Understanding the Difference Between Custodial and Non-Custodial Wallet

Multi-Agent Systems | Web3 Technology | AI Development Company

A custodial vs non-custodial wallet is one of the most important decisions in the world of cryptocurrency. Crypto is no longer a niche experiment—it’s a global financial movement. Whether you are buying your first $100 worth of crypto or managing a six-figure portfolio, one question matters more than most realize: Where will you store your digital assets?

That’s where your crypto wallet storage comes in handy.

This is where the debate of custodial vs non-custodial wallets begins. It sounds technical, but at its core, it’s a matter of trust, control, security, and responsibility.

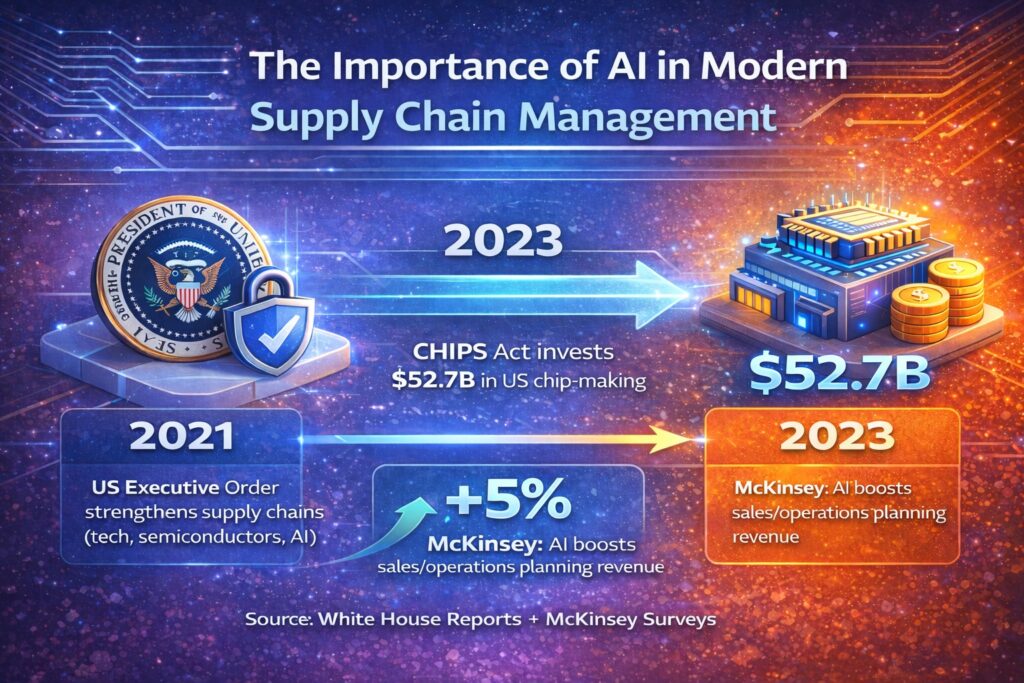

Blockchain technology has gained immense attention from ordinary investors, business leaders, and developers. These business leaders and developers are researching how to integrate these wallets seamlessly into their ecosystems to provide an approach that is significantly better than conventional financial systems.

If you want a clear, human explanation of which wallet is right for you, you are in the right place. By the end of this blog, you’ll know exactly which kind of wallet is best for your goals and experience level.

Why Wallets Matter More Than You Think?

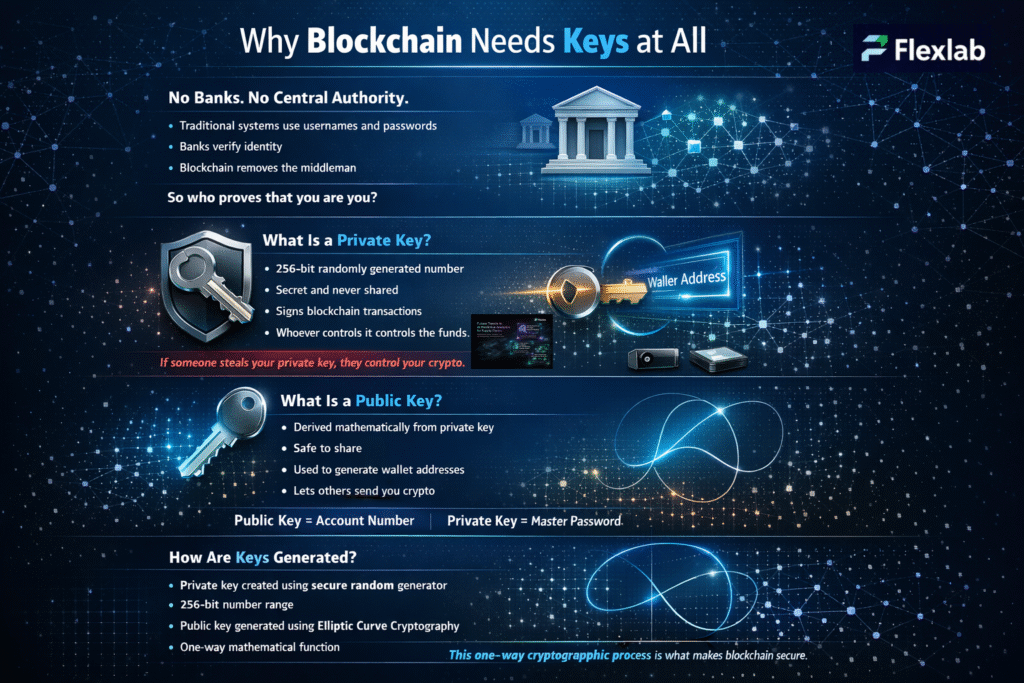

A crypto is not like a physical wallet; it does not hold your money or coins. Instead, it helps protect the keys that let you access and control these coins on a blockchain network. If you lose these keys, you lose your crypto. Hand your keys to the wrong person, and they can take everything that you have.

That’s exactly why picking the right type of wallet is the foundation of safe crypto ownership. This brings us to two major categories of crypto wallets;

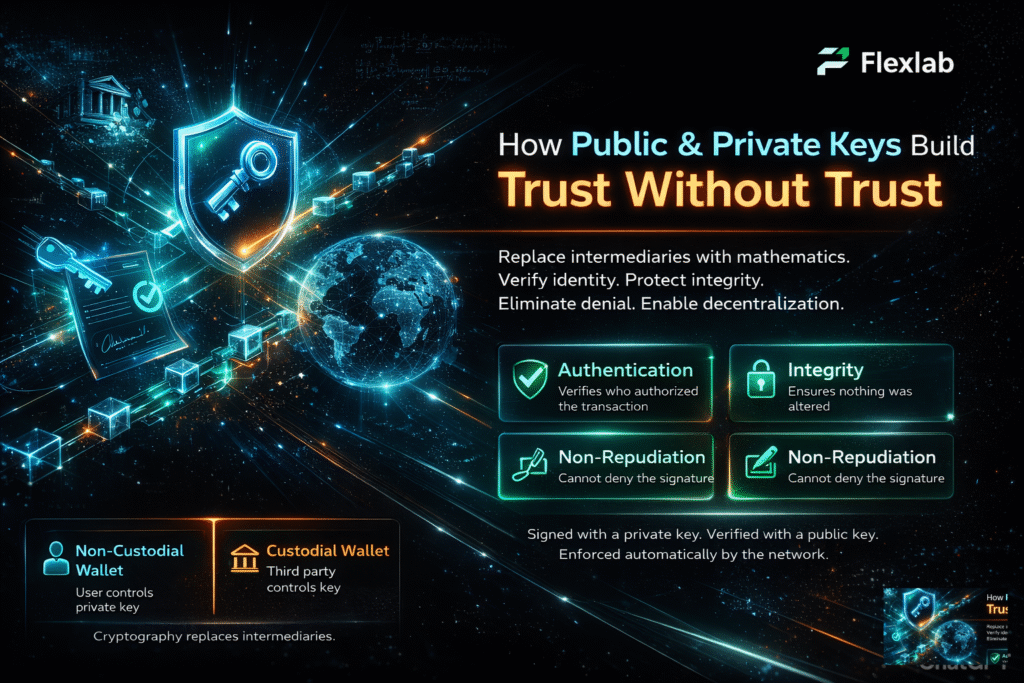

- Custodial Wallets– where your keys are in someone else’s custody.

- Non-Custodial Wallets– where you protect your own keys.

It sounds pretty simple and straightforward, but your choice of wallet is going to have a huge impact on your crypto security.

An Introduction to Custodial Wallet

What is a custodial wallet? A custodial wallet is like using a bank. A custodial wallet is basically a wallet in which the private keys are held by a third party. A company– usually an exchange such as Coinbase, Binance, or Kraken- manages your private keys, stores your funds, and deals with security matters on your behalf. It means that the third party has complete control over your funds, while you only have to permit sending or receiving payments.

With the help of a custodial wallet, consumers get a clean interface, a user-friendly app, and the ease of resetting their password if they forget it.

If you are a beginner, this setup can feel like a sigh of relief. You don’t have to worry about losing seed phrases, and there’s no technical complexity involved. Best of all, it keeps the process stress-free.

How Does It Work?

Before jumping into which crypto wallet suits your work best, let’s demystify how each of them works. Here is an explanation of how a custodial wallet works;

- Users create an account on an exchange or crypto service.

- The specific exchange or crypto service stores your crypto and secures the private keys.

- You log in and make a transaction whenever you want.

You get the access, they keep the control.

This leads to the famous phrase in crypto;

‘Not your keys, not your crypto.’

However, that does not necessarily mean that custodial wallets are not good. In fact, they are trusted and used by millions of users.

Some of the most popular examples of best custodial wallets are: Free Wallet, Coinbase, Binance, Bitgo, BitMex, and Blockchain.com.

The best part about custodial wallets is that there’s no seed phrase or native crypto knowledge needed; if you can run an email account, you can operate a custodial wallet.

What are Non-Custodial Wallets?

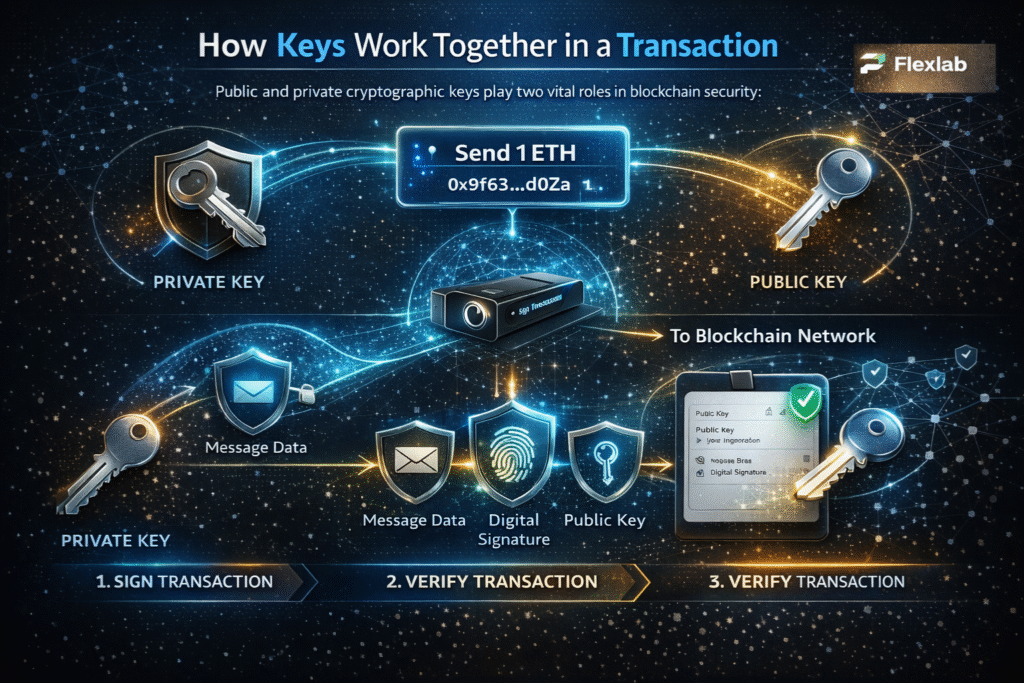

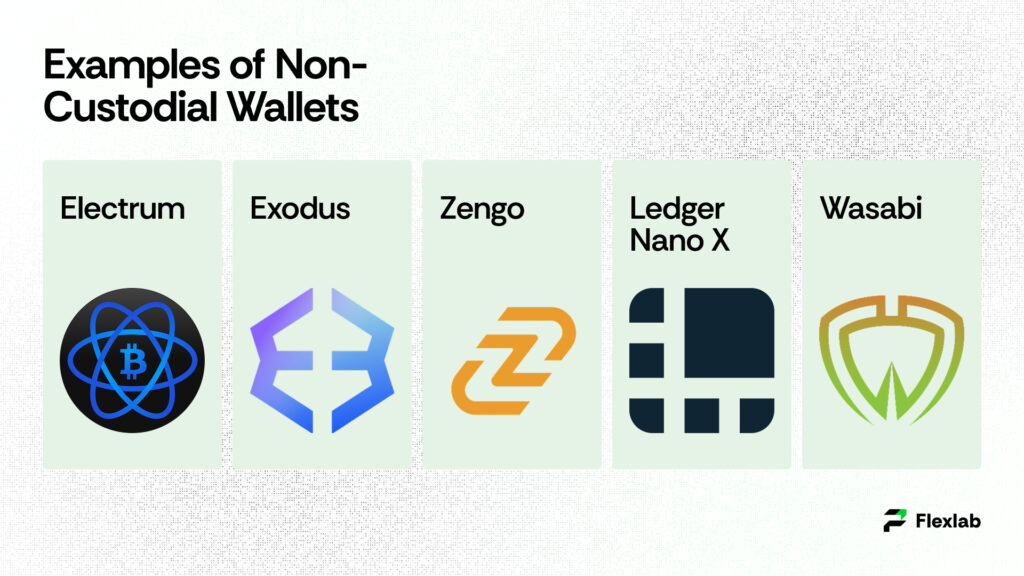

What is a non-custodial wallet? A non-custodial wallet gives you full control over your assets. You yourself hold the private keys, signing authorities, and seed phrase. No middlemen. No company or exchange is storing your funds. Hence, no one can freeze your digital assets. Basically, non-custodial wallets are self-custody wallets that directly connect you to decentralized networks, allowing interaction with DeFi and other decentralized applications. Non-custodial wallets use private key and public key pairs to access assets and allow users to execute transactions.

Another advantage of a self-custody wallet is not having to wait for withdrawal approvals, resulting in faster transaction times.

Examples of non-custodial wallets include Mobile wallets (Trust Wallet, MetaMask, Exodus), paper wallets, hardware wallets, or cold wallets (Ledger, Trezor, Keystone), Browser extensions (Phantom), and Desktop apps (Electrum, Atomic Wallets).

With great power comes great responsibility, and that’s exactly the trade-off here.

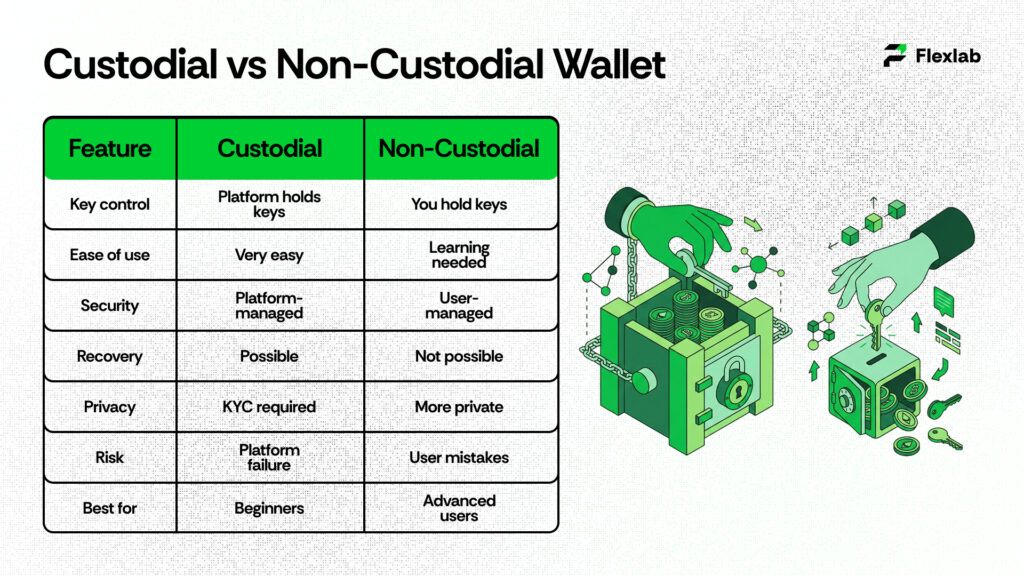

Difference Between Custodial and Non-Custodial Wallets

1. Custodian of Private Keys

The most important factor to consider while comparing a custodial vs non-custodial wallet is who actually holds and has access to private keys. When it comes to custodial wallets, third-party or middlemen hold and manage the private keys. Whereas, in the case of non-custodial wallets, all the blockchain protocols and cryptocurrency transactions are in control of the user. So, if you want to create a wallet where you can be your own bank and safeguard your virtual assets, go with the idea of creating non-custodial blockchain wallets.

However, if you want someone else to store and protect your digital assets, you grant them permission to send or receive assets.

2. Transaction Type

Another key factor to consider when comparing custodial and non-custodial crypto wallets is the type of transaction. The transactions are reflected on the chain in real time in non-custodial wallets. But transactions are not reflected in the case of custodial wallets. Non-custodial wallets lead the show when it comes to the type of transaction.

3. Security

In the case of a custodial wallet, all the sensitive user information is stored in hot and cold storage, which can be hacked by data intruders. For this reason, the custodial wallets may have security concerns unless the authoritative exchange or party implements strong security measures.

Non-custodial wallets give you full ownership of your assets, and all the sensitive information and data remain with users. This reduces the risk of data being stolen or leaked if managed responsibly. However, it is still possible if the user shares the data with the wrong person or if the device gets stolen. Both custodial and non-custodial wallets are highly secure, yet they both face some security concerns.

4. Possibility of Recovery and Backup

When it comes to backup and recovery options, non-custodial crypto wallets lag behind custodial wallets because once you lose the seed phrase, they are gone for good.

The custodial wallets keep the private key with themselves, so even if you lose the access or login information, you can still regain access by requesting the third party or the crypto exchange. However, it is not possible in the case of custodial wallets, where the user is the sole authority. The non-custodial wallets work the best for experienced traders ready to carry the great responsibility of storing the private keys safely.

Since it’s extremely difficult to recover or retrieve the lost private key, the users of non-custodial wallets need to be extra careful.

5. Transaction Time and Cost

With the custodial wallet, every transaction needs approval from the central authority. Consequently, there could be a delay in the transaction going through. On custodial wallets, the transaction costs are typically higher because of the involvement of custodians and other intermediaries.

Non-custodial wallets can authenticate transactions without involving centralized exchanges, so they are usually quicker than custodial wallets. Transaction costs on non-custodial wallets are usually lower because there are fewer or no commission-seeking intermediaries.

6. Offline Accessibility

Custodial wallets need an internet connection to reach centralized servers and access blockchain data. Therefore, custodial wallets can only operate online, making them prone to cyber attacks.

On the contrary, non-custodial wallets can operate both online and offline. A non-custodial wallet can work both from a web browser and a mobile application. However, a hardware wallet is the safest, because users can make transactions even offline, thereby protecting private keys from hackers.

7. Account Creation

For custodial wallets, users are required to complete Know Your Customer (KYC) and Anti-Money Laundering (AML) forms for security and crypto regulatory compliance. This can be a lengthy and time-consuming process.

On the other hand, non-custodial wallets do not require KYC or AML form completion. Therefore, creating a non-custodial wallet may be quicker to set up.

Which One Should You Choose?

The majority of crypto users end up using both(custodial vs non-custodial wallet). However, here is an easy guide depending on your situation;

Use Custodial Wallets If:

- You’re new to crypto

- You want a simple, beginner-friendly app experience

- You prefer recovering access if you lose your password

- You don’t want to or are unable to manage private keys

- You trade or swap crypto often

In short, custodial crypto wallets are great for beginners, traders, and casual users.

Use Non-custodial Wallets If:

- You prefer having complete ownership

- You tend to hold crypto long-term

- Privacy is your foremost priority

- You use DeFi, NFTs, or Web3 apps

- Above all, you don’t want to rely on crypto exchanges

Consequently, non-custodial users are ideal for advanced users, long-term holders, and Web3 explorers.

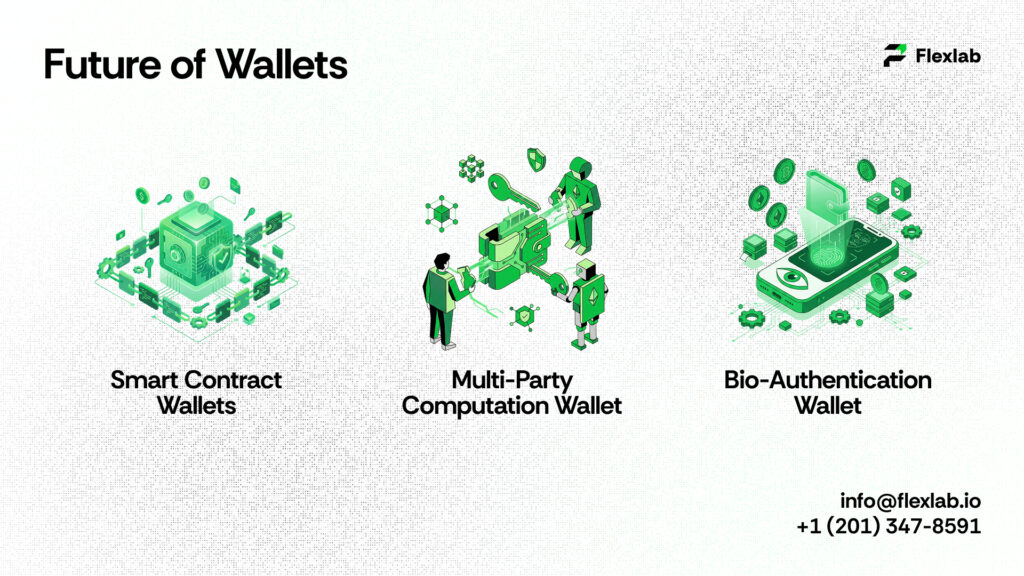

Future of Wallets: Where is It Going?

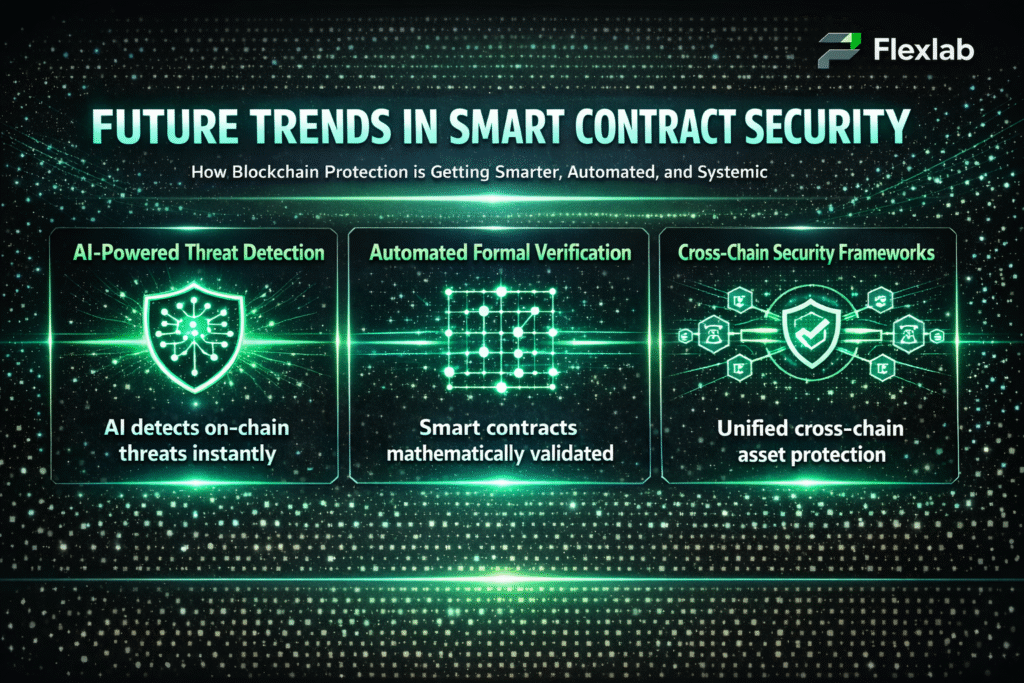

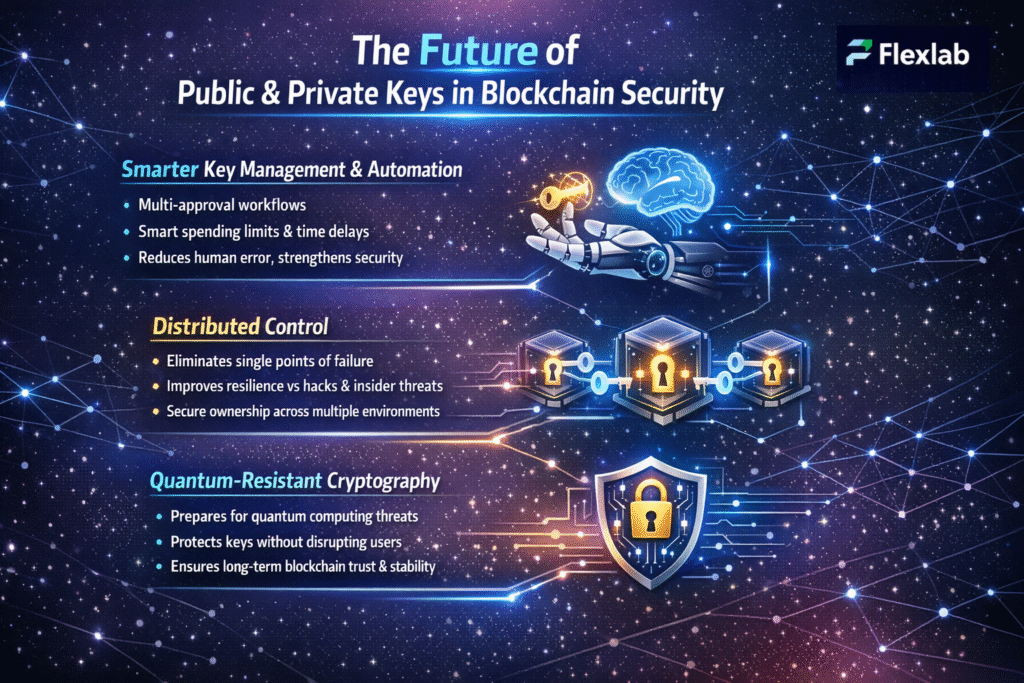

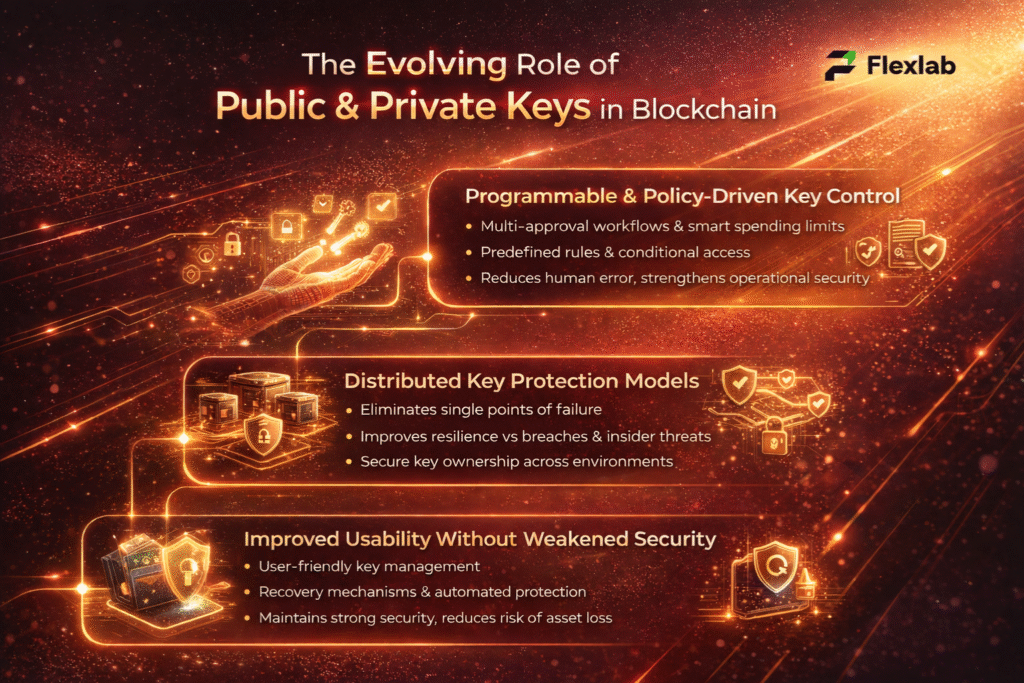

The future of wallets lies somewhere in the middle of custodial vs non-custodial wallet. We are already seeing technological advancements in this field with the invention of:

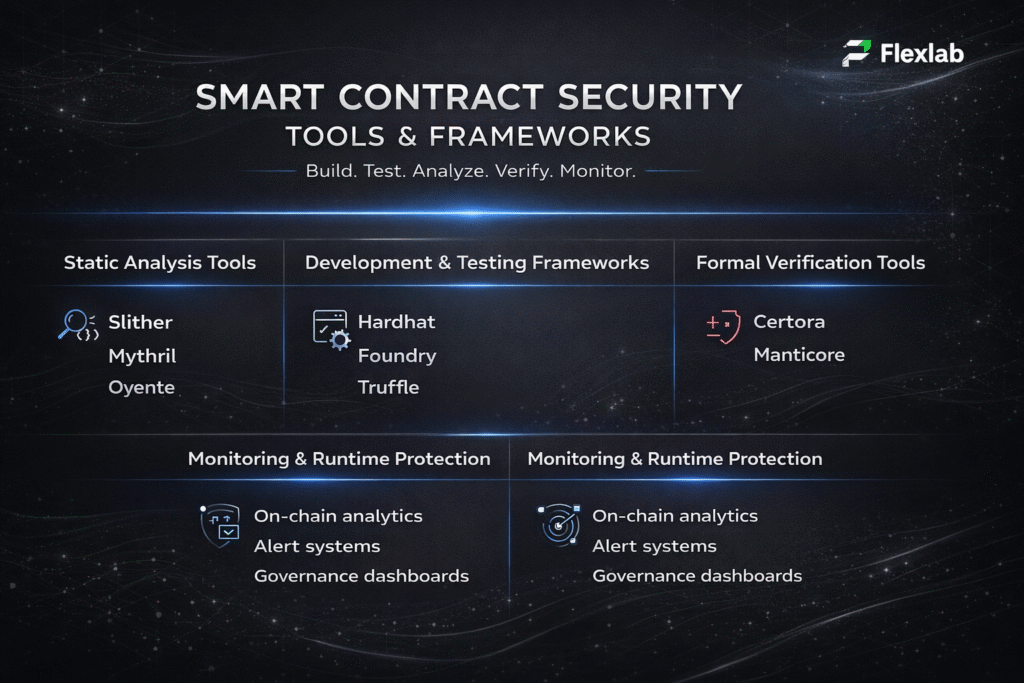

- Smart Contract Wallets: Smart contract wallets let you recover access without seed phrases. Examples of smart contract wallets include Argent and Safe Wallet. These wallets combine the convenience of custodial with the control and independence of non-custodial.

- Multi-Party Computation (MPC) Wallet: In multi-party computation, keys are split into multiple parts, so no one fully controls them— not you, not the company or exchange. It is an emerging protocol for safer and secure self-custody.

- Bio-authentication wallet: Bio-authentication wallets combine face ID pr fingerprint with encrypted hardware security. This is still evolving, but it could make crypto custody far more user-friendly.

Final Verdict: Custodial vs Non-Custodial Wallet

There is no universal winner. Only a wallet that fits your priorities and goals. Users can choose a custodial wallet if they are looking for ease. However, if your priority is to be independent or to have complete control over your assets, choose a non-custodial wallet. Also, you can choose both when you need balance, and most people do.

Crypto is not just about investment; it’s about empowerment. It does not matter which wallet you pick; in fact, the most important step is understanding how your choice affects your control, your assets’ security, and your financial freedom. Now that you have in-depth information about custodial and non-custodial wallets, you can make your decision confidently.

Start Your Crypto Journey with Flexlab

Now that you have in-depth information about custodial vs non-custodial wallet, it is time to utilize them the right way.

Starting your crypto journey should not feel risky or confusing. And for this very purpose, Flexlab has you sorted. Flexlab makes it simple to buy and sell cryptocurrency with a clean, beginner-friendly, and easy-to-use platform built for real people, not just for experts. Flexlab lets you seamlessly integrate your crypto wallets, so your assets are in your control from day one. Connect your existing wallet or set up one, then manage, send, and receive crypto without hopping on different platforms. With clear transaction flows and secure wallet connections, Flexlab removes the friction that often holds beginners back. Whether you’re holding long-term or making regular moves, Flexlab gives you a smooth, reliable way to interact with your wallet and grow confidently in the crypto space.

Ready to Grow Your Business

📞 Book a FREE Consultation Call: +1 (416) 477-9616

📧 Email us: info@flexlab.io

Discover real-world success stories in our portfolio, explore our solutions, and get your blockchain development solutions today. Contact us or have a look at our services. See firsthand what our clients say about us and how you can start your crypto journey with us.

To have more detailed insights into different topics, explore our blog page for more blogs like public vs private blockchain, benefits of using white label crypto exchanges for startups, and what is multimodal AI?

FAQs

1. Is PayPal a custodial wallet?

Yes, the global payment giant PayPal has integrated a custodial wallet for its payment operations. PayPal allows users to buy, sell, and hold bitcoin through its custodial wallet integration across its platform. PayPal manages the private keys and cryptocurrency storage on behalf of users.

2. Can I lose my crypto with a non-custodial wallet?

Non-custodial wallets eliminate third-party vulnerabilities, but there’s a trade-off. If you lose your private key or seed phrase, there’s no way to regain access or recover your crypto. So, yes, security of your non-custodial wallet is in your hands.

3. What is the 30-day rule in crypto?

The 30-day rule in crypto usually refers to a tax rule where you can’t sell a crypto asset at a loss and buy the same asset again within 30 days to claim that loss for tax benefits. It’s meant to prevent “wash trading” for tax reduction, though how it applies depends on your country’s tax laws.