What Are Crypto Wallets and Why Do They Matter?

MVP Development | Blockchain App Development | Blockchain and IoT

Are you in the same boat, thinking what are crypto wallets, and why are they important? If you’re stepping into the world of cryptocurrencies, understanding crypto wallets is essential. These digital or physical tools are your gateway to securely access, manage, and move your crypto assets and NFTs across various blockchain networks like Bitcoin, Ethereum, and Solana.

Want to learn how these wallets work and why they matter? Let’s dive into this helpful, detailed guide to get you started confidently.

What are Crypto Wallets?

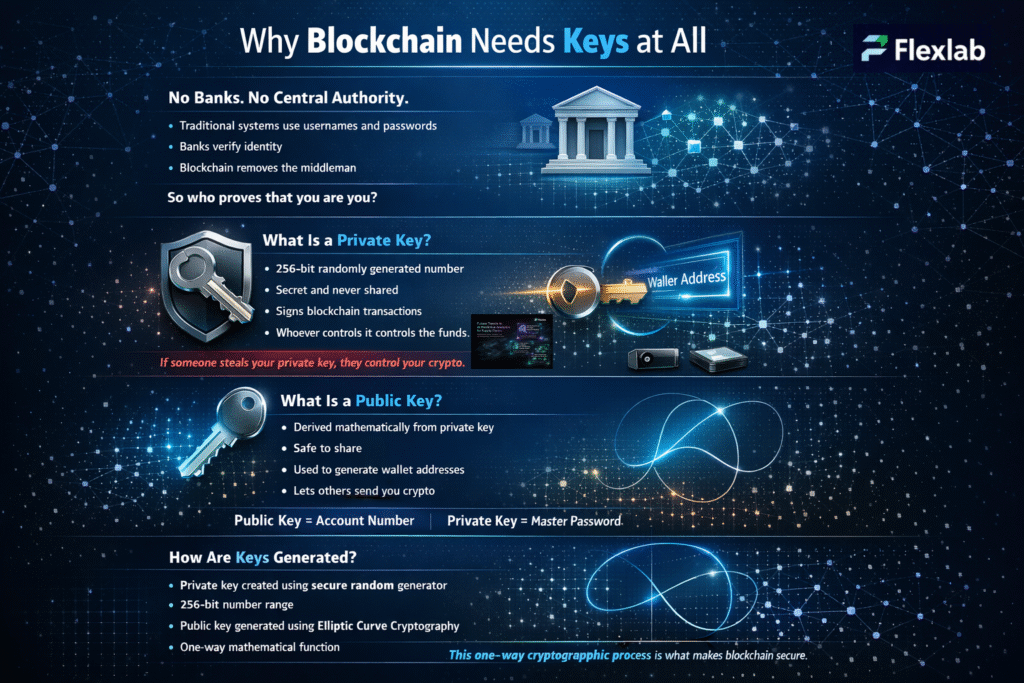

Crypto wallets are digital and physical solution that allows you to access, manage, transact, and secure your cryptocurrencies and non-fungible tokens (NFTs) on several blockchains. A crypto wallet does not hold your money directly. Instead, it secures your private key, permitting you to access your digital assets that live on blockchain networks such as Bitcoin, Ethereum, and Solana.

These wallets store the cryptographic keys needed to authorize transactions, rather than the cryptocurrencies themselves. This means your assets are always stored on the blockchain, but your wallet serves as a gateway to control and move them. Crypto wallets come in different forms, including software applications on mobile and desktop, browser extensions, and physical hardware devices designed for cold storage.

Crypto adoption continues to grow rapidly. As of 2025, there are over 559 million crypto users worldwide, underscoring the growing importance of secure, user-friendly wallets for managing digital investments. Crypto adoption statistics estimate that the crypto wallet market will reach a value exceeding $7.98 trillion by 2030, driven by rising demand for digital assets and blockchain integration in finance and other sectors. This makes selecting the right crypto wallet critical for safely navigating the expanding blockchain ecosystem.

Why are Crypto Wallets Important?

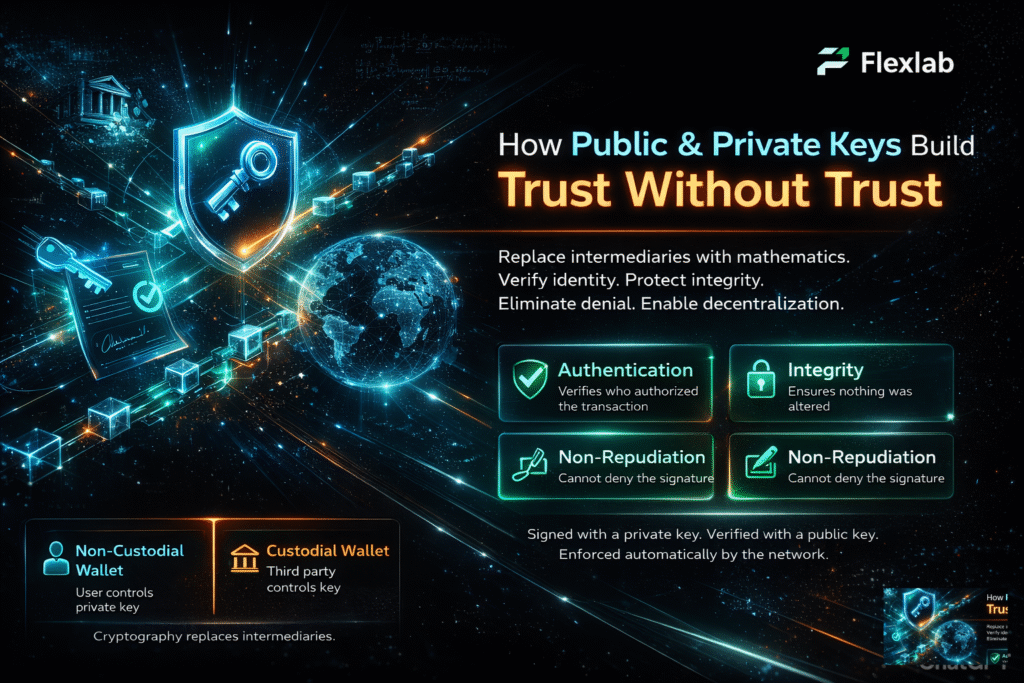

Crypto wallets are important because they provide a secure interface and the necessary keys to access, manage, and transact with digital assets on the blockchain. It allows you full ownership and control over your funds. It safeguards your cryptographic keys (public and private keys) that are required to access your holdings.

- A public key is like your bank account, which is used to receive funds

- A private key is like a password that is only used for transactions

If you lose your private keys, you end up losing your access to your money. That’s why it’s crucial to save your crypto wallet.

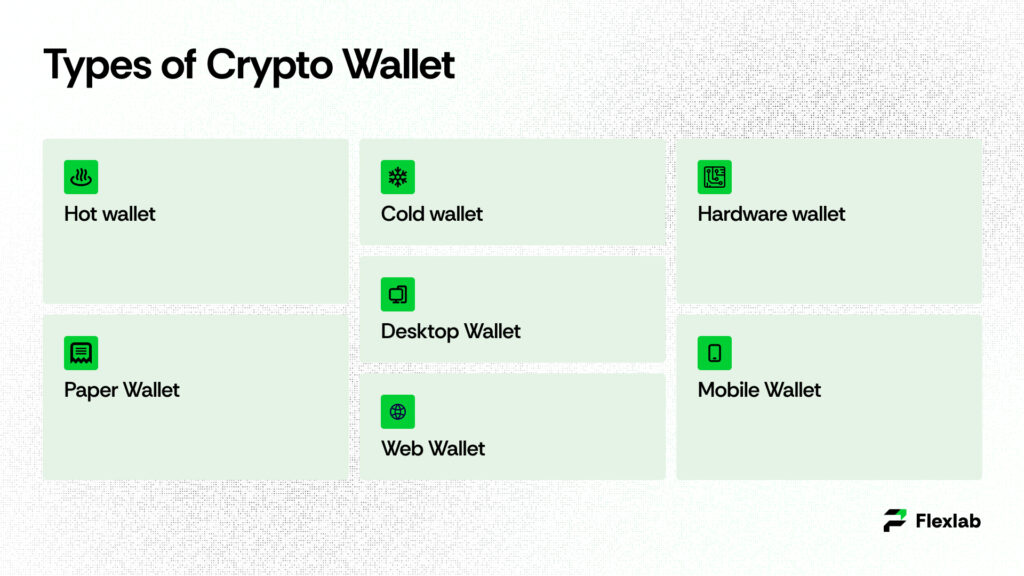

Types of Crypto Wallet

There are different types of crypto wallets you can use to store and manage your digital assets. Each type has its own features, pros, and cons, making some better suited for beginners, while others are preferred by advanced users.

-

- Hot wallet

- Cold wallet

- Hardware wallet

- Paper Wallet

- Desktop Wallet

- Mobile Wallet

- Web Wallet

-

Hot Wallet

Hot wallets are basically those digital wallets that are connected to the internet, like a desktop, mobile, or web wallet. This type of wallet is easy to use and convenient, especially for those who trade or use their crypto in daily transactions. Due to their user-friendly interface, these wallets are well-known to both beginners and experienced users. However, it can also be vulnerable to hackers.

-

Cold Wallets

Cold wallets store keys offline and do not require internet connectivity. This type of wallet uses physical devices such as USB drives and a piece of paper. They offer a higher level of isolation, which is good for long-term storage. These wallets are best who do not access funds frequently or hold significant amounts of crypto. However, to leverage your cold wallet, you need to connect your cold wallet to an online device, transfer the funds to a hot wallet, and then proceed with your transactions.

-

Hardware Wallets

Hardware wallets are a popular kind of cold wallet. They are small physical devices made specifically to secure your private keys offline. When you want to send money, you connect the hardware wallet to your computer or phone and confirm the transaction on the device. Hardware wallets are considered one of the safest ways to store crypto because they are immune to online attacks, but you must always keep them in a safe place to prevent loss or theft.

-

Paper Wallets

Paper wallets are simple; they are printed pieces of paper or physical documents that contain your public and private keys, often in the form of QR codes. Since there’s no digital storage, paper wallets protect your crypto from online threats entirely. However, they can be lost, stolen, or damaged easily, so storing them securely, like in a safe or safety deposit box, is essential.

-

Desktop Wallets

Desktop wallets are software programs that you download and install on your computer. They store your keys locally on your device instead of online servers. Desktop wallets provide a good balance between security and convenience since you control your keys, but you do need to keep your computer free from viruses and malware.

-

Mobile Wallets

Mobile wallets are apps you install on your smartphone. They let you quickly send and receive cryptocurrencies on the go. Mobile wallets are very convenient, often supporting QR code scanning for easy payments. However, because your mobile device connects to the internet, these wallets are classified as hot wallets and carry some risk of hacking if your phone is compromised.

-

Web Wallets

Web wallets run in your browser and store your private keys either locally or on their servers. They’re accessible from any device with an internet connection, making them very convenient. But because some web wallets store keys on central servers, users must trust the provider’s security. These wallets are more vulnerable to phishing scams and hacks compared to non-custodial wallets.

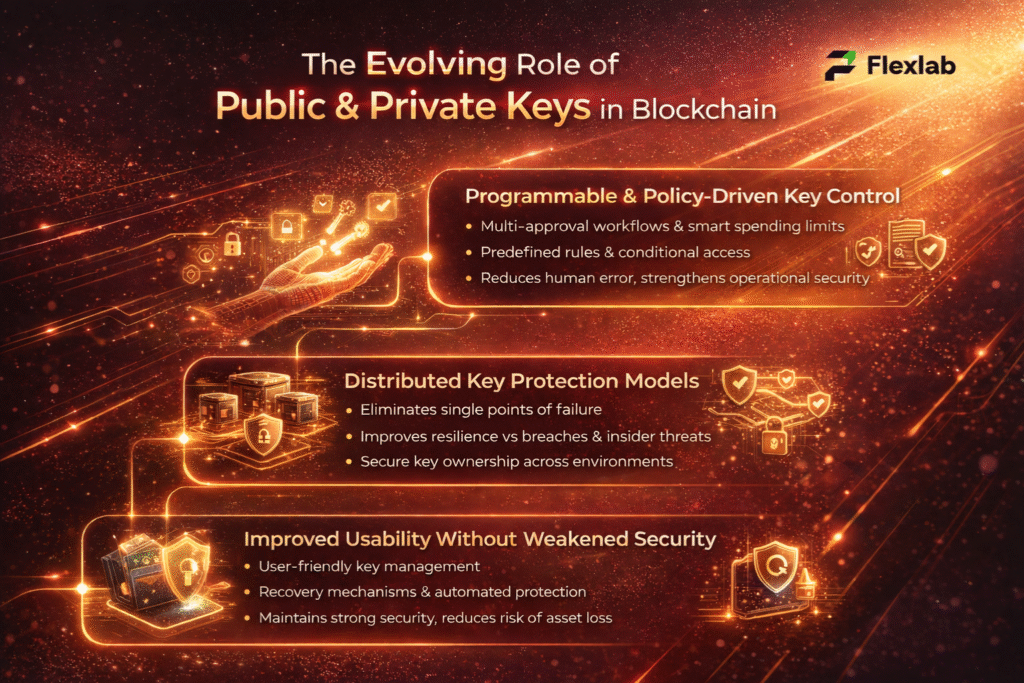

Custodial Wallets and Non-Custodial Wallets

In addition to hot wallet vs cold wallet, it’s important to understand the difference between custodial vs non-custodial wallets. Let’s dig down below.

Custodial Wallets

A custodial wallet means a third party (like an exchange or wallet provider) holds your private keys for you. This is similar to a bank holding your money. It’s often easier for beginners since the service takes care of security, backups, and password resets. However, this means you don’t have full control over your crypto. If the provider gets hacked or runs into trouble, your funds could be at risk.

Non-Custodial Wallets

With a non-custodial wallet, you and only you control your private keys. This gives you full ownership and control over your crypto assets. It’s safer in terms of hacking risk because no third party stores your keys, but it also means you’re fully responsible for safeguarding your keys. Lose your keys, and you lose access to your crypto permanently. Non-custodial wallets are popular with users who want maximum control and privacy, especially if they use DeFi apps and decentralized platforms.

Custodial vs Non-Custodial Wallets: A Brief Comparison Table

| Feature | Custodial Wallet | Non-Custodial Wallet |

| Private Key Control | Managed by a third party | Controlled solely by the user |

| Security | Risk if the provider is hacked | More secure from third-party hacks |

| User Control | Limited access to funds | Full control over funds |

| Backup & Recovery | Provider offers password recovery | User must back up keys; no recovery options |

| Ease of Use | Easy for beginners | Requires more responsibility and know-how |

| Privacy | KYC/AML is often required | Usually no identity verification |

| Access to DeFi | Limited or no direct decentralized finance DeFi access | Full access to DeFi and Web3 apps |

| Risk of Freezing | Possible freezing or restriction by the provider | No freezing; fully decentralized |

Choosing between a custodial and non-custodial wallet depends on your risk tolerance, technical comfort, and how much control you want. New users might prefer custodial wallets for simplicity, while experienced users often lean toward non-custodial wallets for greater sovereignty and security.

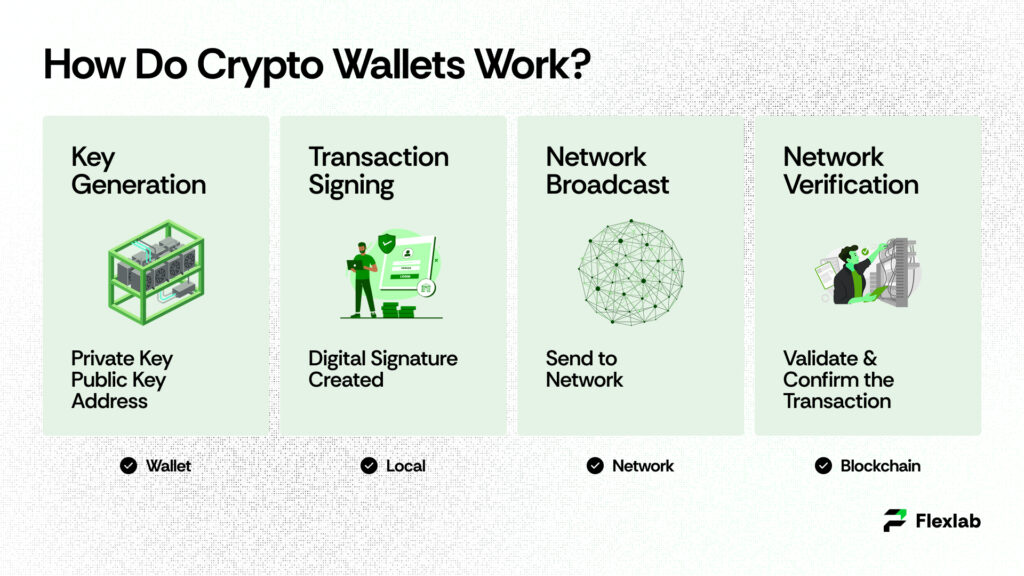

How Do Crypto Wallets Work?

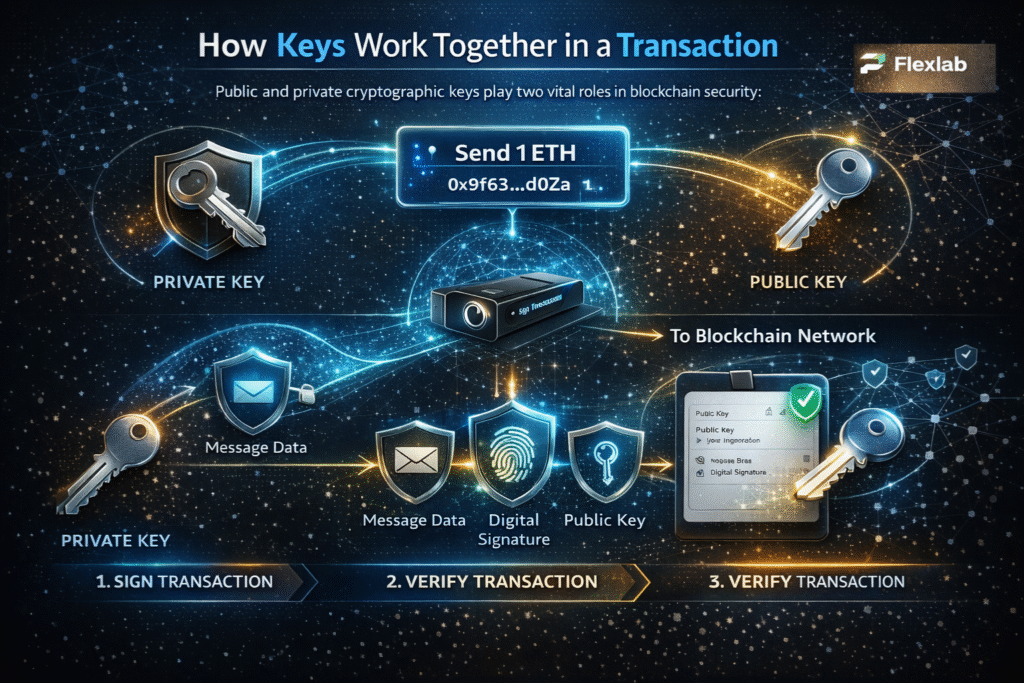

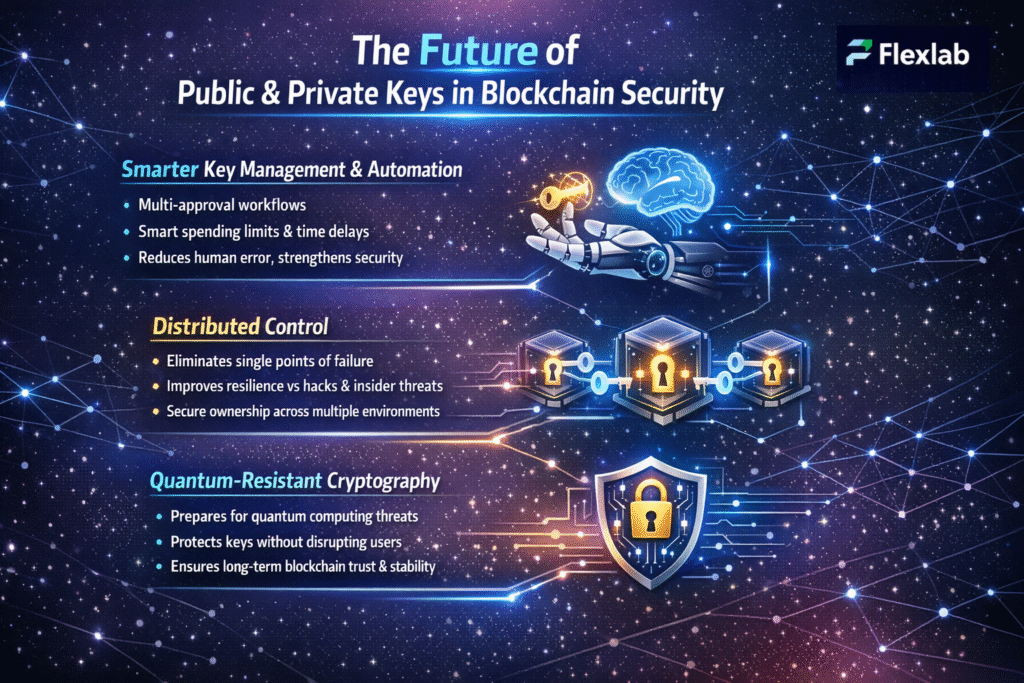

Crypto wallets employ advanced cryptographic methods while connecting to the blockchain. Your wallet runs numerous significant processes behind the scenes whenever you send, receive, and hold cryptocurrency. Hence, it ensures your assets are secured and transactions go through seamlessly.

Have a look at the breakdown of how it works.

- Key creation and address generation

- Sending cryptocurrency

- Broadcast and confirmation

First, you need to create a wallet, which makes a pair of cryptographic keys: a public key and a private key. After that, your public key is turned into a wallet address, which others use to send you cryptocurrency.

Secondly, your wallet uses your private key to digitally sign transactions for sending funds. This approach proves your ownership of your own crypto without ever showing your private keys. It’s keeping everything safe and secure.

Lastly, after signing, the transaction is sent to the blockchain network, where miners or validators verify it and add it to the public blockchain ledger. Once it is confirmed, this process is irreversible.

Remember, your wallet doesn’t actually store the coins. However, it controls the keys that let you access and move coins stored on the blockchain. Each coin lives at a specific wallet address, and only whoever holds the corresponding private key can spend it.

Examples of Crypto Wallet Address

A typical crypto wallet address looks like this (Ethereum example):

0x742d35Cc6634C0532925a3b844Bc454e4438f44e

Each blockchain has its own addressing format. For example, Bitcoin addresses start with “1” or “3,” while Ethereum addresses start with “0x.” These addresses allow you to receive tokens and interact with blockchain networks.

How to Set Up Your Crypto Wallet

Wondering how to build a crypto wallet? Here’s a quick guide on how to set up a crypto wallet:

- Choose Your Wallet Type: Decide between custodial (third-party manages keys) or non-custodial (you control keys) wallets. Determine if you want a hot wallet (software/mobile) or a cold wallet (hardware/paper wallet).

- Download or Purchase: For software wallets, download from official sources like MetaMask or Trust Wallet. For hardware wallets like Ledger or Trezor, buy only from official websites.

- Create Account or Wallet: Follow the setup instructions; create a strong password for software wallets, and securely record your 12 to 24-word recovery phrase offline. This phrase is your ultimate backup.

- Secure Your Wallet: Enable security features like two-factor authentication (2FA). Store your private keys and recovery phrases safely, never sharing them online.

- Start Using: Once set up, you can generate wallet addresses to receive crypto, send payments, and interact with decentralized finance DeFi protocols, smart contracts, and web3 applications.

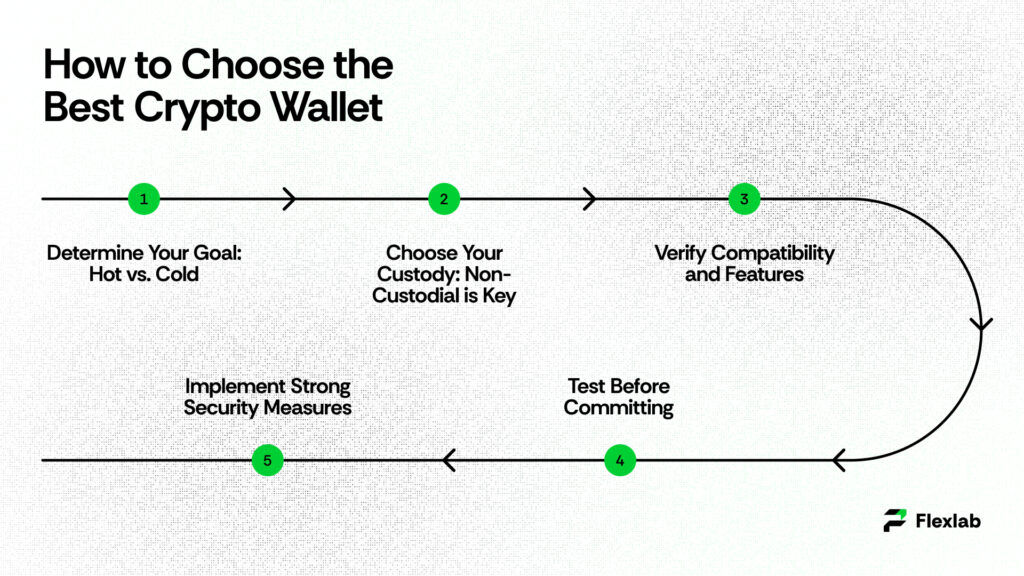

How to Choose the Best Crypto Wallet

Here is the step-by-step guide on how to choose the right crypto wallet below.

- Determine Your Goal: Hot vs. Cold

- Choose Your Custody: Non-Custodial is Key

- Verify Compatibility and Features

- Implement Strong Security Measures

- Test Before Committing

1. Determine Your Goal: Hot vs. Cold

Decide what fits your crypto use. If you trade often or use dApps, a Hot Wallet (mobile or browser-based) offers convenience but less security. For long-term holding with maximum safety, a Cold Wallet, usually a hardware device, is best. Many use both: cold wallets for savings, hot wallets for daily use.

2. Choose Your Custody: Non-Custodial is Key

Choose who holds your private keys. Non-custodial wallets let you control your own seed phrase and funds. Custodial wallets, where a third party holds keys, risk losing funds if hacked or closed. For full ownership and security, pick a non-custodial wallet.

3. Verify Compatibility and Features

Check if the wallet supports all your cryptocurrencies and works on your devices, such as mobile, desktop, or browser. Look for handy features like built-in token swaps or dApp/NFT marketplace access if needed.

4. Implement Strong Security Measures

Use strong passwords and enable two-factor authentication (2FA). Additionally, for non-custodial wallets, write your seed phrase on paper or metal and keep it in a secure place. Moreover, never save it digitally or online.

5. Test Before Committing

Send a small amount of crypto first to test the wallet setup. Practice withdrawing funds to ensure you understand how it works before storing larger amounts.

What are the Risks of Crypto Wallet Storage?

Crypto wallets come with risks, including:

- Loss of Private Keys: Losing your private keys or recovery phrase means losing access to your funds permanently.

- Hacking: Hot wallets are susceptible to phishing, malware, and hacks.

- Scams and Fraud: Always verify software sources and beware of fake wallet apps.

- Regulatory Risks: Changes in cryptocurrency regulation can impact wallet usage and accessibility.

Practicing good security habits, such as using hardware wallets, paper wallets, and enabling 2FA, helps mitigate these risks.

7 Top Crypto Wallets in 2025

Here are seven top crypto wallets offering a blend of security, user experience, and blockchain compatibility.

- Exodus – Best Crypto Wallet Overall

- Zengo – Best Crypto Wallet for Beginners

- Sparrow – Best Crypto Wallet for Bitcoin

- Trust Wallet – Best Mobile Crypto Wallet

- MetaMask – Best Web3 Wallet

- Trezor Model One – Best Entry-Level Hardware Wallet

- Ledger Nano Flex – Best High-End Hardware Wallet

1. Exodus

This crypto wallet is an excellent choice for many investors, particularly those who manage diverse portfolios. It provides broad asset support, thousands of trading pairs, and a built-in crypto swapping feature. It is easy to use, convenient, marked as high-level security, and reliable, too.

2. Zengo

One of the best crypto wallets simplifies the usual complexity by removing the need for complicated seed phrases and private keys, and instead uses cutting-edge technology called multi-party computation (MPC) cryptography—a keyless security model that enhances protection. It has a beginner-friendly, appealing interface, 24/7 live customer support, and a streamlined setup process that quickly onboards new users.

3. Sparrow

It gives full control of your Bitcoin and trading fees, letting you choose either public, private, or Bitcoin Core servers for trades. It has a transaction editor that works as a blockchain explorer and decreases storage requirements. Moreover, this wallet supports the Lightning Network, which is a payment protocol for faster transactions.

4. Trust Wallet

Trust Wallet is a popular mobile wallet known for its ease of use and broad support for cryptocurrencies and NFTs. It lets you safely store and manage thousands of coins and tokens across over 100 blockchains. The wallet also has a built-in decentralized exchange, so you can swap tokens without leaving the app. With features like staking, an embedded dApp browser, and support for buying crypto with fiat, it offers a convenient one-stop shop for mobile users looking to explore Web3 technology. Since it’s a non-custodial wallet, you have full control over your private keys and funds.

5. MetaMask

MetaMask is the leading Web3 wallet favored for its integration with thousands of decentralized apps and DeFi platforms. It supports Ethereum and compatible blockchains, allowing users to interact easily with smart contracts and NFT marketplaces. MetaMask also offers frequent security updates and customizable transaction options like gas fees and slippage tolerance. Available as a mobile app and web extension, it’s a top choice for both beginners and experienced users who want direct access to the decentralized internet.

6. Trezor Model One

Trezor Model One is a hardware wallet designed to keep your crypto safe offline. It was one of the first hardware wallets released and is still popular today, especially among beginners wanting strong security for their private keys. The device uses PIN codes and recovery phrases for protection, and every transaction must be physically confirmed on the device, which adds an extra layer of security. Though it doesn’t support all coins, Trezor’s open-source platform and affordable price make it a reliable choice for cold storage

7. Ledger Nano Flex

The Ledger Nano Flex is a high-end hardware wallet packed with advanced features for secure crypto management. Moreover, it supports over 5,500 coins and tokens and uses a tamper-proof chip to keep your private keys safe. Additionally, its touchscreen and E Ink display make it easy to review and approve transactions. The device also offers near-field communication (NFC) for seamless connection with other gadgets. Ledger’s companion app, Ledger Live, provides portfolio management and transaction tracking across multiple platforms.

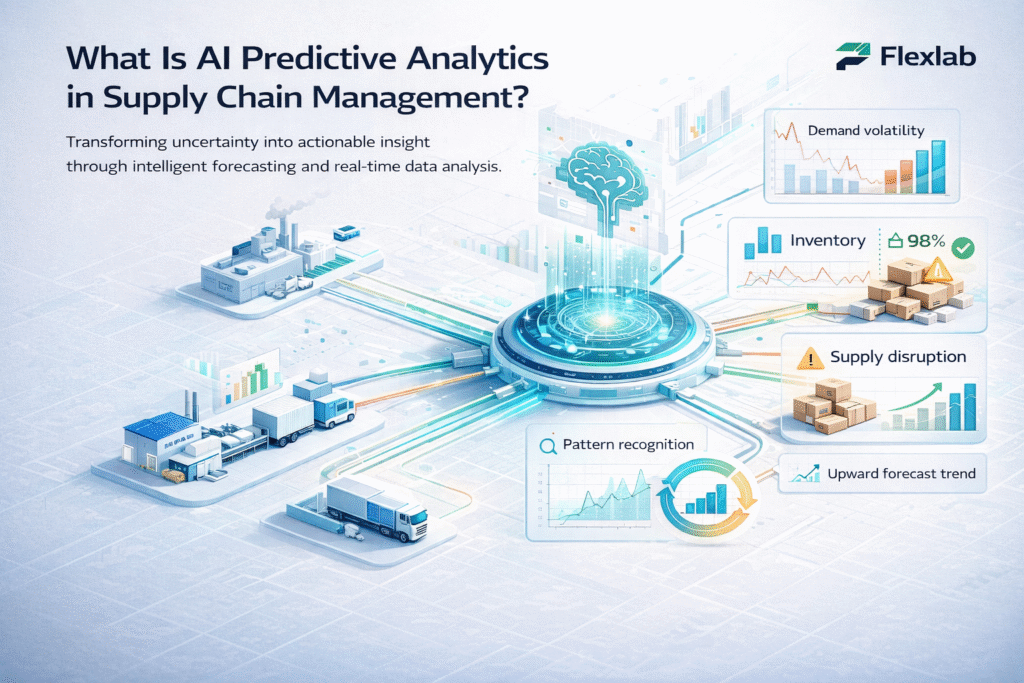

Start Your Crypto Wallet With Flexlab

Flexlab, a trusted AI automation agency, helps beginners and experts build secure, user-friendly crypto wallets tailored to varying needs. Whether you’re looking for the best crypto wallet for beginners 2025 or advanced wallets compatible with complex DeFi protocols, Flexlab provides custom solutions that ensure your assets remain secure. Their expertise ensures integration with the latest blockchain ecosystem features, including support for smart contracts, NFTs, and crypto trading bots, empowering your digital investment journey.

Are you looking for reliable AI and blockchain application development for your crypto wallet? Look no further! Schedule a consultation call today, and let’s build the perfect solution for your needs.

📞 Book a FREE Consultation Call: +1 (416) 477-9616

📧 Email us: info@flexlab.io

Conclusion

In a fast-growing crypto world, a reliable crypto wallet is crucial for safely managing your digital assets. Whether you’re a beginner or an experienced investor, knowing how wallets work and choosing one based on security, usability, and compatibility with your crypto activities will empower you to navigate the blockchain ecosystem with confidence and peace of mind.

Stay connected! For expert advice, insights, and updates, contact us. Also, explore our LinkedIn and blog to dive deeper into AI, blockchain, and crypto wallet development.

Unlock More Guides and Insights:

- Step-by-Step Guide to MVP Development with Blockchain and AI

- Blockchain and IoT: Benefits, Use Cases, and Their Challenges

- Blockchain App Development: The Complete Guide for Businesses

Can you convert a crypto wallet to cash?

Yes, you can convert cryptocurrency stored in a wallet to cash by selling it on centralized exchanges, using peer-to-peer platforms, or withdrawing through crypto debit cards and ATMs. These methods convert your crypto into fiat money, which you can then transfer to your bank account or withdraw in cash.

What are crypto wallets used for?

Crypto wallets are used to securely store private keys that give access to your digital assets, allowing you to send, receive, and manage cryptocurrencies and NFTs across blockchain networks. They act as a gateway to interact safely with decentralized finance (DeFi) and Web3 applications.

Is a crypto wallet safe?

Crypto wallets are generally safe if you use trusted wallets with strong security features like two-factor authentication, hardware storage, and backup seed phrases. Hot wallets connected online carry higher risks of hacking, while cold wallets offer better protection by keeping keys offline.

4 Responses

Nice Post.