What Are Generative AI Applications and How Do They Work?

Smart Contracts | AI and Blockchain | AI Voice Agents

Let’s start from the beginning. When someone refers to artificial intelligence (AI), they typically mean systems designed to predict outcomes. For instance, given an image, decide whether it has a dog or a cat; given a loan applicant’s data, decide whether he will pay or not. However, there is another significant aspect of AI: one that doesn’t just classify or predict, but also helps with the creation of new content for consumers. That is the realm of generative AI. Generative AI generally refers to algorithms or computer systems capable of generating new content, such as images, text, music, etc. Generative AI models are trained on large volumes of existing data, learn the pattern, and then generate something entirely new of a similar kind.

In this blog, we will discover what Generative AI applications are, agentic AI vs. generative AI, use cases, and examples of generative AI.

How Does it Work? In Simple Terms

How does generative AI work? You don’t need to be an expert to get the gist of how generative AI applications work. However, here is the analogy.

- A model is given a vast collection of information, including numerous articles, numerous pictures of bags, or lots of music tracks.

- With the help of AI data analysis, it tends to find the pattern, how words are arranged, and how they follow each other. It identifies how pixels in a picture are related to each other, and how chords follow in musical melody.

- Once it is trained, you give it a ‘prompt’ or input- maybe a short text, for example, ‘draw a red bag in a minimalist room, and it uses what it learned to generate something new consistent with the pattern.

In more technical terms, large ‘foundation models’ such as large language models (LLMs) are trained on massive datasets and can then be adapted to many tasks with relatively little extra training. Some examples of these models that derive from deep learning techniques include Generative Adversarial Networks (GANs) and Variational Autoencoders (VAEs). These models are revolutionizing various industries by enabling novel innovations.

So, from a beginner’s point of view, the system learns from what humans have made and then creates something in the same pattern. That’s the basic essence of generative AI.

Why is Generative AI Useful?

Here are some of the main reasons why this smart technology has gained traction recently.

- Content Creation: Generative AI applications can help speed up creative work by creating drafts of texts, images, and even videos or music.

- Personalization: Generative AI allows content and services to be unique and tailored to users’ individual goals more easily.

- Innovation: It can help people explore new ideas, designs, or formats that might not easily come up through manual effort.

- Automation: Repetitive or tedious manual tasks, such as creating multiple variants of a picture and writing variants of marketing content, can be offloaded with generative AI.

- Data Augmentation: Generative AI can help with data augmentation and simulations. In fields like healthcare and manufacturing, geerative AI models can generate synthetic data to simulate scenarios or train other systems.

In short, generative AI is useful for many reasons because it changes what AI-assisted humans look like – not just categorizing or analyzing, but generating.

Top Applications of Generative AI

Generative AI is revolutionizing various industries by creating designs, content, and smart solutions. From enhancing productivity to improving creativity, its potential applications are vast and varied. Below are some of the major areas where generative AI is being applied.

- Generative AI in Healthcare

- Generative AI in Cybersecurity

- Generative AI in Virtual Assistants

- Generative AI in Finance

- Generative AI in Content Creation

Generative AI in Healthcare

Generative AI in healthcare is transforming the industry through drug discovery, personalized medicine, and medical imaging. It analysis of patient records helps bring customized treatment plans, therefore, increasing successful outcomes for patients. For instance, several companies are utilizing AI to create treatments tailored to individual patient profiles, taking into account their family and genetic history.

Additionally, tools such as Insilico Medicine utilize generative AI to generate synthetic patient data, enabling the training of machine learning models without compromising patient privacy. Generative AI also helps with the early detection of diseases. For example, there are apps like SkinVision that use AI systems to analyze and examine images of the skin to help with diagnosis and detect early signs of skin cancer.

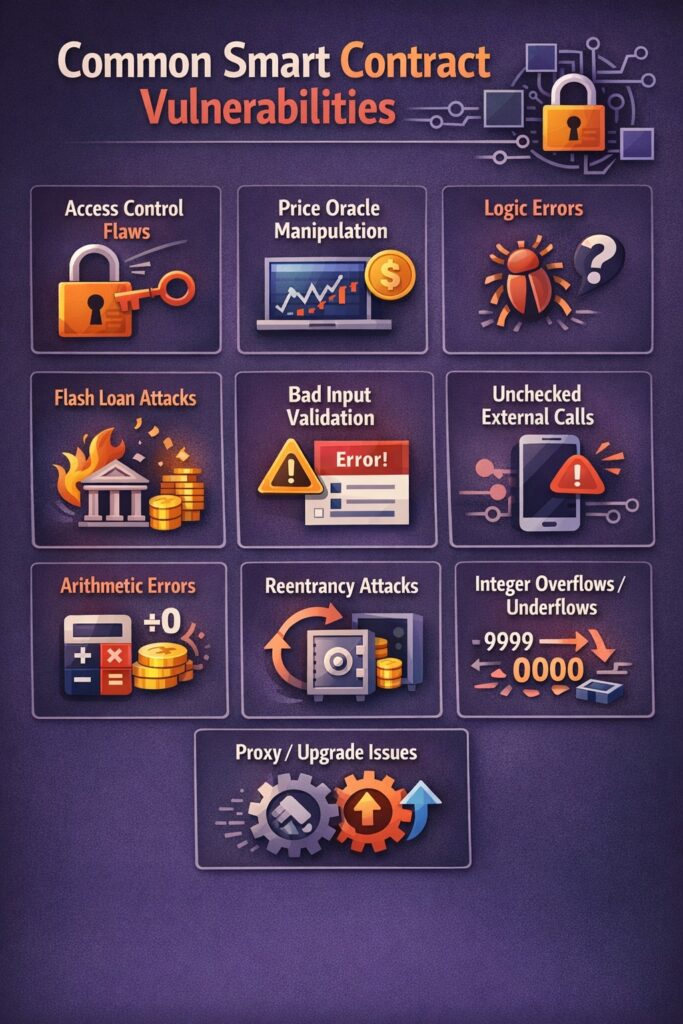

AI Applications in Cybersecurity

Generative AI is revolutionizing cyber risk management by improving threat detection and automating incident response. It is redefining cybersecurity by proactively recognizing threats, simulating attack scenarios, and strengthening incident response capabilities.

Generative AI helps analyze large datasets to recognize normal behavior within a network. For instance, it can detect an unusual spike in traffic that may demonstrate unauthorized access or a malware attack. Furthermore, advanced phishing attacks can also be encountered through generative AI, which utilizes natural language processing (NLP). It works by analyzing the content of emails and social media interactions in order to look for slight anomalies of unusual or false activities.

In addition to this, generative AI also plays an important role in incident analysis and prioritization. Generative AI models can automatically analyze security incidents in real time. These models then prioritize incidents based on severity, enabling security teams to respond quickly and effectively.

The Role of AI in Virtual Assistants

Virtual assistants or AI-powered chatbots utilize generative models to provide a more human-like interaction with customers in customer service fields, effectively answering queries and resolving consumer issues. For example, Erica is a virtual financial assistant at the Bank of America that can assist up to 25 million users in managing their accounts, paying bills, and getting spending insights into their transactions. It helps make banking more accessible and efficient for users. Amazon’s Alexa uses conversational AI to deliver personalized product recommendations based on consumer preferences and past purchases, making shopping a fun experience for millions of customers. Another example of generative AI in virtual assistants is Duolingo. It employs a virtual assistant to tailor language lessons according to the user’s progress. Moreover, it provides real-time feedback and delivers gamified learning challenges to enhance the learning experience.

How AI Is Used in Finance

Generative AI is revolutionizing the finance industry by enhancing fraud detection and risk mitigation. It helps create customized investment plans and improve risk management in the finance sector. One major application is automated report creation. AI generates real-time financial summaries, investment insights, and market trend briefs with high accuracy. In wealth management, advisors use generative AI to create personalized portfolio strategies, scenario analyses, and communication drafts for clients. It helps streamline workflows while significantly improving customer experience. Another use case is synthetic data generation, which allows companies to train models without exposing sensitive data, speeding up generative AI adoption across compliance-heavy environments.

In addition to this, generative AI strengthens and supports regulatory teams by drafting compliance documents, analyzing policy advancements, and summarizing complex regulations.

AI in Content Creation

Generative AI in content creation is redefining content creation across various industries. From images and text to music and videos, AI-driven systems streamline workflows, enhance creativity, and boost productivity while maintaining scalability and consistency. Writers and marketers can draft scripts, articles, and posts in minutes, allowing them to focus on ideas rather than time-consuming first drafts. Generative AI also tailors content to specific audiences by analyzing tone and user preferences.

A well-known example is Netflix, where AI algorithms analyze viewing habits, likes, and preferences to provide personalized recommendations. This personalization drives nearly 80% of the content streamed on the platform. Sephora uses a similar approach through its augmented reality tool, Virtual Artist, which lets users try makeup products virtually, enhancing the shopping experience with more interactive engagement.

Generative AI also supports writers by creating blog drafts, headings, and SEO metadata. These autonomous systems help overcome writer’s block, reduce effort, and ensure consistent, high-quality content with greater ease.

Things to Keep in Mind While Using Generative AI

While the potential is significant and exciting, it is better to stay grounded. Here are some important caveats and considerations to keep in mind to make the best use of Generative AI applications.

- Quality May Vary: The output you get from generative AI may vary in terms of quality. They are not always perfect. It may make mistakes, be inconsistent, or produce something unexpected.

- Prompt Sensitivity: The content or output you receive depends heavily on how the user explains the prompt. The more precise, the better the outputs.

- Bias and Representation: Since the generative models learn from human-made data, they can also inherit biases present in the data. Therefore, the use of these systems demands careful consideration.

- Technical Limits and Cost: Training and running such huge models can be expensive, and using them wisely with responsibility requires knowledge and skills.

- Ethical and Misuse Risk: Generative AI can easily be used to create misleading content, such as deepfakes or fake news. Also, it can be used in ways that can raise security and privacy concerns. Therefore, taking such sensitive things into account is really important.

Keeping these in mind helps you approach generative AI with caution and curiosity.

How to Start Using Generative AI as a Beginner?

If you are just starting out and wondering how you can experiment with generative AI, here are some simple yet effective steps;

- Pick a domain you want to work on. You could write blogs, make graphics, or teach.

- Find a tool. There are plenty of generative AI tools for different purposes that you can try.

- Craft a good prompt. Be specific about what you want, such as style, tone, or constraints, etc.

- Generate and review the content. After the output is created, edit and refine it.

- Consider ethical implications, especially if you are publishing or sharing the output. Do take care of credit, accuracy, and originality.

By using this approach, you can get the benefit of generative AI even without being an expert in machine learning.

Concluding Keyphrases on Applications of Generative AI

Generative AI is transforming how we think, create, and solve problems these days. Its unique abilities to produce text, images, and ideas open new opportunities and possibilities across work, art, and everyday life. As these technologies grow more capable and advanced, they are becoming powerful partners with humans that help us move faster, discover new opportunities, explore new directions, and minimize the limits of traditional workflows. Yet the real significance of generative AI lies in how users choose to use it– with intention, creativity, and awareness. When human judgment meets AI advancements, the result comes out to be more efficient and imaginative way of working.

By developing and deploying AI technologies with the right safety and ethical measures, we can create systems that promote fairness and protect users. Generative AI is not the future of innovation on its own. However, it is becoming an essential part of how we shape our future.

Looking for a Trusted Generative AI Development Company?

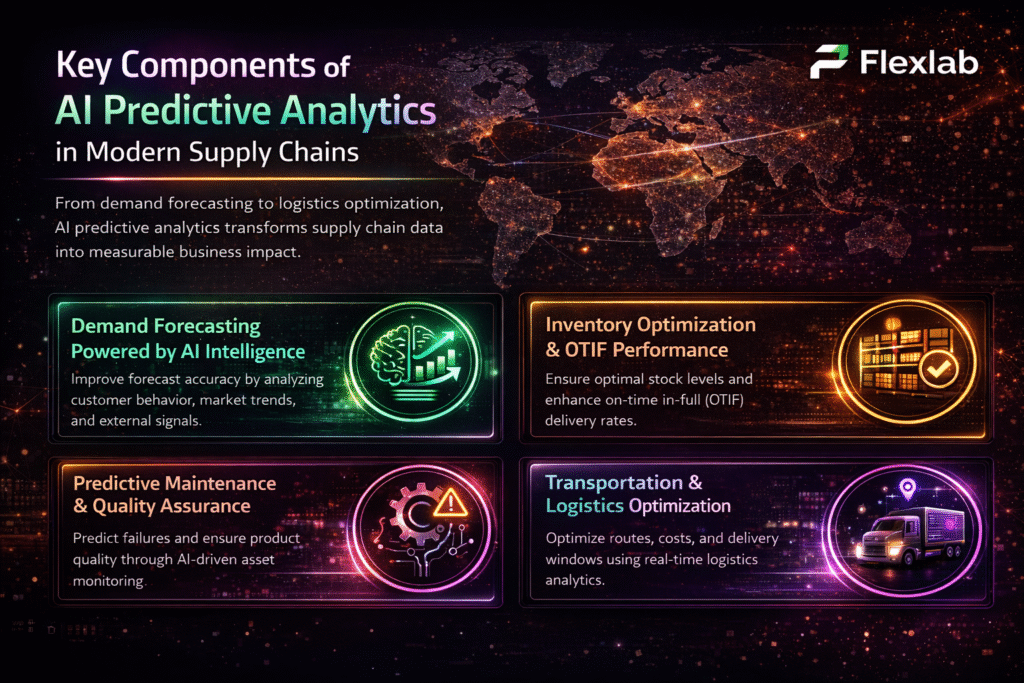

Unlock the power of generative AI with Flexlab, where innovation, engineering, and strategy come together to drive real and measurable results. Our team of skilled developers develops tailored AI solutions for industries like finance, healthcare, retail, and logistics, helping them cut operational costs with increased workflow efficiency through automation and intelligent content creation. From custom AI models to end-to-end deployment, Flexlab turns complex data into smarter decisions, faster processes, and new revenue opportunities.

Ready to Grow Your Business?

📞 Book a FREE Consultation Call: +1 (416) 477-9616

📧 Email us: info@flexlab.io

Discover real-world success stories in our portfolio, explore our solutions, and start your AI solution development journey today. Contact us or have a look at our services. See firsthand what our clients say about us and how we’ve transformed their generative AI vision into measurable success.

To have more detailed insights into different topics, explore our blog page for more blogs like public vs private blockchain, benefits of using white label crypto exchanges for startups, and what is multimodal AI?

FAQs

1. What is the most common use of Generative AI?

The most common use of generative AI is creating and improving content, such as text, images, and code, based on simple user prompts. It’s widely used in writing assistance, marketing content, design, and customer support to save time and boost productivity.

2. What is the most used generative AI tool?

The choice of the right tool depends on what you need: writing, designing, coding, or industry-specific solutions. There is no single best generative AI tool, but leading options like OpenAI’s ChatGPT, Google Gemini, and Adobe Photoshop dominate their fields for text, multimodal tasks, and image generation.

3. What are the seven main types of AI?

The seven main types of AI are reactive machines, limited memory AI, theory-of-mind AI, self-aware AI, narrow AI, general AI, and superintelligent AI. These types range from simple rule-based systems to advanced forms that could one day think, learn, and reason like— or even beyond—humans.

3 Responses