How Does a Crypto Trading Bot Actually Trade for You?

Hot Wallet vs Cold Wallet | White Label Crypto Exchange | Crypto Wallets

What is a crypto trading bot? Do AI crypto trading bots work? Yes, they can work by automating trades and executing strategies that work 24/7, which is a faster approach than human trading. However, they are not foolproof and require careful setup, monitoring, and realistic expectations.

In one 90‑day independent test of 26 AI bots, the top three strategies were profitable with strong win rates and controlled drawdowns, while many others underperformed or lost money.

AI trading bot performance analysis explained a case study of a conservative BTC/USDT AI‑optimized DCA bot showed a 12.8% return over 30 days with a 100% win rate across 36 closed trades, but this was in a specific market period and with cautious settings. Isn’t this amazing? Let’s learn detailed insights about crypto trading bots, how they work, and explore top crypto trading platforms.

What is an AI Crypto Trading Bot?

Do you want to analyze real-time price movement, historical data, and market sentiment that make sharper trades? Don’t hassle more. Here comes the AI crypto trading bot that makes your trading faster, reliable, and result-driven.

An AI crypto trading bot is an advanced software tool for crypto trading that utilizes artificial intelligence and machine learning to automate decision-making. In contrast with traditional bots that follow fixed rules and a backtested script. These trading bots connect to your crypto exchange account via cryptographic keys (API keys), operating 24/7 to collect data. These bots can analyze market data through efficient data processing, identify patterns, and execute trades with the help of mathematical algorithms, machine learning models, and AI. These seamless trades do not require human intervention.

Trading bots software never misses a market opportunity, and they react swiftly to price changes. They are designed to reduce the need for constant market monitoring. This helps traders stay active in volatile cryptocurrency markets. In simple terms, these bots help you remain competitive in the fast-paced world of crypto trading. They offer valuable benefits for both new users and experienced traders.

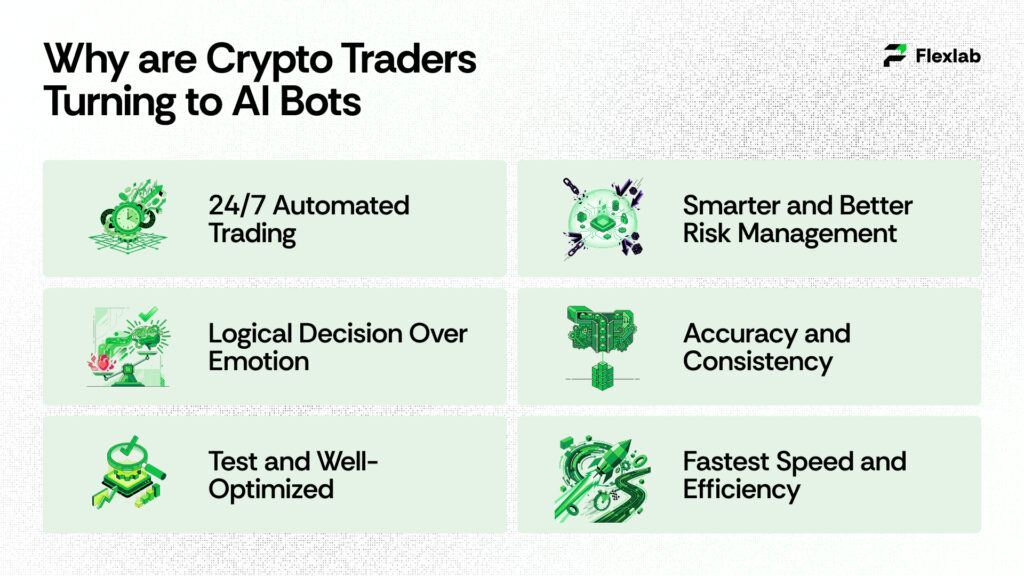

Why are Crypto Traders Turning to AI Bots?

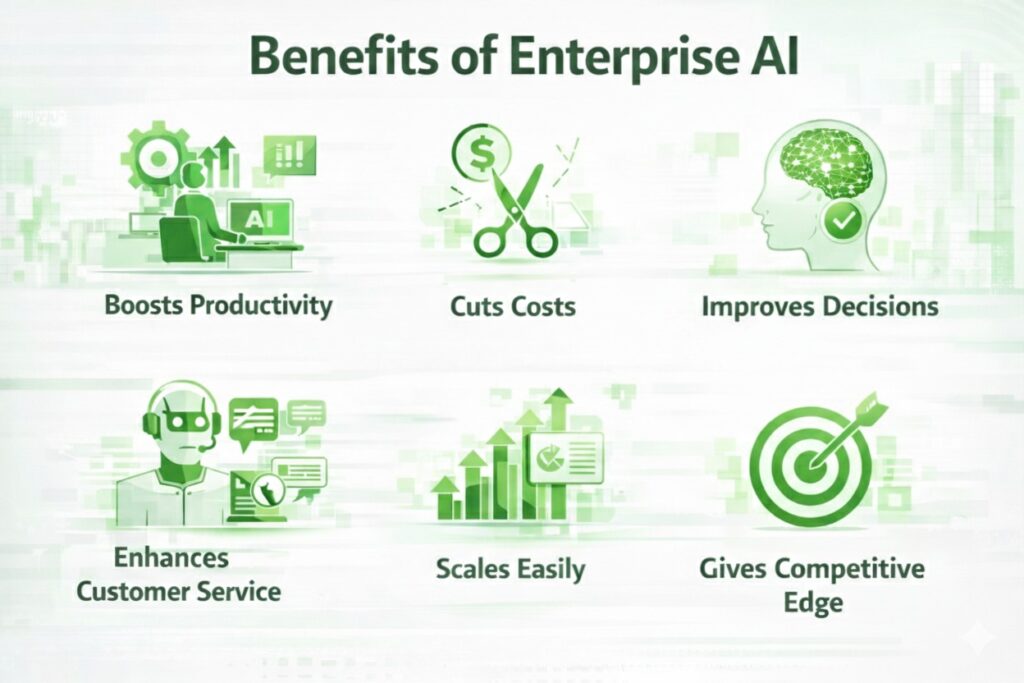

Here are some factors to consider to gain insight into the awareness of AI trading bots. Have a glance at the benefits of cryptocurrency trading with AI:

- 24/7 Automated Trading Operations: The cryptocurrency market never closes, and bots are working around the clock. These bots continuously monitor the cryptocurrency market and execute trades without interruption. It means no downtime and no missed windows.

- Logical Trading Over Emotion Decision: Another benefit of AI bots is to eliminate human greed from trading decisions and prevent impulsive action, such as panic selling or FOMO buying. They consistently follow pre-programmed crypto strategies and adhere to them without being greedy.

- Smarter Risk Management: AI bots are designed to automatically trigger stop-loss orders, protect your capital with take-profit settings, and rebalance portfolios. It helps in mitigating risk and reducing losses during market downturns through strategic portfolio management.

- Test and Well-Optimized: Backtesting tools provide you with past market historical data and let you be aware to simulate your trading strategies accordingly. It will save your real money putting on the line and enable you to make wise decisions. Some AI bots also have built-in backtesting module features.

- Fastest Speed and Efficiency: AI trading bots analyze data and execute trades in milliseconds. They capture market opportunities so quickly that a human trader might miss. Moreover, they can monitor the abundance of trading pairs simultaneously, which is far beyond a human capacity with advanced application monitoring tools.

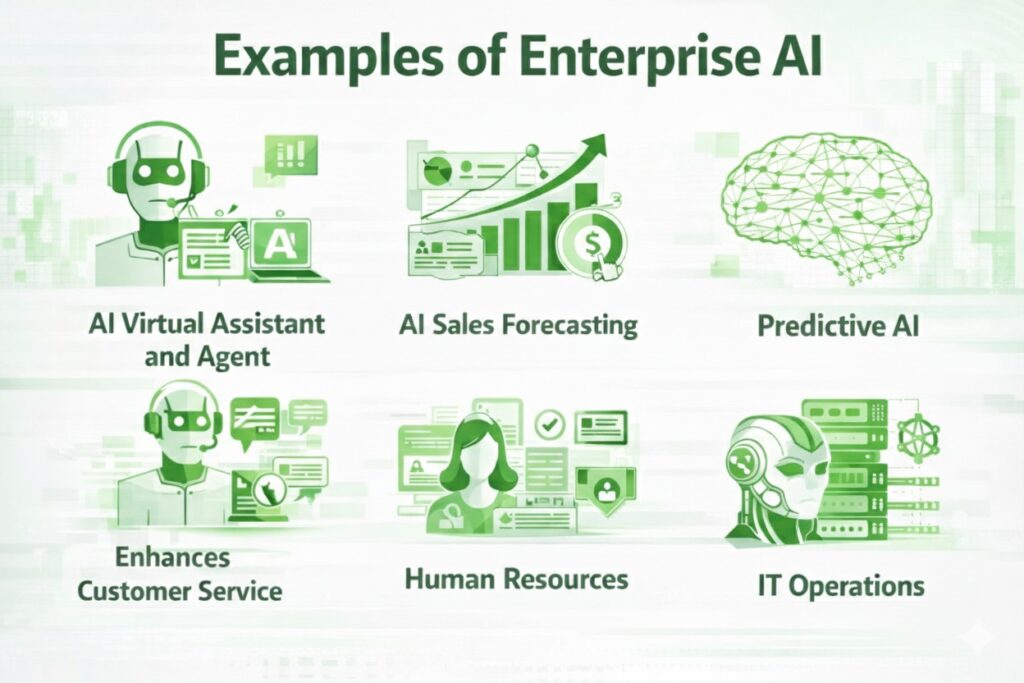

Types of Crypto Trading Bot

- Grid trading bots

Place a series of buy and sell orders within a price range, buying lower and selling higher as the market moves sideways. These are popular on platforms like Pionex, Bitsgap, and 3Commas for range‑bound markets. - DCA (Dollar‑Cost Averaging) bots

Invest fixed amounts at regular intervals, smoothing out volatility over time. Traders use DCA bots to build long‑term positions in assets like Bitcoin or Ethereum without trying to time the market. - Trend‑following bots

Use indicators such as moving averages or RSI to detect uptrends and downtrends, then open long or short positions accordingly. They work best in strong trending markets and can struggle when price chops sideways. - Arbitrage and market‑making bots

Arbitrage bots try to profit from small price differences across exchanges or markets, while market‑making bots quote both buy and sell orders to earn the spread. These usually require more capital, tighter risk controls, and deeper technical expertise. - AI‑driven and signal‑based bots

Use machine learning models or external trading signals to adjust strategies in real time. Instead of fixed rules, they can adapt to changing volatility, volume, and correlations, but they are more complex to test, explain, and monitor.

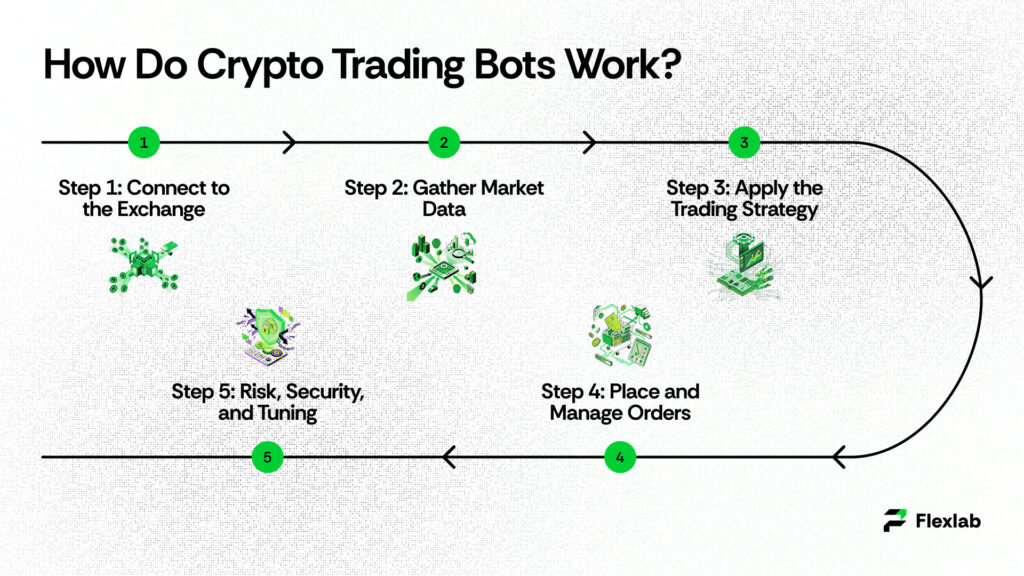

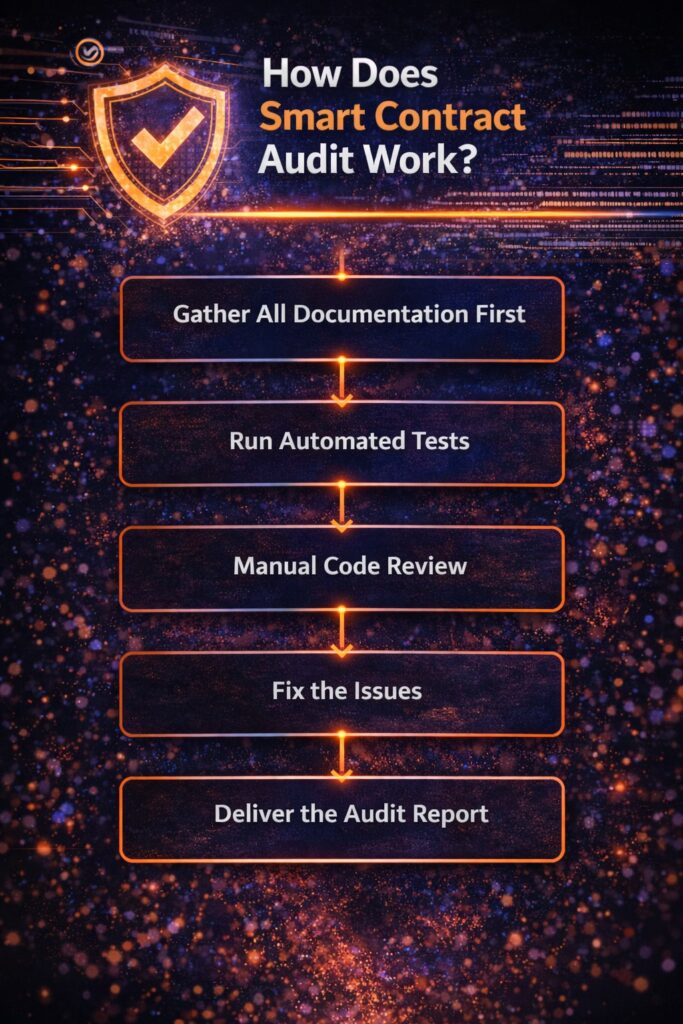

How Do Crypto Trading Bots Work?

Crypto trading bots are software programs that connect to your exchange account and place trades for you automatically. They follow a set of rules or strategies you define, like when to buy, when to sell, and how much to risk on each trade. The goal is to remove emotion, react faster than humans, and keep your strategy running 24/7 in the crypto market.

Step 1: Connect to the Exchange

- You create API keys in your exchange account and plug them into the bot.

- These keys let the bot read your balance protected by robust network security, see prices, and place orders without needing your login password.

- You can usually choose permissions , such as “trade only” and disable withdrawals for extra safety. For unused funds, pair this with a cold storage crypto wallet.

Step 2: Gather Market Data

- The bot constantly pulls live data like prices, trading volume, and order book depth.

- It may also use indicators such as moving averages, RSI, or Bollinger Bands to understand trends and momentum.

- This data stream is the input the bot uses to decide what to do next.

Step 3: Apply the Trading Strategy

- Inside the bot, you configure simple rules or a full strategy, for example: “If Bitcoin drops 5% in an hour, buy,” or “If price breaks above resistance, open a long.”

- Common strategies include grid trading, dollar‑cost averaging, trend‑following, arbitrage, and scalping. Also read some crypto trading tips for beginners.

- The bot checks your rules against the live market data every few seconds (or faster) to see if conditions are met.

Step 4: Place and Manage Orders

- When conditions match your rules, the bot automatically executes each crypto transactions (buy or sell order) on the exchange.

- It can also set stop‑loss and take‑profit levels to manage risk and lock in gains without you watching the screen.

- After orders fill, the bot tracks open positions, updates balances, and gets ready for the next signal.

Step 5: Risk, Security, and Tuning

- You control how much of your balance each trade can use and how big a loss you are willing to tolerate while staying mindful of cryptocurrency regulation.

- You monitor performance and tweak settings over time, turning off strategies that don’t work and refining the ones that do.

- Good practice is to start with small amounts or paper trading, then scale up once you’re confident the bot behaves as expected.

5 Best Crypto Trading Bot Platforms for 2026

If you’re new to cryptocurrency for beginner and eager to learn about the best AI crypto trading bot, then you’re in the right place. Let’s explore the top automated trading platforms below;

- Cryptohopper

- Coinrule

- Bitsgap

- 3Commas

- Pionex

1. Cryptohopper

Cryptohopper is a cloud-based crypto trading bot platform that stands out for its versatility and rich feature set. It supports automated trading bots across many exchanges, including Binance, Coinbase Pro, Kraken, and KuCoin. You don’t need to run any software manually. One standout feature is its strategy marketplace, a hub where traders can buy, sell, or download free strategies and bot templates. This setup lets you use community-created strategies or hire expert signallers to guide your bots.

Furthermore, this trading bot also provides a drag-and-drop strategy builder that needs no coding. It includes backtesting and paper trading modes, allowing you to test your ideas safely.

2. Coinrule

Coinrule is a user-friendly crypto trading automation tool that enables traders to create and deploy trading rules without requiring any coding. It has a user-friendly interface that allows you to develop strategies by selecting simple triggers and actions. For instance, if Bitcoin drops 10% in 1 hour, then buy X amount through the drop-down menu. This approach makes algorithmic trading accessible and convenient to everyone while lowering the barrier of entry.

Coinrule offers 250 ready-made strategy templates, which you can copy or customize easily for either basic stop-loss or complex momentum strateg

ies. This is best for quick learners or crypto trading for beginners. It supports exchanges such as Binance, Coinbase Pro, Kraken, KuCoin, and more, connected securely via API keys.

3. Bitsgap

Bitsgap is a comprehensive crypto trading bot, also known as a one-stop trading hub where you can connect 15+ exchanges. It also manages your entire crypto portfolio and trades from a single interface. It is well known for its Grid trading bot and DCA bot. In a grid trading bot, you can excel at buying low price while selling high price within a price range. Dollar-Cost Averaging DCA bots work well for gradually building positions.

Moreover, it provides algorithmic tools for crypto arbitrage opportunities across exchanges. Bitsgap’s interface has a powerful charting terminal where you can manually trade with advanced order types or easily monitor your bots in real time. Furthermore, it has rich features such as technical indicators, Trailing Up/Down features for grids, and Smart Orders (e.g., simultaneous stop-loss and take-profit).

4. 3Commas

3Commas is the most well-known and globally used crypto trading platform due to its rich functionality and large community. It supports 20+ exchanges, including Binance, Kraken, Coinbase, KuCoin, and many others. Now you can manage all your exchange accounts in one place. It offers a variety of automated bots such as DCA Bot, Grid Bot and Option Bot. DCA bot helps you to implement dollar-cost-averaging strategies to buy or sell in portions. Grid bot is good for range trading, and the Option bot works for derivative trading on certain exchanges.

The standout quality of 3Commas is to provide the blend of manual and automated trading tools. Moreover, its SmartTrade terminal features allow you to trade, simultaneously take-profit and stop-loss, trail stops, and other advanced order combinations. It also essentially gives you superpowers even for manual trades.

5. Poinex

Pionex is a crypto exchange and automated trading platform known for its built-in, free trading bots. It removes the need to connect external APIs or use paid bot services. This makes it beginner-friendly while still powerful enough for active traders.

The platform supports hundreds of cryptocurrencies and offers spot, margin, and futures markets. You can deploy bots across different trading environments and use leverage if desired. Pionex provides about 16 bot types, including Grid, DCA, Infinity Grid, and futures grid bots. These help you profit from market volatility, accumulate positions over time, or run leveraged strategies automatically.

Its fee structure is competitive. Spot trading fees are around 0.05%, and futures maker fees are even lower, cheaper than many popular exchanges.

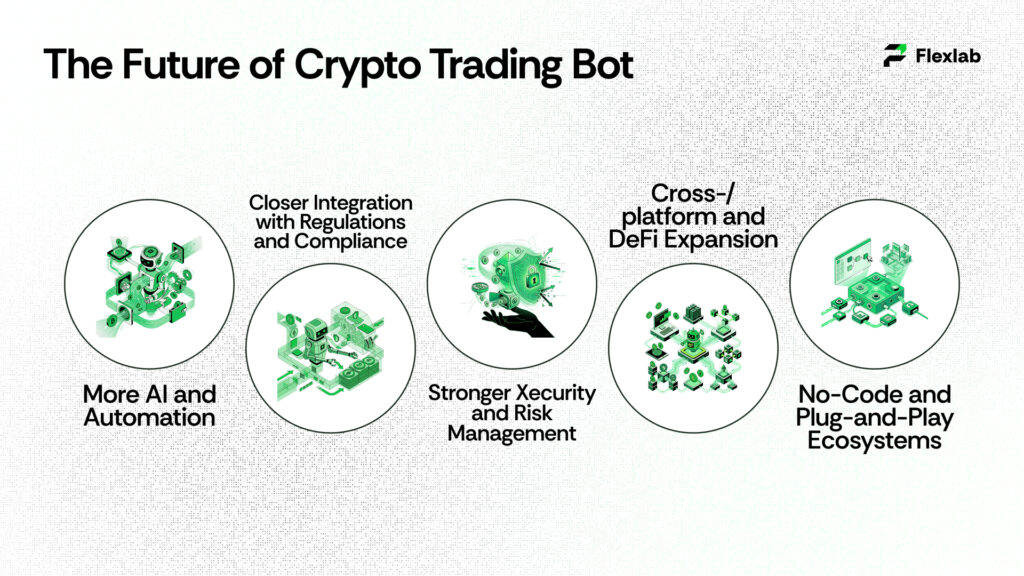

The Future of Crypto Trading Bot

- More AI and automation

Bots will increasingly rely on AI agents that learn from historical and live data, auto‑optimize parameters, and switch strategies based on conditions like volatility or liquidity. This will make institutional‑style automation more accessible to regular traders. - Closer integration with regulations and compliance

As cryptocurrency regulations tighten, serious bot platforms will include compliance features. These include KYC/AML support, audit trails, tax reporting exports, and client fund controls. Such features help bots evolve from “retail hobby tools” into regulated financial products. - Stronger security and risk management

Future bots will emphasize secure key storage, granular API permissions, and builtin risk dashboards with clear drawdown limits, max position sizes, and circuit breakers. Expect safer defaults so beginners do not accidentally over‑leverage or expose their entire portfolio, incorporating enterprise risk management from the start. - Cross‑platform and DeFi expansion

Bots will work across centralized exchanges, DEXs, and even on‑chain lending or perp protocols, routing orders to wherever pricing and fees are best. This cross‑venue routing turns bots into full “execution agents” rather than simple exchange‑bound scripts. - No‑code and plug‑and‑play ecosystems

Strategy marketplaces, drag‑and‑drop builders, and template libraries will keep growing, making it normal to launch, test, and share bots without writing code. Traders will pick from pre‑built playbooks, then customize risk and time horizon instead of building from scratch, often starting with mvp development to validate ideas quickly.

How Flexlab Can Help in Using a Crypto Trading Bot?

FlexLab is a company that specializes in blockchain development and AI automation, and it can help with creating or running an AI crypto trading bot by providing the technical foundation needed to build such a system. Instead of starting from scratch, FlexLab offers ready-made, customizable trading or exchange platforms that save time, reduce costs, and handle complex parts like security, backend setup, liquidity, and integrations. Because they also work with AI automation, they can help incorporate features like real-time market analysis, pattern detection, and automated trade execution, all of which are essential for a modern AI-driven trading bot.

With FlexLab’s tools, you can build a bot that trades 24/7 and reacts quickly to market changes. It also helps you avoid emotional decisions. However, no AI trading bot can guarantee profits. Their tools make development easier and safer, but you still need careful monitoring and solid risk management.

Final Verdict on Crypto Trading Bot

Crypto trading bots, powered by AI, empower traders to automate strategies, operate 24/7, and execute with precision that surpasses manual efforts in speed and discipline. Platforms like Cryptohopper, 3Commas, and Pionex deliver proven tools for grid, DCA, and trend-following approaches, while innovations from partners like Flexlab streamline secure, custom development for real-world gains. Contact us now or explore our LinkedIn to see real feedback from clients.

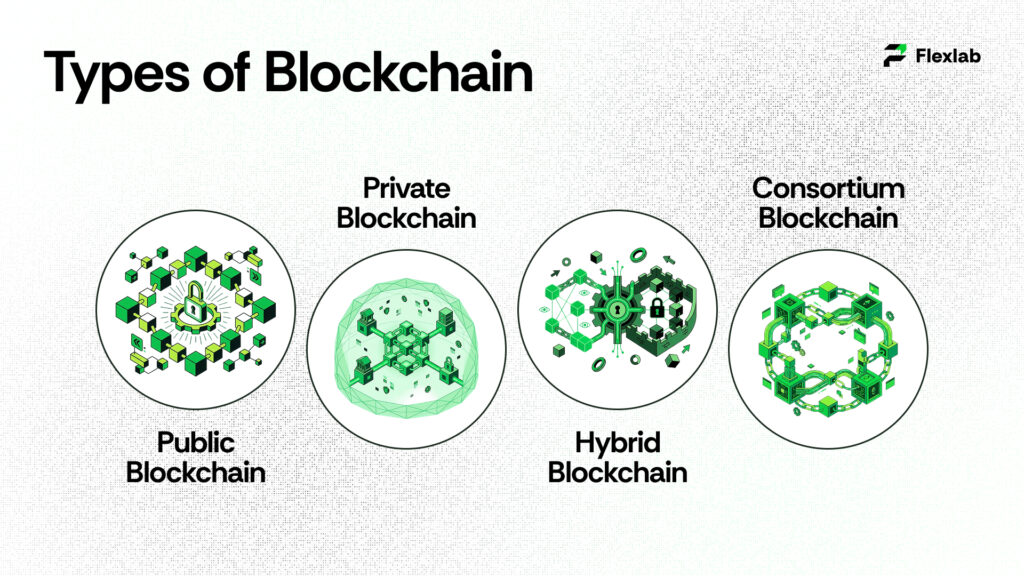

You can also visit our blockchain and AI blog page to read more helpful insights regarding blockchain and AI and blockchain application development, AI automation agency, public and private keys, public vs private blockchain, and many more.

Ready to Automate Your Crypto Profits 24/7?

Don’t miss market opportunities – supercharge your trades with a custom AI bot from Flexlab.

📞 Book a FREE Consultation Call: +1 (416) 477-9616

📧 Email us: info@flexlab.io

Do crypto trading bots work?

Yes, AI crypto trading bots work effectively by automating 24/7 trades, leveraging machine learning for pattern recognition, and outperforming manual trading by 10-40% in consistency when properly configured with backtesting and risk controls.

Which bot is best for crypto trading?

Cryptohopper stands out as the best overall for 2025 due to its versatile features, strategy marketplace, multi-exchange support, and user-friendly no-code tools, ideal for beginners and pros alike.

Can you make $100 a day with crypto?

Possible but not guaranteed, it depends on capital (e.g., $10K+ at 1% daily return), market conditions, strategy, and risk management; bots like grid or DCA can yield 15-50% APR in tests, but volatility often leads to losses without oversight.

One Response