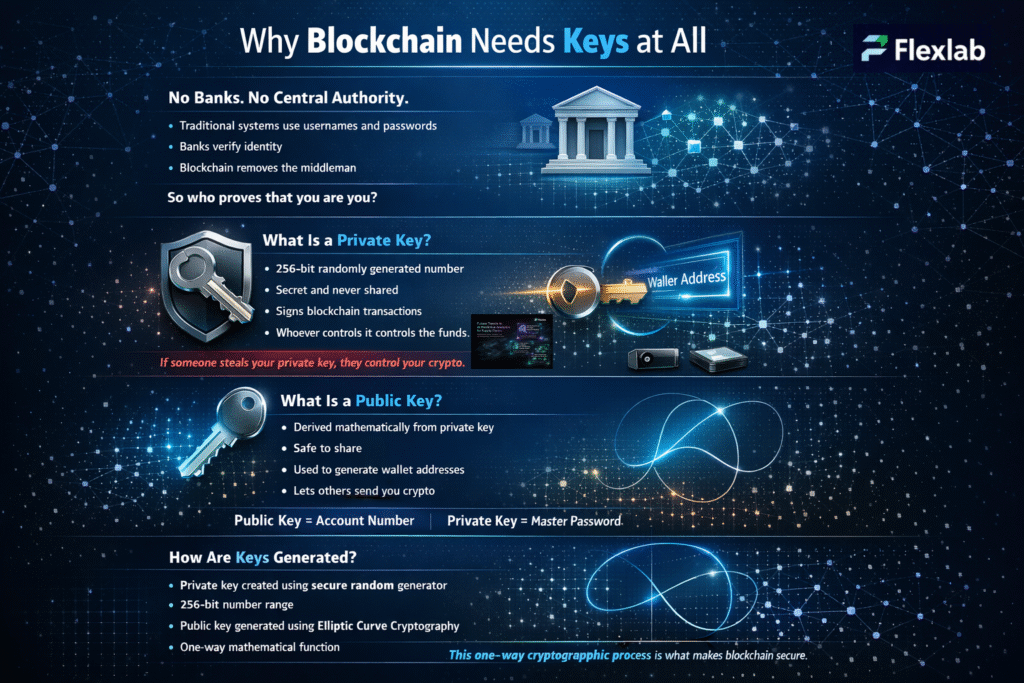

3. Storing Your Seed Phrase Digitally

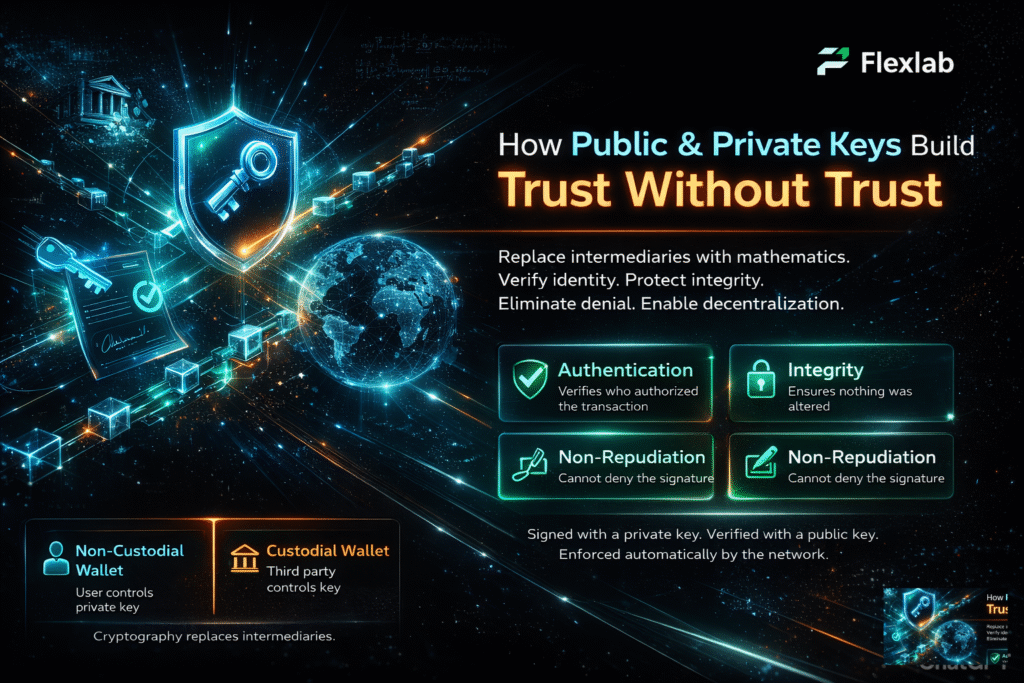

Your seed phrase is the master key to your entire portfolio. Seed phrase exploits and front-end compromises were the primary attack methods in the first half of 2025, accounting for over 80% of losses. Yet people still make the common mistake of storing their seed phrases digitally. Proper management of public and private keys is a cornerstone of protection in the crypto ecosystem.

Taking screenshots, saving in cloud drives, or writing seed phrases in notes apps is a common mistake. Some users think they’re being smart by taking a photo of their seed phrase and storing it in Google Photos or iCloud. That’s basically handing hackers the keys to your vault.

A victum recently lost $100,000 when their photographed seed phrase got compromised through phishing. Malware can scan your devices for text files containing common seed phrase words. Cloud storage gets hacked. Your phone can be stolen. Digital storage of seed phrases is asking for trouble.

Even browser extensions can be traps. A malicious Chrome extension called “Safery: Ethereum Wallet” ranked as the fourth result for “Ethereum wallet” on the Chrome Web Store and was designed to steal seed phrases by encoding them into micro-transactions on the Sui blockchain. It looked completely legitimate with clean branding and fake five-star reviews. Want to learn more? Read about the malicious chrome extension exfiltrates seed phrases.

How to Avoid this:

- Write your seed phrase on paper or engrave it on metal, never digitally

- Store physical backups in multiple secure locations, like safes or bank deposit boxes

- Never enter your seed phrase on any website or in any app except when recovering your actual wallet

- No legitimate service will ever ask for your seed phrase

- Consider metal backup solutions that survive fire and water damage

- Implement these protections as part of your overall crypto trading strategies

Ready to Bulletproof Your Crypto Security Today?

Don’t let these mistakes cost you millions—secure your transactions with expert help from Flexlab.

📞 Book a FREE Consultation Call: +1 (416) 477-9616

📧 Email us: info@flexlab.io

4. Not Testing Transactions First

Sending large amounts in one transaction without testing is gambling with your money. Professional traders with a solid plan know this; beginners learn it the hard way. A test transaction means sending a tiny amount first, like $10 or $20, to verify everything works before sending the full amount.

Always send a test amount to ensure the address works and is correct, and once confirmed, proceed with the full amount. Yes, you pay transaction fees twice. Yes, it takes a few extra minutes. But that small cost and time investment can save you from a big loss. This is essential advice that can save your entire portfolio.

Test crypto transactions catch multiple types of errors. They verify the address is correct, confirm the network matches, ensure the receiving wallet can accept that token, and prove the funds actually arrive where you expect. If something’s wrong, you lose $20 instead of $20,000.

This is especially important when:

- Sending to a new address for the first time

- Using a new exchange or wallet

- Transferring between different blockchains

- Moving significant amounts of money

- Dealing with any unfamiliar process

- Managing your holdings across multiple platforms

How to Avoid this:

- Always test with a small amount first when sending to new addresses

- Wait for full confirmation before sending the main amount

- Keep records of successful test transactions for future reference

- Budget for the extra fees, it’s cheap insurance

- Never skip this step just to save a few dollars in fees

- Use AI automation tools or tracking software to log all test movements

5. Forgetting About Transaction Fees

Transaction fees, known as gas fees, fluctuate dramatically from pennies to hundreds of dollars, driven by network congestion and timing. During Ethereum peak periods, a single transaction can cost $50–$100 or even more. Understanding fee structures is crucial when figuring out how to trade cryptocurrency profitably.

Underpaying gas fees can leave your transaction stuck or pending indefinitely. Your transaction sits in limbo, not confirmed but not canceled either. Meanwhile, your funds are essentially frozen, and you can’t use them.

The bigger problem hits small portfolio holders. If you’re trying to move $200 worth of cryptocurrency and the fee is $75, you just lost over one-third of your money to fees. This happens constantly with Ethereum-based tokens. A Paxful user mistakenly set a $500,000 transaction fee for a Bitcoin transfer, significantly exceeding standard fees, and because mining fees are automatically distributed to miners, recovering the funds was nearly impossible.

Different blockchains have vastly different fee structures. Bitcoin and Ethereum tend to have higher fees, especially during busy times. Networks like Polygon, Arbitrum, Solana, and Binance Smart Chain usually have much lower fees, often just pennies per transaction. This impacts which might be the best cryptocurrencies to invest in for frequent transfers.

How to Avoid this:

- Check current network fees before making transactions

- Use the fee estimation tools available in most wallets

- For Ethereum, check sites like Etherscan Gas Tracker to see current rates

- Consider timing, fees are often lower during weekends and off-peak hours

- Make sure you have enough of the network’s native token to cover fees

- For small amounts, use low-fee networks when possible

- Factor fees into your management approach and overall strategy

6. Ignoring Memo/Tag Requirements

Some cryptocurrencies require a memo, destination tag, or payment ID in addition to the wallet address. This is common with coins like XRP (Ripple), Stellar (XLM), EOS, and Binance Chain (BEP-2) tokens. Some networks, such as XRP, Stellar, and Binance Smart Chain, require an additional memo or destination tag to ensure funds are routed correctly, and failure to include it may result in lost funds.

Think of it like this: the wallet address is the bank, and the memo is the account number within that bank. Exchanges and custodial services use one address for many users, and they identify who owns what through these memos or tags. Send without the correct memo, and your funds arrive at the exchange, but they have no way to credit your account.

This is particularly frustrating because the funds aren’t lost in the technical sense; they arrived at the destination. But without the proper memo, the receiving platform can’t identify whose funds they are. Some exchanges will help you recover, but it often requires contacting support, proving ownership, and waiting days or weeks. For cases where a unique deposit memo or tag is required but was submitted incorrectly or was missing, you might be asked to make another minimum deposit from the same address with the correct memo/tag included so they can verify you are the owner. Some platforms charge recovery fees or won’t help at all.

How to Avoid this:

- Always check if the cryptocurrency requires a memo, tag, or payment ID

- Read the deposit instructions carefully on exchanges

- Copy and paste the memo exactly as provided; don’t type it manually

- Verify both the address and the memo before confirming

- If unsure, contact support before sending rather than after

- Track memo requirements in your portfolio software for different exchanges

7. Using Public Wi-Fi for Transactions

Performing transfers on public Wi-Fi at coffee shops, airports, or hotels is extremely risky. Public networks are hunting grounds for hackers using tools to intercept data. Public Wi-Fi networks can be exploited by hackers, so avoid making any crypto transactions on them, and if you must access an exchange or wallet, use a VPN to encrypt your connection.

Hackers on the same public network can potentially see your transaction details, steal login credentials, or inject malicious code into your connection. Man-in-the-middle attacks let them intercept communication between you and the exchange or wallet you’re using. This vulnerability in the ecosystem has cost countless users their investments.

Even worse, some “public Wi-Fi” networks are actually fake hotspots set up by scammers specifically to steal cryptocurrency. They name them things like “Coffee Shop Guest WiFi” or “Airport Free WiFi” and wait for victims to connect. Once you’re on their network, they can see everything you do, including accessing your wallets.

How to Avoid this:

- Never perform transfers on public Wi-Fi

- If you absolutely must, use a reputable VPN service to encrypt your connection

- Use your phone’s mobile data instead; it’s much more secure

- Wait until you’re on a trusted private network

- Consider using a separate device only for cryptocurrency that never connects to public networks

- Essential protections for safeguarding your investments

8. Not Verifying Smart Contract Addresses

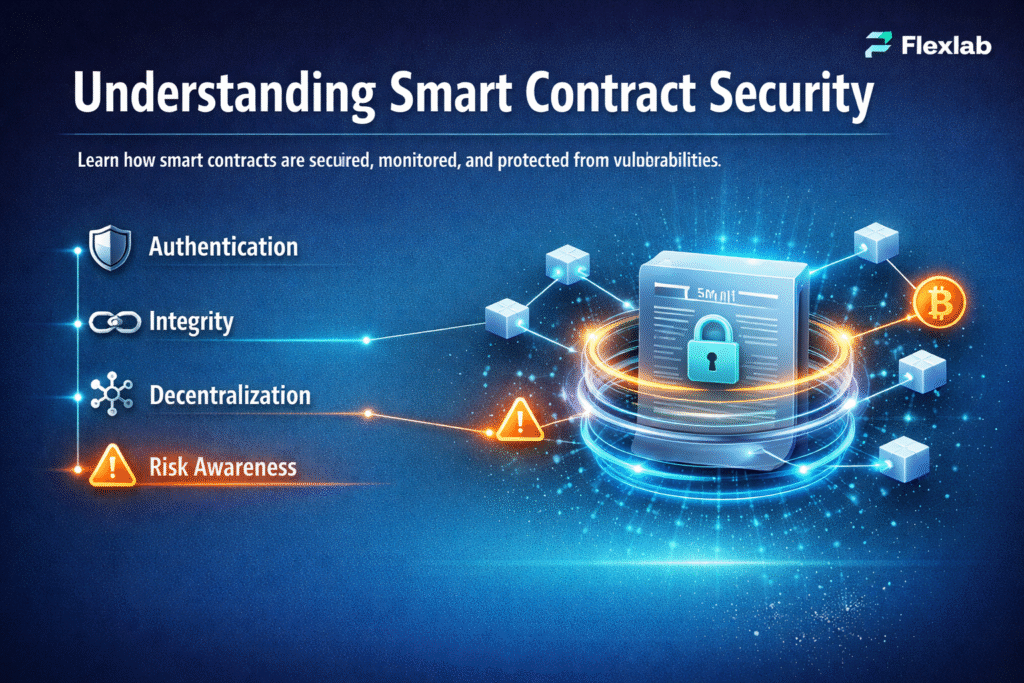

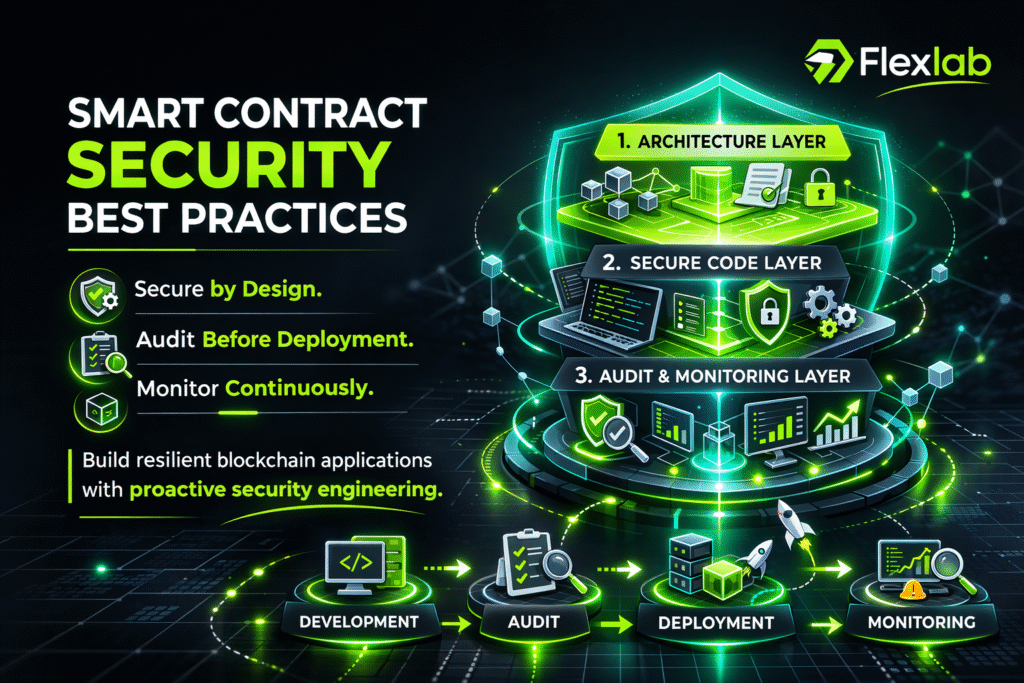

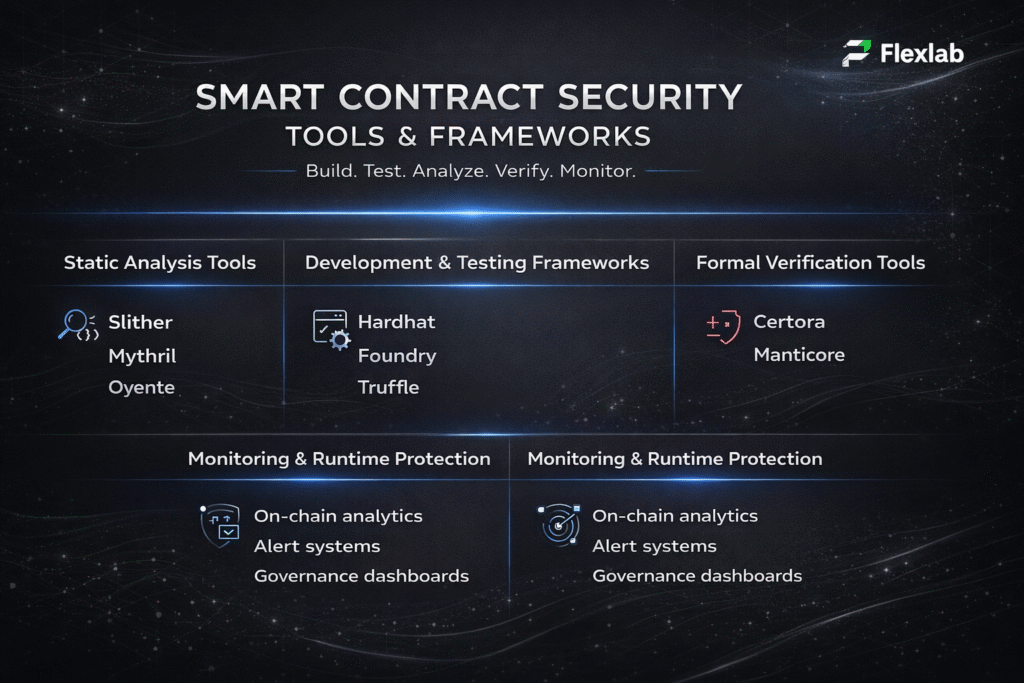

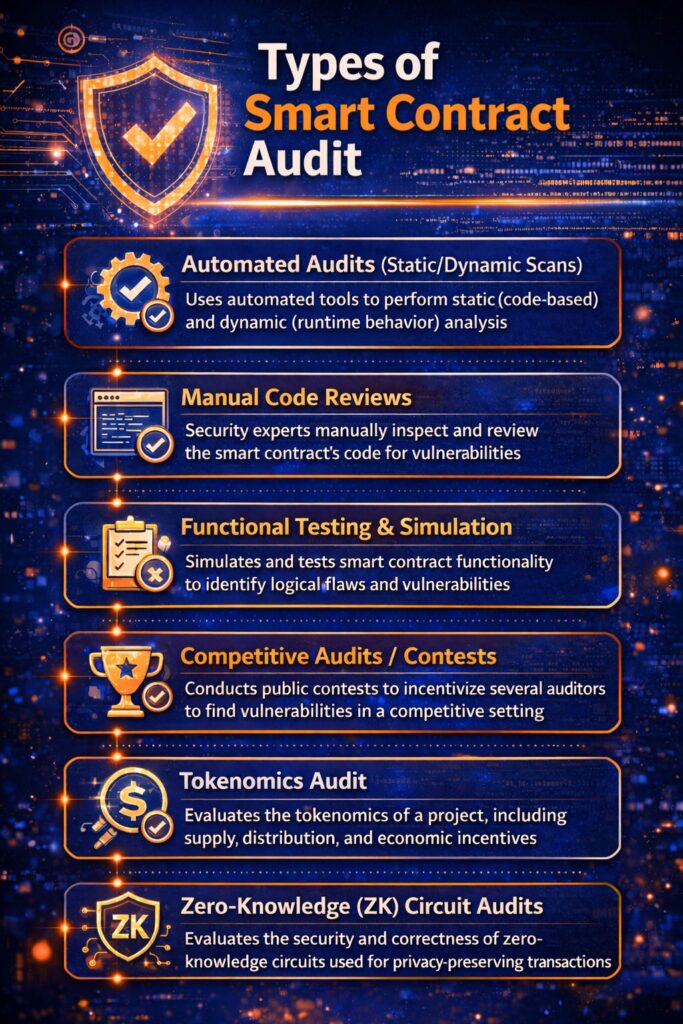

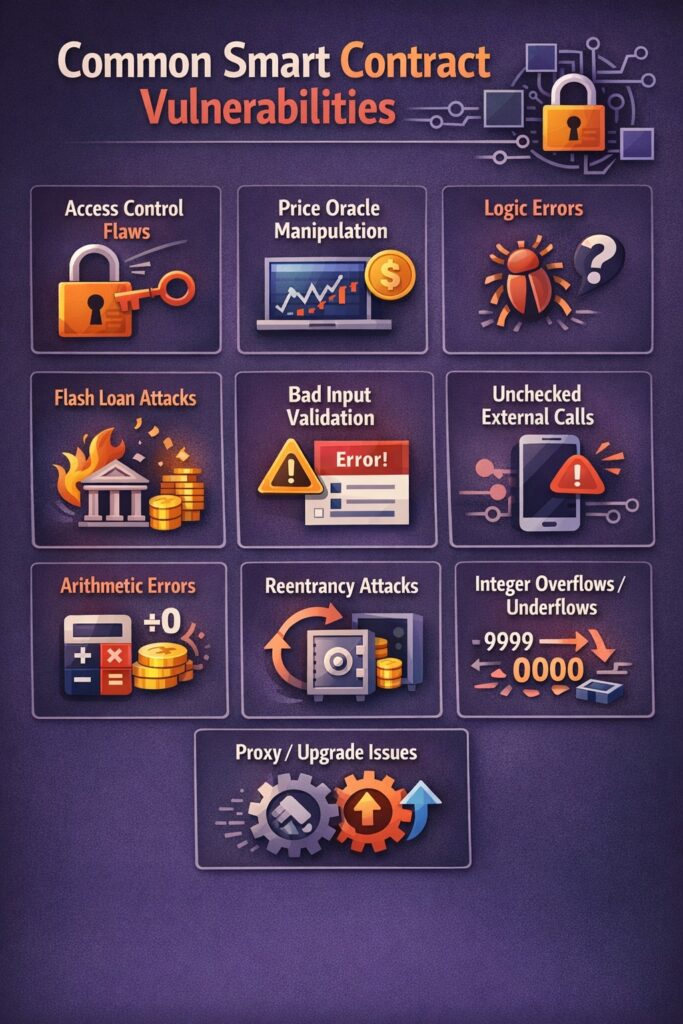

When interacting with DeFi protocols, swapping tokens on decentralized exchanges, or adding tokens to your wallet, you often need to input smart contract addresses. Using the wrong contract address can send your funds to a scam token or drain your wallet completely. Understanding smart contracts is part of both fundamental vs technical analysis in the ecosystem.

Scammers create fake tokens with names identical to popular cryptocurrencies. They might call it “Ethereum” or “USDT,” but it’s actually a worthless scam token. If you add the wrong contract address to your wallet and then try to send or swap, you could lose everything. This is especially important when evaluating which assets to purchase.

Phishing websites are everywhere in the space. They look exactly like popular DEXes or token websites, but with slightly different URLs. Once you connect your wallet and approve transactions, they drain your funds. Some sophisticated scammers even create fake initial coin offering (ICO) websites to steal funds from investors.

How to Avoid this:

- Always get contract addresses from official sources like the project’s official website

- Verify URLs carefully, scam sites use look-alike domains

- Check contract addresses on block explorers like Etherscan

- Be suspicious of contracts shared in Telegram groups or Discord

- Use token lists from reputable sources in DEX interfaces

- Never connect your wallet to suspicious sites

- Consider consulting a custom software development firm if you’re launching your own token to ensure proper implementation

9. Approving Unlimited Token Allowances

When using decentralized exchanges and DeFi protocols, you need to approve them to spend your tokens. Many platforms default to requesting “unlimited” approval, meaning they can spend unlimited amounts of that token from your wallet forever. Infinite allowances to sketchy routers or blind-signing typed data let drainers empty wallets.

While this is convenient because you only approve once, it’s also dangerous. If that protocol gets hacked or turns out to be malicious, they can drain every token you gave unlimited approval to. This has happened countless times in the decentralized ecosystem.

Users should prefer exact-amount approvals and review and revoke approvals monthly. You can check what approvals you’ve given using tools like Revoke cash or Unrekt. You might be shocked to see dozens of old approvals from protocols you used years ago. Some traders use the best crypto AI trading bots that manage these approvals automatically as part of their toolkit.

How to Avoid this:

- Never approve unlimited spending unless necessary

- Set approval amounts to exactly what you need for that specific transaction

- Regularly review and revoke old approvals

- Be especially careful with new or unaudited protocols

- Use approval management tools to see who has access to your wallet

- Implement this as a core protection in your overall approach

10. Not Keeping Transaction Records

Failing to keep detailed records of your transfers causes massive problems, especially at tax time. Starting January 1st, 2025, the IRS requires wallet-based cost tracking, meaning transaction records need to match disposals exactly. Understanding cryptocurrency regulation is crucial for compliance.

Every movement is a taxable event in the United States. Selling, swapping, spending, or even moving between your own wallets can trigger tax obligations. Without proper records, you can’t accurately calculate what you owe using methods like the FIFO method first in first out. That leads to either overpaying taxes or underpaying and risking audits, penalties, and interest.

All exchanges will have to report their gains and losses to the IRS on Form 1099-DA starting in 2025. The IRS is getting much more sophisticated at tracking cryptocurrency. They’re not messing around with regulatory compliance.

But tax compliance isn’t the only reason to keep records. If you need to dispute a transfer, prove ownership, or recover funds, detailed records are essential. They’re also crucial for understanding your own performance and portfolio management. Good tracking software becomes invaluable here, especially when you’re trying to understand profitability consistently.

How to Avoid this:

- Use tax software like CoinTracker, Koinly, or CryptoTraxer to automatically track movements

- Export transaction histories from exchanges regularly

- Keep records of wallet addresses you own

- Document the date, amount, price, and purpose of each transfer

- Store records securely for at least 7 years

- Don’t wait until tax season to organize everything

- Tracking software can automate much of this process

- Understand regulations in your jurisdiction

Extra Tips for Safe Crypto Transactions

Beyond these top 10 mistakes, here are additional best practices that combine analysis methods with practical crypto trading tips:

- Use Address Whitelisting: Many exchanges let you whitelist addresses, meaning only pre-approved addresses can receive withdrawals. This prevents mistakes and adds protection even if someone hacks your account.

- Enable All Security Features: Two-factor authentication, withdrawal confirmations via email, anti-phishing codes, and all other features should be turned on. Every layer helps protect your holdings.

- Stay Calm and Focused: Many mistakes happen when people are rushed, distracted, or emotional. The FOMO fear of missing out can lead to rushed decisions and costly errors. Take your time with every transfer. There’s no undo button. This is especially important when dealing with the volatility of cryptocurrency.

- Educate Yourself Continuously: The space evolves constantly. New scams, new protocols, new risks. Stay informed through reputable sources and learn from others’ mistakes. Whether you’re learning fundamentals or perfecting your approach, education is ongoing.

- Consider Using Automation Wisely: Some traders use bots or other tools to manage their portfolios. While these can be helpful, always maintain control over your private keys and never give unlimited access to any automated system.

- Understand Blockchain Finality: Once a transaction is confirmed on the blockchain, it’s permanent and unchangeable, and no central authority, like a bank or support desk, can change, delete, or recall a transaction. This is a fundamental principle of the technology and decentralized structure. This isn’t like traditional finance, where chargebacks exist. You’re responsible for getting it right the first time.

- Diversify Your Approach: Don’t put all your eggs in one basket. When researching which assets to purchase, consider multiple projects and use both analytical methods. Your protection plan should include portfolio diversification.

The Bottom Line About Crypto Transactions

Crypto transactions offer incredible power but demand unwavering vigilance. Avoiding these top 10 mistakes safeguards your assets from billions in preventable losses. Mastering test transactions, secure key storage, and network verification turns risks into routine safety, empowering confident trading in this decentralized world.

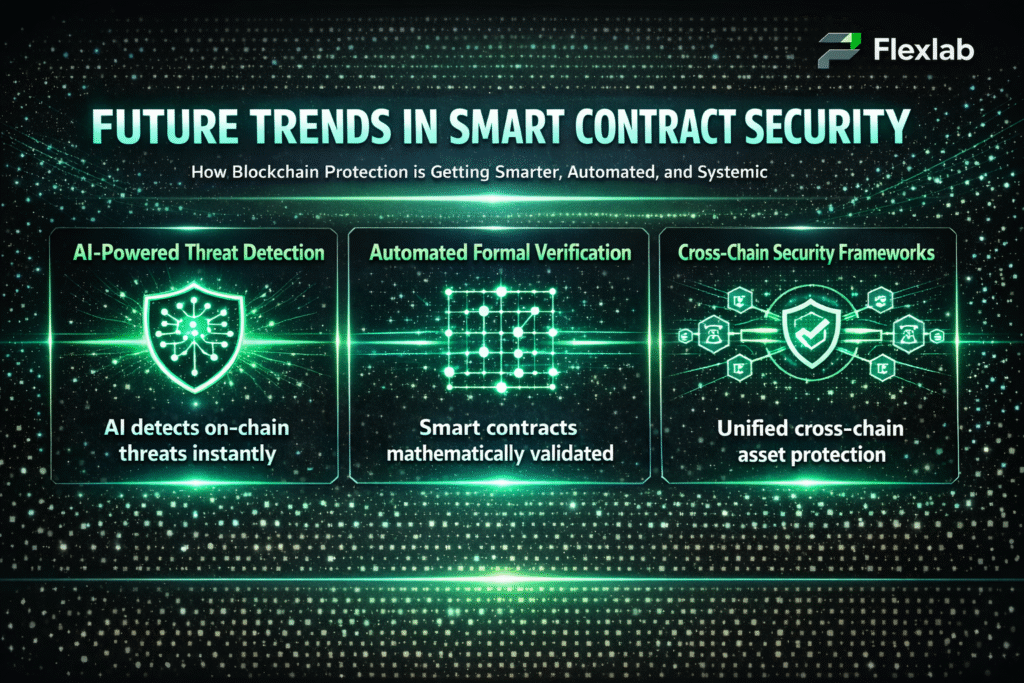

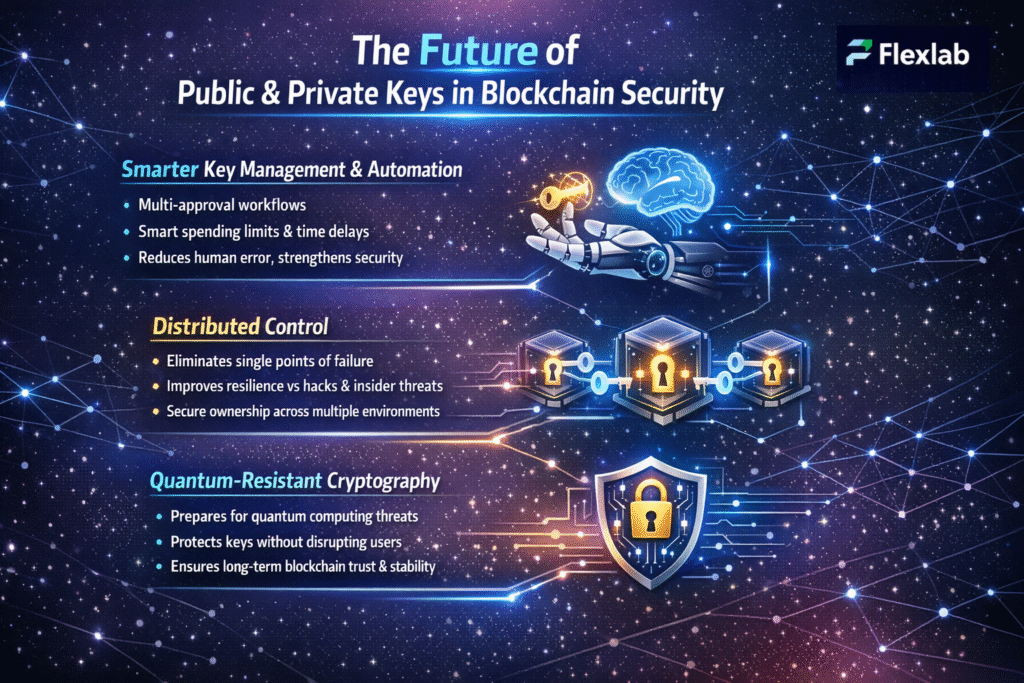

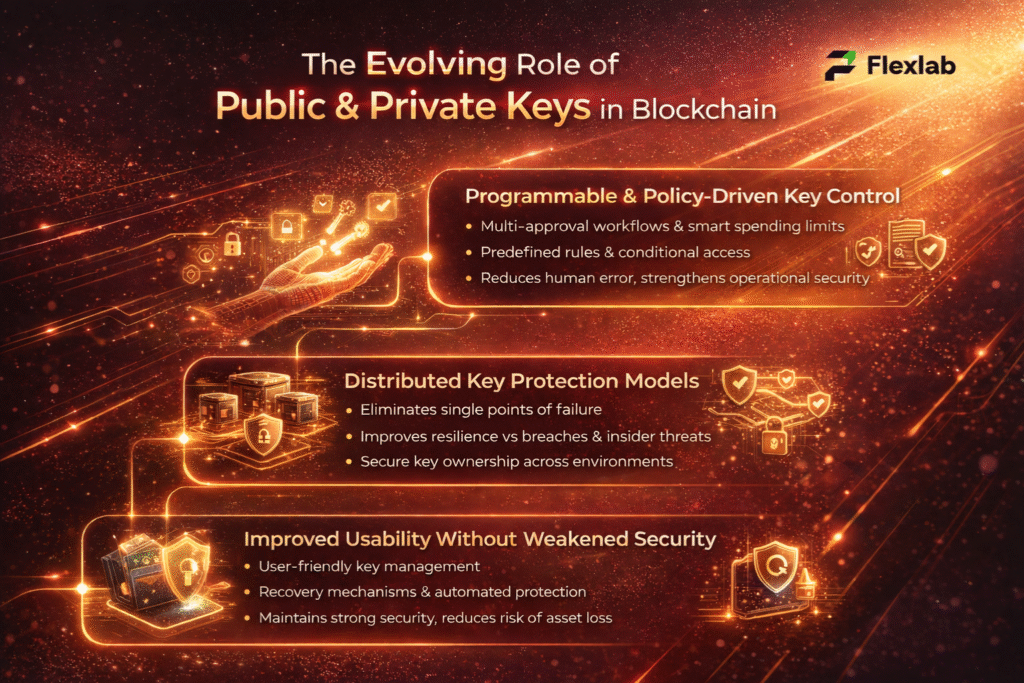

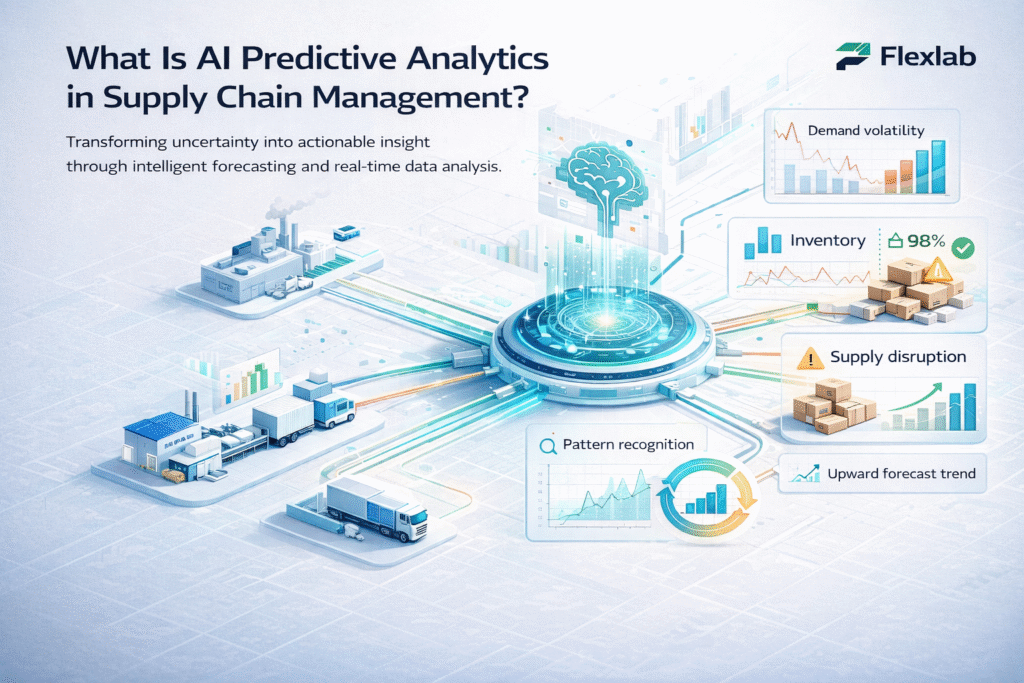

How Flexlab Helps Your Crypto Security

Flexlab delivers tailored cybersecurity solutions for crypto users, including automated key management to prevent seed phrase leaks and address poisoning. Custom AI tools monitor transactions in real-time, flag wrong networks or unlimited approvals, and enforce whitelisting for seamless security. Partner with Flexlab for expert audits, recovery strategies, and compliance tracking, ensuring your portfolio thrives without the pitfalls.

Ready to explore more? Contact us now and check out our LinkedIn to see our projects. You can also glance at our insightful AI and blockchain blogs, including;

FAQs

Q1: What are crypto transactions?

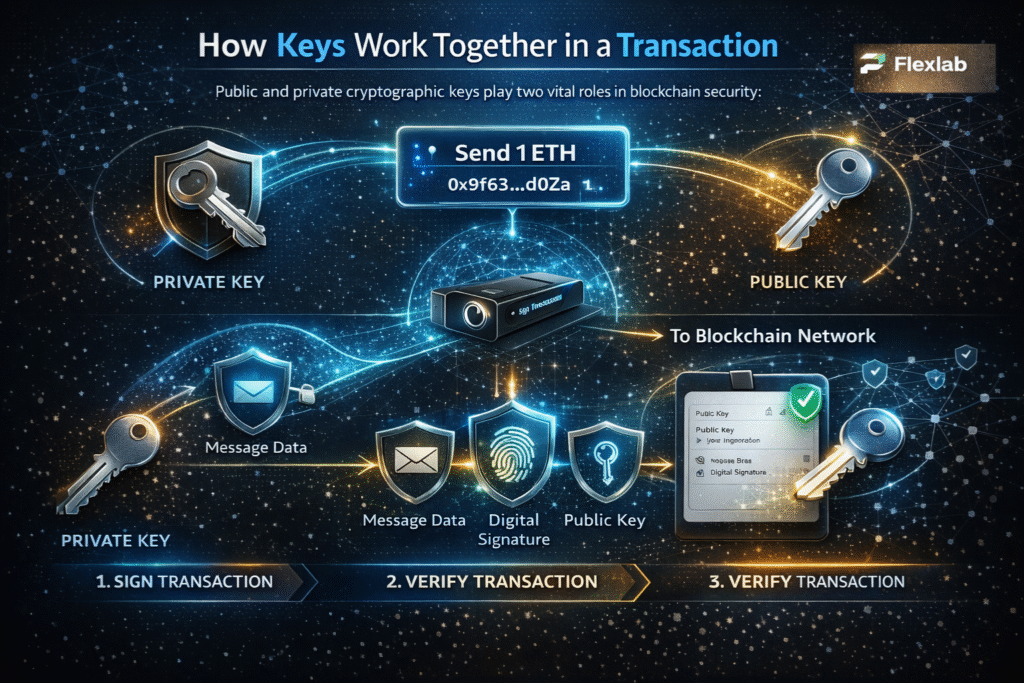

Crypto transactions are digital asset transfers recorded on a blockchain, involving the sender, receiver, amount, and a digital signature to verify authenticity. They occur on decentralized networks, eliminating the need for a central authority, thereby ensuring peer-to-peer trust and security.

Q2: Can I withdraw crypto directly to my bank?

You cannot withdraw cryptocurrency directly to a bank account. Instead, you first need to sell or convert your crypto into fiat currency through a cryptocurrency exchange or broker. After conversion, you can transfer the fiat money to your linked bank account. Direct crypto-to-bank transfers are not supported because banks operate with fiat funds, not crypto.

Q3: How can I see crypto transactions?

You can view crypto transactions using your wallet’s transaction history or public blockchain explorers. Blockchain explorers are websites that display all transactions on a blockchain, showing details like transaction amount, sender and receiver addresses, and the transaction’s status. These tools help verify and trace transactions transparently on chains like Bitcoin or Ethereum blockchain technology.