Consensus mechanisms are fundamental to blockchain networks, determining how participants agree on the validity of transactions.

Over $350 million was lost to crypto exploits in early 2026, with many attacks exploiting weak smart contract security and poorly designed protocols, according to the Reddit.com report on January 2026 crypto hacks. Every second a contract is live, attackers scan for vulnerabilities, and your code is under constant scrutiny.

Modern smart contract development demands structured threat modeling, hardened architecture, rigorous testing, and continuous monitoring.

This guide will show you how to prevent critical smart contract vulnerabilities, implement defensive coding patterns, execute thorough audits, deploy resilient monitoring systems, and prepare a production-ready launch strategy that protects capital and builds long-term trust. Security is not optional. It is infrastructure.

Smart Contract Security is the backbone of any reliable blockchain system within modern blockchain technology ecosystems. Moreover, unlike traditional software, smart contracts are immutable once deployed, meaning any flaw can lead to permanent loss of funds or irreparable damage. Therefore, understanding smart contract security is essential for developers, organizations, and users engaging in decentralized finance or blockchain applications.

As per the CryptoSlate 2026 Report, in 2026 alone, over $350 million in crypto assets were lost due to insecure smart contracts. These incidents highlight why a strong foundation in security practices can prevent catastrophic financial loss. By focusing on smart contract vulnerabilities, threat modeling, and preventive principles, developers can significantly reduce risks before deployment.

Smart contract security refers to designing, developing, and deploying blockchain contracts written in secure programming languages that are resistant to attacks, function exactly as intended, and preserve the integrity of digital assets. Unlike regular software:

A secure smart contract ensures code correctness, robust access control, and safe interactions with external systems. By anticipating potential threats, developers protect both funds and user trust in DApps.

Every deployed contract carries high stakes. Poor security can result in:

According to CryptoPotato’s 2026 report, over $4 billion was lost globally in crypto hacks, with a majority targeting flawed smart contracts. Therefore, understanding vulnerabilities and planning mitigations is the foundation of blockchain security.

Developers must be aware of frequent attack vectors to prevent costly mistakes. Key vulnerabilities include:

| Vulnerability | Description | Potential Impact | Mitigation / Best Practice |

| Reentrancy | External call re-enters contract | Theft of funds, double withdrawals | Checks-Effects-Interactions, reentrancy guards |

| Overflow / Underflow | Math operations exceed limits | Token or balance errors | Solidity ≥0.8 built-in checks, SafeMath |

| Weak Access Control | Unauthorized actors access sensitive functions | Admin abuse, critical failures | Least privilege, multi-sig authorization |

| Oracle Manipulation | Reliance on manipulated external data | Price exploits, fund loss | Multiple oracle feeds, sanity checks |

| Unchecked External Calls | Calls to untrusted contracts without validation | Funds stolen, contract hijacked | Validate inputs, assume callee is hostile |

Understanding these vulnerabilities is the first step toward building secure smart contracts and protecting decentralized ecosystems.

Beyond vulnerabilities, several conceptual principles guide secure development:

These principles prepare developers to implement smart contract best practices effectively in later stages of the lifecycle.

Building secure contracts is about preventing them through disciplined engineering. Additionally, structured review processes, such as a professional smart contract audit, significantly reduce overlooked vulnerabilities.

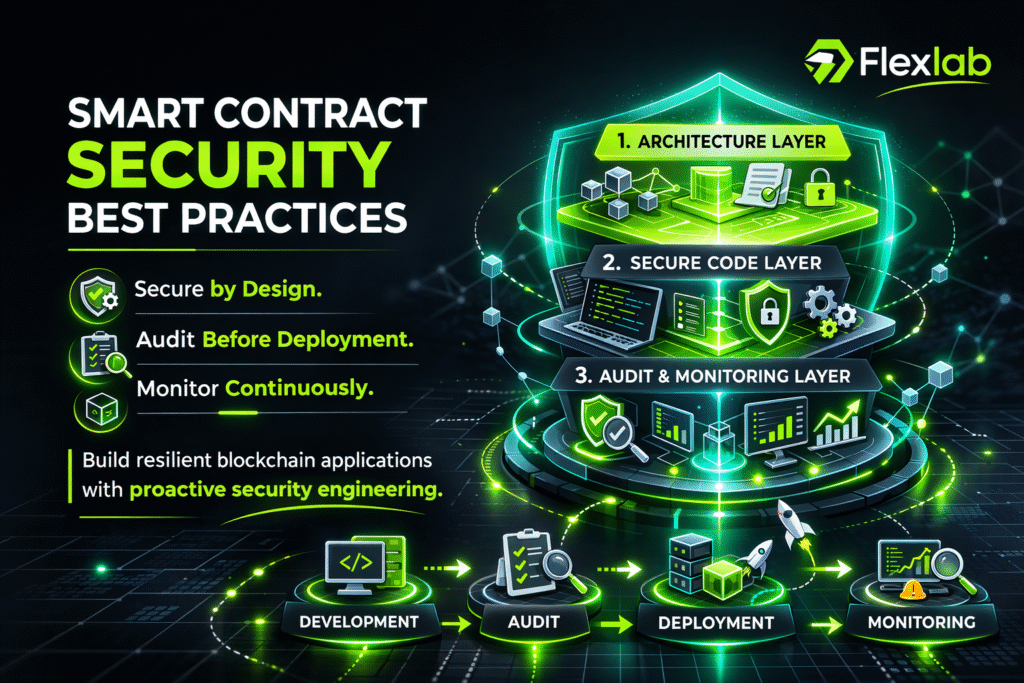

While understanding vulnerabilities is important, implementing smart contract security best practices is what truly protects decentralized applications from exploitation.

In modern Web3 ecosystems, security must be embedded throughout the design-to-deployment lifecycle. The following practices form the operational foundation of secure smart contract development.

Security begins before a single line of Solidity is written.

A secure-by-design approach means:

Over-engineered contracts increase attack surfaces. Instead, developers should separate storage, logic, and access control into clearly structured components.

Threat modeling at the architecture phase helps identify:

By thinking like an attacker early, teams prevent structural weaknesses later.

Even well-designed contracts fail without disciplined coding standards. Defensive programming ensures contracts behave safely under unexpected conditions.

Key coding practices include:

Additionally, always use the latest stable Solidity version to benefit from built-in overflow protection and compiler improvements. Secure coding is about writing predictable, auditable code.

Security does not end at deployment. It evolves.

Robust smart contract security includes:

Consequently, Security is not a one-time checklist. It is an ongoing discipline.

Benefits of Implementing Best Practices

When development teams combine secure architecture, defensive coding, and continuous validation, they achieve:

In competitive Web3 markets, security maturity differentiates serious projects from risky experiments.

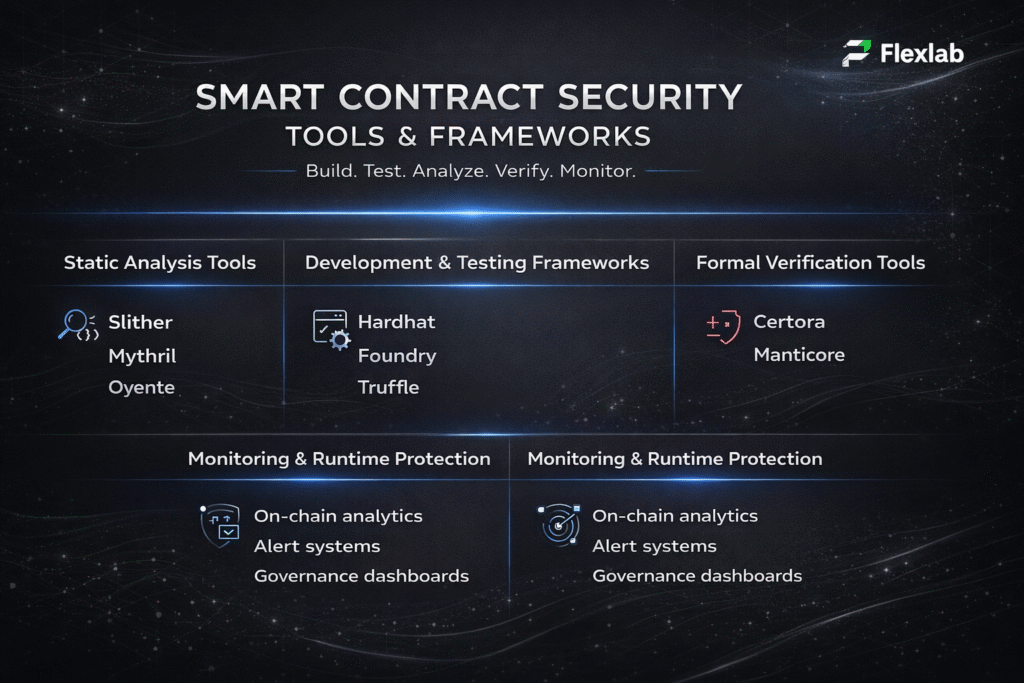

While best practices define what developers should do, tools and frameworks determine how efficiently and accurately they can do it. In modern blockchain ecosystems, relying solely on manual code review is no longer sufficient. Instead, professional teams combine automated analysis, structured testing environments, and advanced verification tools to strengthen smart contract security.

The following categories represent the most widely adopted tools used in secure smart contract development today.

Static analysis tools examine smart contract code without executing it inside the Ethereum virtual machine. As a result, developers can quickly detect common vulnerabilities, logic flaws, and risky patterns before deployment.

Some of the most widely used tools include:

These tools significantly reduce the likelihood of overlooked weaknesses. However, they should complement, not replace, manual review.

Testing frameworks provide structured environments for writing, deploying, and validating smart contracts before mainnet release. Consequently, they improve reliability and smart developer productivity.

Leading frameworks include:

By integrating automated unit tests, integration tests, and fuzz testing, teams can detect issues long before contracts handle real assets.

For high-value DeFi protocols and enterprise-grade blockchain systems, standard testing may not be sufficient. In such cases, formal verification provides mathematical guarantees about contract behavior.

Advanced tools and approaches include:

Although formal verification requires additional expertise, it dramatically increases assurance levels for critical systems.

Security does not end at deployment. Therefore, runtime monitoring tools play a crucial role in detecting anomalies, suspicious transactions, or exploit attempts in real time.

Modern approaches include:

By continuously observing contract behavior, projects can respond quickly to abnormal patterns and minimize potential damage.

Combining static analysis, structured testing, formal verification, and runtime monitoring creates a multi-layered defense strategy. Each tool addresses a specific risk individually. Together, however, they form a comprehensive smart contract security framework capable of protecting high-value blockchain applications.

Ultimately, secure development is not just about writing safe code. It is about building an ecosystem of tools that continuously validate, monitor, and strengthen contract integrity.

To help developers and blockchain teams, especially every smart contract developer responsible for production systems, choose the right solution, the following comparison highlights the strengths, ideal use cases, and limitations of the most widely adopted smart contract security tools and development frameworks. Each tool plays a different role within a comprehensive smart contract security strategy.

| Tool | Category | Primary Purpose | Best For | Strength | Limitation |

| Slither | Static Analysis | Automated vulnerability detection | Early-stage code review | Fast execution and developer-friendly reports | Limited deep economic analysis |

| Mythril | Symbolic Execution | Advanced security flaw detection | Complex exploit discovery | Detects multi-transaction attack paths | Slower than lightweight analyzers |

| Hardhat | Development Framework | Testing and deployment environment | Structured development workflows | Rich plugin ecosystem and debugging tools | Requires configuration setup |

| Foundry | Testing Toolkit | Solidity testing and fuzzing | High-performance test environments | Extremely fast and powerful fuzzing | Steeper learning curve for beginners |

| Certora | Formal Verification | Mathematical contract validation | Enterprise-grade DeFi protocols | Provides formal security guarantees | Higher complexity and resource requirements |

Although no single tool guarantees complete protection, combining static analysis, structured testing frameworks, and formal verification tools creates a layered smart contract security framework. As a result, development teams can significantly reduce exploit risks while improving reliability and investor confidence.

While smart contract security practices continue to improve, new risks are evolving just as quickly. As blockchain adoption expands across DeFi, enterprise ecosystems, and cross-chain infrastructures, the overall attack surface continues to widen.

For this reason, understanding modern security challenges is essential for long-term resilience and sustainable growth.

As decentralized finance protocols become more advanced, their underlying smart contracts grow significantly more complex. In particular, multi-layer integrations, automated liquidity strategies, oracle dependencies, and composability between protocols increase the likelihood of hidden vulnerabilities.

At the same time, economic attack vectors such as flash loan exploits and market manipulation introduce risks that traditional code audits may not fully capture. Instead of targeting syntax errors, these attacks exploit weaknesses in financial logic and game theory. Consequently, developers must evaluate not only technical security but also economic design risks when building secure smart contracts.

With the rapid expansion of cross-chain bridges and multi-network deployments, new systemic vulnerabilities have emerged. Because bridges often custody large volumes of locked assets, they naturally become high-value targets for attackers.

Moreover, governance mechanisms and access control systems introduce additional exposure. For example, poorly designed admin privileges, upgrade functions, or DAO voting structures can enable malicious actors to manipulate contracts or seize control. As a result, secure key management, strict role-based permissions, and governance audits are becoming indispensable components of modern smart contract security frameworks.

Beyond technical vulnerabilities, regulatory scrutiny is increasing across global markets. As governments introduce evolving compliance requirements around digital assets and DeFi, projects must adapt quickly to avoid legal and financial consequences.

Additionally, operational risks such as weak key storage practices, misconfigured deployments, or insufficient monitoring tools can undermine even well-audited contracts. In many cases, security failures occur not during development but during deployment or maintenance. In particular, a weak configuration of deployment tools can expose contracts to avoidable operational risks.

Therefore, smart contract security must extend beyond code reviews. Ultimately, it requires operational discipline, compliance awareness, and continuous risk management to remain effective.

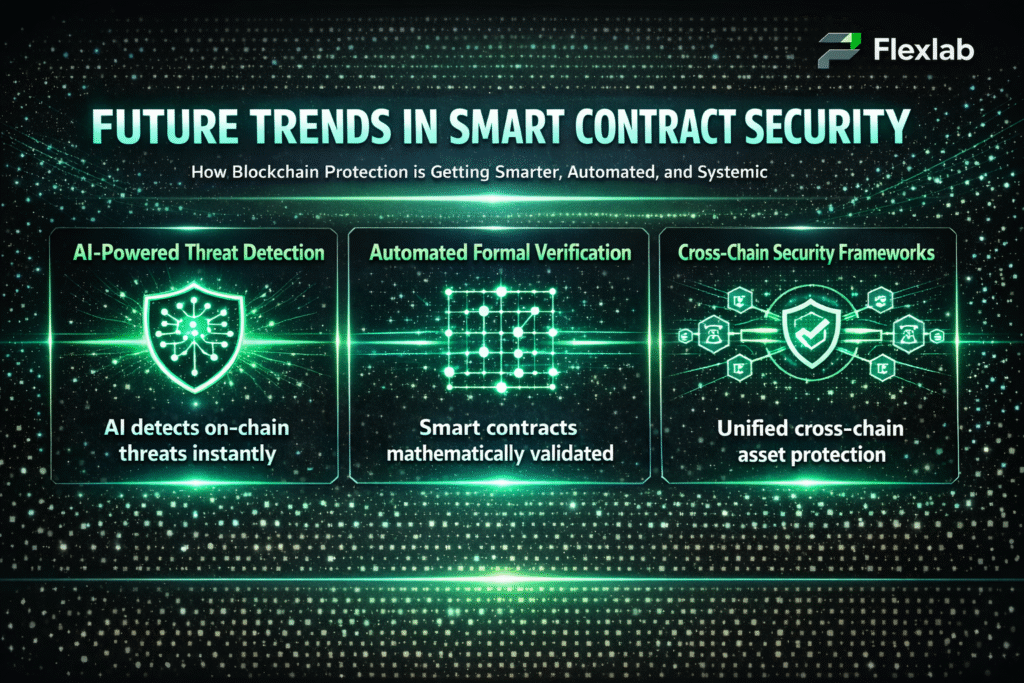

As blockchain ecosystems continue to mature, smart contract security is evolving from reactive patching to proactive, intelligent protection. Projects are now integrating automated monitoring, AI-powered vulnerability detection, and systemic defenses to prevent attacks before they occur.

For developers and organizations, anticipating future threats is essential to maintain trust, resilience, and regulatory compliance.

Artificial intelligence is transforming how smart contracts are secured. Unlike traditional audits, AI-driven systems can analyze behavioral patterns and implement real-time anomaly detection, thereby identifying previously unseen attack vectors.

As a result, this enables real-time detection of unusual contract interactions, governance manipulations, and potential exploits; consequently, it reduces human error and, in turn, accelerates response times.

Automated formal verification is making high-assurance smart contracts accessible to more projects. By integrating verification into development pipelines, teams can mathematically validate contract logic before deployment.

As a result, this ensures that contracts behave exactly as intended; consequently, it significantly lowers the risk of bugs, economic exploits, and unintended interactions across blockchain networks. Moreover, by reinforcing predictable behavior, it strengthens overall system reliability and trust.

As decentralized applications increasingly operate across multiple chains, security must extend beyond individual contracts.

Future strategies will focus on:

As a result, this shifts security from contract-level defense to system-wide resilience; consequently, it protects value across entire blockchain ecosystems, thereby strengthening overall network stability and trust.

Smart contract security is no longer optional; it is a competitive advantage. Projects that integrate AI, automation, and systemic protections will not only withstand attacks but also attract more users, investors, and regulatory trust.

Ultimately, the future of smart contract security depends on intelligent design, proactive monitoring, and cross-chain resilience.

While smart contract security frameworks continue to improve, real-world examples show that vulnerabilities can still cause significant financial and reputational damage. By examining these cases, smart contract developers and organizations can better understand how theoretical risks translate into practical consequences.

More importantly, these examples highlight the importance of proactive design, rigorous testing, and continuous monitoring.

One of the earliest and most influential smart contract failures occurred with The DAO, where a reentrancy vulnerability allowed an attacker to withdraw funds before balances were updated repeatedly.

As a result, millions of dollars worth of ETH were drained, ultimately leading to a historic hard fork of the Ethereum network. This case demonstrated how a single overlooked logic flaw can reshape an entire ecosystem.

Always protect against reentrancy attacks using checks-effects-interactions patterns and secure coding standards.

As cross-chain bridges gained popularity, they became high-value targets for attackers. Several bridge vulnerabilities allowed malicious actors to mint or withdraw assets without proper validation.

Because bridges often hold large liquidity pools, these weaknesses resulted in substantial losses across multiple ecosystems. These events exposed the risks of centralized validators, flawed signature verification, and weak monitoring systems.

Therefore, secure cross-chain validation mechanisms and implement multi-layer verification.

Flash loans introduced a new category of economic exploits. Instead of attacking code directly, attackers manipulated market prices and protocol logic within a single transaction.

Consequently, DeFi protocols with weak oracle protections or flawed pricing formulas suffered significant losses. These attacks proved that economic design vulnerabilities can be just as dangerous as coding errors.

Combine technical audits, economic stress testing, and Oracle security reviews.

Every exploit begins as an overlooked assumption. Every loss begins as an unchecked vulnerability. In modern blockchain ecosystems, delay is exposure. Precision is protection. Flexlab engineers hardened smart contract architectures designed to withstand evolving attack surfaces, economic manipulation, and cross-chain complexity.

Explore our services to see how secure architectures are engineered from the ground up. Review our portfolio to examine real-world blockchain security implementations across decentralized and AI-driven ecosystems.

If your protocol handles real values, now is the time to evaluate its resilience. Connect with us through our contact us page and initiate a focused security discussion.

For ongoing insights on blockchain protection, advanced verification, and AI-powered security intelligence, visit our website, explore the latest perspectives on our blog, or follow us on LinkedIn to stay ahead of emerging exploit patterns and industry shifts.

Read more:

Smart contract security determines whether blockchain innovation survives real-world pressure. Code executes exactly as written. Flaws execute just as precisely.

Taken together, best practices, testing frameworks, real-world failures, and emerging threats all point to one clear standard: discipline at every layer.

First, architecture must be intentionally designed for resilience. Next, verification must rigorously validate assumptions and logic. Furthermore, continuous monitoring is crucial for detecting anomalies early. Finally, economic design must align incentives to prevent exploitation.

In short, discipline is not optional; rather, it is required at every stage and across every layer.

Security is not a feature release. It is structural integrity. Protocols built on rigorous smart contract security endure. Those who ignore it disappear. In decentralized systems, security is the only lasting foundation.

Not completely. Audits and testing reduce known risks, but unknown vulnerabilities can still exist in complex logic or third-party integrations. That’s why continuous monitoring matters. In addition, bug bounties and upgrade mechanisms create a safety net. Security isn’t about being flawless; it’s about being prepared.

Absolutely. When users deposit funds into a protocol, they are trusting code, not people. Therefore, public audits and transparent security reports signal professionalism and accountability. On the other hand, one major exploit can permanently damage credibility. Strong security practices build confidence before users even connect their wallets.

It depends on the structure. Upgradeable contracts allow fixes if vulnerabilities are discovered, which reduces long-term risk. However, they introduce governance and access control concerns. Immutable contracts remove upgrade risk, but mistakes cannot be corrected. The safest approach balances flexibility with strict permissions and clear governance rules.

What are the benefits of AI in the supply chain? AI is slashing supply chain costs by 20-50%. Walmart keeps 98%of its shelves stocked, UPS saves $400Mannuallyy on fuel, and Amazon delivers Prime in hours. But your supply chain operations? Stockouts are bleeding $1.2M, data silos are killing forecasts, and manual chaos is wasting millions.

This guide reveals exactly how AI delivers these results, from AI demand forecasting accuracy to predictive maintenance and the hidden challenges tripping up 87% of implementations. Most importantly, discover Flexlab’s 30-Day AI Blueprint that turns your messy enterprise resource planning ERP system data into Amazon-level efficiency without $2M setups or 12-month delays.

Ready to unlock 28% cost savings like your competitors? Let’s dive in.

Businesses nowadays leverage AI to handle and optimize supply chain tasks, such as monitoring product quality, balancing the right amount of inventory stocks, and finding the best delivery routes via transportation management systems with more efficiency than traditional or old software.

Artificial Intelligence (AI) is a general term for applications that act like smart humans and do complex tasks. It is a big part of machine learning (ML), where systems learn from consuming tons of data instead of following step-by-step instructions. This lets AI beat regular supply chain management software at things like deciphering information from videos, understanding speech or text, guessing future markets with predictive modeling, deciding in tricky situations, and finding hidden info in huge data piles.

These skills help fix and speed up workflow in supply chains everywhere. For instance, supply chain systems powered by ML algorithms can spot patterns in data that people miss, so it forecasts what customers demand more accurately. Hence, it leads to more economically efficient inventory management without any waste. Moreover, AI in transportation also checks traffic and weather to suggest faster routes, cutting delays. It watches work areas to catch bad quality checks or safety problems using Internet of Things devices. And new ideas like generative AI in supply chain and autonomous AI agents keep popping up as people test AI more.

Supply chains, especially in the US, have faced more attention lately due to disruptions and risks.

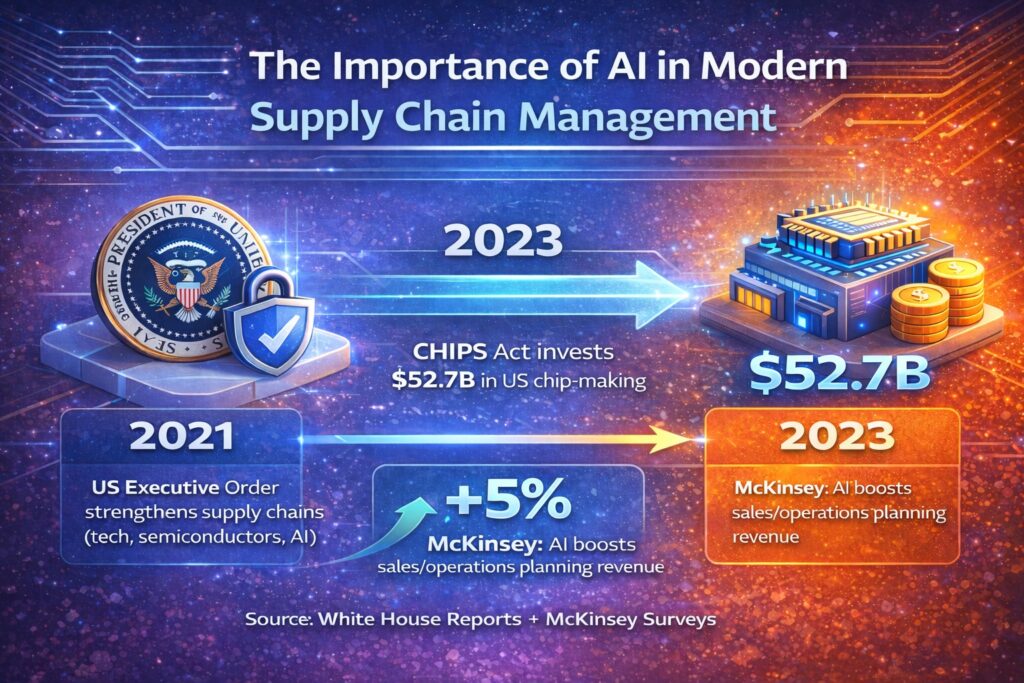

In 2021, the US President signed an Executive Order to strengthen key supply chains, like tech, semiconductors, and AI. The goal was to make America’s supply chains tougher against problems like foreign threats, cyberattacks, and climate issues, while keeping AI tech competitive and safe via a resilient supply chain.

By 2023, a White House progress report showed real steps forward. The CHIPS and Science Act poured $52.7 billion into US chip-making, which powers AI. They also boosted training and research to spark AI innovation.

A new Executive Order focused on safe, reliable AI. Additionally, partnerships like the Indo-Pacific Economic Framework built stronger global chains for digital products, cutting risks in raw materials and boosting US leadership in AI.

These moves not only fix weak spots but also drive AI-powered progress while protecting the technology behind the AI boom. Moreover, recent McKinsey surveys confirm the payoff. In fact, most companies report that AI has boosted sales and operations planning revenue by over 5%. As a result, businesses are increasingly prioritizing AI investments to stay competitive.

AI offers companies a great chance to simplify operations and beat competitors in supply chains. It helps businesses predict customer demand accurately, spot risks early via supply chain analytics, and make smart choices based on data, which saves money and boosts supply chain efficiency.

Moreover, AI also takes over routine jobs like managing stock levels, finding the best delivery routes, and picking suppliers. This lets workers focus on big-picture supply chain strategies instead of daily chores.

In short, achieving this level of precision and efficiency in today’s fast-moving supply chains without AI would be nearly impossible.

The future of supply chain worked well with AI technology, where no manual intervention is required. Let’s read some of the potential benefits of AI in supply chain management.

AI systems ingest vast datasets, such as past sales, weather patterns, social media sentiment, economic indicators, and even geopolitical events, to accurately forecast customer demand. In contrast, traditional methods depend on human estimates or basic spreadsheets. Thus, this approach often misses 20-50% of real needs, whereas AI machine learning improves accuracy by 30-50% over time as they learn from new data.

For example, retailers like Walmart use AI to forecast seasonal spikes, avoiding overstock during slow periods or shortages during peaks. Hence, it directly accelerates profits and customer satisfaction.

AI optimizes inventory management. This can be done by analyzing sales data, supply chain dynamics, and external variables that maintain ideal stock levels. In this way, businesses strike a delicate balance between having enough stock to meet demand and avoiding excessive stock that incurs holding costs using supply chain tools. Moreover, AI systems automatically reorder stock when stock levels fall below a predefined threshold.

Therefore, it ensures a smooth replenishment without human intervention. It automates reorder points and knows when to order and how much, so you save big on storage fees and never run out of products. For instance, companies like Amazon that integrate AI with robotics, where AI signals restocking in seconds after detecting low shelves. Hence, it ensures products move efficiently, minimizes obsolescence, boosts cash flow, and ROI on storage assets without human delays.

AI makes warehouses work better and faster. AI coordinates, organizes, and manages autonomous robots, automated guided vehicles AGVs, and smart picking systems to streamline receiving, storage, order fulfillment, and shipping. It helps in organizing shelves and warehouse layouts smartly. Machine learning looks at how much stuff moves through each aisle. It then suggests the best floor plans to grab items quicker, from unloading trucks, to storage racks, to packing, and out the door.

AI also maps the fastest paths for workers and robots to move goods around. This speeds up orders and cuts walking time. Plus, it checks demand clues from sales, marketing, and factories. This forecasts needs perfectly, balancing stock levels so warehouses don’t waste space or run empty.

For example, companies like Logiwa leverage AI in their warehouse and inventory management software to improve efficiency, accuracy, and decision-making capabilities. An AI system leads to a significant reduction in cost and enhances operational efficiency in warehouse operations.

AI systems improve real-time tracking that allows for better inventory management and the movements of goods and products. There are IoT sensors combined with AI that provide end-to-end tracking from suppliers to customers. Thus, it highlights issues such as temperature fluctuation for perishables or delays at ports instantly. Dashboards alert managers to anomalies, improving transparency and collaboration across partners. In practice, this helped companies during COVID disruptions by rerouting shipments proactively, reducing late deliveries from 25% to under 5%.

Furthermore, AI-powered supply chain systems improve logistics efficiency while optimizing delivery routes based on real-time data and AI predictive analytics. Thus, this approach improves resource allocation and faster delivery times.

AI slashes supply chain operating costs by automating repetitive tasks via supply chain automation, boosting machinery performance, and cutting human errors for smoother operations. It perfects documentation accuracy, predicts equipment breakdowns early, and optimizes transportation routes by factoring in traffic, weather, and other conditions, suggesting faster alternatives that can trim logistics expenses by up to 30%.

For example, Uber Freight uses algorithms to minimize empty truck miles through smart routing, while early AI adopters report 15% overall logistics savings, proving a massive impact across entire networks.

How can AI enhance sustainability in supply chains? AI checks supplier info against green standards, like fair labor, pollution levels, water use, and avoiding conflict minerals. Blockchain proves where materials really come from. It tests eco-friendly options, like low-carbon suppliers, to cut company emissions by 10-20%.

AI Tools like Oracle spot bad suppliers instantly, helping follow rules such as Europe’s CSRD or US SEC laws. Businesses get “green” badges faster, cut waste with reusable packaging, and attract planet-friendly buyers. Sustainability becomes a money-saver and an edge over rivals, with generative AI in the supply chain simulating eco-scenarios for better decisions.

By processing live data on traffic, weather, fuel prices, vehicle capacity, and delivery windows, AI in transportation calculates the most efficient routes, sometimes rerouting mid-trip to avoid jams. This cuts transportation costs by 10-20%, reduces fuel use by 15%, and shortens delivery times by 18% on average. US logistics firms like UPS save millions yearly with tools like ORION, which optimizes 55,000 drivers’ paths daily, lowering miles driven and carbon emissions through transportation management systems TMS software.

Computer vision AI inspects products via cameras for defects at high speeds, catching issues humans miss, while predictive analytics forecasts equipment breakdowns using vibration and usage data from Internet of Things IoT devices. This drops defect rates by 40% and maintenance costs by 25%, extending machine life. Food manufacturers apply it to ensure compliance, avoiding recalls that cost millions. Food and pharma sectors use it for zero-defect compliance, while Oracle integrates it with ERP for automated holds/releases, preventing multimillion-dollar losses.

AI boosts supply chains significantly, but it also comes with real hurdles, especially for companies not ready for the switch.

Data privacy and security are the main concerns, as AI systems require vast amounts of sensitive data from suppliers, customers, and shipments, raising significant security concerns. To ensure security, businesses should comply with global regulations, such as the GDPR and the CCPA. This approach protects info and avoids fines.

For instance, EU companies face the strict EU AI Act, which demands strict data privacy, where small firms often struggle with these rules.

AI algorithms work as they are trained. Therefore, companies must ensure that their data is accurate, relevant, and continuously updated to avoid erroneous predictions. Data security is a key challenge when it comes to AI adoption in industries. AI only works well with up-to-date data. Bad or messy info leads to wrong forecasts, like overstocking or missed delays.

Global supply chains make it worse: pulling data from suppliers in different countries, time zones, and formats creates integration headaches and errors.

Implementing any new technology comes with upfront costs. Companies should carefully evaluate the potential benefits and ROI before investing in AI. Here are some key costs to consider:

However, smart firms weigh ROI first, knowing long-term savings (like 20-40% cost cuts) beat the initial hit.

AI impacts the workforce significantly by automating routine tasks like inventory checks and route planning, which reduces manual labor but creates an urgent need for reskilling and upskilling programs. Companies must strike a careful balance between rapid technological advancement and preserving their existing talent pool. Therefore, ensure employees don’t just survive but thrive alongside intelligent systems.

AI powers real-world supply chain wins at giants like Amazon and Walmart, cutting costs 20-50% via smarter forecasting and automation. Research highlights cases from UPS to Zara, proving massive ROI in efficiency and resilience.

Amazon’s AI crunches sales, weather, and trends to stock warehouses perfectly. It auto-reorders 400M+ products, slashing stockouts 25% and saving billions on excess inventory, thus key to Prime’s fast delivery.

Walmart uses ML to adjust stock in real time across 10K+ stores based on local demand and delays. As a result, it reduced overstock 10–20% while boosting shelf availability to 98%, freeing $1B+ in tied-up cash yearly.

UPS’s ORION AI plans 55K drivers’ routes daily, factoring in traffic and weather. As a result, it cuts 100M miles yearly, saves $400M in fuel, and speeds deliveries by 18%—thereby handling 20M+ packages seamlessly.

DHL’s AI optimizes global routes and warehouses while predicting disruptions. As a result, on-time rates improved 15%, fuel use dropped 10%, and real-time analytics now manage 1B+ shipments annually.

Zara’s ML analyzes store/online sales to tweak inventory per location. Cuts markdowns 20%, sells out trends faster, thus turning 2-week design-to-shelf vs. industry’s 6 months.

Coca-Cola’s AI blends POS, weather, social data for local forecasts. Reduced stockouts/overstocks 30%, optimized bottling/transport for 200+ countries.

FedEx Surround AI tracks fleets and predicts delays. Consequently, it reroutes critical shipments, reducing late deliveries by 20% across the global network.

BMW’s computer vision inspects parts on production lines, while AI predicts machine failures. As a result, defects drop 40%, and downtime falls 50% in factories.

Therefore, these apps show AI’s edge: 50% better forecasts, 65% fewer stockouts, and scalable globally.

You’ve seen the wins; Walmart’s 98% stocked shelves, UPS’s $400M fuel savings, Amazon’s zero stockouts. Flexlab makes this YOUR reality with a custom AI Supply Chain Blueprint that transforms your messy ERP data into enterprise-grade supply chain automation in 30 days, or it’s FREE.

Check our blockchain and AI blog page and discover AI Automation Agency in Toronto, Agentic AI vs Generative AI, Marketing Automation, Automation Testing, and Benefits of AI in FinTech for Businesses.

AI isn’t a “nice-to-have”; it’s table stakes for 2026 survival. Walmart’s 98% stocked shelves, UPS’s $400M fuel savings, and Amazon’s zero-stockout warehouses prove 20-50% efficiency gains are real and replicable. You’ve seen the benefits (65% fewer stockouts, 30% faster routes), government mandates (CHIPS Act, EU AI Act), and challenges (data silos, $500K costs, reskilling).

The gap? Execution. 87% of companies stall on implementation—you won’t.

Flexlab bridges it with your 30-Day AI Supply Chain Blueprint. Contact us now and visit our LinkedIn page to see real client feedback.

Generative AI creates optimized replenishment plans, simulates what-if scenarios, and auto-generates supplier contracts from performance data boosting resilience 20-30% and cutting inventory costs via real-time demand signals. It also enhances risk mitigation by modeling disruptions proactively.

No, AI evolves jobs, not eliminates them. Routine tasks (45% of roles) automate, creating new ones like AI governance, robot orchestration, and exception management. Amazon reskilled 700K+ workers into higher-paying AI-adjacent roles; supply chains gain job upgrades with less burnout.

AI delivers 15-40% cost cuts, 50% better forecasts, 65% stockout reduction, seen in Amazon (zero-stockout warehouses), UPS ($400M fuel savings). 2026 trend: Agentic AI automates end-to-end planning; resilience jumps 30% via disruption modeling.

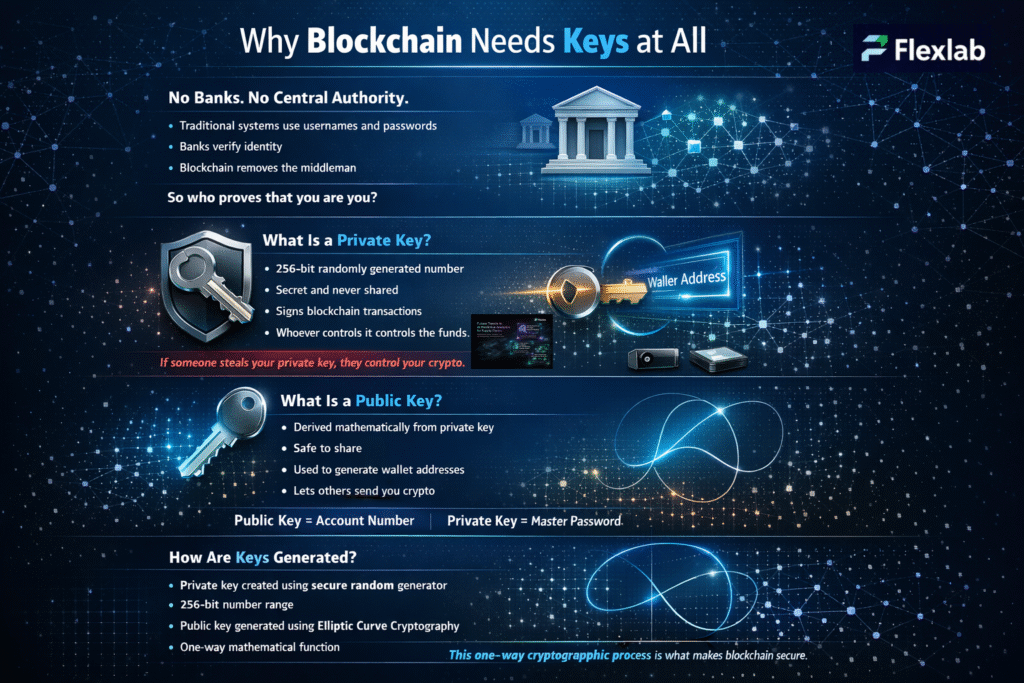

Public key vs private key is the foundation of blockchain’s “trustless” security model. Blockchain secures billions and even trillions of dollars in digital value without relying on centralized authorities. Instead, it uses cryptographic systems that ensure data integrity, ownership, and authenticity across decentralized networks.

Imagine sending a message in a locked box to someone across the world. If anyone copies the key, they can unlock the box and read the message. Early digital security relied on symmetric cryptography, where one shared key encrypted and decrypted data. Algorithms like AES and Data Encryption Standard (DES) use this method.

To overcome its limitations, asymmetric cryptography was introduced. Also known as public vs private key encryption, it uses two mathematically linked keys. The public key is shared openly, while the private key remains secure. Data encrypted with a public key can only be decrypted using its corresponding private key.

This blog will be your guide to what public and private keys are and how public vs private key works in blockchain security in detail.

Traditionally, systems rely on usernames and passcodes, a central authority, and banks acting as guardians of identity. Blockchain networks remove this central server, also known as a bank. But then, who will verify your identity and prove that you are you?

It’s the cryptographic keys. Instead of logging into an account with a username and password, you prove your ownership by mathematically proving that you own a private key.

What is a private key? A private key is basically a randomly generated number, usually 256 bits long. It is a secret that is never shared and is the master key to your funds. If someone steals your private key, they control your crypto. A private key works like a password, but far more powerful. Anyone with the private key can access, transfer, or steal your digital assets. In blockchain security, the private key signs the transaction, and it helps verify that you are the rightful owner of a wallet address. Without your private key, you can never be able to recover your crypto funds. That is exactly why private keys can never be shared or stored online carelessly. Strong cryptocurrency security depends on protecting your private key using hardware wallets, offline backups, and encryption to prevent hacking, fraud, and irreversible loss.

What is a public key? A public key is mathematically derived from your private key. A public key is a cryptographic code that allows others to send you assets on a blockchain network. In the blockchain ecosystem, your public key is used to create wallet addresses that appear in cryptocurrency transactions. When someone transfers funds, they essentially use your public key-derived address to identify you as the recipient. Public keys are safe to share, and they act like your account number in digital wallets. Together with private keys, they guarantee secure verification, transparency, and trust without relying on middlemen.

The keys discussed here are not really keys, but rather large prime numbers that are mathematically related to one another. In this case, “related” means that only the corresponding private key can decrypt data encrypted with a public key. A secure random number generator usually generates the private key. It contains a large range, typically 256 bits long. Therefore, the chance of two people having the same key is practically zero. In addition to this, a public key is created using Elliptic Curve Cryptography (ECC). As its name implies, ECC depends on elliptic curves to generate keys. It is mostly used for key agreements and digital signature verification. This process is one-way, fast to compute forward. In addition to this, this process is impossible to reverse. This one-way creation process is what makes blockchain platforms safe.

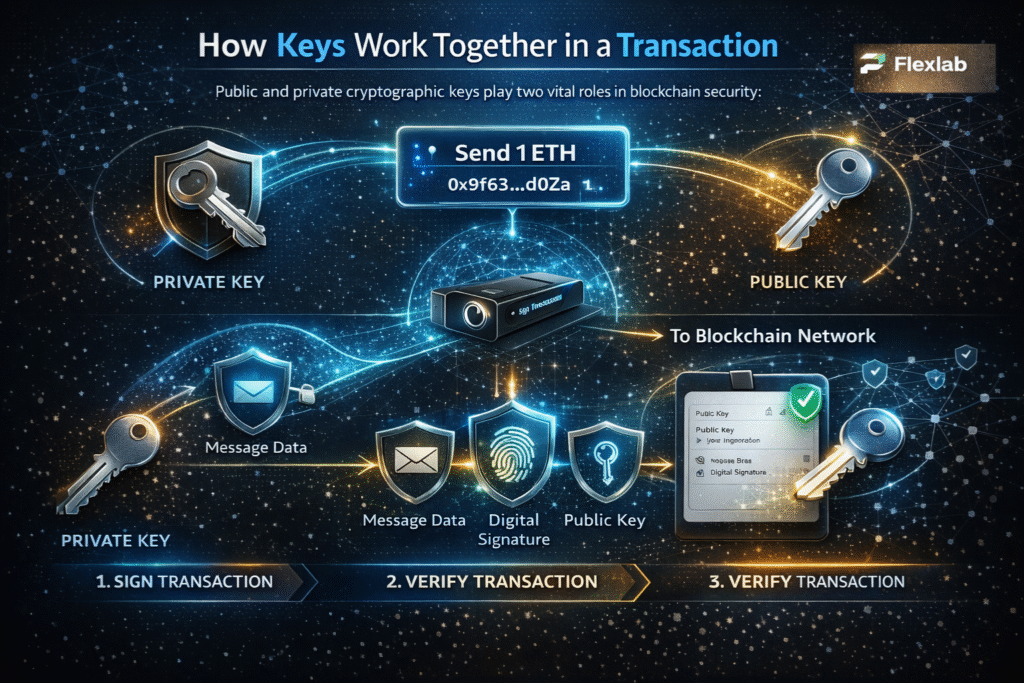

To really understand blockchain security, it helps to understand what happens when a transaction is created and verified. When you start a transaction, your wallet software constructs a message explaining or describing what you want to do. For instance, the message says ‘Send 1 ETH to this address.’ This message is then signed using your private key. Furthermore, the signing process constructs a digital signature, which is unique to both the message and the private key. Even changing one micro detail in the transaction will entirely change the digital signature.

Your transaction now contains the three most important elements;

When the transaction is broadcast to the blockchain network, blockchain nodes independently verify it. These nodes use your public key to verify whether the signature matches the transaction data. If it matches, the blockchain network knows the real owner approved the transaction.

In this process, you never reveal your private key. It stays safely on your device, while the system uses your public key to validate and verify your authority. Therefore, this process allows millions of strangers to agree on ownership without trusting each other or a central server.

Basically, public and private keys work like a digital lock-and-key system. This system helps guarantee that online communication and transactions remain safe, private, and trustworthy. These keys work in two major ways;

Public and private keys ensure that the message reaches the intended recipient. When a user wants to share a private message with someone, they use their public key to encrypt that message; however, the receiver has to have their private key to decrypt that message. Even if someone other than the receiver intercepts the message, they would require the private key to decrypt or open that message. Encryption algorithms like RSA-OAEP and Elliptic Curve Integrated Encryption Scheme (ECIES) mostly use this method. Many secure websites (HTTPS), online banking platforms, and messaging apps also apply this hybrid approach.

Digital signatures prove that a specific sender sent the message and that no one has altered it. The sender uses their private key to create a digital signature, which is basically a unique stamp on the message. Afterwards, the receiver can verify that signature using your public key. If it checks out, they know two things. First, the message has been sent by you, and the message content has not been altered.

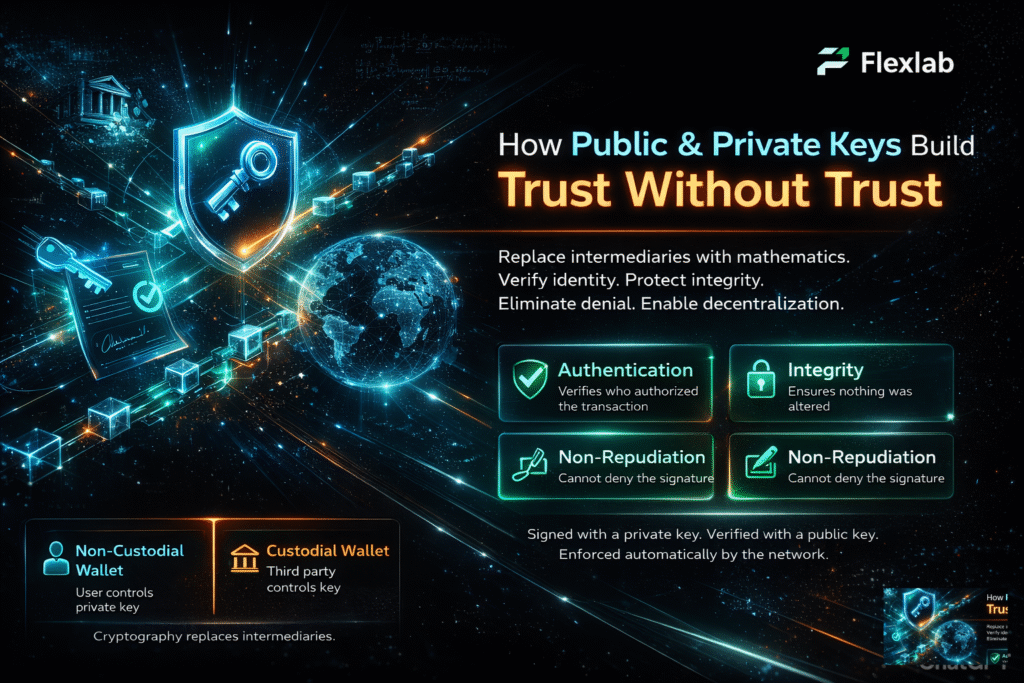

Traditional and old financial systems used to rely on intermediaries or banks to verify your identity and ownership. However, blockchain replaces those intermediaries with cryptography. Public and private keys create trust without trust by providing three major security properties;

Every transaction or message uses a private key to sign it and a public key to verify it, allowing the network to enforce rules automatically without third-party approval. This is what enables decentralized finance, NFTs, DAOs, and smart contracts to operate globally and continuously. Instead of trusting institutions and humans, users trust maths.

When we talk about types of crypto wallets, the only word that comes to mind is custodial vs non-custodial wallet. How keys are stored and managed defines the security protocols of a wallet. When it comes to non-custodial wallets, the users control and manage the private keys themselves without trusting the middlemen. A non-custodial wallet simply helps generate, store, and use them. Consequently, the ownership solely belongs to the users. Examples include MetaMask, Trust Wallet, and Hardware Wallets like Ledger.

However, when it comes to a custodial wallet, a third party or intermediary holds the private key on behalf of the user. Several exchanges help users store their private keys.

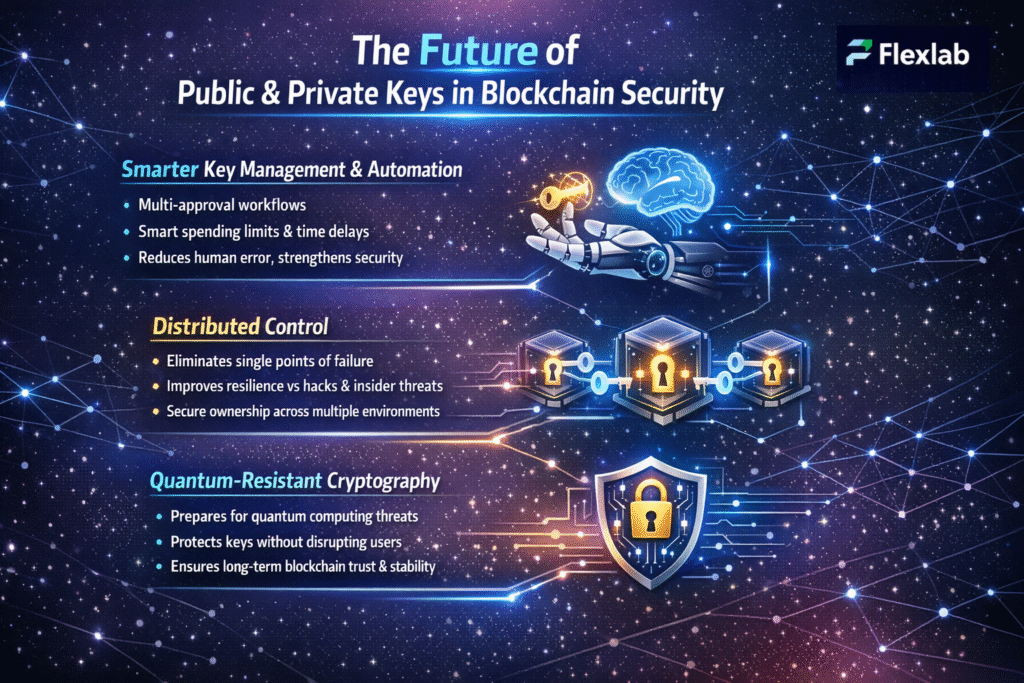

As blockchain technology continues to mature, the role of public and private keys is expanding beyond basic transaction security. Increasing adoption, growing transaction volumes, and evolving cyber threats push blockchain systems to rethink how they create, manage, and protect cryptographic keys. As a result, future blockchain security focuses not only on stronger encryption but also on smarter key control, improved resilience, and long-term sustainability.

As blockchain adoption grows, key management is becoming more automated and intelligent. Instead of relying only on manual private key handling, future systems enforce security rules through programmable logic. As a result, transactions follow predefined conditions such as multi-approval workflows, spending limits, and time delays. This approach reduces human error while strengthening overall blockchain security.

Future blockchain systems are moving away from storing private keys in a single location. Instead, they distribute control across multiple secure environments. Consequently, attackers cannot compromise ownership by accessing one system alone. This distributed model significantly improves resilience against hacks, insider threats, and operational failures.

Although today’s encryption remains reliable, future computing advancements introduce new risks. Therefore, blockchain networks are actively preparing quantum-resistant cryptographic methods. These upgrades protect public and private keys without disrupting existing users. By planning, blockchain platforms ensure long-term trust and system stability.

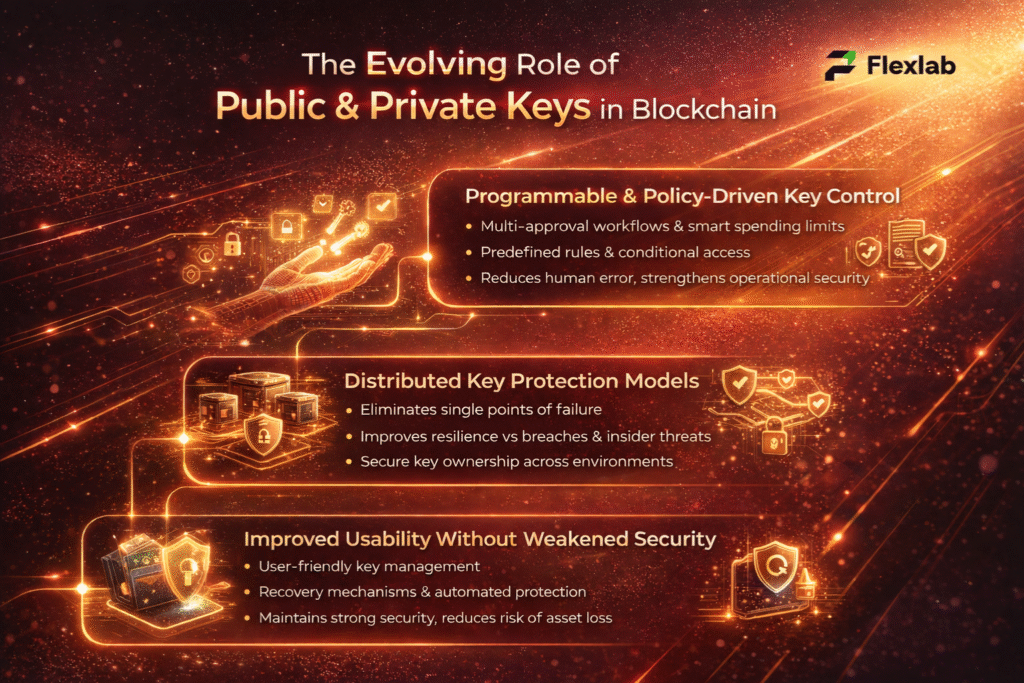

As blockchain systems continue to scale, public and private keys now play a broader role beyond basic transaction security. Modern blockchain networks actively improve how they control, protect, and apply keys across complex environments. As a result, key management is becoming more resilient, automated, and better suited for large-scale adoption.

Rather than relying on a single private key for full authority, blockchain platforms now apply programmable rules to key usage. For example, transactions may require multiple approvals, spending limits, or predefined conditions. Consequently, this approach reduces human error while strengthening operational security without compromising decentralization.

To eliminate single points of failure, modern systems avoid storing private keys in one place. Instead, they distribute key control across multiple secure environments. Therefore, attackers cannot gain full access by compromising a single system. This model significantly improves resilience against breaches, insider threats, and operational disruptions.

Blockchain wallets are evolving to make key management more user-friendly. Instead of placing the full burden on users, modern solutions introduce recovery mechanisms and automated safeguards. As a result, users can maintain strong security while reducing the risk of permanent asset loss or access errors.

Understanding public and private keys is just the beginning. Whether you’re building secure wallets, integrating blockchain into your business, or exploring cutting-edge AI and crypto solutions, Flexlab can help you make it happen.

Check out our portfolio to see how we’ve empowered businesses with secure, scalable blockchain and AI solutions. If you’re curious about what we can do for your project, contact us today. Discover the future of secure technology with Flexlab, where innovation meets trust.

Explore our full range of services or dive into more insights on our blog. Connect with us on LinkedIn to stay updated on the latest in blockchain, AI, and digital security.

Curious to dive deeper into blockchain, secure systems, and real-world applications? These reads will help you level up your skills and see how blockchain can truly transform businesses and careers:

Public Key Vs Private Key encryption forms the foundation of blockchain security, ensuring that encrypted communication is safe and that identities are verified reliably. By using public keys to lock messages and private keys to unlock them, blockchain guarantees that only the intended recipient can access sensitive information.

These keys protect wallets and digital assets, and they also support scalable, efficient, and reliable blockchain systems. Moreover, understanding how public and private keys work together enables businesses and individuals to maintain trust, minimize risks, and confidently adopt decentralized technologies. As a result, proper key management strengthens security, ensures transparency, and allows blockchain networks to operate smoothly across global platforms.

A key ceremony is a controlled process that securely generates and manages cryptographic keys in complex systems. In some blockchain setups, especially those using multiparty computation, participants create keys through a formal ceremony to ensure no single person ever controls the complete private key. This reduces the risk of leaks or insider threats and strengthens trust in environments with high security requirements.

Yes, some advanced systems use transient-key cryptography, where they create key pairs for short time intervals and then destroy them. These temporary keys help timestamp and secure data without long‑term key exposure and can support features like forward secrecy. This approach can improve security for certain time‑sensitive applications on or alongside blockchains.

In decentralized identity systems, a decentralized identifier (DID) links an identity to one or more public keys in a verifiable document. Instead of traditional usernames and passwords, these public keys help confirm identity and allow authentication across Web3 applications. This approach gives users more control over their digital identity without relying on central authorities.

Do you want to know what a smart contract audit is? Smart contract audits are comprehensive, independent code reviews that expose security vulnerabilities, bugs, and inefficiencies in blockchain applications before immutable deployment. Expert auditors use manual analysis, automated tools, and formal verification to harden smart contracts against exploits, ensuring reliability when a single flaw can trigger million-dollar disasters in DeFi or dApps.

In this complete guide, discover audit types, the step-by-step process, real-world costs and timelines, essential tools, common vulnerabilities like flash loans and oracle manipulation, and why Flexlab’s audit-first expertise powers secure launches for Toronto’s enterprise blockchain projects.

A smart contract audit is a detailed analysis of a protocol’s smart contract code to detect security vulnerabilities, poor coding practices, and inefficiencies. It suggests fixes to solve these issues. Audits make sure decentralized applications in Web3 are secure, reliable, and fast.

During the audit, a team of security experts reviews the code, logic, architecture, and security measures. They use automated tools and hands-on checks to spot issues. Specifically, they hunt for spots where hackers could attack and ways to improve the code.

Smart contract code is deployed to a blockchain such as Avalanche, BNB Chain, or Ethereum. Once the contracts are live, they can be used by anyone, from end-users to malicious actors. This is why all flaws and vulnerabilities must be fixed before launching or updating the decentralized app in the blockchain ecosystem.

After the audit wraps up, auditors share a summary report that contains details about their findings, how issues were fixed, other problems, and a plan for leftovers. As a result, projects can launch confidently, knowing the app is solid and user funds are safe from catastrophic risk.

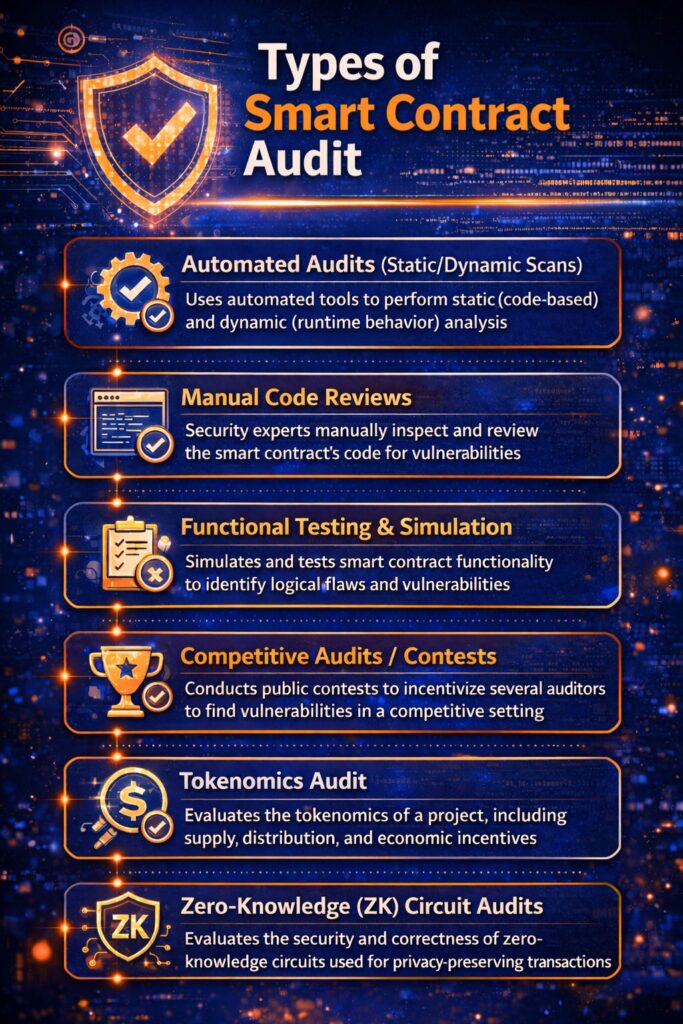

Smart contract audits ensure that blockchain code is safe in many ways: automated scans for rapid vulnerability detection, manual expert reviews for logic flaws, and specialized audits such as Tokenomics and zero-knowledge proofs. These security audits target high-risk vulnerabilities, including reentrancy attacks (where hackers drain funds by looping calls), weak access controls, and wasteful gas use that could crash the app. Most end with a report listing fixes to avoid hacks and protect users.

Let’s read some of the key types of smart contract audits:

Teams often use automated tools like Slither, Mythril, or Securify to quickly check code. Specifically, static scans read the code without running it, thereby spotting syntax errors or common bugs. Meanwhile, dynamic scans execute the code to detect runtime issues, such as overflows, which makes them great for catching basic problems in just a few hours. In addition, combining both methods ensures a more thorough audit.

Experts read every line by hand to get the full picture. They spot tricky logic flaws, like reward miscalculations, that tools miss. Plus, they confirm the code matches your project goals, using the docs as a guide. Thus, it’s essential since machines can’t grasp intent.

Smart contract auditors test in a fake setup, such as Hardhat and Ganache networks. They run functions under stress-high loads, weird inputs to check behavior, and gas efficiency. For instance, they simulate user flows to ensure deposits and withdrawals work without breaking.

Platforms like Code4rena or Sherlock run contests where many auditors examine the same code. This provides more comprehensive coverage than a single firm, often uncovering rare issues. It’s competitive, so top spotters win prizes, boosting thoroughness.

These focus on your token’s economics. Specifically, experts review incentives, supply rules, inflation risks, and how they integrate into smart contracts, such as whether staking rewards dilute value unfairly. This helps prevent pump-and-dump schemes or unfair distributions.

Specialized smart contract auditing uses ZK-proof protocols that hunt bugs in arithmetic circuits and ensure the integrity of privacy-focused apps. This is especially critical for rollups or shielded transactions where correctness is everything.

A smart contract audit is important for rectifying security vulnerabilities, bugs, and inefficiencies in code before deployment. It also prevents irrevocable financial losses. Blockchain code is immutable and acts as law. Therefore, audits are essential for ensuring security, reliability, and functionality in DeFi and dApps. Moreover, it protects against hacks that cost billions of dollars.

Have a glance at the key reasons for smart contract audits:

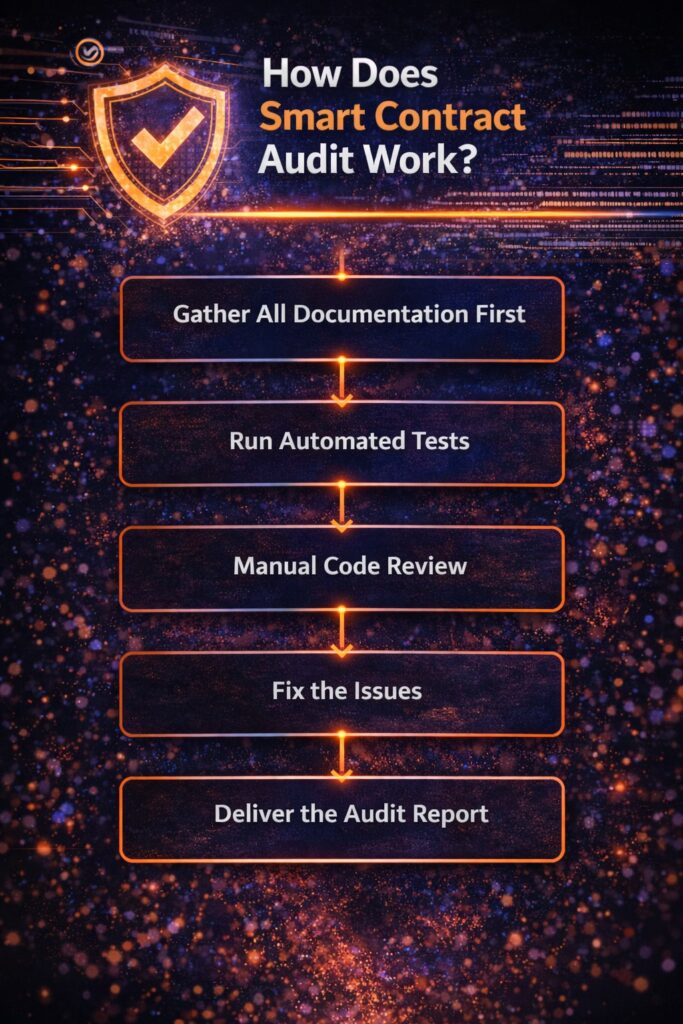

A smart contract audit is a detailed and comprehensive process. It consists of thousands or even tens of thousands of lines of code that uncover bugs, security gaps, sloppy coding, and anything that is missed. Tools and expert reviewers team up to check both what’s there and what’s not. Here’s the full process, broken down in detail.

Firstly, the auditor needs to gather all the relevant documents related to the project. This includes the white paper outlining the big idea, the complete codebase, architecture diagrams, tokenomics details, and a full spec sheet explaining exactly what the smart contract should do. Auditors read the documentation to grasp a high-level understanding of blockchain application goals, such as how users interact, where funds move, and the core business logic.

Without having access to the documentation, a smart contract developer can’t determine whether the code delivers on your vision or not. For instance, if your DeFi protocol promises locked staking rewards, the docs spell that out clearly. At this stage, developers and auditors lock in a “code freeze”; no more edits after this point, or anything new gets ignored in the review. This prevents mid-audit changes from messing up the analysis. Expect this prep phase to take a day or two, depending on project complexity.

Once auditors understand the code and app, they run automated tests with specialized tools. This is the fastest way to spot potential problems. For instance, they run integration tests across big code chunks, unit tests on single functions, and penetration tests to poke for security holes. They also track line coverage; a high percentage means tests hit most code lines. After this wraps up, they shift to manual checks.

Automated tests flag some issues, but they miss the big picture, like what developers intended or subtle logic flaws. Plus, they sometimes give false alarms. That’s why a hands-on review is crucial. Auditors read every line, map how parts connect, and cross-check against project specs to catch what tools overlook. Combining both methods ensures nothing sneaky slips by during Ethereum Virtual Machine execution.

When problems surface, auditors team up with blockchain developers to patch them. This back-and-forth can drag on, but it’s key to success. Fixing everything upfront ensures contracts are deployment-ready. In blockchain technology, security is everything; user funds depend on it, so budget time for pros to hunt and squash risks during this quality assurance phase.

Finally, auditors hand over a detailed report on findings. It lists issues, fixes applied, and a plan for leftovers. This becomes your roadmap for polishing the project and sharing proof of security with users and investors.

Smart contract security audit takes 1 to 6 weeks. However, timelines vary depending on project size and complexity. For instance, simple ones wrap faster, while DeFi protocols stretch longer due to thorough checks.

Code size and complexity matter when considering time. A basic ERC-20 token might take 3-5 days, while advanced apps with custom logic require 3-4 weeks or even more. Moreover, poor documentation or messy code adds time, as auditors must reverse-engineer intent. Team responsiveness during fixes also matters; unresponsive devOps services extend remediation.

Here’s a breakdown from industry standards:

|

Project Type |

Estimated Time |

Examples |

| Simple tokens (ERC-20/BEP-20) | 3-5 days | Basic mint/burn/transfer logic |

| Medium dApps | 1-2 weeks | Lending platforms or governance DAOs |

| Complex DeFi/DAOs | 3-4 weeks | Multi-contract ecosystems with integrations |

| Enterprise-grade | 1-2 months+ | Large codebases with heavy custom features |

Smart contract audit cost anywhere from $5,000 to $500,000+ in 2026, depending on project complexity and scope. Most standard DeFi projects fall in the $50,000-$100,000 range.

Key 2026 Audit Cost Benchmarks

There are some factors that affect smart contract audit cost. For instance, prices hinge on codebase size, like lines of code, logic complexity (e.g., custom math or cross-chain features on blockchain infrastructure), blockchain (Solana/Rust audits cost 20-30% more than Ethereum/Solidity), urgency (rush fees add 30-50%), and firm reputation. Moreover, poor docs or extra services like formal verification also increase the cost price. Retainers for ongoing fixes charge $5k-$30k/month.

Here are the main tools for smart contract development. Let’s read each tool below:

Slither is a free static analyzer for Vyper contracts and Solidity code. For example, it has over 90 detectors for issues like reentrancy and overflows. Additionally, it runs seamlessly in CI/CD pipelines like Hardhat and has low false positives.

Mythril performs symbolic execution on EVM bytecode to detect bugs such as unchecked calls or timestamp tricks. It works via CLI or SaaS and requires only contract addresses.

Echidna fuzzes contracts with random inputs to crash invariants. Specifically, it is perfect for property-based testing on key functions like token balances.

Securify automates pattern matching for compliance and basic logic errors using 37+ templates. In addition, it provides quick scans with code snippets in reports.

MadMax specializes in gas griefing detection, for example, spotting unbounded loops that enable denial-of-service attacks through high fees.

Certora uses formal verification to mathematically prove that specs hold, making it particularly ideal for complex DeFi invariants on blockchain protocols like Aave.

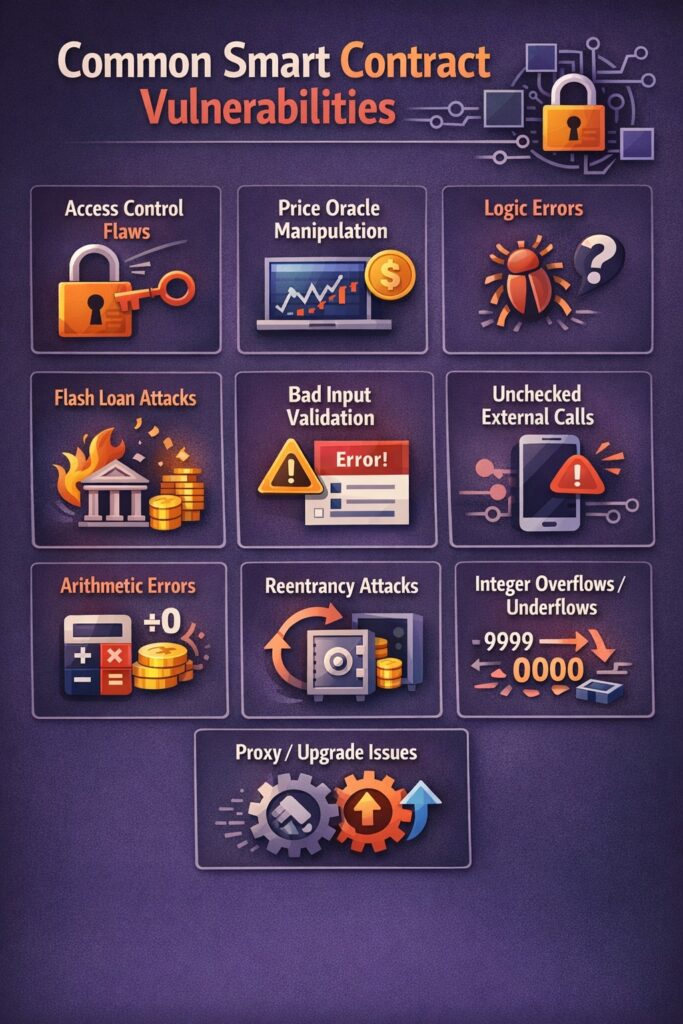

Common smart contract bugs can wipe out millions in hacks, but audits catch them early. Here’s a rundown of the top ones from OWASP’s 2026 list, explained simply.

Hackers sneak into admin functions they shouldn’t touch. For example, anyone can call a “mint” button and create unlimited tokens. Always lock down roles with checks like “if msg.sender is owner.”

Bad price feeds let attackers fake asset values. Then, they borrow huge loans cheaply or liquidate unfairly. Fix it by using trusted oracles like Chainlink with multiple sources.

Code does the wrong thing, like wrong reward math or bad voting. Users get overpaid, or votes flip. Test every business rule step-by-step.

Borrow tons instantly, exploit a tiny bug, and repay in one go. As a result, it drains pools fast. To prevent this, implement rate limits or checks, and ensure effects and interactions occur in the correct order.

No checks on user data, crashes, or tricks the code. Like huge numbers breaking math. Always sanitize inputs first.

Call another contract, assume it worked, but it fails silently. Leads to stuck funds. Add “require(success)” after calls.

Math glitches beyond simple overflows, like division by zero. Wrap numbers with SafeMath libraries.

Contract calls out before updating balances. Hacker loops back and drains funds, like the 2016 DAO $60M hack. Update the state first, then call out.

Numbers wrap around (255 + 1 = 0), minting fake tokens. To prevent this, use Solidity 0.8+ safe math or libraries.

Upgradable contracts letthe attackers hijack versions or reset states. Therefore, double-check init logic and admin controls.

Flexlab plays a key role in smart contract security as a blockchain development and AI automation agency. They offer smart contract audit services to keep blockchain applications safe.

Flexlab provides detailed smart contract audits following 10 critical steps, from docs review to ongoing monitoring. First, they check documentation for mismatches. Then, static tools like Slither spot basic bugs like reentrancy. Manual reviews catch tricky logic errors next.

They run unit, integration, and fuzz tests to simulate attacks. Plus, they review external dependencies and optimize gas use. After the findings, Flexlab helps fix issues and retests everything. For example, their 2025 guide stresses secure access controls and no timestamp tricks.

As your go-to for AI-blockchain workflows, Flexlab uses an “audit-first” approach for DeFi platforms. As a result, this builds trust, cuts hacking risks, and ensures compliance. Additionally, their full reports give clear fixes, making deployment confident—perfect for enterprise automation and private chains.

Moreover, explore our blockchain and AI blog page and discover how Flexlab helps Toronto businesses, NFT Marketplace Development Company, Custodial vs Non-Custodial Wallet, Crypto Trading Bot, and Public vs Private Blockchain.

Smart contract audit services aren’t a luxury; they’re the armored vault protecting your blockchain empire from exploits that drained $385 million in January 2026 alone. By blending automated precision, manual mastery, and rigorous testing, audits mitigate reentrancy risks, access control gaps, and logic errors, delivering 135:1 ROI against average $13.5 million incidents while building unbreakable user trust.

Choose Flexlab for your next audit: our AI-enhanced workflows, 10-step process from docs review to post-deployment monitoring, and proven expertise in DeFi, NFTs, and private chains ensure compliant, gas-optimized code ready for Toronto’s booming Web3 scene. Contact us now and visit our LinkedIn page for more insights.

No, ChatGPT cannot reliably perform full smart contract audits on its own. While tools like AuditGPT (built on GPT models) show promise in spotting ERC rule violations with high precision (96.6%) but low recall (37.8% F1-score), it misses many vulnerabilities and serve best as an auxiliary for code parsing or PoC generation.

Leading smart contract auditors include Sherlock (top-ranked for lifecycle security with contests and AI monitoring), Halborn, Trail of Bits (research-grade for rollups), BlockSec, ConsenSys Diligence, Nethermind Security (formal methods), Quantstamp, and QuillAudits. Firms like INORU and Hashlock handle multi-chain audits, while platforms like Code4rena crowdsource via contests. For enterprise needs, Flexlab offers AI-blockchain audits.

Master Solidity/Rust programming, blockchain fundamentals (EVM, consensus), Web3 security (OWASP top 10 like reentrancy), and auditing tools (Slither, Mythril). Then, build hands-on experience via CTFs (Capture The Flag), bug bounties on Immunefi/Code4rena, open-source contributions, and personal audits, while also developing critical thinking, communication for reports, and continuous learning on new exploits.

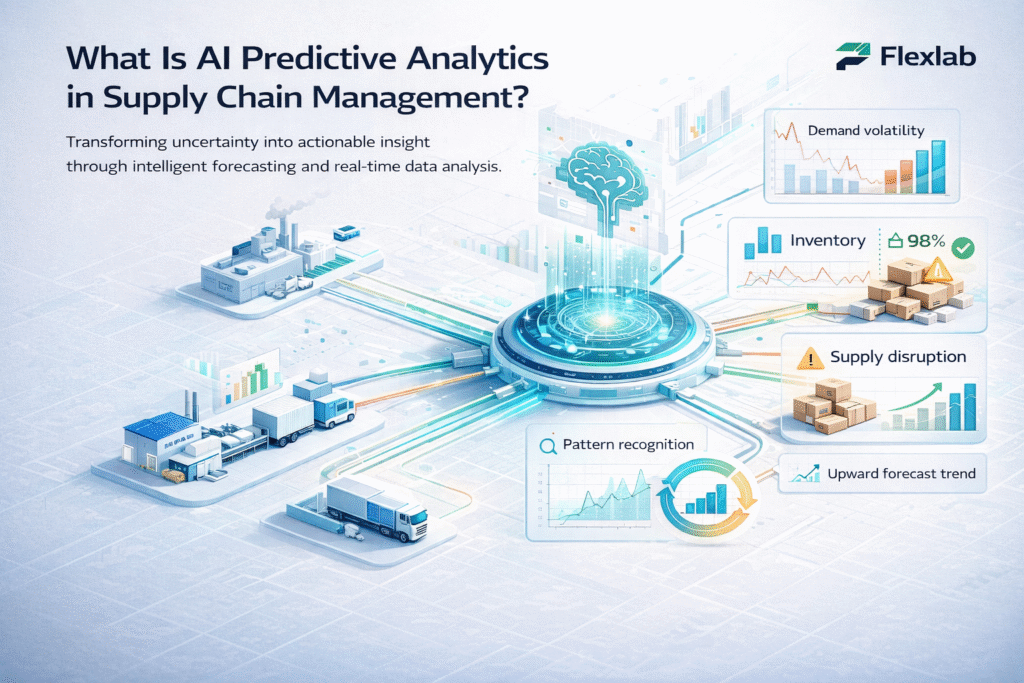

AI predictive analytics is transforming how organizations plan, operate, and protect modern supply chains in an environment defined by uncertainty and speed. As global networks become increasingly complex, businesses can no longer rely on static forecasts or manual planning to maintain supply chain efficiency and consistently meet customer expectations.

Today’s supply chains generate massive volumes of data across sales, inventory, logistics, production, and transportation. However, when powered by business intelligence, advanced data analysis techniques, and AI models, this data shifts from an operational burden to a strategic asset. As a result, instead of reacting to delays, shortages, or cost spikes after they occur, organizations can anticipate outcomes and act proactively.

Moreover, AI predictive analytics enables organizations to improve demand forecasting, strengthen inventory optimization, reduce operational risk, and increase OTIF on time in full performance. By combining machine learning algorithms and applications, artificial neural networks, and real-time ecosystem signals, predictive systems continuously learn and adapt to changing conditions.

In this guide, we explain what AI predictive analytics means for supply chains, how it works, where it delivers the highest impact, and how organizations can use it to build resilience, agility, and long-term competitive advantage.

AI predictive analytics in supply chain management refers to the use of intelligent systems and advanced algorithms to analyze historical and real-time data to forecast future outcomes. Rather than relying on assumptions or static reports, organizations use predictive analytics to anticipate demand shifts, supply disruptions, and operational bottlenecks before they affect performance.

By combining data from sales, manufacturing, logistics, and external market signals, predictive systems transform uncertainty into actionable insight. Consequently, businesses move from reactive planning to proactive execution, improving accuracy, efficiency, and decision speed across the entire supply chain.

Modern supply chains face persistent challenges, including demand volatility, forecast inaccuracies, excess inventory, stockouts, and poor OTIF performance. In addition, limited visibility into disruptions often forces organizations into costly last-minute decisions.

AI predictive analytics addresses these challenges by providing early visibility into potential risks and opportunities. As a result, organizations can stabilize operations, reduce inefficiencies, and improve customer service while maintaining cost control.

At the core of AI-driven forecasting are predictive analytics models that identify patterns, trends, and anomalies across large datasets. These models evaluate historical demand, seasonality, supplier performance, and transportation data to predict what is likely to happen next.

Unlike traditional forecasting methods, predictive models continuously improve as new data becomes available. Therefore, supply chain leaders can adjust plans in near real time, significantly reducing errors and minimizing costly surprises.

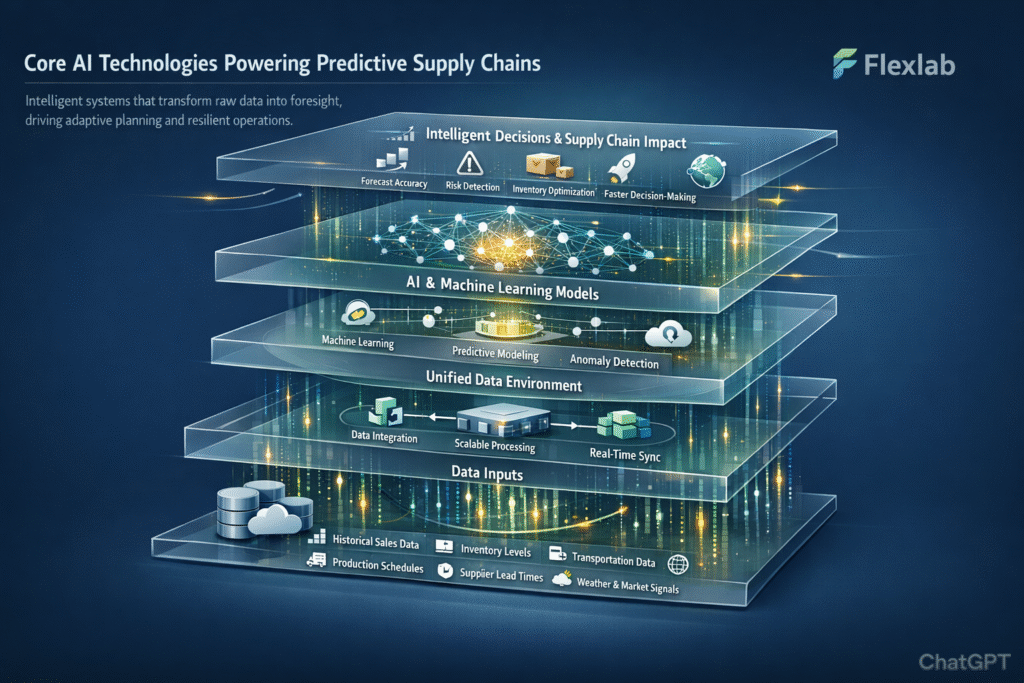

At the core of modern predictive supply chains are intelligent AI technologies that enable organizations to transform data into foresight. These technologies support advanced pattern recognition, continuous learning, and faster decision-making across complex and fast-moving supply networks.

By combining scalable data processing with adaptive analytical capabilities, organizations can enhance planning accuracy, anticipate disruptions, and support more resilient and responsive supply chain operations.

The effectiveness of AI predictive analytics depends heavily on data quality and consistency. While organizations do not need perfect data, they do need reliable inputs across the supply chain.

Key data sources typically include historical sales data, inventory levels, supplier lead times, production schedules, transportation data, and external signals such as weather patterns and market trends. When integrated into a unified environment, these datasets enable more accurate and actionable predictions.

AI predictive analytics is powered by machine learning algorithms and applications that allow systems to learn from data without explicit programming. Over time, these models adapt to changing conditions, improving forecast accuracy and responsiveness.

More advanced use cases rely on artificial neural networks and deep learning techniques to model complex, non-linear relationships. This capability is especially valuable for demand sensing, risk detection, and managing highly dynamic global supply chain environments.

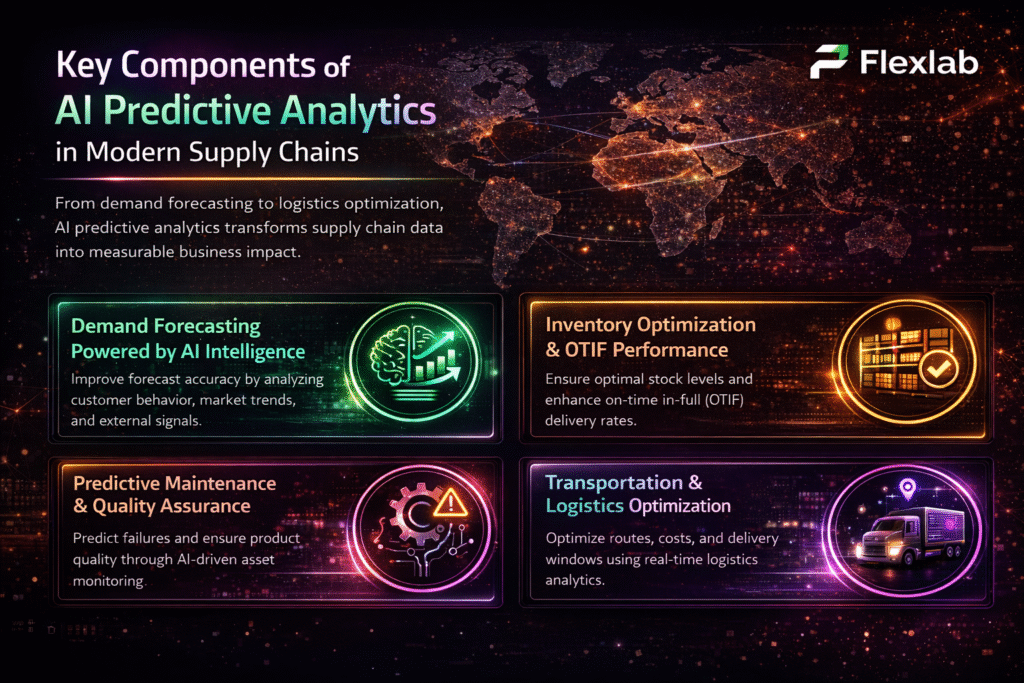

AI predictive analytics delivers value through interconnected components that transform raw data into forecasts, recommendations, and automated actions. When implemented correctly, these components improve both operational performance and strategic decision-making.

AI-driven demand forecasting evaluates customer behavior, market trends, promotions, and external signals, rather than relying solely on historical averages. As a result, organizations achieve higher forecast precision while reducing overproduction and stockouts.

Real-world impact: Retailers using AI-based forecasting report forecast accuracy improvements of 20–30%, according to industry studies.

Predictive inventory optimization ensures the right products are available at the right time and location, without tying up excess working capital. Consequently, improved inventory decisions directly enhance OTIF (on time in full) performance, strengthening customer trust and operational reliability.

Predictive maintenance uses AI to monitor asset health, sensor data, and performance trends to anticipate failures before they occur. As a result, organizations reduce downtime, prevent quality issues, and maintain consistent production schedules.

AI enhances logistics planning by analyzing routes, carrier performance, fuel costs, and delivery constraints in real time. When integrated with transportation management systems, predictive analytics enables dynamic routing, smarter carrier selection, and faster exception handling.

AI predictive analytics directly improves key performance indicators, including forecast accuracy, inventory turnover, service levels, OTIF performance, logistics cost per unit, and working capital efficiency. Together, these improvements deliver measurable business impact.

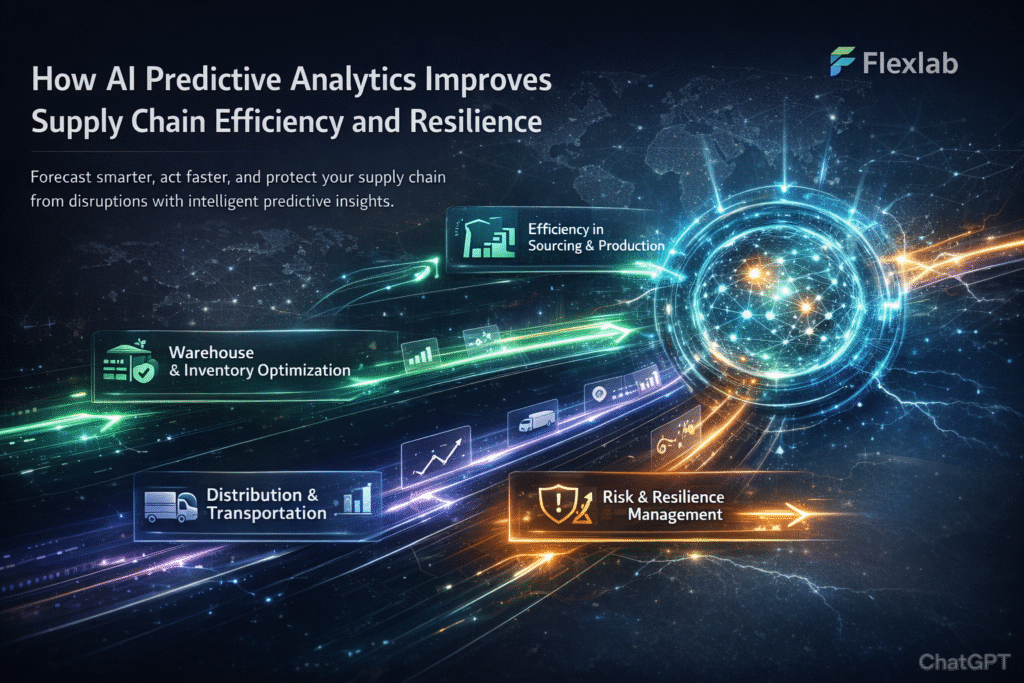

AI predictive analytics reshapes supply chains by enabling faster responses, smarter planning, and stronger risk preparedness. Additionally, by forecasting outcomes, organizations improve operational continuity while adapting to changing market conditions.

AI-powered insights help eliminate inefficiencies across sourcing, production, warehousing, and distribution. Therefore, organizations achieve faster cycle times, lower operating costs, and better demand–supply alignment.

Predictive analytics enhances supply chain resilience by modeling risk scenarios and estimating their potential impact. Consequently, teams can reroute shipments, shift sourcing strategies, or adjust inventory buffers before disruptions affect customers.

Predictive insights support data-driven supply chain strategies related to network design, capacity planning, and supplier diversification. As a result, strategies remain aligned with business goals and customer expectations.

Successfully implementing AI in supply chains requires a structured approach that balances technology, data, and human expertise. Organizations must begin with focused pilot projects, ensuring that data quality, integration with existing systems, and user adoption are prioritized from the outset.

By carefully planning each stage, organizations can leverage AI predictive analytics to generate actionable insights while minimizing risks. Proper governance, continuous monitoring, and cross-functional collaboration are critical to ensure that predictive models remain accurate, relevant, and aligned with business goals.

| Component | Primary Function | Business Impact |

| Demand Forecasting | Predict future customer demand | Higher accuracy, reduced stockouts |

| Inventory Optimization | Balance stock levels and service | Lower holding costs, better OTIF |

| Predictive Maintenance | Anticipate equipment failures | Less downtime, higher output |

| Transportation Optimization | Improve routing and delivery | Lower logistics costs, faster delivery |

Successful adoption requires more than advanced technology. Organizations should start with focused pilot use cases, prioritize data quality, integrate with ERP enterprise resource planning systems, and maintain human oversight during early automation stages.

Common pitfalls include over-automation too early, weak data governance, unrealistic ROI expectations, and treating AI as a one-time deployment. Organizations that view AI as a continuous improvement capability achieve more sustainable results.

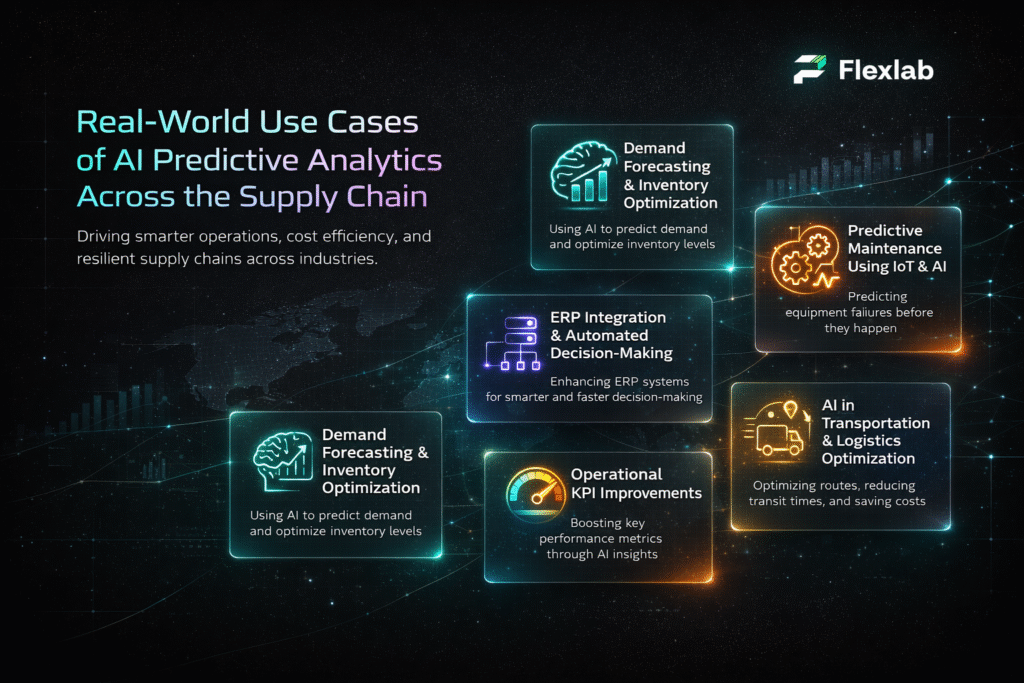

AI predictive analytics delivers measurable value across industries by enabling proactive, data-driven execution. Across sectors such as retail, manufacturing, logistics, and pharmaceuticals, organizations are increasingly leveraging predictive intelligence to optimize operations, reduce costs, and improve service levels.

Organizations using predictive analytics report inventory holding cost reductions of up to 20% while simultaneously improving service levels. Consequently, smarter stock positioning enhances cash flow, reduces waste, and ensures customers receive products on time. Moreover, predictive forecasting allows companies to anticipate seasonal spikes and market shifts, which can improve forecast accuracy by 15–30% according to industry benchmarks.

By combining IoT sensors with AI models, predictive maintenance identifies early warning signs of equipment failure. As a result, unplanned downtime can be reduced by up to 30%, extending asset lifespan and preventing costly operational disruptions. Additionally, organizations benefit from optimized maintenance schedules, reduced repair costs, and improved production reliability. This capability is particularly valuable for manufacturers and logistics providers managing high-value machinery or fleets.

Modern ERP platforms increasingly embed predictive analytics to enable automated decision-making. With AI copilots, planners receive contextual recommendations rather than static reports, accelerating decision cycles and minimizing human error. Consequently, companies achieve faster response times, higher operational efficiency, and improved OTIF (on-time, in-full) performance. Furthermore, integration with ERP systems allows predictive insights to flow directly into procurement, production, and distribution planning, enhancing overall supply chain agility.

AI predictive analytics is transforming transportation and logistics by enabling smarter routing, predictive maintenance, and real-time decision-making across complex supply networks. By leveraging these technologies, organizations can proactively manage shipments, avoid bottlenecks, and reduce costs, even in volatile conditions.

According to Statista, companies adopting AI in logistics report transportation cost reductions of up to 15% while improving delivery speed by 12–18%. Moreover, AI-driven routing optimizes carrier selection, fleet utilization, and delivery scheduling, which directly enhances OTIF (on-time, in-full) performance and customer satisfaction.

In addition, integrating IoT technology with predictive analytics allows organizations to monitor vehicles and warehouse assets in real time. Consequently, predictive maintenance reduces unplanned downtime by up to 30%, extends asset lifespan, and prevents costly delays. Furthermore, AI systems can dynamically adjust routes during peak demand or unexpected disruptions, ensuring shipments are delivered efficiently while minimizing fuel consumption and operational risk.

By combining AI technologies with transportation management systems (TMS), companies achieve higher operational reliability, improved cost efficiency, and increased overall supply chain agility. For example, global logistics providers using AI-driven networks report up to 20% faster turnaround times across multi-node supply chains. Meanwhile, predictive insights help planners make informed decisions, reducing human error and enabling automated rerouting when conditions change.

Overall, AI in transportation and logistics not only lowers costs and improves speed but also strengthens resilience, responsiveness, and operational transparency across the supply chain.

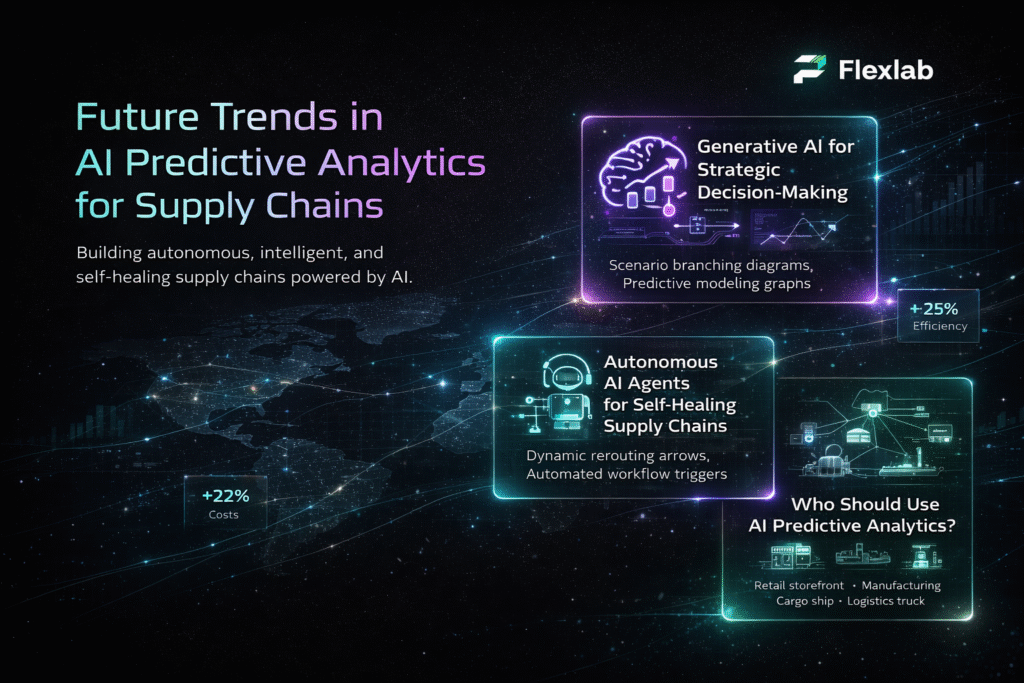

The future of supply chains is becoming increasingly autonomous and intelligent, driven by rapid advancements in AI predictive analytics. According to Gartner (2026), over 65% of leading organizations are expected to adopt autonomous AI agents and predictive analytics at scale, improving operational efficiency by up to 25%.

Generative AI is reshaping strategic planning by enabling scenario simulation, optimized decision-making, and advanced forecasting. Consequently, supply chain leaders can model multiple sourcing strategies, evaluate demand fluctuations, and design resilient networks before disruptions occur. Real-world applications show that companies using generative AI for scenario planning can reduce supply chain costs by up to 12% while maintaining high service levels.

Autonomous AI agents detect disruptions, reroute shipments, and trigger replenishment workflows without human intervention. As a result, organizations experience faster response times, reduced emergency shipping costs, and improved OTIF performance. Moreover, by continuously monitoring real-time signals from suppliers, transportation networks, and warehouses, these agents enhance supply chain resilience and support proactive risk mitigation.

AI predictive analytics is most effective for organizations operating complex, multi-node supply chains with high demand variability. Industries that benefit significantly include retail, manufacturing, logistics, pharmaceuticals, consumer packaged goods (CPG), and global distribution networks.

Moreover, enterprises with multiple warehouses, regional distribution centers, or international suppliers can leverage predictive analytics to optimize inventory, reduce costs, and enhance customer satisfaction. Consequently, organizations adopting these technologies gain a competitive edge by making faster, smarter, and more data-driven decisions.