The Impact of Blockchain Audit on DeFi, NFT, and Web3 Ecosystems

MVP Development in Blockchain | What is Web3 | Blockchain App Development

Big hacks are still rocking the Web3 applications world, showing continuous smartness every year. Recall the Ronin bridge hack in 2022? That massive breach set the stage for what was coming next. By 2024, there were over 300 major incidents, around $2.2 billion in losses across DeFi and the blockchain ecosystem.

Then 2025 hit even harder. Bybit reportedly lost $1.5 billion, Cetus lost $223 million in just minutes, and GMX v1 took a $40 million hit. What’s even more alarming is that off-chain attacks, which happen outside smart contracts, made up more than 80% of total losses in 2024. To make matters worse, AI and automation-driven exploits rapidly increased by over 1,000% year over year, as hackers are now combining artificial intelligence with blockchain vulnerabilities.

These failures shake trust. Users fear losing funds. Teams ship slower, investors hesitate, and real adoption stalls. That hurts everyone building in DeFi, NFTs, and Web3 ecosystems. In a nutshell, blockchain audits become mandatory. It is the first line of defense against evolving threats in DeFi, NFTs, and Web3 applications.

The fix starts before launch. A focused blockchain audit finds logic bugs, oracle risks, key management gaps, and access controls that attackers hunt. Identify issues early, then patch, retest, and monitor. In October 2025, as DeFi TVL and non-fungible tokens (NFT) activity rise again, the cost of skipping audits continues to increase.

Here is what you will get from this post. We will explain how audits work for DeFi blockchain protocols, NFT mints and marketplaces, and Web3 applications. We will share real cases, checklists, and quick wins that followed immediately.

If you run a private blockchain, marketplace, wallet, or L2, do not wait. An audit is less expensive than a post-mortem, and it’s better for your brand in the long term. Ready to protect users and grow with confidence? Reach out to our Flexlab team for a blockchain audit and a fast security review.

Understanding Blockchain Audits, Why They Matter

In the rapidly expanding world of distributed ledger technology, trust and transparency are key factors. Whether it’s a new DeFi platform, NFT project, or layer-one blockchain, users want to know their data and funds are secure. That’s where blockchain audits step in to ensure everything runs safely. They act as a crucial safety check, ensuring that the blockchain architecture running behind these digital systems is reliable, efficient, and designed to run smoothly without hidden risks.

What is a Blockchain Audit?

A blockchain audit is a detailed review of the code, systems, and operations behind a blockchain-based project. It focuses on examining smart contract security, blockchain protocols, and how data flows through the peer-to-peer network to ensure everything works securely and efficiently.

The primary objective of a blockchain audit is to identify bugs, security vulnerabilities, or design weaknesses before they can lead to real-world issues, such as hacks, data loss, or financial loss.

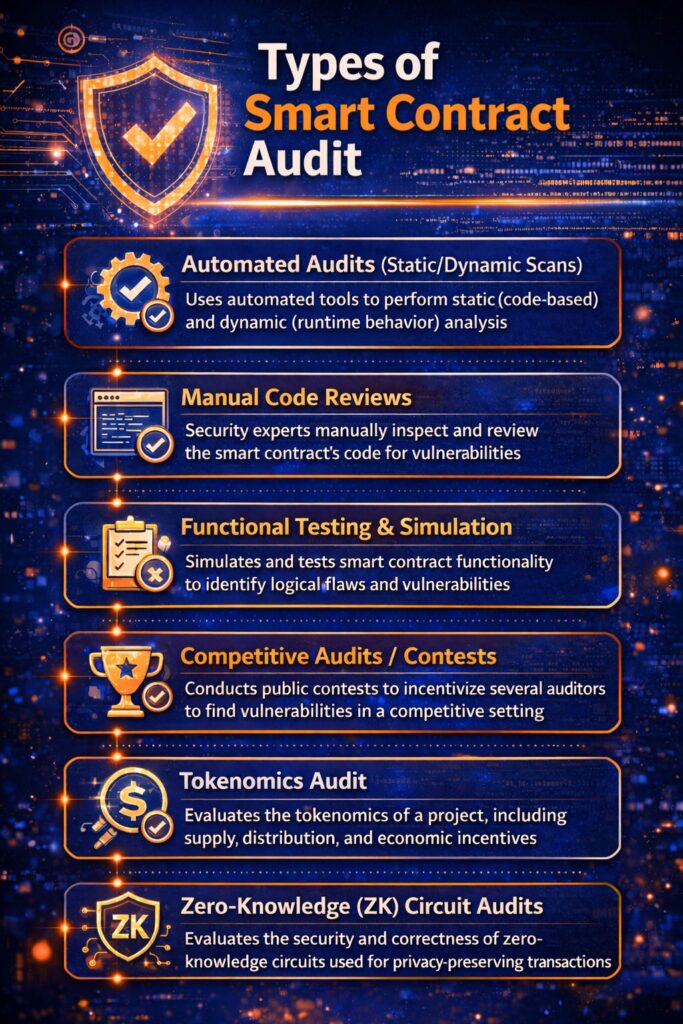

Audits are performed by independent blockchain developers or specialized security firms such as Flexlab. They utilize a combination of automated tools, manual code reviews, and test simulations to ensure the project behaves as intended.

In short, a blockchain audit builds trust, transparency, and confidence, protecting users, funds, and the overall reputation of the project. Most projects schedule audits before launch or after major updates to maintain high regulatory compliance and security integrity.

In the advanced blockchain world, the smallest coding mistake can lead to massive financial losses or irreversible damage. This is the reason that blockchain security audits play such a crucial role in building trust, protecting user assets, and ensuring long-term project success.

Why Blockchain Audits Matter?

Blockchain audits are essential because they help to prevent costly mistakes and protect users from irreparable harm. In decentralized systems, once a smart contract is implemented, it’s nearly impossible to change, meaning any bug or loophole can be exploited instantly and permanently. Some important points are mentioned below to describe why blockchain audits matter:

-

Catch Errors before Launch

Audits help developers identify and fix bugs, logic flaws, or misconfigurations before the platform goes live. This action reduces the risk of hacks or system failures that could hurt the project’s reputation in the industry.

-

Protect User Funds and Data

A well-audited blockchain system ensures that users’ assets and personal information are safe from theft, manipulation, or unauthorized access. This is especially critical in DeFi platforms and NFT marketplaces where large sums and sensitive data are at stake.

-

Build Trust with Users and Investors

When any project is audited, it signals transparency and accountability. Users feel more secure and confident when using the platform, and investors are more likely to support it knowing that blockchain experts have addressed risks.

-

Meet Legal and Regulatory Requirements

Audits help platforms comply with international standards such as GDPR, ISO 27001, and financial regulations. This is essential for long-term growth and for working with financial institutions such as banks, governments, or enterprise clients.

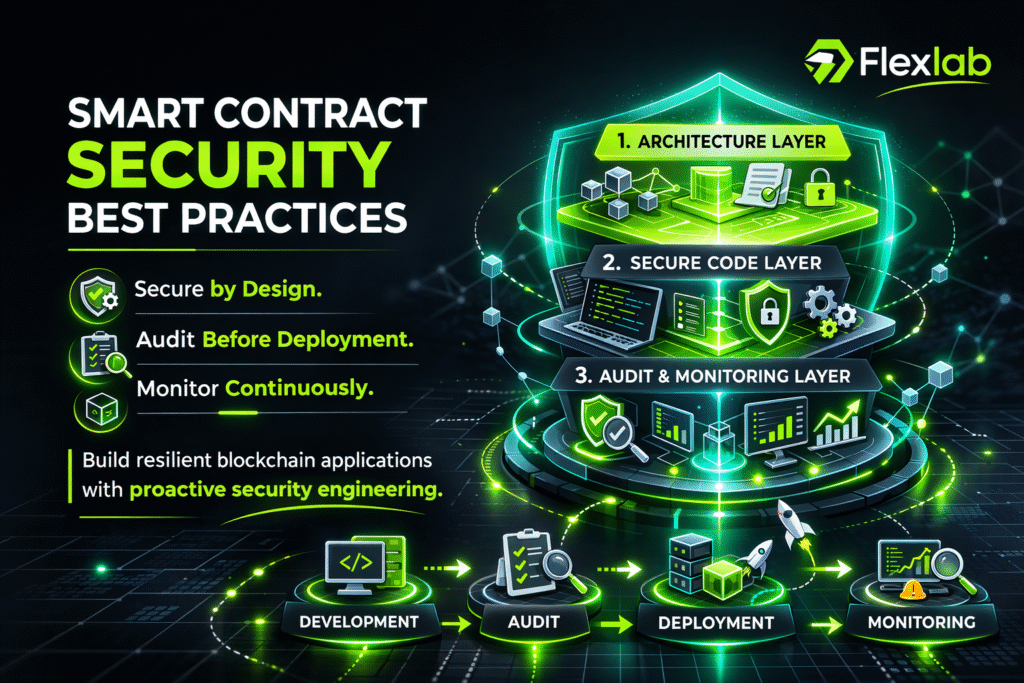

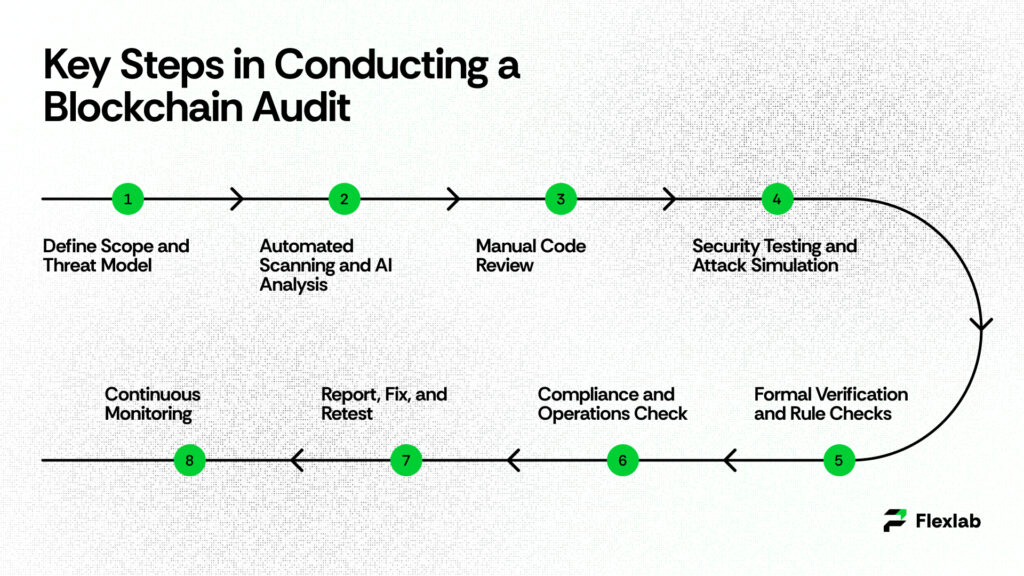

Key Steps in Conducting a Blockchain Audit

The steps mentioned below describe how audit firms and security teams run secure, fast audits in 2025. Each step eliminates risk at a different layer, which is why skipping any one step leaves a gap.

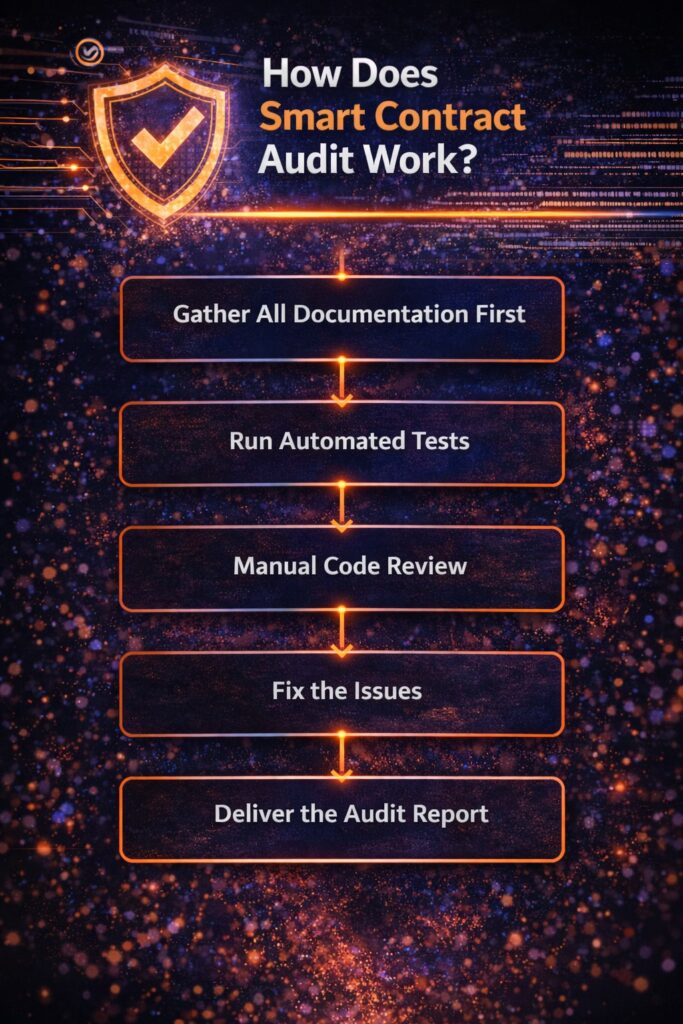

1. Define Scope and Threat Model

When defining your audit scope, include contracts, proxies, upgraders, scripts, oracles, admin multisigs, bridges, chain IDs, and external dependencies. A well-defined scope is crucial, as it helps prevent blind spots that often highlight security risks.

Notably, many DeFi incidents originate in upgrade flows or external calls rather than within the main contract. To minimize such risks, document roles and assumptions, and map out potential attack surfaces across your blockchain technology to prevent blind spots.

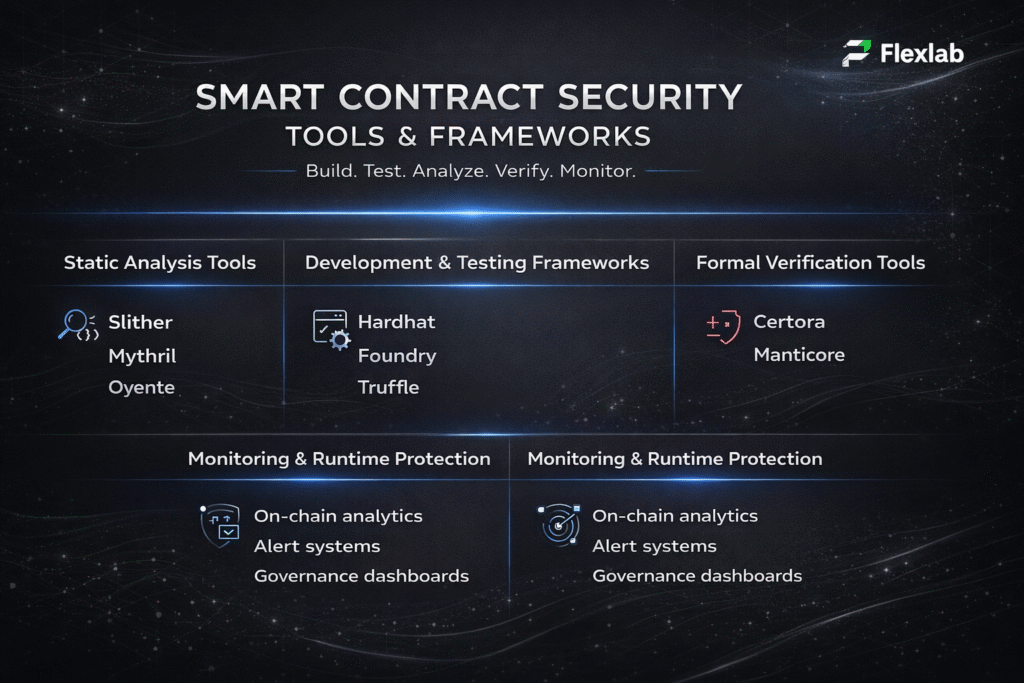

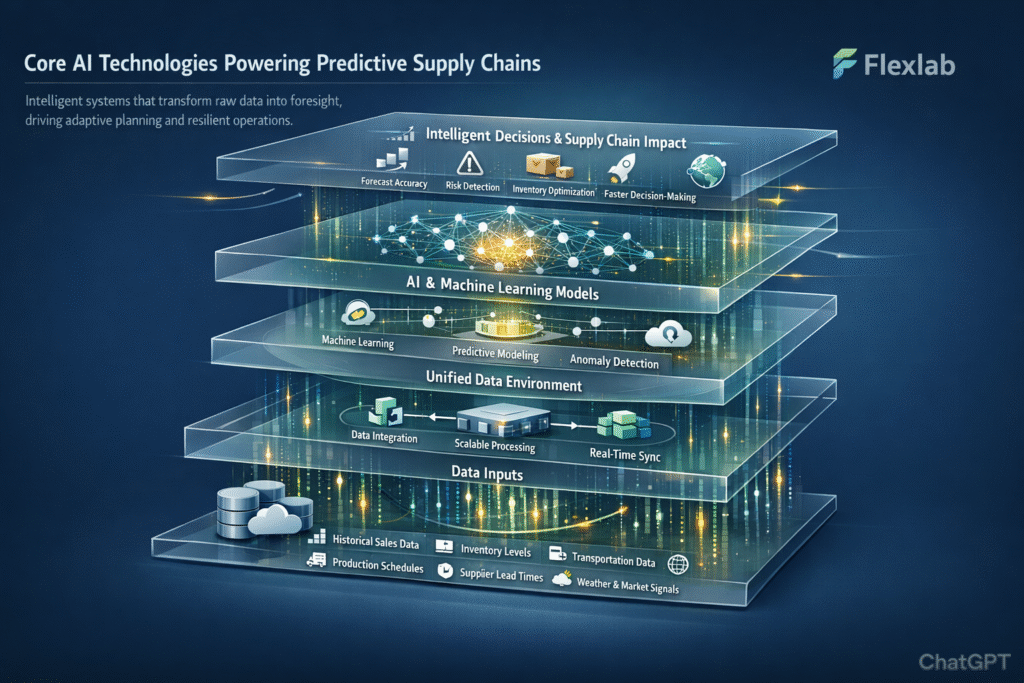

2. Set up Automated Scanning and AI Analysis

To strengthen your audit workflow, set up AI and automation tools that run static analysis, linters, dependency checks, known-vulnerability signatures, and AI-based pattern matching.

Automation is essential because it quickly detects low-hanging bugs and flags risky patterns across large codebases. With the 2025 upgrade, AI analyzers can now cluster findings by risk level, making the review process faster and more focused.

This approach allows security teams to prioritize high-impact issues and dedicate human expertise where it is most essential.

3. Manual Code Review by Senior Engineers

During the process, senior engineers review the code line by line. As they do so, they track how data changes and ensure that it follows the established rules. Consequently, this thorough review enables the detection of logical errors, money flaws, and hidden access issues that are typically missed by automated tools.

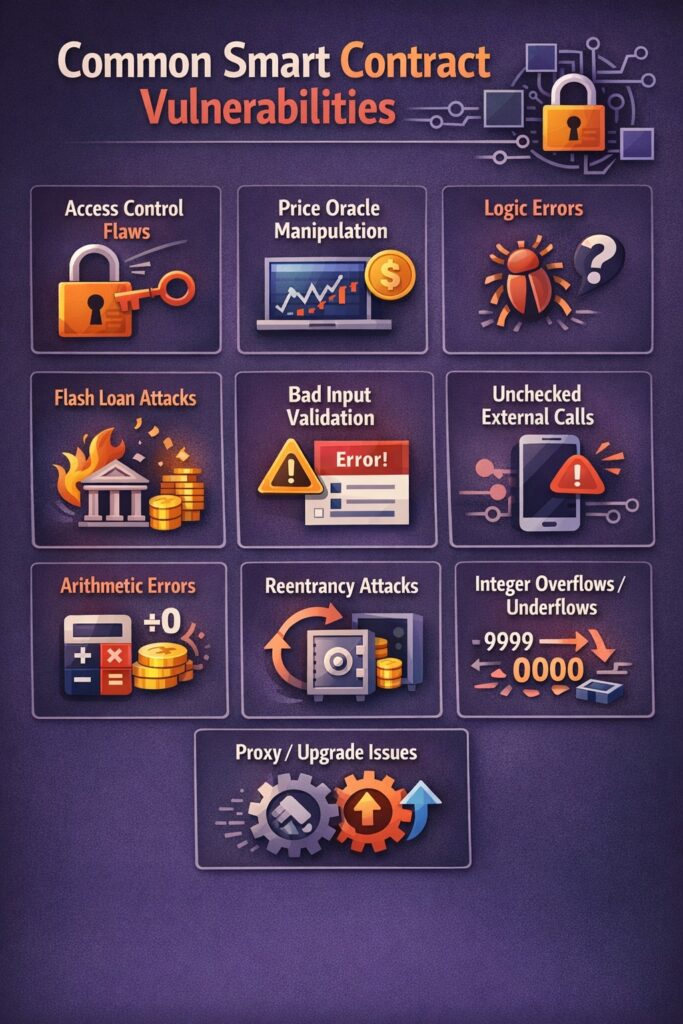

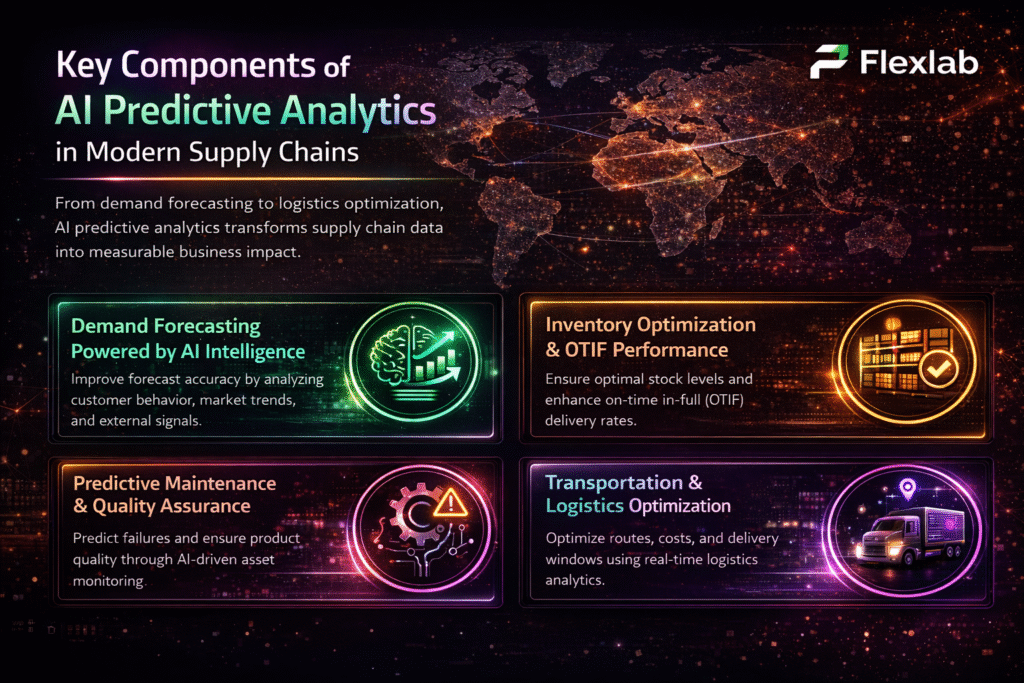

In DeFi projects, experts examine reentrancy bugs, price oracle use, rounding, interest math, liquidation paths, and asset interactions.

In NFT projects, they focus on mint limits, allowlist logic, metadata freezing, marketplace approvals, and royalty settings. Senior auditors also manually inspect smart contract security to detect logic errors and hidden access flaws. For NFTs, they review ERC 721 and ERC 1155 minting standards to ensure safe and compliant transactions.

4. Security Testing and Attack Simulation

We run multiple tests to find weak spots before attackers do. These include fuzzing, property-based testing, testnet forks, and targeted attacks on off-chain parts such as APIs, signers, and bots.

This matters because many 2024 losses came from off-chain issues. Testing both code and operations helps close those gaps.

Examples are: For DeFi, we simulate oracle delays, MEV attacks, and liquidity shocks.

For NFTs, we stress test batch mints, operator approvals, and freeze–unfreeze actions.

5. Formal Verification and Rule Checks

We verify core math and economic rules using advanced zero-knowledge proofs to validate blockchain protocols without revealing sensitive data. In turn, this helps lower the risk in important contracts such as vaults, bridges, and stablecoins. However, it’s best to use these checks specifically on high-risk components to ensure the greatest value for the effort invested.

6. Compliance and Operations Check

Assure that admin controls, key handling, access reviews, logs, and incident plans are all in one place. Even secure code can fail if operations are weak. Clear records, open reports, and stablecoin disclosures build trust with users, partners, and regulators.

7. Report, Fix, and Retest

Once issues are identified, share a clear report with supporting evidence, detailed impact information, and straightforward fixes. Focus on what matters most and act fast. A quick patch and retest cycle reduces the chance of attacks. Finally, publish a concise, redacted report so your community is aware of the improvements made and the reasons behind them.

8. Continuous Monitoring

Keep an eye on your system at all times. Add alerts, track unusual activity, and monitor signers or contract upgrades. Threats change fast, so constant checks help to detect new issues and live incidents before they cause any damage.

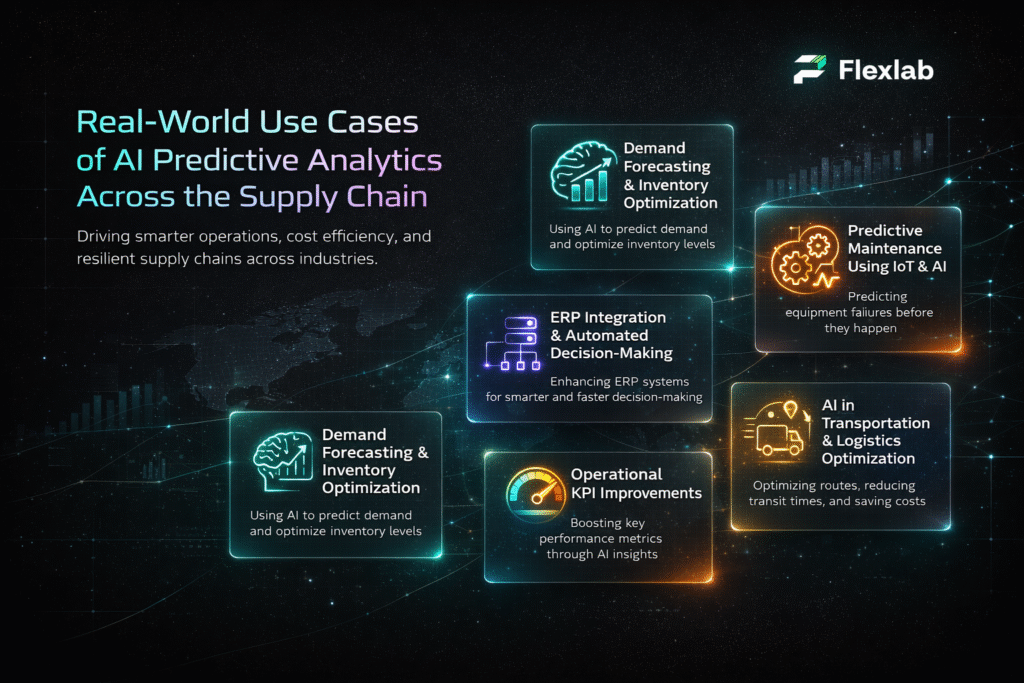

Quick Use Cases You Can Relate To

Let’s briefly check how this works in real life. In a stablecoin vault, AI scans can identify risky math errors in interest calculations, helping fix rounding issues before they drain yield.

For an NFT mint, testing tools catch bugs that could allow unlimited minting, saving the creator revenue. Moreover, in a perpetual DEX, simulations can reveal liquidation problems caused by delayed price feeds, leading to a secure trading buffer.

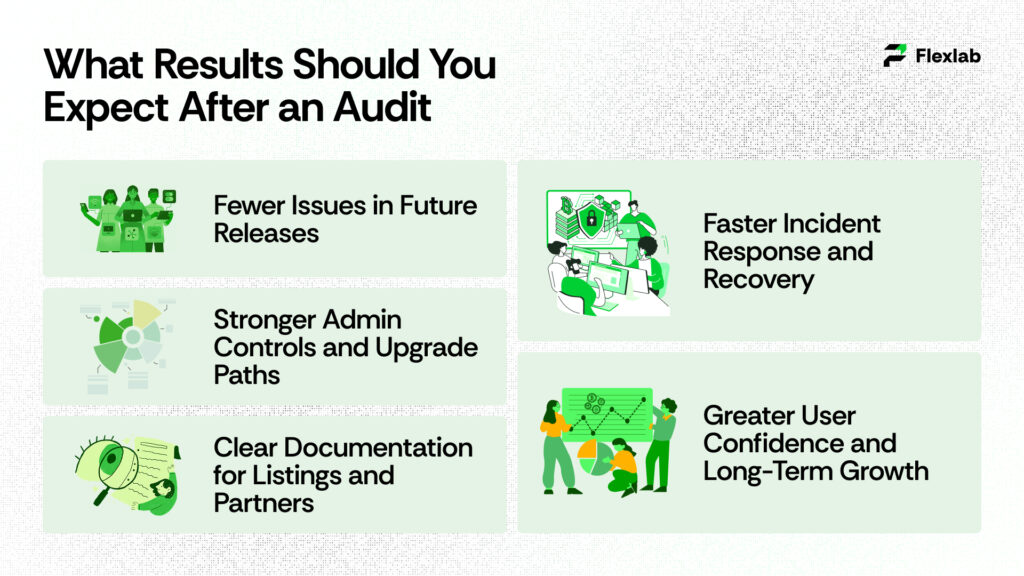

What Results Should You Expect After an Audit?

A good blockchain audit delivers lasting peace of mind. You will notice fewer major issues in future releases and enjoy stronger admin controls with secure upgrade paths.

Your project will have clear documentation ready for listings, partners, and exchanges, making it easier to build trust and grow. When alerts go off, your team will respond faster because everything is better organized and verified.

At Flexlab, we combine expert auditors with AI-powered tools to make this process faster and more accurate. We help you identify hidden risks, strengthen your contracts, and prepare your project for confident, secure long-term growth.

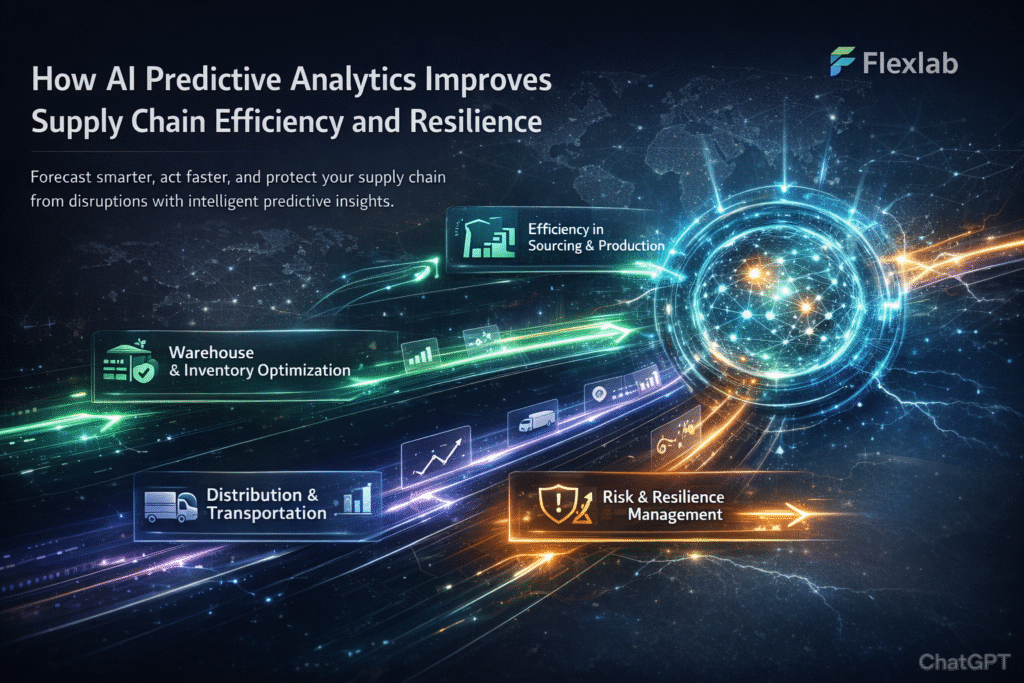

How Blockchain Audits Boost Security in DeFi and NFTs

Security isn’t just about code; it’s about people, operations, and how your system reacts when markets move fast. Audits give you a structured way to test all of that before attackers do. That’s why Flexlab’s right-fit audit programs for DeFi protocols and NFT platforms help reduce losses, speed up listings, and maintain community confidence when others are struggling. In a space where one exploit can erase years of trust, proactive auditing turns uncertainty into resilience, helping projects stay strong even in volatile markets.

Preventing Major Hacks and Financial Losses

DeFi platforms and NFT projects often lose funds in ways that could have been avoided. weak upgrades, broken mint rules, missing access checks, or flawed price logic. Big hacks prove the risk.

A proper audit changes that whole scenario. It identifies areas where things can fail and the potential damage that could result, before it happens. Audits catch reentrancy bugs, bad oracle logic, unlimited NFT mints, admin privilege leaks, and weak key handling.

Think of it as turning unknown risks into a simple, clear, fixed list. That list costs far less than a breach and gives real peace of mind. Practically means that:

- Stablecoin projects added buffers and limits to protect collateral.

- NFT drops test mint limits and approvals to stop fake collections.

- Bridges and L2s check signer rules and replay protection for secure transfers.

Conclusively, most losses arise from known issues. A smart, detailed audit finds and fixes them before attackers do.

Building User Trust and Meeting Regulations

Trust and compliance now go hand in hand in Web3. A public audit report is a technical document; it is the proof that your team takes security and responsibility seriously. When users and partners can access your audit summary, changelog, and retest notes, confidence grows naturally.

In 2025, being audit-ready is as important as being listing-ready. Projects are expected to show:

- Clear admin roles and transparent upgrade rules.

- Open documentation on token mechanics and controls.

- KYC and AML checks were needed for user safety.

- Regular security reviews as the code and tools evolve.

The reason it matters is simple: global regulations are tightening. Non-compliance can now cost a million in penalties or lost partnerships. In the U.S., clearer crypto rules mean stronger demands for audit-backed disclosures and record-keeping. Moreover, as banks are involved in digital custody, the bar for audits and security logs is rising. Here’s how audits make it easier:

- Public summary report: shows what was tested and fixed.

- Controls review: verifies admin permissions and safety delays.

- Monitoring setup: adds alerts for key changes and large transfers.

- Readiness pack: a small folder with your audit report, policies, and response plan ready for partners and exchanges.

Overall, audits simplify compliance and security by providing clear documentation and safeguards. In addition, a public summary report outlines what was tested and fixed, thereby ensuring transparency. Furthermore, the controls review verifies administrative permissions and safety delays to maintain proper oversight. Finally, continuous monitoring adds alerts for critical changes and large transfers, thus enhancing real-time security.

Finally, a readiness pack compiles the audit report, key policies, and response plan into a concise folder, making it easy to share with partners and exchanges.

Therefore, transparency builds lasting trust. When your project ships with a verified audit, clear fixes, and active monitoring, users feel safe, and that’s what keeps them engaged.

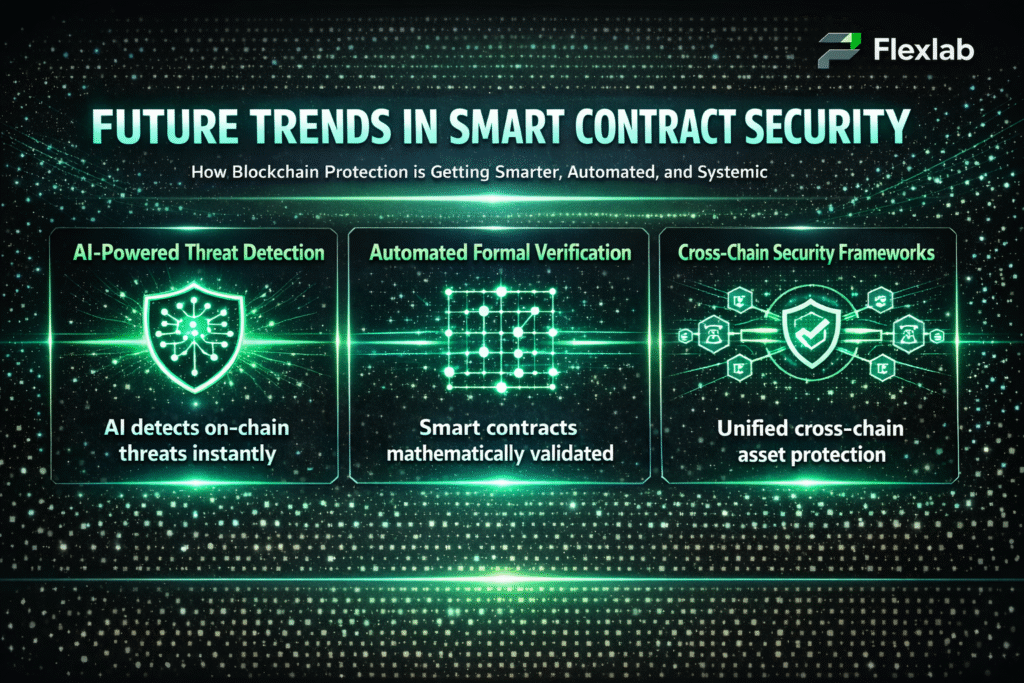

Emerging Trends and Best Practices for Web3 Audits in 2025

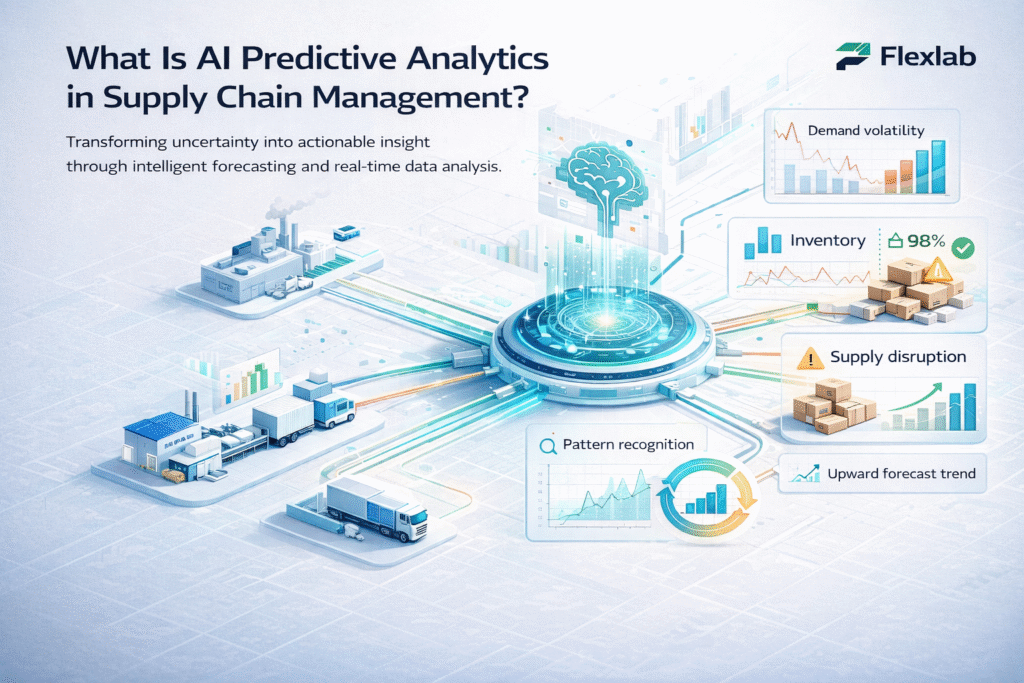

Web3 security is evolving fast. In 2025, attackers no longer just target smart contracts; they also go after bots, admin keys, and upgrade systems. That’s why modern audits now focus on the entire stack, not only the code.

The new approach is all about continuous protection. Security is not a one-time task; you review, patch, and retest after every update. Audits now cover everything: smart contracts, APIs, signers, oracles, and even front-end apps; however, most losses often occur due to off-chain gaps.

AI tools help spot potential risks quickly, but final reviews still rely on senior auditors who can judge the real-world impact. Teams also use selective formal testing, applying deep verification only where it matters most, such as vaults, bridges, and stablecoin logic.

To stay safe, it’s essential to develop strong controls, multisigs, time locks, and clear admin roles so that the chances of misuse are reduced. Moreover, the best teams don’t stop there—they continually learn and share. By studying new hacks, identifying attack patterns, and publishing their findings, they help keep the entire community informed and resilient.

Hence, Web3 security isn’t just a checkbox; it is a culture. Train your team, stay alert, and grow by embedding security into every stage of development, from smart contract design to ongoing monitoring. Do remember that in a decentralized world, trust is your strongest currency.

With Flexlab’s audit solutions, you get continuous protection, AI-powered insights, and expert guidance to keep your Web3 stack resilient and future-ready.

Real-World Examples of Successful Audits

-

Ronin Network

After a major hack, Ronin strengthened its defenses by adding more validators, improving key management, and enhancing its encryption protocols as part of reinforcing its blockchain architecture. This continuous monitoring ensures safe updates and stronger fund protection.

-

CertiK DeFi Reviews

CertiK’s audit data revealed common issues in oracles and bots, helping teams focus on real risks. By testing oracles, limiting withdrawals during periods of high volatility, and verifying vault logic, early projects can avoid costly errors. For deeper insights, check the trend takeaways in Hack3d H1 2025.

-

Deloitte Web3 Programs

Deloitte works with enterprises to combine audits, compliance checks, and role mapping, building transparency and trust with both regulators and users. Keeping audit records and clear admin plans ready helps speed up approvals and boost credibility. See Deloitte’s overview of enterprise Web3 programs.

Ultimately, Real audits prevent real losses. With Flexlab, expert-led audits and live monitoring to keep your project secure and trusted.

Explore How Flexlab Delivers Blockchain Audit Excellence

Empower your vision with secure and scalable blockchain solutions. Whether you’re building a DeFi platform, launching an NFT marketplace, or expanding a Web3 application, Flexlab is the partner you can count on. As a trusted blockchain development company, Flexlab provides full-cycle services, including smart contract audits, protocol design, and compliance consulting.

Ready to Launch Your Blockchain Project?

📞 Book a FREE Consultation Call: +1 (416) 477-9616

📧 Email us: info@flexlab.io

Our team utilizes AI and automation to detect vulnerabilities early, and we specialize in securing platforms built on ERC 721, ERC 1155, and private blockchain frameworks. You can explore our portfolio to see how we’ve empowered clients to develop safer, scalable blockchain ecosystems. For insights on smart contract security, Web3 trends, and audit strategies, visit our blog page.

For foundational context and clarification, read What Are Smart Contracts? How Do They Work? A Beginner’s Guide. For NFT projects, don’t forget to cover mint rules, royalties, and marketplace hooks. You can learn more in What are NFTs and How Do They Work in Real Life?.

Ready to take the next step? Contact us to discuss your project, or connect with us on LinkedIn to stay updated about blockchain security innovations.

Closing Insights: Blockchain Audit Is the New Trust Layer

Blockchain audit is no longer optional. It’s the trust layer that enables secure DeFi, reliable NFTs, and resilient Web3 applications. It protects users, satisfies regulators, and empowers blockchain developers to innovate safely.

Whether you’re building a new protocol, launching an NFT collection, or scaling a Web3 platform, an audit should be part of your strategy from day one. The blockchain ecosystem depends on it.

FAQs

1. What are the most common mistakes teams make before a blockchain audit?

One of the biggest mistakes teams make is rushing into audits without defining a clear scope or understanding their system’s dependencies. This lack of preparation often results in missed vulnerabilities or incomplete reviews. Many teams also fail to document code changes or admin roles, which can slow down the audit process. Proper planning, documentation, and early involvement of auditors make the entire process faster, more effective, and cost-efficient.

2. How often should blockchain projects get audited?

Blockchain audits shouldn’t be treated as one-time tasks. A comprehensive audit is recommended before launch, followed by additional audits after every major upgrade, code change, or feature release. Continuous monitoring and smaller re-audits after every 6–12 months help detect new risks introduced by evolving threats. This proactive approach ensures consistent security and maintains user trust.

3. What’s the difference between a blockchain audit and a smart contract audit?

A blockchain audit reviews the technical and operational ecosystem, covering smart contracts, APIs, admin controls, bridges, and off-chain systems, to ensure total platform security. In contrast, a smart contract audit focuses solely on analyzing the logic, vulnerabilities, and code behavior within the contract itself. Together, they provide complete protection, ensuring your blockchain project is both technically sound and operationally resilient.